Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

For instance, within the industry, THF is the solvent that is the most well-liked in creating vinyl polymer (PVC). There are many processes used for the production of Tetrahydrofuran (THF). Tetrahydrofuran (THF) is often factory-made exploitation of aldehyde through the carbonylation and chemical process. Tetrahydrofuran (THF) can even be factory-made from maleic chemical compounds through chemical change chemical action. However, the foremost wide accepted method of Tetrahydrofuran (THF) production is through 4-butanediol dehydration and cyclization. alternative ways of Tetrahydrofuran (THF) production embrace the dichloro-butane methodology and hydrocarbon reaction methodology.

THF is usually polymerized to create Polytetramethylene Ether Glycol (PTMEG) that is often used as stuff for numerous fibers, as well as textile, at intervals in the textile business. Rising demand for textile from attire and textile industries due to the strong strength and snap offered by the fiber has diode to a rise within the PTMEG production, stimulating the expansion prospects of the Tetrahydrofuran Market within the forecast period.

The market growth is additionally propelled by a bunch of alternative product applications as well as coatings, production of varnishes, employed in chemical intermediate, as a laboratory chemical, process aid within the production of crude, and use as a reaction medium within the pharmaceutical sector. Tetrahydrofuran is employed in polytetramethylene ether glycol production. Tetrahydrofuran is an extremely volatile organic solvent utilized as stuff for various syntheses like for the formulation of ether chemicals having high molecular mass by the chemical process. Factors like the high demand for polyurethane and the high growth in energy markets are completely poignant to the expansion of the market.

Key Market Drivers

Growing Demand of Tetrahydrofuran in Polymer Industry

Tetrahydrofuran (THF) is not only an organic compound but also a versatile colorless liquid with an ether-like odor. It finds its primary use as a precursor to polymers, making it an indispensable component in various industrial applications. One of the most crucial applications of THF lies in the production of polytetramethylene ether glycol (PTMEG), a raw material that plays a pivotal role in the manufacturing of spandex fibers. In 2021, global plastics production reached approximately 390.7 million tonnes, with China contributing the largest share at nearly 29%-32%, making it the leading producer worldwide.This data, sourced from Conversio Market & Strategy GmbH and nova-Institute, highlights China’s central role in the global polymer industry. Regions like North America accounted for 18%, followed by the EU at 15%-19%, Rest of Asia at 17%, and other regions including Latin America, CIS, and Japan contributing smaller shares. This widespread and increasing demand for plastics directly supports the growth of Tetrahydrofuran (THF), a critical solvent and intermediate used primarily in the production of polytetramethylene ether glycol (PTMEG), a precursor for spandex fibers. THF is also essential in manufacturing high-performance polymers and resins. As polymer production scales up globally, especially in applications requiring flexibility, durability, and resistance such as coatings, adhesives, and elastomers the demand for THF is expected to rise steadily, driven by strong industrial expansion across these regions.

Spandex, renowned for its exceptional elasticity and stretchability, has become a staple in the textile industry. It is extensively utilized in the production of a wide range of clothing items, including sportswear, casual wear, and undergarments. The global textile industry, experiencing exponential growth, has resulted in an increased demand for spandex. Consequently, the demand for PTMEG and THF, as essential components in spandex production, has witnessed a significant surge.

The escalating demand for Tetrahydrofuran in the polymer industry serves as a major driving force behind the global THF market. With the continuous expansion of the textile industry and the ever-growing need for spandex and other THF-based products, the demand for THF is projected to soar even higher. This presents a remarkable opportunity for key players in the Tetrahydrofuran market to enhance their production capacities and cater to the burgeoning market, thereby solidifying their position in the industry.

Key Market Challenges

Volatility in Prices of Raw Materials

Tetrahydrofuran (THF) is a versatile organic compound, characterized by its colorless liquid form and ether-like odor. With its wide range of applications, THF serves as a crucial precursor to polymers in industries such as pharmaceuticals, polymers, and coatings. The production of THF involves the utilization of 1,4-butanediol, which is derived from butadiene, a byproduct of the steam cracking process. Consequently, any fluctuations in the prices of these raw materials can significantly impact the overall cost of producing THF.Recent reports have shed light on the tight availability and soaring prices of the raw materials, amplifying the pricing trend of Tetrahydrofuran across different regions. The volatility in the prices of conventional fossil fuel-based raw materials, like butadiene, poses a substantial challenge for the growth of the THF market. Geopolitical events such as the ongoing war in Ukraine have contributed to the surge in prices and increased volatility in the raw material markets. These factors further exacerbate the challenges faced by the THF market. The fluctuations in raw material prices not only affect the production costs but also impact the overall profitability of businesses operating in the THF market. This volatility creates an atmosphere of uncertainty, making it difficult for companies to plan for the future and invest in capacity expansions.

Despite the availability of low-cost raw materials, the continuous price fluctuations pose a significant threat to the growth of the THF market. This volatility has the potential to hinder the dominant Tetrahydrofuran segment, which accounts for over 50% of the global market. In conclusion, while the demand for Tetrahydrofuran continues to grow across various industries, the volatility in raw material prices presents a significant challenge to the global THF market. To address this issue, companies may need to explore alternative raw materials, improve production efficiency, or consider passing on the increased costs to consumers. Navigating this challenge will be crucial for the future growth and sustainability of the global Tetrahydrofuran market.

Key Market Trends

Surge in Environmental and Regulatory Concerns

Tetrahydrofuran (THF) is an organic compound widely recognized as a vital precursor to polymers, finding extensive applications in diverse industries such as pharmaceuticals, polymers, and coatings. However, the utilization of THF, like many chemical compounds, can lead to adverse environmental effects. It is crucial to note that THF exhibits high flammability and, when released into the environment, it has the potential to contaminate the air, water, and soil. In recent years, a noticeable upsurge in environmental and regulatory concerns has emerged surrounding the production and use of chemicals, including THF. This surge is driven by an increasing awareness of the significant environmental impact associated with chemical production. Regulatory bodies and consumers alike are exerting mounting pressure for the adoption of greener and more sustainable practices.To address these concerns, regulatory bodies worldwide are implementing stricter regulations on chemical manufacturing processes, aiming to minimize environmental harm caused by THF and other chemicals. Companies are now required to comply with regulations pertaining to emissions, waste disposal, and the use of hazardous substances. The impact of these environmental and regulatory concerns on the global THF market cannot be understated. Companies are now compelled to adapt their operations to adhere to more stringent regulations while also meeting the surging demand for environmentally friendly products.

Key Market Players

- Ashland Inc.

- Banner Chemicals Limited

- BASF SE

- DCC PLC

- Hefei TNJ Chemical Industry Co.Ltd.

- Henan GP Chemicals Co., Ltd

- Mitsubishi Chemical Corporation

- REE ATHARVA LIFESCIENCE PVT. LTD

- Shenyang East Chemical Science-Tech Co., Ltd.

- Sipchem Chemicals Co

Report Scope:

In this report, the Global Tetrahydrofuran Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Tetrahydrofuran Market, By Technology:

- Reppe Process

- Davy Process

- Propylene Oxide Process

- Butadiene Process

Tetrahydrofuran Market, By End User:

- Polymer

- Textile

- Pharmaceutical

- Paints and Coatings

- Others

Tetrahydrofuran Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Tetrahydrofuran Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Ashland Inc.

- Banner Chemicals Limited

- BASF SE

- DCC PLC

- Hefei TNJ Chemical Industry Co.Ltd.

- Henan GP Chemicals Co., Ltd

- Mitsubishi Chemical Corporation

- REE ATHARVA LIFESCIENCE PVT. LTD

- Shenyang East Chemical Science-Tech Co., Ltd.

- Sipchem Chemicals Co

Table Information

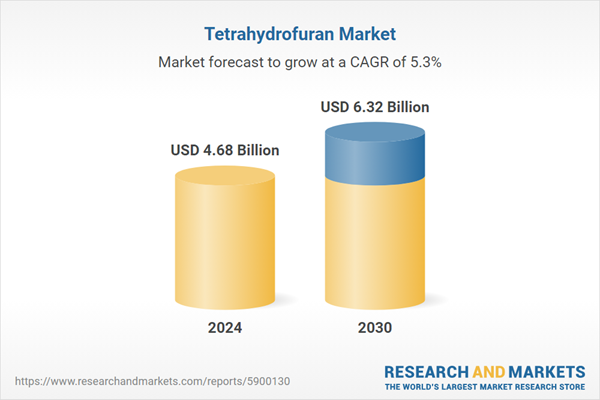

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.68 Billion |

| Forecasted Market Value ( USD | $ 6.32 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |