Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- Data center development in the country has started to grow steadily with investments from operators such as Raxio Data Centres, Safaricom, and others.- Smart city initiatives lead to the development and adopting of digital platforms in the country, such as the collaboration between Ethio Telecom and Addis Ababa city administration to build a smart city in Addis Ababa, Ethiopia. In July 2023, The memorandum of understanding(MoU) was signed between The Federal Democratic Republic of Ethiopia and the Republic of Korea to develop a “Smart City” project in Ethiopia.

- In terms of 4G & 5G connectivity, telecom operators such as Ethio Telecom have announced that they will expand 5G and service quality in Ethiopia to meet end-user's demands. For instance, in June 2023, the World Bank invested significantly in Africa to help Safaricom Ethiopia build and run advanced 4G and 5G mobile networks.

- Increasing demand for digitalization, an increasing number of internet users, and digitalization in different sectors are increasing the demand for colocation data centers and contributing to the Ethiopia data center market growth.

- In terms Of mechanical infrastructure, the Ethiopia data center market is experiencing growth in adopting air-based cooling solutions with a strong redundancy of N+1. In contrast, operators are installing power backup solutions with on-site fuel storage.

- The adoption of renewable energy is gaining traction in the market, with governments in the country taking several initiatives to grow green energy resources. For instance, the Ethiopian government plans to generate over 35,000 MW through geothermal by 2037.

- In terms of colocation, the Ethiopia data center market is expected to witness a rise in revenue generation competitiveness as new investors enter the industry from 2022 onward.

WHY SHOULD YOU BUY THIS RESEARCH?

- Market size available in the investment, area, power capacity, and Ethiopia colocation market revenue.- An assessment of the data center investment in Ethiopia by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across locations in the country.

- A detailed study of the existing Ethiopia data center market landscape, an in-depth industry analysis, and insightful predictions about market size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in Ethiopia

II. Facilities Identified (Upcoming): 01

III. Coverage: 1 City

IV. Existing vs. Upcoming (Area)

V. Existing vs. Upcoming (IT Load Capacity)

- Data Center Colocation Market in Ethiopia

II. Retail Colocation Pricing

- The Ethiopia data center market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the industry.

VENDOR LANDSCAPE

- The market has started witnessing the entry of foreign investors in 2022. Some of the key investors in the Ethiopia data center market are Raxio Data Centres, Safaricom, and wingu.africa.- africa inaugurated its first facility in the country in Addis Ababa with a space of around 161 thousand square feet and a power capacity of around 10 MW once fully built.

- Addis Ababa is the preferred location, with major investments from colocation service providers. wingu.africa, Safaricom, and others.

IT Infrastructure Providers

- Cisco Systems- Huawei Technologies

- Hitachi Vantara

- IBM

Support Infrastructure Providers

- ABB- Cummins

- Legrand

- Schneider Electric

- Vertiv

Data Center Investors

- Raxio Data Centres- Safaricom

- wingu.africa

EXISTING VS. UPCOMING DATA CENTERS

- Existing Facilities in the Region (Area and Power Capacity)- Addis Ababa

- List of Upcoming Facilities in the region (Area and Power Capacity)

REPORT COVERAGE:

This report analyses the Ethiopian data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments. The segmentation includes:- IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

- Electrical Infrastructure

- UPS Systems

- Generators

- Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

- Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

- General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

- Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

KEY QUESTIONS ANSWERED:

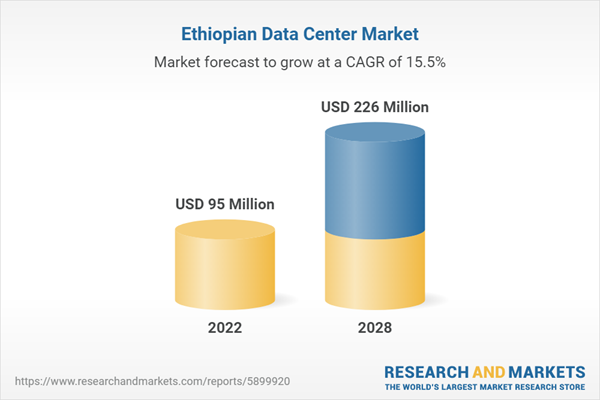

1. How much is the Ethiopia data center market investment expected to grow?2. What is the growth rate of the Ethiopia data center market?

3. How many data centers have been identified in Ethiopia?

4. What are the driving factors for the Ethiopia data center market?

5. Who are the key investors in the Ethiopia data center market?

Table of Contents

Companies Mentioned

- Cisco Systems

- Huawei Technologies

- Hitachi Vantara

- IBM

- ABB

- Cummins

- Legrand

- Schneider Electric

- Vertiv

- Raxio Data Centres

- Safaricom

- wingu.africa

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 95 Million |

| Forecasted Market Value ( USD | $ 226 Million |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Ethiopia |

| No. of Companies Mentioned | 12 |