Key Market Trends and Insights:

- The Asia-Pacific chlor-alkali market dominated the market in 2024 and is projected to grow at a CAGR of 5.0% over the forecast period.

- By country, India is expected to grow at a CAGR of 8.5% over the forecast period.

- By type, chlorine is projected to exhibit a CAGR of 4.6% over the forecast period.

- By end use, alumina is expected to grow at a CAGR of 4.7% over the forecast period.

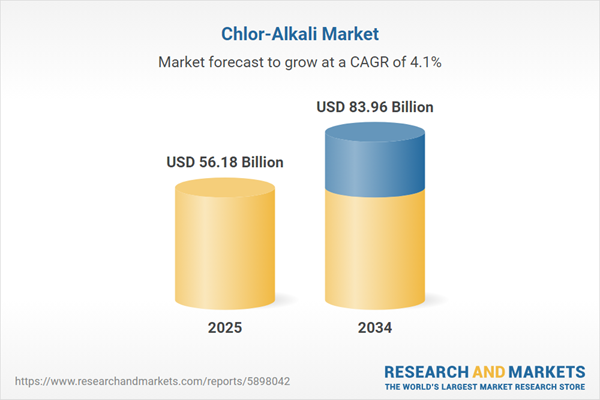

Market Size & Forecast:

- Market Size in 2024: USD 56.18 Billion

- Projected Market Size in 2034: USD 83.96 Billion

- CAGR from 2025 to 2034: 4.10%

- Fastest-Growing Regional Market: Asia-Pacific

Additionally, government-backed schemes are propelling domestic chlor-alkali capacities, boosting the scope of chlor-alkali market expansion. For example, Perform Achieve and Trade (PAT), under India’s National Mission for Enhanced Energy Efficiency, incentivises chlor-alkali producers to reduce energy use through tradable efficiency credits. This drives membrane cell adoption and cleaner production. On the other hand, the country’s Production Linked Incentive (PLI) scheme is expected to indirectly benefit chlor-alkali producers by boosting downstream sectors like paper, textiles, and PVC.

Global Chlor-Alkali Market Report Summary

Description

Value

Base Year

USD Billion

2024

Historical Period

USD Billion

2018-2024

Forecast Period

USD Billion

2025-2034

Market Size 2024

USD Billion

56.18

Market Size 2034

USD Billion

83.96

CAGR 2018-2024

Percentage

XX%CAGR 2025-2034

Percentage

4.10%CAGR 2025-2034- Market by Region

Asia-Pacific

5.0%CAGR 2025-2034 - Market by Country

India

8.5%CAGR 2025-2034 - Market by Country

Mexico

4.3%CAGR 2025-2034 - Market by Type

Chlorine

4.6%CAGR 2025-2034 - Market by End Use

Alumina

4.7%Market Share by Country 2024

USA

18.5%Key Trends and Recent Developments

June 2025

Kumho Mitsui Chemicals Inc. (KMCI) started up its new chlor-alkali facility in Yeosu, South Korea, utilising Thyssenkrupp Nucera's state-of-the-art e-BiTAC v7 electrolyser technology. The facility, which can produce 60,000 tonnes of chlorine annually, will now assist KMCI's primary production of Methylene Diphenyl Diisocyanate (MDI), which is essential for the creation of polyurethane products. KMCI’s new Yeosu plant enhances chlorine supply for global polyurethane production, reshaping the chlor-alkali market dynamics.December 2024

On the property of Chemours' (NYSE: CC) titanium dioxide (TiO 2) plant in DeLisle, Mississippi (United States), PCC SE announced plans to construct and run a chlor-alkali complex. A chlorine supply agreement between PCC and Chemours is contingent upon a number of precedent-setting customary conditions. This project supports captive chlorine needs for Chemours’ TiO₂ operations.September 2024

Between 2013 and 2016, CYDSA, a Mexican chemical giant, replaced Monterrey's chlorine and caustic soda factory with a cutting-edge mercury-free operation. The Global Environment Facility (GEF) authorised a USD 12 million project to convert the last mercury-cell plant in Coatzacoalcos. CYDSA’s mercury-free upgrades mark a global shift toward greener technologies, redefining the chlor-alkali market trends.October 2024

Mundra Petrochemical Ltd. (MPL), a division of the prestigious Adani Enterprises, commissioned India's largest Chlor-Alkali project, which Nuberg EPC, a global EPC and turnkey project management company, announced. With a capacity of 2200 TPD and a 100% NaOH process, this innovative project is set to have a big impact on the industry. Adani’s Mundra project boosts India's chlor-alkali capacity with advanced NaOH processing.Integration of Chlor-Alkali Units in Green Hydrogen Roadmaps

Governments and firms are treating chlor-alkali plants as critical infrastructure for green hydrogen production. In Japan, AGC Chemicals and Tokyo Electric Power are piloting integrated membrane electrolysis units that simultaneously produce chlorine and hydrogen with considerably lower emissions. This trend in the chlor-alkali market is redefining investment priorities. Europe is also pushing for hydrogen-compatible electrolysers in chemical parks, making chlor-alkali units an innovation hotspot. The convergence of hydrogen and chlorine production is thus creating an economically viable decarbonisation pathway, especially in the EU and ASEAN regions.Surge in PVC Demand Backed by Infrastructure Stimulus Plans

The demand for chlorine, especially for polyvinyl chloride (PVC) production, is gaining traction from global infrastructure stimulus projects. India’s INR 100 lakh crore Gati Shakti Master Plan aims to develop logistics and highways, fuelling PVC consumption. Similarly, the United States Infrastructure Investment and Jobs Act, signed in 2021, is funnelling over USD 110 billion into bridges and roads, increasing downstream demand for chlorinated polymers. Producers in the United States, India, and the UAE are ramping chlorine output to match such a structural growth in the chlor-alkali industry.Water Treatment Demand Fuelling Caustic Soda Growth

Another noticeable trend is the growing application of caustic soda in water and wastewater treatment across Asia and Africa. According to the UN World Water Development Report 2024, water demand is projected to spike by 20-30% by 2050. Governments in Southeast Asia, particularly Vietnam and Indonesia, are retrofitting municipal water systems using caustic soda-based pH control and purification processes. This is fuelling chlor-alkali demand growth, especially for suppliers offering low-carbon footprint variants of caustic soda.Sustainability Pressure Driving Membrane Cell Technology Adoption

The shift from mercury and diaphragm technologies towards membrane cell process is no longer optional. As per EU REACH regulations, mercury cell technology is banned, pushing companies like Vynova and AkzoNobel to adopt membrane-based retrofits. Moreover, India’s chlor-alkali producers are investing in energy-efficient membrane cells to align with 2030 net-zero commitments. Membrane cells, offering power savings, are being increasingly preferred even in Middle Eastern countries seeking ESG investments in petrochemicals, thereby widening the scope for chlor-alkali industry opportunities.Regional Value Chain Integration in Emerging Markets

Countries like Brazil, Egypt, and Saudi Arabia are developing chlor-alkali clusters as part of broader industrialisation schemes. In June 2025, thyssenkrupp nucera secured a new order from CMDC, part of BCI, to expand its chlor-alkali plant in Jubail Industrial City. The project marks the next development phase. Such an integrated approach enhances cost efficiency and supply chain resilience. These initiatives are making chlor-alkali plants less dependent on international imports, increasing regional self-sufficiency in chemical intermediates.Global Chlor-Alkali Industry Segmentation

The report titled “Global Chlor-Alkali Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Caustic Soda

- Chlorine

- Soda Ash

Market Breakup by Production Process

- Membrane Cell

- Diaphragm Cell

- Others

Market Breakup by Application

- Pulp and Paper

- Organic Chemical

- Inorganic Chemical

- Soap and Detergent

- Alumina

- Textile

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

CAGR 2025-2034- Market by

Region

Asia-Pacific

5.0%Latin America

4.4%Middle East and Africa

4.3%North America

3.9%Europe

3.8%Global Chlor-Alkali Market Share

By product, caustic soda continues to be the largest category due to water treatment demand

Caustic soda dominates the market due to its wide usage in alumina refining, pulp & paper, water treatment and textiles. The compound’s role in wastewater neutralisation and pH control has become critical as industrial water recycling gains momentum globally. In India, caustic soda production has been scaled significantly by firms like GACL and Aditya Birla Chemicals to support rising demand from the textile hubs of Gujarat and Tamil Nadu, boosting the overall chlor-alkali consumption. In the Middle East, desalination plants are major consumers, prompting regional chlor-alkali expansions around the Red Sea economic zone.Chlorine is witnessing the fastest growth, driven primarily by rising global demand for PVC in construction, automotive, and electronics. In the United States, companies like Olin Corporation and Westlake are scaling chlorine production to match PVC extrusion needs in housing projects. Chlorine has also become vital for water purification, supporting ongoing initiatives like the Africa Water Vision 2025, boosting the chlor-alkali market opportunities. Furthermore, newer applications such as lithium-ion battery precursors and bio-based solvents are opening niche markets for chlorinated intermediates, expanding its industrial footprint.

By production process, membrane cell process leads the market due to its energy efficiency and regulatory compliance

Membrane cell technology has emerged as the most preferred production method, as per the chlor-alkali industry report, especially in Europe and Japan, due to its energy efficiency and lower environmental footprint. Regulatory crackdowns on mercury emissions and EU REACH guidelines are fuelling upgrades to membrane cells across legacy facilities. Indian manufacturers like DCM Shriram and GACL have significantly replaced their mercury capacity with membrane technology. With global chemical players looking to reduce Scope 1 and 2 emissions, membrane cell installations are becoming integral to ESG-compliant manufacturing.

Despite its lower purity output, diaphragm cell technology is witnessing moderate growth in the chlor-alkali market, particularly in developing economies where capital costs are a constraint. Many plants in Latin America and Southeast Asia continue operating diaphragm units, often retrofitted with better brine purification to reduce environmental impact. The United States still retains diaphragm capacity, especially for products where trace salt content is tolerable.

By application, organic chemicals dominate the market owing to heavy chlorine derivatives usage in PVC

Organic chemical synthesis continues to be the dominant application in the chlor-alkali market, with chlorine acting as a base feedstock for PVC, solvents, and various intermediates used in pharmaceuticals and agrochemicals. Chlorinated hydrocarbons such as ethylene dichloride and vinyl chloride monomer are the backbone of global PVC production. Rapid urbanisation and industrialisation in Asia-Pacific and North America continue to drive downstream chemical output. Furthermore, the rise of electric vehicles and lithium-ion battery components is indirectly boosting demand for organic chlorinated compounds, making this application indispensable across chemical value chains.As per the chlor-alkali industry analysis, the soap and detergent category is registering the fastest growth due to rising consumer awareness on hygiene and government-backed sanitation campaigns. Caustic soda is a primary ingredient in both household and industrial detergent manufacturing. Countries in Africa and South Asia are witnessing strong demand, driven by new detergent manufacturing hubs and expanding FMCG penetration. Furthermore, eco-labelled detergent formulations, using purer grades of caustic soda, are creating high-margin sub-categories.

Global Chlor-Alkali Market Regional Analysis

Asia-Pacific emerges as the largest market with strong chemical production base

Asia-Pacific leads the global market due to its concentration of large-scale chemical manufacturing hubs, rapidly expanding end-use sectors, and robust government-backed industrial corridors. Countries like China, India, and South Korea boast massive downstream consumption in textiles, alumina, and PVC. Additionally, regional players benefit from cost-effective labour, favourable regulatory structures, and increasing investments in renewable-powered electrolysis systems. Many chlor-alkali units are integrated within mega petrochemical clusters, enhancing economies of scale and lowering logistics costs. The region’s emphasis on green hydrogen integration is also catalysing membrane cell upgrades across facilities.The chlor-alkali market in the Middle East and Africa region is witnessing the fastest growth owing to industrial diversification agendas and increasing demand for water treatment solutions. Governments are promoting non-oil-based sectors including textiles, FMCG, and construction chemicals, directly fuelling caustic soda and chlorine consumption. Large-scale desalination projects and wastewater treatment infrastructure development are emerging as significant demand boosters for caustic soda.

Competitive Landscape

Leading chlor-alkali market players are focusing on energy efficiency, circular production, and integration with green hydrogen value chains. Companies are investing in membrane cell upgrades and on-site captive chemical units to ensure supply reliability and emissions reduction. There is also rising interest in regional self-sufficiency, especially in Asia and the Middle East, where infrastructure-led growth is unlocking demand across sectors.Most of the chlor-alkali companies find lucrative opportunities in niche product variants, such as food-grade soda ash and battery-grade chlorine intermediates, where margins are higher, and demand is more stable. Players that embed digital automation and AI-driven process controls into their electrolysis operations are expected to gain an edge, especially in cost optimisation and ESG compliance.

BorsodChem

BorsodChem, a Wanhua Chemical Group subsidiary, was established in 1949 and is headquartered in Hungary. The company operates an integrated chlor-alkali facility focused on producing chlorine for downstream isocyanate production. BorsodChem has adopted membrane cell electrolysis and invested in waste heat recovery systems. It supplies chlorine derivatives to Central and Eastern European industries.Ciner Group

Ciner Group, established in 1978 and headquartered in Istanbul, Turkey, is a global leader in soda ash production. The company operates some of the world’s lowest-cost soda ash facilities, including natural trona-based production in the United States and Turkey. Ciner leverages eco-friendly mining and low-emission processing, catering to the glass, detergent, and lithium battery sectors.Covestro AG

Covestro AG, founded in 2015 and headquartered in Leverkusen, Germany, is a materials science company with a strong chlor-alkali portfolio. It uses chlorine primarily in polycarbonate and polyurethane production. Covestro pioneered oxygen-depolarised cathode (ODC) technology to reduce energy consumption in electrolysis.Dow Inc.

Dow Inc., established in 1897 and headquartered in Midland, Michigan, United States, is a global chemicals major with deep chlor-alkali integration. Dow uses chlorine and caustic soda in its plastics and coatings divisions. It focuses on process intensification, including real-time digital optimisation of brine treatment and electrolysis efficiency.

Other key players in the market are Ercros S.A., Formosa Plastics Corporation, Genesis Energy L.P., INEOS AG, KEM ONE Group, and Kemira Oyj, among others.

Key Highlights of the Global Chlor-Alkali Market Report:

- Comprehensive performance analysis with forecasts extending through 2034, reflecting global regulatory impacts.

- Spotlight on next-gen electrolysis innovations such as oxygen-depolarised cathodes and AI-integrated plant automation.

- Detailed profiling of global and regional chlor-alkali producers, focusing on energy efficiency and vertical integration.

- Geospatial demand mapping, highlighting cluster-based growth in GCC, ASEAN, and Central European industrial parks.

- Forward-looking capital allocation trends, including green hydrogen-linked chlor-alkali investments and membrane retrofitting opportunities.

- Dedicated chemical and energy transition analysts delivering market intelligence grounded in technical and commercial realities.

- Actionable insights customised for manufacturers, investors, and policy stakeholders across the chlor-alkali value chain.

- Blended research approach combining regulatory scans, patent databases, plant-level insights, and real-time market movements.

- Data-backed strategies refined with machine learning models to predict process shifts and margin-sensitive disruptions in advance.

Table of Contents

Companies Mentioned

The key companies featured in this Chlor-Alkali market report include:- BorsodChem (Wanhua)

- Ciner Group

- Covestro AG

- Dow, Inc.

- Ercros S.A.

- Formosa Plastics Corporation

- Genesis Energy, L.P.

- INEOS AG

- KEM ONE Group

- Kemira Oyj

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 56.18 Billion |

| Forecasted Market Value ( USD | $ 83.96 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |