The rising consumer awareness of environmentally friendly goods and western impact are the main drivers of the market development. In addition, the demand for personalised and different-sized products for brand differentiation is growing. For example, the producers use different shapes, colours, as well as designs as a branding tool for the product for the packaging material. In addition, the growing preference among younger people worldwide for carbonated drinks and various ready-to-eat food items can also boost the growth of the PET packaging market.

Many of the manufacturers also follow PET packaging due to its low manufacturing and shipping costs, the minimal specifications for solid waste and storage, and ease of transport. The growing R&D to develop reusable and recyclable packaging solutions and technological advancements like plasma coating, which makes bottles more imperious, also lead to industry development.

PET Packaging Market Trends

With rising environmental awareness, there is a strong demand for sustainable PET solutions. Brands are increasing the use of recycled PET (rPET) to reduce plastic waste, especially in the beverages sector, where companies are committing to fully recyclable bottles. Initiatives like closed-loop recycling, where PET packaging is reused in a circular manner, are gaining traction.A major trend of PET packaging market is that companies are innovating to create lightweight PET bottles that retain durability, helping to reduce material use and costs. Enhanced PET grades with better barrier properties are being developed to preserve product freshness, especially in food and pharmaceutical applications.

Recent Developments

As per the PET packaging market dynamics and trends, Race Eco Chain, a company specialising in plastic waste management, has declared a partnership with Ganesha Ecosphere to create washing facilities aimed at producing PET flakes. Ganesha Ecosphere Ltd is recognised as a prominent PET recycling entity in India. According to a filing by Race Eco Chain with the stock exchange, the board has granted its preliminary approval for this collaboration.Industry Outlook

As per the Pet packaging industry analysis, Coca-Cola India, a pioneer in launching 100% recycled PET (rPET) in the Indian beverage sector, is now intensifying its commitment to promoting a circular economy. The company has announced the launch of Coca-Cola in ASSP, featuring 100% recycled PET (rPET) in 250ml bottles, starting in the state of Orissa. This initiative, produced in collaboration with Coca-Cola's bottling partner, Hindustan Coca-Cola Beverages Pvt. Ltd. (HCCBPL), underscores the company's dedication to sustainability by focusing on reducing carbon emissions and encouraging environmental responsibility.Over the six years from 2018 to 2023, worldwide investments in plastics circularity reached a total of USD 190 billion, averaging USD 32 billion annually, with over half of this amount allocated to North America, which can contribute to the growth of the PET packaging industry. This information is derived from the Plastics Circularity Investment Tracker, as reported by the nonprofit organisation Circulate Initiative and supported by the International Finance Corporation (IFC).

Furthermore, a July 2024 analysis from the Bank of America Institute indicates that more than 90% of extracted materials are either wasted, lost, or remain inaccessible, which impacts the PET packaging industry revenue. BofA Global Research anticipates that "plastic consumption, waste, emissions, and leakage" may increase by 50% to 70% by the year 2040, driven by the growing global demand for plastic.

Technological Advancements and Increasing Demand for Sustainable Packaging Drive Market Growth

- Technological advancements in PET packaging, such as improved barrier properties and lightweight, are enhancing their application across various industries.

- The increasing demand for sustainable and recyclable packaging solutions is driving the market for PET packaging.

- The growth of the food and beverage industry, which requires efficient and safe packaging, is boosting the demand for PET bottles and containers.

- Rising consumer awareness about environmental issues and the benefits of PET recycling is promoting PET packaging demand growth.

- Government regulations and initiatives aimed at reducing plastic waste are supporting the adoption of PET packaging.

High Production Costs and Competition from Alternative Materials Hinder Market Growth

- The high production cost of PET packaging, including raw materials and energy, can be a barrier to widespread adoption.

- Intense competition from alternative packaging materials, such as glass, metal, and paper, can limit the demand of PET packaging market.

- Environmental concerns related to plastic pollution can impact the perception and demand for PET packaging.

- Variability in raw material prices, particularly petroleum-based feedstocks, can affect production costs and pricing.

Growing Demand for Lightweight and Customizable Packaging Present Growth Opportunities

- Increasing demand for lightweight packaging solutions in the food and beverage industry offers significant growth opportunities for PET packaging.

- The growing popularity of customisable and aesthetically appealing packaging is driving the demand for PET bottles and containers.

- Expanding applications of PET packaging in the pharmaceutical, personal care, and household products sectors are boosting PET packaging demand.

- The development of bio-based PET and advanced recycling technologies can open new market opportunities.

PET Packaging Industry Segmentations

Polyethylene terephthalate or PET is a polyester type, which, depending on the user's requirement, can be moulded into a variety of packaging containers like boxes and PET bottles. PET packaging is created by the melting of PET resin pellets and the extruder into suitable shapes. It is thermally stable, non-breakable, durable, and microorganism-resistant, preventing the deterioration of packaged material and ensuring quality maintenance. It is also highly resistant to humidity, solvents, and alcohols and has mild resistance to dilute alkaline and halogenated hydrocarbons. Owing to these features, it is commonly used in the packaging of food and beverage items, in personal care products, and pharmaceutical products.The forms available in the PET can be divided into:

- Amorphous PET

- Crystalline PET

On the basis of packaging, the industry can be segmented into:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

Based on filling technology, the industry can be categorised as:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

Its major end-users are:

- Beverages Industry

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

The regional markets include:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

PET Packaging Market Share

The beverage sector holds the largest share and is the primary driver of demand. This dominance is largely due to the widespread use of PET for bottling water, carbonated drinks, juices, and energy drinks, where PET’s durability, transparency, and recyclability make it an ideal choice. Additionally, the demand for convenient, single-serve, and eco-friendly beverage containers has further fuelled PET packaging market opportunities, especially with rising consumer interest in sustainable packaging options.The food sector follows, utilising PET packaging for items such as sauces, condiments, and ready-to-eat meals. PET is highly valued here for its ability to preserve freshness and prevent contamination, which is essential for maintaining food quality.

Competitive Landscape

The report gives a detailed analysis of the following key players in the global PET packaging market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:Amcor Plc

Amcor Plc is a global leader in the market, known for its innovative and sustainable packaging solutions. The company's extensive product portfolio caters to a wide range of industries, including food, beverage, healthcare, and personal care. Amcor focuses on sustainability and innovation, investing heavily in research and development to create eco-friendly packaging solutions, which can boost PET packaging market value.Berry Global Inc.

Berry Global Inc. is a prominent player in the market, offering a diverse range of products designed for various applications. The company's strong emphasis on quality and customer satisfaction has bolstered its market position. Berry Global invests in advanced manufacturing technologies to improve the efficiency and quality of its products. The company also focuses on expanding its global footprint through strategic acquisitions and partnerships, enhancing its market presence and customer base as well as PET packaging market revenue.

Graham Packaging Company

Graham Packaging Company is well-known for its high-quality PET packaging solutions, catering to the beverage, food, and personal care industries. Graham Packaging emphasizes innovation and sustainability, investing in research and development to create environmentally friendly packaging solutions. The company also engages in strategic collaborations and acquisitions to expand its product portfolio and market reach.Resilux NV

Resilux NV is a key player in the PET packaging market, known for its high-performance packaging solutions. Resilux focuses on continuous innovation and technological advancements to enhance its product offerings. The company also prioritises sustainability, developing eco-friendly packaging solutions that meet the evolving needs of consumers and industries.PET Packaging Market Regional Analysis

The Asia-Pacific dominates the market, representing the majority of the PET packaging market share overall and is expected to grow at a CAGR of 5.8% in the forecast period. India, China, Australia, and Japan are expected to have CAGRs of 6.1%, 5.0%, 3.9%, and 3.5% between 2025 and 2034.Increasing consumer disposable income has led to a rise in the demand for processed and packaged food and beverages in countries including China, India, Indonesia, Thailand, and Singapore, which has led to a growth of the market in the region. In addition, the fast growth of the e-commerce sector in developing countries like China and India offers market vendors significant opportunities for growth.

Table of Contents

Companies Mentioned

The key companies featured in this PET Packaging market report include:- Amcor Plc

- Berry Global Inc.

- Graham Packaging Company

- Resilux NV

- Plastipak Packaging, Inc.

Table Information

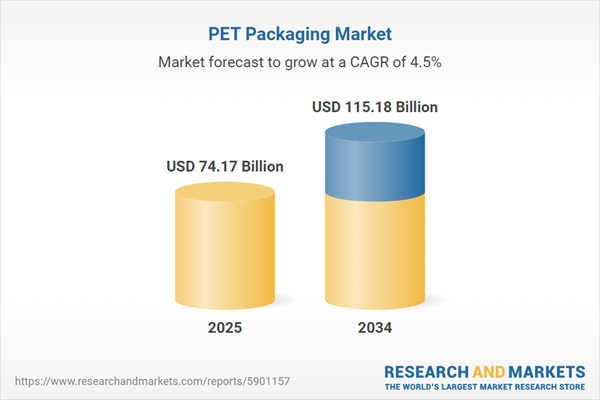

| Report Attribute | Details |

|---|---|

| No. of Pages | 163 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 74.17 Billion |

| Forecasted Market Value ( USD | $ 115.18 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |