Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand of Long Fibre Thermoplastics (LFT) in Automotive Industry

The increasing application of LFTs in the automotive industry is a major driver of market growth. These materials offer an outstanding strength-to-weight ratio, allowing manufacturers to create lightweight yet high-strength components that enhance fuel efficiency and overall vehicle performance. LFTs also provide excellent impact resistance, making them ideal for critical applications such as underbody shields, structural supports, and interior panels. With growing pressure to meet emissions standards and improve fuel economy, automakers are accelerating the shift toward advanced lightweight materials like LFTs. The ability of LFTs to deliver strength without sacrificing safety or durability further supports their rising adoption in next-generation automotive design.Key Market Challenges

Volatility in Prices of Raw Materials

Fluctuating raw material prices pose a significant challenge to the LFT market. Geopolitical instability, trade disruptions, and global supply chain issues have contributed to uncertainty in the availability and pricing of key materials. This volatility increases production costs and pressures manufacturers to adjust pricing strategies, potentially impacting profit margins and market competitiveness. Furthermore, supply constraints may hinder production and delay product deliveries. The growing emphasis on sustainable production adds to the challenge, as companies seek to incorporate recycled or bio-based materials without compromising performance or cost efficiency. Navigating these complexities requires strategic sourcing, supply chain optimization, and investment in research to develop viable material alternatives.Key Market Trends

Advancements in Manufacturing Process

Technological advancements are transforming the LFT manufacturing landscape, enabling improved process efficiency and product quality. Innovations such as hot melt extrusion are gaining traction for producing LFT pellets with enhanced fiber dispersion and mechanical performance. These modern methods offer better control over fiber length and alignment, which directly translates to improved end-product characteristics.Additionally, the adoption of Industry 4.0 technologies - including automation, AI, and machine learning - is streamlining operations, reducing waste, and enhancing overall productivity. The growing integration of 3D printing also presents opportunities for customized, lightweight, and structurally complex LFT components across industries such as automotive and industrial design. Collectively, these manufacturing innovations are reshaping the LFT landscape and unlocking new possibilities for application.

Key Market Players

- SABIC

- Solvay SA

- RTP Company

- JNC Corporation

- Avient Corporation

- Celanese Corporation

- LANXESS AG

- Daicel Corporation

- Kingfa SCI. & TECH. CO., LTD.

- Asahi Kasei Corporation

Report Scope:

In this report, the Global Long Fibre Thermoplastics (LFT) Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Long Fibre Thermoplastics (LFT) Market, By Resin Type:

- Polypropylene

- Polybutylene Terephthalate

- Polyamide

- Others

Long Fibre Thermoplastics (LFT) Market, By Application:

- Automotive

- Consumer Goods

- Sporting Goods

- Industrial Goods

- Others

Long Fibre Thermoplastics (LFT) Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Long Fibre Thermoplastics (LFT) Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- SABIC

- Solvay SA

- RTP Company

- JNC Corporation

- Avient Corporation

- Celanese Corporation

- LANXESS AG

- Daicel Corporation

- Kingfa SCI. & TECH. CO., LTD.

- Asahi Kasei Corporation

Table Information

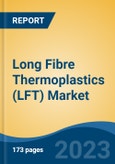

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.76 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |