Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As a key segment of the global fertilizer industry, its market expansion is closely tied to the growth of the agricultural sector and the increasing adoption of advanced farming techniques. The continual rise in global food requirements places constant pressure on agricultural systems, positioning UAN as a critical input in meeting yield targets. Despite facing challenges such as fluctuating raw material prices and environmental concerns, the market remains resilient. Its trajectory is shaped by emerging trends in product customization, sustainable agricultural practices, and digital farming technologies, all of which are reinforcing the long-term relevance of Liquid UAN in the evolving agri-input landscape.

Key Market Drivers

Rise in Demand of Food Due to Growing Population

The Liquid Urea Ammonium Nitrate (UAN) market is witnessing substantial growth, driven largely by the rising global population and escalating concerns surrounding hunger and food security. As a critical input in modern agricultural practices, UAN plays a key role in boosting crop yields, thereby supporting the availability of food to meet the nutritional demands of a growing global population. With the world population projected to reach approximately 9.8 billion by 2050, there is mounting pressure on global food production systems to enhance output. UAN, as a high-efficiency nitrogen-based fertilizer, is instrumental in increasing agricultural productivity and addressing the intensifying demand for food.This demographic trend further highlights the urgency of ensuring food security a condition where all individuals have consistent access to sufficient, safe, and nutritious food for a healthy life. According to the 2024 edition of the *State of Food Security and Nutrition in the World* report, an estimated 713 to 757 million people experienced hunger in 2023 equivalent to one in every eleven individuals globally and one in every five across the African continent.Liquid Urea Ammonium Nitrate contributes to food security by enabling farmers to maximize yields from limited arable land. Its targeted nitrogen delivery supports the healthy growth and development of crops, ensuring higher output per hectare. Moreover, beyond yield enhancement, UAN also contributes to improving crop quality, which is essential for meeting nutritional standards and increasing market value. By delivering essential nutrients efficiently, UAN supports the production of high-quality, nutritionally rich crops an important factor in combating global hunger.

Key Market Challenges

Price Volatility

Price volatility in the Liquid Urea Ammonium Nitrate Market presents significant challenges for both producers and end-users. For farmers, unpredictable pricing complicates budgeting for fertilizer costs, while producers face revenue and margin uncertainties. This volatility is largely driven by fluctuations in the prices of key raw materials urea and ammonium nitrate whose costs are influenced by factors such as energy prices, global supply-demand imbalances, and geopolitical developments. Any substantial variation in these input costs can have a direct impact on the market price of Liquid UAN. Moreover, the energy-intensive nature of UAN production heightens its vulnerability to shifts in energy prices, especially those of natural gas, a critical feedstock for ammonia production an essential component of UAN.Changes in natural gas prices can substantially affect overall production costs and thereby influence UAN pricing. Broader macroeconomic factors, including recessions or slowdowns in economic activity, can also dampen demand for agricultural products and, by extension, for fertilizers like UAN. In such scenarios, economic uncertainty further amplifies market volatility. To mitigate these risks, stakeholders in the Liquid UAN market increasingly rely on structured risk management approaches, such as hedging strategies and long-term supply contracts, to reduce exposure to pricing fluctuations and ensure greater financial predictability.

Key Market Trends

Increasing Demand for Customized formulations

In the fertilizer industry, the adoption of customized formulations particularly Liquid Urea Ammonium Nitrate (UAN) has emerged as a prominent trend, driven by the need for greater precision in agricultural practices. This approach supports both agronomic performance and environmental stewardship. Different crops require specific nutrients at various growth stages.Customized Liquid UAN formulations enable farmers to precisely align nutrient delivery with crop demands, enhancing plant health, increasing yields, and minimizing nutrient waste. UAN (Urea Ammonium Nitrate) solutions generally contain nitrogen concentrations of 28%, 30%, or 32%, although customized formulations with varying nutrient levels are also manufactured to meet specific requirements. The production process involves blending urea, ammonium nitrate, and water in a final mixing tank, after which the solution is precisely measured, thoroughly mixed, and subsequently cooled.

Furthermore, within a single field, soil characteristics such as nutrient availability, pH, and composition can vary considerably. Tailored UAN formulations allow for site-specific nutrient management, thereby improving nutrient efficiency and reducing the risk of imbalances that can hinder crop performance. The ability to customize formulations also helps farmers optimize fertilizer usage. By aligning inputs with crop and soil needs, nutrient uptake becomes more efficient, leading to better yields and potentially lowering input costs. Additionally, this targeted approach reduces the likelihood of over-fertilization, which can cause nutrient runoff, soil degradation, and elevated production expenses. As a result, customized Liquid UAN formulations contribute to a more sustainable and cost-effective agricultural system.

Key Market Players

- Yara international ASA

- CF Industries Holdings, Inc

- Nutrien Ltd

- Koch Fertilizer, LLC

- EuroChem Group

- OCI Nitrogen B.V

- Thyssenkrup Uhde GmbH

- LSB Industries

- Peptech Biosciences Ltd.

- The Mosaic Company

Report Scope:

In this report, the Global Liquid Urea Ammonium Nitrate Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Liquid Urea Ammonium Nitrate Market, By Sales Channel:

- Direct

- Indirect

Liquid Urea Ammonium Nitrate Market, By Application:

- Field Crops

- Vegetables

- Plantation Crops

- Pulses

- Horticulture Crops

Liquid Urea Ammonium Nitrate Market, By Mode of Application:

- Foliar

- Drenching

Liquid Urea Ammonium Nitrate Market, By Region:

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Liquid Urea Ammonium Nitrate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Yara international ASA

- CF Industries Holdings, Inc

- Nutrien Ltd

- Koch Fertilizer, LLC

- EuroChem Group

- OCI Nitrogen B.V

- Thyssenkrup Uhde GmbH

- LSB Industries

- Peptech Biosciences Ltd.

- The Mosaic Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

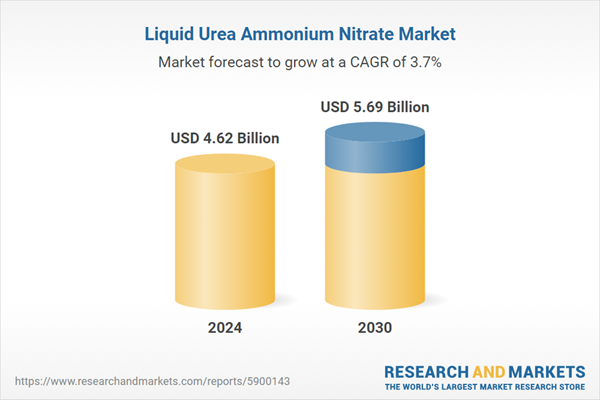

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.62 Billion |

| Forecasted Market Value ( USD | $ 5.69 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |