Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key selection criteria for greenhouse films include their light transmission and diffusion properties, which are vital for ensuring uniform light distribution. Proper light dispersion helps prevent leaf scorching and excess heat buildup, fostering healthier plant development.

While polyethylene films remain the dominant choice, polyvinyl chloride (PVC) films are also gaining traction. Though costlier, PVC films offer enhanced durability with a lifespan of up to five years and flexibility in width (typically 4 to 6 feet). However, PVC’s tendency to attract dust can affect long-term performance. Compared to traditional glass coverings, greenhouse films offer several advantages - cost-efficiency, easy installation, and design flexibility - making them increasingly popular for modern greenhouses.

Key Market Drivers

Rising Demand from the Agriculture Industry

With the global agricultural market projected to reach USD 4.82 trillion by 2025 and exports expected to hit USD 865.2 billion, the demand for greenhouse films is surging. These films help regulate key environmental factors such as temperature, humidity, and light, while protecting crops from adverse weather.The accelerating adoption of Controlled Environment Agriculture (CEA) is a major contributor to market growth. CEA allows year-round cultivation and supports food security, especially in regions with climate challenges or limited arable land. As more agricultural players turn to CEA to ensure reliable, local food production, the demand for advanced greenhouse films continues to rise. This trend is particularly strong in regions grappling with climate variability, urbanization, and increasing population-driven food demands.

Key Market Challenges

High Production Costs

Despite the promising outlook, the greenhouse film industry faces a major hurdle: elevated production costs. Manufacturing involves expensive raw materials, advanced machinery, and high energy inputs, all of which push up overall costs.Additionally, the development of films with enhanced performance - such as better light diffusion, thermal insulation, anti-drip features, and increased durability - requires significant R&D investment. Manufacturers are also under pressure to meet growing environmental expectations by producing biodegradable and sustainable films, which involve premium materials and specialized processes.

As a result, these high production costs often translate to higher prices for end-users, which can be a deterrent - particularly in cost-sensitive or developing markets, where affordability remains a critical barrier to adoption.

Key Market Trends

Rising Popularity of Multi-Layer Films

One of the most transformative trends in the greenhouse film space is the adoption of multi-layer films, also known as multi-wall films. These advanced coverings are composed of multiple plastic layers, each engineered for a specific purpose, such as light control, moisture resistance, and temperature regulation.A standout example is the 6-layer EVO AC greenhouse film, known for its anti-drip properties and high light transmission, which help reduce disease risks and enhance crop yields. By evenly diffusing sunlight throughout the greenhouse, multi-layer films eliminate hot spots and ensure uniform plant exposure, supporting balanced growth and improving operational efficiency.

Key Market Players

- Gineger Plastic Products Ltd.

- RKW SE

- Plastika Kritis S.A.

- Agriplast Srl

- Essen Multipack Ltd.

- Berry Global Group, Inc.

- Polifilm Extrusion GmbH

- Armando Alvarez SA

- FVG Folien-Vertriebs GmbH

- Eiffel S.p.A.

Market Segmentation

By Resin Type:

- Low-Density Polyethylene (LDPE)

- Ethylene-Vinyl Acetate

- Linear Low-Density Polyethylene (LLDPE)

- Others

By Thickness:

- 80-150 microns

- 150-200 microns

- Greater than 200 microns

By Application:

- Fruits

- Vegetables

- Flowers

- Ornamental Plants

By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

The report provides detailed company profiles, strategic insights, and product innovations of major players in the global greenhouse film market. These profiles help stakeholders assess competitive dynamics and strategic positioning.Available Customizations

TechSci Research offers customizable features in its Global Greenhouse Film Market report. Companies can request:

- Detailed analysis and profiling of up to five additional market players, tailored to their specific research or business requirements.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Gineger Plastic Products Ltd.

- RKW SE

- Plastika Kritis S.A.

- Agriplast Srl

- Essen Multipack Ltd.

- Berry Global Group, Inc.

- Polifilm Extrusion GmbH

- Armando Alvarez SA

- FVG Folien-Vertriebs GmbH

- Eiffel S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

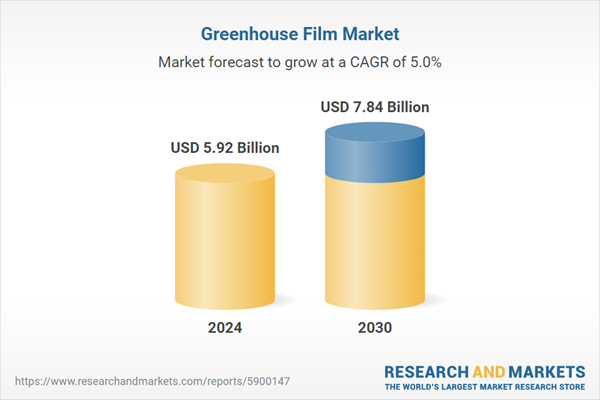

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.92 Billion |

| Forecasted Market Value ( USD | $ 7.84 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |