Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the market encounters substantial hurdles regarding production intricacy and supply chain instability, which frequently lead to severe product shortages. The necessity for significant capital expenditure on sterile manufacturing sites and strict adherence to regulatory standards further limits production potential. According to data from the U.S. Pharmacopeia in 2024, sterile injectable drugs accounted for 69% of all active drug shortages. This figure highlights the severe fragility of the manufacturing infrastructure, representing a significant barrier to the steady growth of the global market.

Market Drivers

The swift expansion of biologics and complex macromolecule therapies acts as a major catalyst for market advancement. As pharmaceutical innovators increasingly prioritize large-molecule medications like monoclonal antibodies and peptides, the natural instability of these liquid formulations demands the application of lyophilization to maintain long-term potency. This momentum is supported by the consistent volume of regulatory approvals for such treatments; for instance, Biopharma PEG reported in January 2025 that the FDA authorized 18 new biologic entities in 2024, constituting a significant share of new therapies that usually necessitate sophisticated freeze-drying methods. This transition is further bolstered by the industry's emphasis on specialized medicine, with the Regulatory Affairs Professionals Society noting in January 2025 that 52% of new drug approvals in 2024 targeted rare diseases, a sector heavily dependent on stable, lyophilized injectable forms for worldwide distribution.Simultaneously, the growth of Contract Development and Manufacturing Organization (CDMO) services is transforming the production environment. The substantial capital requirements and technical difficulties linked to sterile lyophilization are driving innovators to outsource production to specialized partners who are actively expanding their facilities to avoid capacity constraints. As reported by DCAT Value Chain Insights in July 2025, Vetter Pharma began construction on a new $285 million clinical manufacturing facility in Des Plaines, Illinois, aiming to ensure long-term availability for complex injectables. This increase in external manufacturing investment meets the urgent demand for adaptable and scalable supply chains, directly mitigating the historical vulnerability of the sterile injectable production base.

Market Challenges

The intense complexity of production processes and the inherent vulnerability of the supply chain serve as major obstacles to the advancement of the Global Lyophilized Injectable Market. Creating sterile manufacturing environments requires massive capital funding and rigorous compliance with regulatory protocols, which limits the pool of qualified manufacturers. This centralization of manufacturing capabilities implies that even slight technical issues or quality assurance failures at a single site can cause extensive product unavailability. Such operational inflexibility constrains the industry's capacity to rapidly adjust production levels in reaction to shifting demand.These repeated supply disruptions directly diminish market earnings and impede the wider acceptance of lyophilized treatments. The ongoing failure to sustain dependable inventory levels compels healthcare networks to ration supplies or transition to substitute formulations. According to the American Society of Health-System Pharmacists, the pharmaceutical sector hit a record high of 323 active drug shortages in the first quarter of 2024. This unparalleled degree of supply chain volatility emphasizes the challenges manufacturers encounter in satisfying global requirements, thereby serving as a primary constraint on the market's consistent financial expansion.

Market Trends

The widespread adoption of dual-chamber syringes and cartridges marks a significant advancement in packaging technology, designed to alleviate the reconstitution difficulties associated with lyophilized products. These sophisticated systems separate the freeze-dried powder and the diluent into distinct chambers, enabling automatic mixing within the unit to eradicate user mistakes and contamination risks linked to manual vial manipulation. The increasing dependence on these patient-friendly designs is mirrored in the robust financial results of major component producers. As per the Stevanato Group's fiscal year 2024 results released in March 2025, revenue from their high-value solutions division, which comprises high-performance syringes, rose by 15% year-over-year to reach €422.3 million.In parallel, the integration of Artificial Intelligence (AI) for cycle optimization is radically transforming manufacturing productivity by substituting empirical trial-and-error approaches with predictive modeling. Pharmaceutical engineers are utilizing AI algorithms and digital twin simulations to predict drying behaviors and track essential process variables in real-time, guaranteeing uniform product quality while significantly shortening energy-heavy cycle times. Prominent biopharmaceutical companies are actively adopting these digital tools to improve supply chain responsiveness. For example, Sanofi announced in May 2025 the launch of its third Digital Accelerator dedicated to digitizing its worldwide manufacturing and supply chain, aiming to cut the time to market for new drugs by as much as one year through these AI-powered initiatives.

Key Players Profiled in the Lyophilized Injectable Market

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Schott AG

- Aristopharma Ltd.

- Vetter Pharma GmbH

- Jubilant HollisterStier LLC

- F. Hoffmann-La Roche Ltd.

- Novo Nordisk A/S

Report Scope

In this report, the Global Lyophilized Injectable Market has been segmented into the following categories:Lyophilized Injectable Market, by Packaging:

- Single-Use Vials

- Point-Of-Care Reconstitution

- Specialty Packaging

Lyophilized Injectable Market, by Delivery:

- Prefilled Diluent Syringes

- Proprietary Reconstitution Devices

- Single-Step Devices

- Multi-Step Devices

Lyophilized Injectable Market, by Indication:

- Autoimmune Diseases

- Infectious Diseases

- Metabolic Conditions

- Others

Lyophilized Injectable Market, by End-User:

- Hospital Pharmacy

- Retail Pharmacy

- Others

Lyophilized Injectable Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Lyophilized Injectable Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Lyophilized Injectable market report include:- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Schott AG

- Aristopharma Ltd.

- Vetter Pharma GmbH

- Jubilant HollisterStier LLC

- F. Hoffmann-La Roche Ltd

- Novo Nordisk A/S

Table Information

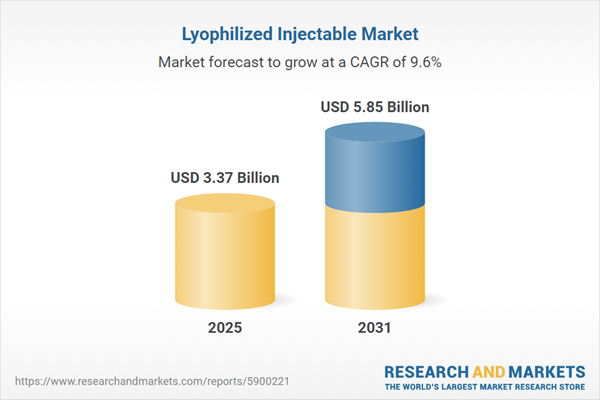

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.37 Billion |

| Forecasted Market Value ( USD | $ 5.85 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |