Global Thermal Paper Market Overview

The growth of the thermal paper market is being aided by the rising adoption of Point of Sale (POS) systems in sectors like transportation, retail, healthcare, and hospitality, among others. Reportedly, 73% of businesses planned to purchase new features or functionality for their POS system in 2023 whereas 43% planned to deploy POS software for use on a mobile device. This is boosting the demand for thermal paper rolls in printing receipts in POS systems. With the increasing trend towards faster transactions and improved customer experience in retail and service industries, thermal printing, due to its quick print speeds and low maintenance costs, is gaining popularity.The growing focus of retailers to enhance customer loyalty and the rising demand for personalised transaction prints and customised receipts are surging the usage of thermal paper to print unique promotional content on receipts. Furthermore, the increasing popularity of custom thermal papers with personalised marketing messages, company logos, and eco-friendly packaging is aiding the thermal paper market expansion.

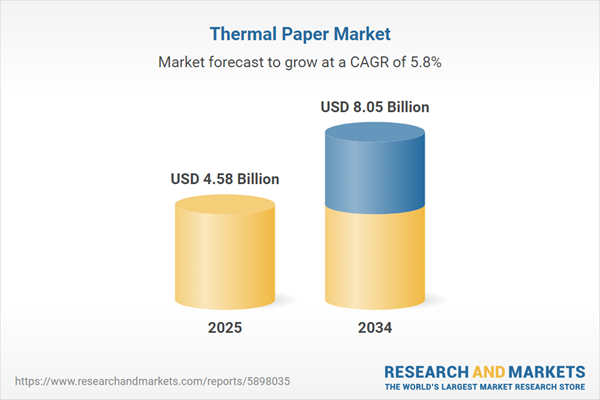

Global Thermal Paper Market Growth

The increasing demand for mobile and portable thermal printers used by delivery drivers, field service professionals, and remote businesses is surging the adoption of portable and compact thermal paper rolls. Such printers allow on-the-go printing of invoices, receipts, and labels, improving convenience and mobility.With businesses seeking new ways to engage customers, receipts printed on thermal paper are anticipated to serve as a platform for discount codes, advertisements, and loyalty programmes. To capitalise on this trend, thermal paper manufacturers are offering advertising-ready paper solutions that can support dynamic content, such as the capability to directly integrate discount codes, promotional offers, or QR codes on receipts.

The surging integration of blockchain technology to enhance transaction security is providing lucrative thermal paper market opportunities. Businesses are exploring new ways to use thermal paper in verifiable receipts and secure documentation to combat frauds and improve record-keeping in sectors like retail, finance, and government.

Key Trends and Development

Flourishing e-commerce and logistics sectors; the rising trend of barcoding and inventory management in warehousing; technological advancements and innovations; and the growing emphasis on sustainability are driving the thermal paper market expansion.September 2024

Lecta launched its Termax range of high-substance thermal papers for ticketing applications. The Termax products include Termax TFX (phenol-free), the top-coated Termax TC30X (phenol-free) paper, and Termax TFS (BPA-free) papers offering high thermal image stability and durability.May 2024

Lecta introduced its new thermal and metallised papers containing a high percentage of recycled fibre. The thermal paper products, Termax Recy TFXr100 and Termax Recy TFXr3 are Ineris-certified, phenol-free, and boast print quality in high-speed thermal printers.November 2021

UPM Raflatac announced the commercial availability of Total Phenol Free thermal paper labels made with 100% recycled fibres for logistics and retail labelling applications.January 2021

Avery Dennison launched rDT, recycled direct thermal paper labels containing recycled post-consumer waste. The launch aims to meet the growing demand for sustainable thermal solutions in the e-commerce and logistics sectors.Robust Growth of the E-Commerce and Logistics Sectors

The robust growth of the e-commerce and logistics sectors is creating lucrative thermal paper market opportunities. In FY 2022, the India logistics sector witnessed 14% growth to reach a value of USD 435 billion. Moreover, the US Department of Commerce estimated that US retail e-commerce sales in Q3 2024 reached USD 300.1 billion, a surge of 2.6% from the previous quarter. With the rising demand for high-quality and durable shipping and tracking labels in these sectors, the use of thermal paper for printing barcodes and QR codes that track packages throughout the supply chain is increasing. The rapid printing capabilities and cost-effectiveness of thermal paper make it ideal for manufacturing easy-to-apply, durable, and reliable shipping labels integral in e-commerce and logistics applications. Furthermore, the increasing trend of automation of warehouses and logistics centres and the growing implementation of automated sorting systems are boosting the demand for thermal paper to generate labels for products and packages.Rising Trend of Barcoding and Inventory Management in Warehousing

As per the thermal paper market analysis, the growing trend of inventory management and barcoding in warehousing is increasing the demand for thermal paper in logistics and supply chain operations. With businesses seeking more ways to manage and track inventory, the use of thermal paper in barcodes and labels for accurate and quick scanning and sorting is increasing. Automation and RFID systems are significantly gaining traction in warehousing applications, surging the demand for high-quality and durable thermal paper capable of withstanding various warehouse conditions. In the forecast period, the development of premium thermal paper that offers resilience, clarity, and long-lasting prints to meet the growing demands of modern logistics operations is expected to aid the market.Technological Advancements and Innovations

The development of advanced coatings and formulations to improve the durability, resolution, and clarity of thermal prints amid the growing demand for high-quality prints in sectors like healthcare, retail, and logistics is boosting the thermal paper market revenue. There is a rising integration of radio-frequency identification (RFID) tags into thermal paper to enable advanced tracking and identification in the retail and logistics sectors. In addition, the development of portable thermal printers and mobile POS systems that enable businesses to print receipts, invoices, and labels on the go is revolutionising the market. Such printers boast improved efficiency and user-friendliness, surging their usage to print high-quality thermal paper labels and receipts with enhanced precision. In the forecast period, the growing trend of smart packaging and labelling is expected to bolster the integration of thermal papers with time-temperature indicators or sensors to provide real time insights regarding the condition of goods.Rising Focus on Sustainability

The growing focus on sustainability is shaping the thermal paper market trends and dynamics. Manufacturers are developing BPS-free and BPA-free coatings to develop thermal papers. There is also a rising focus on biodegradable, sustainable, and non-toxic coatings such as water-based or soy-based coatings that reduce the environmental impact of thermal paper and cater to growing consumer demand for eco-friendly products. With the growing focus on sustainability, manufacturers are increasingly developing recycled thermal paper products with post-consumer recycled materials. They are also attempting to lower the environmental impact of thermal paper production by minimising energy consumption, lowering water use, and decreasing waste.Global Thermal Paper Market Trends

The thermal paper market is benefiting from the robust growth of the e-commerce and logistics sectors. In FY 2022, India’s logistics sector grew by 14%, and U.S. e-commerce sales reached USD 300.1 billion in Q3 2024. The demand for durable shipping labels and tracking solutions in these industries is increasing, with thermal paper being ideal for printing barcodes and QR codes. Additionally, the trend of warehouse automation is driving further demand for thermal paper labels. Technological advancements are also shaping the market, with improvements in print durability, resolution, and the integration of RFID tags into thermal paper for better tracking and identification. Portable thermal printers and mobile POS systems are gaining popularity for their efficiency in printing receipts and labels on the go. Sustainability is a growing focus, with manufacturers developing BPA-free, biodegradable, and water-based coatings to reduce environmental impact. The demand for eco-friendly products has led to innovations in recycled thermal paper and sustainable production practices.Opportunities in the Global Thermal Paper Market

There is a rising usage of thermal paper in the healthcare sector for printing patient records, diagnostic reports, and medical prescriptions due to its reliability and high quality. The expansion of healthcare infrastructure, particularly in emerging economies, is providing lucrative opportunities for manufacturers to provide thermal paper rolls for medical applications.Due to its versatility, thermal paper is increasingly used in emerging applications such as vending machines, event ticketing, parking tickets, airline boarding passes, and automated self-checkout systems. This is prompting manufacturers to diversify their offerings and create customised thermal paper solutions tailored to specific sectors such as entertainment, tourism, and public transport.

The rising adoption of smart systems and the Internet of things (IoT) devices is aiding the market. With businesses and customers increasingly relying on self-checkout kiosks, smart POS terminals, and automated ticketing systems, the usage of thermal paper for automatically printing receipts, tickets, and labels is growing.

Global Thermal Paper Market Restraints

Traditionally, thermal paper used BPA as a developer to facilitate the printing of images using heat. Various pharmacological studies have outlined the negative health effects of BPA through skin absorption, such as disruption of endocrine systems and lowered fertility rates.Due to its coating, thermal paper is not recyclable, which complicates its disposal and contributes to landfill waste. The introduction of stringent environmental regulations and the shift towards recyclable and sustainable alternatives can limit the growth of the thermal paper industry. Moreover, the growing trend of digital receipts, e-invoicing, and paperless transactions in sectors like hospitality, retail, and transportation can also challenge the market.

Global Thermal Paper Industry Segmentation

The report titled "Global Thermal Paper Market Report and Forecast 2025-2034" offers a detailed analysis of the market based on the following segments:Market Breakup by Application

- POS

- Tags and Labels

- Lottery and Gaming

- Others

Market Breakup by Technology

- Direct Thermal

- Thermal Transfer

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Thermal Paper Market Share

By Application Insights

Due to its cost-effectiveness and efficient and rapid printing speed, thermal paper is extensively used to print invoices, receipts, and transaction records at checkout counters in the hospitality, retail, and service sectors.In the logistics, healthcare, manufacturing, and retail sectors, thermal paper is used to print high-resolution tags and labels such as shipping tags, product labels, inventory control labels, and barcodes. The flexibility benefits of thermal printers make it ideal for printing different shapes and sizes of tags and labels. Factors such as the robust growth of the e-commerce sector and stringent labelling regulations in sectors like food and beverage and pharmaceuticals are driving the thermal paper demand growth.

Meanwhile, thermal paper incorporating security features such as barcodes, holograms, and special inks, is used for gaming receipts and lottery tickets. With scratch cards, lottery tickets, and gaming receipts requiring detailed and high-quality prints, the use of thermal paper is rising.

By Technology Insights

Thermal transfer technology utilises a ribbon, typically made of wax, resin, or a combination of both, to transfer the ink onto the paper. More resistant and durable to fading than their counterparts, thermal transfer prints are ideal for applications where longevity and resistance to environmental factors are essential. As thermal transfer technology can create crisp and high-quality images, its utilisation for producing graphics, logos, and barcodes is increasing. The rising demand for technologies compatible with different label materials, including synthetic labels, plastics, and coated papers, is boosting the thermal paper market value.Meanwhile, direct thermal printing does not require ink, ribbons, or toner, making it more affordable than thermal transfer technology. Fast printing, low maintenance, and compact and lightweight designs of direct thermal printing also boost its appeal.

Global Thermal Paper Market Regional Insights

North America Thermal Paper Market Trends

The growing emphasis on sustainability in the region is surging the demand for BPA-free, water-based and eco-friendly thermal paper products. As per a 2021 Gallup survey, 43% of surveyors in the United States expressed concern about global warming. In addition, the increasing focus on smart labels and smart packaging in sectors like pharmaceuticals, logistics, and food and beverages is boosting the use of thermal paper RFID tags, QR codes, and time-temperature labels. The thermal paper market development in the region is further being fuelled by the growing adoption of portable thermal printers and mobile POS systems.Europe Thermal Paper Market Outlook

The rise of contactless transactions and smart payment systems is surging the demand for high-quality thermal paper that is capable of supporting digital receipts and QR codes. Rapid digital transformation across various sectors is boosting the demand for thermal paper. With sustainability becoming a critical consideration for European businesses, the demand for eco-friendly, BPA-free, and biodegradable thermal paper is increasing. In addition, the growing trend of personalised marketing and smart retail solutions is surging the usage of thermal paper in receipts containing QR codes for loyalty programmes, personalised promotions, and product recommendations.Asia Pacific Thermal Paper Market Overview

As per the thermal paper market regional analysis, the robust growth of the e-commerce sector and the increasing demand for shipping labels, barcode printing, and tracking solutions are aiding the market. In FY 2023, e-commerce platforms in India reached a GMV of USD 60 billion, marking a y-o-y increase of 22%. The expansion of sectors like hospitality and retail sectors and the rising adoption of POS systems are driving the demand for thermal paper rolls for printing receipts and invoices, particularly in small businesses and restaurants.Latin America Thermal Paper Market Drivers

The robust growth of the foodservice sector, especially takeout services and quick-service restaurants (QSRs), is increasing the demand for thermal paper for receipts, order tickets, and food labelling. In 2022, consumer foodservice sales in Mexico reached USD 50.3 billion, representing nearly 70% in food and 30% in drink sales. In addition, the Latin America thermal paper market expansion is being aided by digitisation of government services, such as issuing permits, licenses, and other official documents. Thermal paper is increasingly used in official receipts and documentation.Opportunities in the Middle East and Africa Thermal Paper Market

The expansion of shopping malls and retail chains is boosting the adoption of point-of-sale (POS) systems, surging the usage of thermal paper for printing receipts, invoices, and transaction records. In June 2024, Emaar Properties announced a monumental expansion of Dubai Mall, including 240 new food and beverage outlets and luxury stores. Moreover, the robust growth of the hospitality sector, especially in countries like the UAE and South Africa, is increasing the demand for thermal paper receipts for hotel check-ins and ticketing for food service operations and events. Furthermore, the expansion of transportation infrastructure, such as railway, metro, and aviation systems, is propelling the thermal paper market growth.Competitive Landscape

Key thermal paper market players are developing advanced coatings to improve the clarity, durability, and performance of thermal papers. They are also investing in research and development (R&D) activities for creating new and advanced thermal papers that can withstand various environmental conditions.Ricoh Company Ltd.

Ricoh Company Ltd., founded in 1927, is a prominent technology company that is headquartered in Tokyo, Japan. Its key areas of operations include digital imaging, printing solutions, thermal printing solutions, and document management solutions, among others. Some of its product offerings include multifunction printers (MFPs), POS systems, and cloud-based document management systems.

Oji Holdings Corporation

Oji Holdings Corporation, headquartered in 1873, is a prominent player in the paper and pulp sector. Headquartered in Tokyo, Japan, the company is one of the largest paper manufacturers in the world. The company is focused on enhancing its sustainability efforts by producing eco-friendly products and investing in energy-efficient technologies and green manufacturing practices.Koehler Paper

Koehler Paper, established in 1807 and headquartered in Oberkirch, Germany, is a leading producer of high-quality paper products. Its expansive product portfolio includes premium paper products, thermal paper, and label paper, among others. The company heavily invests in research and development activities to improve the functionality and quality of paper.Key players in the thermal paper market are Appvion Operations, Inc., Mitsubishi Paper Mills Limited, and Hansol Paper Co. Ltd, among others.

Table of Contents

Companies Mentioned

The key companies featured in this Thermal Paper market report include:- Ricoh Company Ltd.

- Oji Holdings Corporation

- Appvion Operations, Inc.

- Koehler Paper

- Mitsubishi Paper Mills Limited

- Hansol Paper Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.58 Billion |

| Forecasted Market Value ( USD | $ 8.05 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |