Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The demand for potash is intrinsically linked to the global population growth and the increasing need for sustainable food production. With the world's population projected to reach over 9 billion by 2050, the pressure on agriculture to produce more food efficiently and sustainably is intensifying. Potash fertilizers play a critical role in this equation, as they enhance crop yields, improve crop quality, and help plants withstand environmental stressors, such as drought and disease.

Several factors influence the dynamics of the global potash market. Geographically, major producers of potash include Canada, Russia, Belarus, and China, with significant reserves and production capacities. Additionally, the market is affected by economic conditions, weather patterns, and crop prices, which can influence farmer decisions on fertilizer application. Furthermore, environmental concerns and regulations related to nutrient runoff and sustainability practices are shaping the industry, driving the development of innovative, eco-friendly potash products.

The global potash market has witnessed fluctuations in prices and supply-demand dynamics over the years, with cycles of boom and bust. However, it remains a critical sector for ensuring global food security, making it a focus of attention for both industry stakeholders and policymakers.

Key Market Drivers

Population Growth and Food Security

Population growth remains a fundamental driver of the rising global demand for potash fertilizers. With the global population expected to exceed 9.7 billion by 2050, food production must increase by at least 60% to meet future consumption needs. Potash, as a key source of potassium, is critical to increasing agricultural productivity and improving plant health. It supports essential physiological functions in crops, such as enzyme activation, water regulation, and nutrient transport, thereby enabling farmers to produce more food per hectare and maintain soil fertility over repeated growing cycles.As cultivable land becomes increasingly scarce, boosting yield per acre becomes imperative. Potash fertilizers help strengthen crop root systems, enhance drought resistance, and reduce crop vulnerability to pests and diseases. In 2023, potassium-deficient soils were estimated to affect over 40% of global croplands, significantly impacting food security in developing regions. By replenishing potassium in the soil, potash ensures better plant resilience and enables farmers to optimize every growing season, making it a vital input for meeting nutritional needs in a resource-constrained world.

The shift in dietary habits is another factor fueling potash demand. Rising incomes and urbanization have led to greater consumption of fruits, vegetables, and protein-rich foods, all of which are potassium-intensive crops. In the past five years, global fruit and vegetable consumption per capita has grown by more than 15%, putting pressure on supply chains to increase production sustainably. Potash enhances the quality, taste, and shelf life of these crops, making it essential not just for quantity but for delivering high-value produce that meets evolving consumer preferences.

Beyond increasing yields, potash plays a role in improving the nutritional quality of crops key to addressing hidden hunger and malnutrition. Crops grown with adequate potassium are often richer in vitamins, minerals, and sugars, supporting better human health. As global food systems aim to deliver both caloric sufficiency and nutritional value, potash fertilizers offer a solution that supports both goals. In the context of population growth and rising food demand, potash is indispensable for producing diverse, nutrient-rich crops while sustaining agricultural ecosystems for future generations.

Key Market Challenges

Price Volatility

The potash market is sensitive to supply-demand imbalances. When demand for potash outstrips supply, prices tend to rise sharply. Conversely, when there is an oversupply of potash, prices can plummet. These fluctuations make it challenging for both producers and consumers to make informed decisions about potash purchases and investments in the agricultural sector.Potash is a globally traded commodity, and its prices are often denominated in different currencies. Currency exchange rate fluctuations can significantly impact the cost of potash for buyers in different countries. A stronger currency in the producing country can lead to higher export prices, which can affect affordability and demand in importing nations.

Geopolitical conflicts and trade disputes can disrupt potash markets. Export restrictions, tariffs, and trade barriers can lead to supply disruptions and uncertainty. Producers and consumers must navigate these geopolitical challenges, which can result in price spikes and market instability.

Farmers' decisions regarding fertilizer use are influenced by the relative prices of different fertilizers, including potash. Price volatility in the potash market can lead to fluctuations in farmers' fertilizer choices. When potash prices are high, farmers may seek alternative fertilizers or reduce their fertilizer application, affecting the potash market.

Price volatility poses a significant challenge for potash producers. When prices are high, profitability can soar, but during periods of low prices, profit margins can shrink or turn negative. This can hinder investment in new mining operations, infrastructure, and technology upgrades.

Farmers rely on stable input costs to plan and budget for their crop production. Price volatility in the potash market can disrupt these plans, making it difficult for farmers to predict their expenses accurately. This uncertainty can affect their overall financial stability.

Key Market Trends

Technological Advancements

Technological advancements are playing a pivotal role in boosting the global potash market, driving efficiency, reducing production costs, and enhancing the accessibility of potash fertilizers. Over recent years, the potash industry has witnessed significant innovations that are reshaping the landscape of potash production and distribution. One of the most notable advancements is in the area of potash mining and extraction. New extraction methods and technologies have been developed to access potash reserves more efficiently, whether they are found in underground mines or in the form of brine deposits. These innovations result in increased productivity, lower energy consumption, and reduced environmental impact, making potash mining more sustainable and cost-effective.In addition to mining, advancements in potash processing and beneficiation have also improved the overall efficiency of the industry. Cutting-edge technologies allow for the extraction of high-purity potash products, reducing waste and increasing the quality of the final fertilizers. These improvements not only enhance the competitiveness of potash products but also contribute to environmental sustainability.

Furthermore, the transportation and distribution of potash have been streamlined through technological innovations. The development of more efficient logistics systems, including rail and maritime transportation, has enabled the timely and cost-effective delivery of potash fertilizers to global markets. This ensures a steady supply of potash to meet the demands of a growing agricultural sector. Precision agriculture technologies have also played a role in boosting the potash market. These technologies, which include soil testing, GPS-guided machinery, and data analytics, help farmers optimize their fertilizer application.

Key Market Players

- Intrepid Potash Inc

- JSC Belaruskali

- Compass Minerals Intl. Ltd.

- Mosaic Company

- Uralkali Trading SIA

- Rio Tinto Ltd.

- BHP Billiton Ltd.

- Eurochem

- Red Metal Ltd.

- Encanto Potash Corp. (EPC)

Report Scope:

In this report, the Global Potash Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Potash Market, By Product:

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

- Other

Potash Market, By End Use:

- Agriculture

- Non-agriculture

Potash Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Potash Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Potash market report include:- Intrepid Potash Inc

- JSC Belaruskali

- Compass Minerals Intl. Ltd.

- Mosaic Company

- Uralkali Trading SIA

- Rio Tinto Ltd.

- BHP Billiton Ltd.

- Eurochem

- Red Metal Ltd.

- Encanto Potash Corp. (EPC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

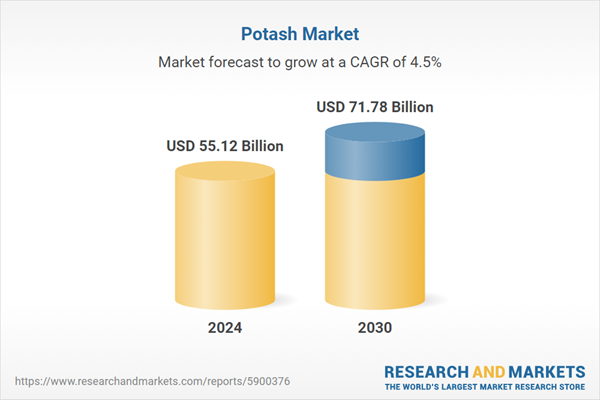

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 55.12 Billion |

| Forecasted Market Value ( USD | $ 71.78 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |