Wire and cable jacket materials are integral to the electrical industry. They are used to protect electrical cables and wires from damage and ensure the safety of users. The jacket material is the outermost layer of the wire or cable, and it serves as a barrier against environmental factors such as moisture, abrasion, and temperature extremes. One of the primary functions of the wire and cable jacket material is to provide mechanical protection to the wire or cable.

The jacket material acts as a shield, protecting the inner conductors from physical damage that could cause electrical faults or even a short circuit. For example, cables used in harsh environments, such as underground or in the ocean, require a jacket material that is resistant to abrasion and impact.

In addition to providing mechanical and environmental protection, the wire and cable jacket material can also enhance the aesthetic value of the product. For instance, the jacket material can be colored to match the surrounding environment or for easy identification. This is particularly useful in large installations where multiple cables are used, and identifying specific cables can be challenging.

Drivers:

Increasing demand for energy and power

One of the key drivers of the wire and cable jacket material market is the increasing demand for energy and power across the globe. This demand has been driven by the growing population, increasing urbanization, and rising industrialization in various regions.As a result, there has been a significant increase in the deployment of power transmission and distribution networks, which has led to a surge in the demand for wire and cable jacket materials. The International Energy Agency (IEA) reported a growth of almost 5% in global electricity demand for 2021 and an estimated 4% growth in 2022, underpinned by the ongoing economic recovery.

Advancements in communication technology

Government initiatives promoting the expansion of broadband internet access and infrastructure are also expected to drive growth in the communications industry, leading to increased demand for wire and cable jacket materials. For example, in the United States, the Federal Communications Commission (FCC) has allocated funds to support the development of broadband infrastructure in rural areas, which is expected to boost demand for wire and cable jacket materials.The increasing adoption of smart devices and expansion of the Internet of Things (IoT) has led to an exponential increase in data transmission and communication. As a result, there has been a surge in the demand for high-speed and high-bandwidth cables that can transmit data reliably and quickly. This has led to the development of new materials that can withstand the harsh operating conditions of high-speed data transmission.

The communication segment is expected to witness robust growth over the forecast period.

The communications industry is a major end-user of wire and cable jacket materials, as it requires reliable and high-quality cables for transmitting data and information. The increasing demand for high-speed internet and data transmission has driven the growth of the communications industry, which in turn has led to increased demand for wire and cable jacket materials.The demand for wire and cable jacket materials in the communications industry is expected to continue growing due to the increasing use of advanced technologies such as 5G and the Internet of Things (IoT), which require high-quality cables. In addition, the growing trend of remote work and virtual communication has further increased the need for reliable and fast data transmission.

Asia Pacific and North America regions accounted for a significant share of the global wire and cable jacket material market.

Based on geography, the wire and cable jacket material market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific regions. The Asia Pacific wire and cable jacket materials market is expected to witness significant growth during the forecast period, driven by the increasing demand for these materials from the construction, automotive, and energy industries.China, India, and Japan are the major contributors to the growth of the market in this region. The growing population, urbanization, and industrialization in these countries are expected to fuel the demand for wire and cable jacket materials.

The North American wire and cable jacket materials market is expected to grow at a moderate rate, driven by the increasing demand for these materials fromindustries operating in different sectors such as construction.

Market Developments:

- In April 2023,AutomationDirect, a company that provides automation and control products, such as PLCs, HMIs, sensors, motors, and drives, to industrial and manufacturing customers, made public the release of its 300V Atlas Type AWM wire that is suitable for use in appliance wiring, control cabinets, and machine tool applications. The wire has a polyvinyl chloride (PVC) outer jacket in various colours and is available in sizes from 26 AWG to 16 AWG. It complies with the regulations of the National Electrical Code (NEC) and NFPA Standard 79, and it is manufactured in the United States of America.

- In June 2022,Borealis and Borouge announced their participation at the 2022 WIRE trade show held from 20 to 24 June in Düsseldorf, Germany. They showcased a diverse range of innovative technologies and material solutions for the Wire & Cable industry. These accomplishments served as evidence of how Borealis and Borouge's polyolefin innovations and customer-centric approach had contributed to driving the global transition towards a more sustainable energy future. Borlink™ HVDC technology played a pivotal role in energy transition initiatives worldwide, including the German Corridors project. Additionally, they launched the first Borcycle™ M jacketing compound containing up to 50% post-consumer recyclate. It was also announced that the entire Borealis Wire & Cable portfolio would be ADCA-free by the end of 2022.

- In September 2021,leveraging their extensive cable design and manufacturing expertise, Hydro Group introduced several new cable jacket options to their standard range of polyurethane sheathing materials. These additions were aimed at enhancing the company's capacity to cater to a diverse range of Defence, Renewable, and Oil & Gas applications.

Segmentation:

BY MATERIAL

- PUR (Polyurethane)

- PVC (Polyvinylchloride)

- TPR/TPE (Thermoplastic rubber/elastomer)

- Thermoplastic CPE (Chlorinated Polyethylene)

- Others

BY END USER

- Aerospace and Defence

- Medical

- Communication

- Robotics

- Others

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Arkema

- MISUMI

- Calmont Wire & Cable Inc.

- Galaxy Wire & Cable, Inc.

- Habia Cable

- TE Connectivity

- Dow

- W. L. Gore & Associates, Inc.

Table Information

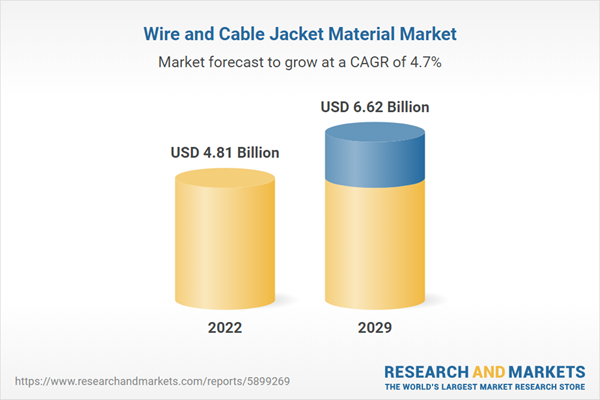

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | March 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 4.81 Billion |

| Forecasted Market Value ( USD | $ 6.62 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |