Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market’s expansion is fueled by rising pharmaceutical output, driven by an aging population, increased chronic disease incidence, and enhanced global healthcare access. The growing demand for biopharmaceuticals such as vaccines, monoclonal antibodies, and biosimilars further propels the need for advanced membrane filtration. Regulatory pressures from agencies like the FDA and EMA also necessitate stringent contamination control, reinforcing the role of filtration technologies. Emerging markets and continuous innovations - such as Alfa Laval’s 2022 launch of a multipurpose membrane system - are accelerating adoption, making membrane filtration an integral component of modern pharmaceutical production.

Key Market Drivers

Rising Pharmaceutical Production

The consistent growth of the global pharmaceutical sector, fueled by rising population, aging demographics, and chronic illness prevalence, is a major driver for membrane filtration technologies. To meet rising demand, pharmaceutical firms are expanding production across drug categories - ranging from small molecules to complex biopharmaceuticals and vaccines.For instance, Meissner Corporation's USD 250 million investment in 2023 to build a U.S.-based facility highlights the focus on boosting microfiltration capabilities and ensuring supply chain resilience. Each drug type requires specific filtration processes for sterilization and purification, reinforcing the indispensable role of membrane technologies. Moreover, as biopharmaceutical production increases, so does the demand for high-performance filtration systems that ensure purity and safety. Maintaining product integrity and adhering to stringent regulatory standards make membrane filtration essential in safeguarding pharmaceutical quality during large-scale manufacturing.

Key Market Challenges

Scale-Up Challenges

Scaling membrane filtration systems from laboratory settings to full-scale production presents several technical and operational hurdles. Key variables such as membrane fouling, pressure dynamics, and mass transfer may behave unpredictably at larger scales, affecting filtration consistency. Fouling becomes more pronounced during scale-up, necessitating advanced mitigation strategies to maintain efficiency.Larger systems also introduce complex flow dynamics that require precise calibration to avoid membrane damage or suboptimal filtration. Regulatory validation of large-scale operations demands rigorous testing to prove reliability and adherence to quality standards. Moreover, membrane materials must withstand high operational stress over extended use. The scale-up process also raises cost concerns, involving higher capital expenditure, operating costs, and resource usage. Striking a balance between economic viability and process reliability remains a significant challenge for pharmaceutical manufacturers adopting large-scale membrane filtration.

Key Market Trends

Increased Outsourcing

The trend of outsourcing filtration processes to contract manufacturing organizations (CMOs) is gaining momentum in the pharmaceutical industry. CMOs offer expertise in membrane filtration technologies, enabling pharmaceutical firms to focus on core functions like drug development and marketing. These organizations provide scalable and cost-efficient solutions, often reducing capital investment burdens for pharma companies.By leveraging economies of scale and specialized infrastructure, CMOs offer flexibility in production and quicker adaptation to market demands. Moreover, their deep regulatory knowledge ensures compliance with GMP standards, easing the regulatory approval pathway. Outsourcing also minimizes operational risks, as CMOs often maintain backup systems to prevent disruptions. This growing reliance on third-party providers reflects a strategic shift toward efficiency, compliance, and scalability in pharmaceutical manufacturing.

Key Players Profiled in this Pharmaceutical Membrane Filtration Technologies Market Report

- 3M Company

- Danaher Corporation

- GE Healthcare

- GEA Group

- Graver Technologies

- Merck Millipore

- Parker Hannifin Corporation

- Repligen Corporation

- Sartorius Stedim Biotech GmbH

- Thermo Fisher Scientific Inc

Report Scope:

In this report, the Global Pharmaceutical Membrane Filtration Technologies Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Pharmaceutical Membrane Filtration Technologies Market, by Material:

- Polyethersulfone (PES)

- Mixed Cellulose Ester & Cellulose Acetate (MCE & CA)

- Polyvinylidene Difluoride (PVDF)

- Nylon Membrane Filters

- Others

Pharmaceutical Membrane Filtration Technologies Market, by Technique:

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Others

Pharmaceutical Membrane Filtration Technologies Market, by Application:

- Final Product Processing

- Raw Material Filtration

- Cell Separation

- Water Purification

- Air Purification

Pharmaceutical Membrane Filtration Technologies Market, by Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pharmaceutical Membrane Filtration Technologies Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Pharmaceutical Membrane Filtration Technologies market report include:- 3M Company

- Danaher Corporation

- GE Healthcare

- GEA Group

- Graver Technologies

- Merck Millipore

- Parker Hannifin Corporation

- Repligen Corporation

- Sartorius Stedim Biotech GmbH

- Thermo Fisher Scientific Inc.

Table Information

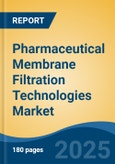

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.89 Billion |

| Forecasted Market Value ( USD | $ 9.87 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |