Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

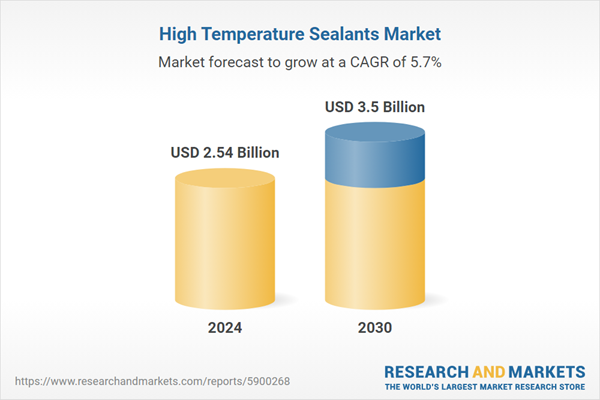

Known for their ability to maintain flexibility, resist degradation, and provide reliable sealing under elevated temperatures, high-temperature sealants are formulated for use in harsh thermal environments. The market's expansion is also being propelled by the increased utilization of renewable energy technologies - including solar panels, wind turbines, and geothermal systems - which demand robust and long-lasting sealing solutions. As industries prioritize energy efficiency and performance in high-temperature conditions, the role of these advanced sealants becomes increasingly indispensable.

Key Market Drivers

Growing Demand from the Aerospace and Automotive Industries

A major factor fueling growth in the high-temperature sealants market is the escalating demand from the aerospace and automotive sectors. These industries are adopting high-performance sealing materials to ensure the durability and reliability of components exposed to extreme heat. For instance, Mexico stands as the seventh-largest producer of passenger vehicles globally, manufacturing 3.5 million units annually, with 88% exported - primarily to the U.S., which accounts for 76% of these exports. The aerospace industry, known for its stringent performance standards, heavily relies on sealants that can withstand high temperatures, making them an essential component in aerospace assembly and maintenance. The increasing production and export activity in both sectors directly contribute to the rising need for high-temperature sealing solutions.Key Market Challenges

Price Volatility of Raw Materials

One of the primary challenges confronting the global high-temperature sealants market is the fluctuating cost of raw materials. These sealants often depend on specialized compounds that are sourced from limited suppliers and are sensitive to disruptions in global supply chains, geopolitical shifts, and varying market demands. This volatility results in unpredictable manufacturing costs, complicating competitive pricing strategies and long-term planning. It also constrains investment in R&D for next-generation formulations. To counter these issues, manufacturers are focusing on diversifying their supplier base, strengthening supply chain efficiency, and innovating formulations that rely less on volatile inputs, thereby fostering market resilience.Key Market Trends

Growing Demand for Customized Solutions

A key trend shaping the high-temperature sealants market is the increasing demand for customized products tailored to specific industrial requirements, especially in aerospace and electronics. These sectors operate under highly specialized conditions, necessitating sealants that deliver both performance and adaptability. Manufacturers like Jinyang Chemicals are developing advanced silicone-based sealants known for superior weather resistance, gap filling, and waterproofing capabilities. Their medium modulus formulations strike a balance between flexibility and strength, making them suitable for construction and general sealing applications. Additionally, the availability of standard and customized color options further supports application-specific customization, meeting the precise needs of diverse projects.Key Market Players

- 3M Company

- Bostik SA (Arkema)

- CSL Silicones, Inc.

- CSW Industrials, Inc.

- DOW Corning Corporation

- H.B. Fuller

- Henkel AG & Co., KGaA

- Illinois Tool Works (ITW), Inc.

- Mcgill Airseal LLC

- Momentive Performance Materials, Inc.

Report Scope:

In this report, the Global High Temperature Sealants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:High Temperature Sealants Market, By Chemistry:

- Silicone

- Epoxy

- Others

High Temperature Sealants Market, By Application:

- Electrical & Electronics

- Transportation

- Industrial

- Construction

- Others

High Temperature Sealants Market, By Region:

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global High Temperature Sealants Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Company

- Bostik SA (Arkema)

- CSL Silicones, Inc.

- CSW Industrials, Inc.

- DOW Corning Corporation

- H.B. Fuller

- Henkel AG & Co., KGaA

- Illinois Tool Works (ITW), Inc.

- Mcgill Airseal LLC

- Momentive Performance Materials, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.54 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |