Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Disposable Incomes and Urbanization

A key growth driver for the kids apparel market in India is the increase in disposable incomes, particularly among middle-class households in urban and semi-urban areas. India’s per capita disposable income rose from USD 2.11 thousand in 2019 to USD 2.54 thousand in 2023, empowering families to spend more on quality children’s clothing. Urbanization is transforming consumption patterns, with lifestyle upgrades and increased access to modern retail formats influencing parents to opt for stylish and branded kidswear. Exposure to global fashion trends, driven by metropolitan living, has shifted buying behavior from basic needs to occasion-specific and premium apparel choices. Additionally, dual-income households now have greater spending power, leading to higher demand across categories such as festive wear, premium outfits, and custom-designed clothing. These developments signal continued demand growth as economic and urban trends evolve.Key Market Challenges

Price Sensitivity and Fragmented Consumer Preferences

The India kids apparel market faces considerable challenges due to price sensitivity, especially in Tier II and Tier III cities. While urban regions embrace branded and fashion-forward kidswear, a large segment of consumers still prioritizes affordability. Parents often hesitate to invest heavily in children’s clothing, knowing that kids quickly outgrow garments, leading them to favor inexpensive or locally manufactured alternatives. This makes it difficult for premium brands to maintain profitability while catering to a price-conscious audience. Moreover, consumer tastes vary significantly across regions, influenced by local culture, climate, and festivals. This diversity complicates efforts to standardize offerings or pricing strategies. Competing with unorganized market players while balancing affordability and quality remains a complex challenge for organized retailers and brands.Key Market Trends

Growing Demand for Sustainable and Organic Kidswear

An important trend reshaping the India kids apparel market is the rising interest in sustainable and organic clothing options. Increasingly, health-conscious and environmentally aware parents are choosing garments made from natural, chemical-free materials such as organic cotton, bamboo, and hemp. These eco-friendly alternatives are seen as safer for children’s sensitive skin and align with broader values around ethical consumption.Urban consumers, especially in metropolitan cities, are driving this trend, supported by emerging brands like Greendigo, Superbottoms, and Berrytree. These players offer conscious fashion that appeals to modern parental priorities. Additionally, growing awareness of climate change and ethical sourcing is encouraging even larger brands to develop eco-friendly collections and adopt sustainable packaging practices. As Gen Z parents prioritize sustainability, this trend is expected to gain more traction in the coming years.

Key Players Profiled in this India Kids Apparel Market Report

- Gini & Jony Ltd.

- Aditya Birla Fashion and Retail Ltd.

- Benetton India Pvt. Ltd.

- Arvind Fashion Pvt. Ltd. (Tommy Hilfiger)

- Indian Clothing League Pvt. Ltd.

- Tiny Girls Clothing Pvt. Ltd.

- H & M Hennes & Mauritz AB

- Inditex Trent Retail India Private Limited (ZARA)

- GAP International Sourcing (India) Private Limited

- Mothercare (India) Ltd.

Report Scope:

In this report, the India Kids Apparel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Kids Apparel Market, by Product Type:

- Uniforms

- T-Shirts/Shirts

- Bottom Wear

- Ethnic Wear

- Others

India Kids Apparel Market, by Distribution Channel:

- Supermarkets/Hypermarkets

- Multi-Brand Stores

- Online

- Others

India Kids Apparel Market, by Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Kids Apparel Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this India Kids Apparel market report include:- Gini & Jony Ltd.

- Aditya Birla Fashion and Retail Ltd.

- Benetton India Pvt. Ltd.

- Arvind Fashion Pvt. Ltd. (Tommy Hilfiger)

- Indian Clothing League Pvt. Ltd.

- Tiny Girls Clothing Pvt. Ltd.

- H & M Hennes & Mauritz AB

- Inditex Trent Retail India Private Limited (ZARA)

- GAP International Sourcing (India) Private Limited

- Mothercare (India) Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | May 2025 |

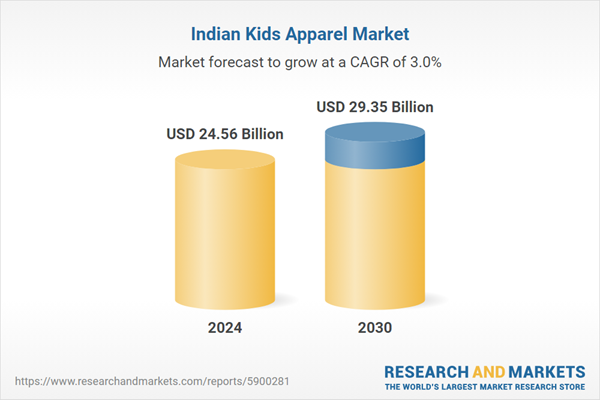

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.56 Billion |

| Forecasted Market Value ( USD | $ 29.35 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 11 |