Zeolite Molecular Sieve Market Trends:

Increasing environmental regulations

Stricter laws implemented by governments and regulatory agencies around the globe to reduce pollution and the negative effects of industrial activity on the environment are positively impacting the zeolite molecular sieves market outlook. These products are highly effective in adsorbing pollutants and separating harmful substances from industrial emissions and wastewater. Their use in catalytic converters for automotive exhaust systems and in industrial gas purification processes helps industries comply with emission standards and environmental regulations. The ability of zeolite molecular sieves to selectively adsorb and remove volatile organic compounds (VOCs), nitrogen oxides (NOx), and sulfur compounds from emissions makes them indispensable in meeting regulatory requirements. As environmental concerns continue to escalate, the product demand utilization in pollution control and emission reduction applications is also expected to rise, thereby strengthening the zeolite molecular sieve market growth.Growing demand in the healthcare and pharmaceutical industries

Zeolites are increasingly used in the pharmaceutical industry for drug delivery systems, due to their unique properties such as high surface area, tunable pore sizes, and biocompatibility. They can encapsulate and release therapeutic agents in a controlled manner, enhancing the efficacy of drug formulations. Additionally, zeolite molecular sieves are used in medical applications such as wound dressings and implants, where they provide antimicrobial properties and promote healing. Consequently, the rising prevalence of chronic diseases and the need for advanced drug delivery systems are driving the demand for zeolite molecular sieves in the healthcare sector. Moreover, the development of new zeolite-based materials for targeted drug delivery and diagnostic applications is further expanding their use in the pharmaceutical industry, thereby contributing to zeolite molecular sieve demand.Advancements in industrial and chemical processes

Zeolite molecular sieves are widely used in petrochemical and refining industries for processes such as hydrocracking, catalytic cracking, and isomerization, where they enhance the efficiency and selectivity of chemical reactions. The continuous development of new zeolite structures and improved synthesis methods are expanding their application in industrial processes. For example, the advent of hierarchical zeolites, which combine micro- and mesoporous structures, has significantly improved catalytic performance and mass transfer properties, leading to more efficient chemical processes. Furthermore, the increasing adoption of zeolite molecular sieves in biofuel production, where they facilitate the conversion of biomass into renewable fuels is aiding in market expansion. The trend toward sustainable and efficient industrial processes is also driving the demand for advanced zeolite molecular sieves.Zeolite Molecular Sieve Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on material, grade, application, and end use industry.Breakup by Material:

- Natural Zeolite

- Artificial Zeolite

Natural zeolite accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material. This includes natural and artificial zeolites. According to the report, natural zeolite represented the largest segment.The rising demand for natural zeolite owing to its abundant availability, cost-effectiveness, and versatile applications is bolstering the zeolite molecular sieve market share. Natural zeolites, such as clinoptilolite and chabazite, are extracted from volcanic ash deposits and have excellent ion exchange and adsorption properties. They are widely used in gas separation, agriculture, and water purification applications. In addition to this, their natural origin makes them more economically viable compared to synthetic zeolites, particularly for large-scale applications. Consequently, the increasing demand for sustainable and eco-friendly materials spurring the preference for natural zeolites as they require less energy-intensive processing is boosting the zeolite molecular sieve market revenue.

Breakup by Grade:

- Type 3A

- Type 4A

- Type 13X

- Others

The zeolite molecular sieve market research report revealed that the demand for type 3A zeolite molecular sieves is driven by their smallest pore size which helps them effectively adsorb molecules with a diameter of less than 3 angstroms. They are primarily used in drying applications, particularly in the natural gas and petrochemical industries, to remove moisture and prevent unwanted reactions.

Besides this, type 4A zeolite molecular sieves feature 4-angstrom pores, making them ideal for adsorbing water, carbon dioxide, and smaller hydrocarbons. It is commonly used in household and industrial detergents; they enhance cleaning efficiency by softening water and trapping contaminants.

Concurrently, type 13X zeolite molecular sieves possess larger pores of about 10 angstroms, suitable for adsorbing larger molecules such as aromatics and branched-chain hydrocarbons, which is driving their market demand. They are widely employed in air purification, gas separation, and solvent recovery applications due to their high capacity and selectivity.

Furthermore, other zeolite molecular sieves offering varying pore sizes and properties tailored for niche applications, including type 5A for n-alkane separation and type Y for catalytic cracking in petroleum refining are impelling the market growth.

Breakup by Application:

- Catalyst

- Adsorbent

- Desiccants

Based on the zeolite molecular sieve market segmentation, the widespread product utilization as a catalyst in chemical reactions, particularly in the petrochemical industry is providing an impetus to the market growth. They help enhance processes such as catalytic cracking, hydrocracking, and isomerization by improving fuel quality and yield. Their high surface area and selectivity enable efficient conversion of feedstocks into valuable products.

Meanwhile, the surging product adoption as an adsorbent for their ability to selectively trap and remove specific molecules is influencing market expansion. It finds a wide range of applications in gas separation, air purification, and water treatment. Their porous structure allows for effective adsorption of impurities, enhancing process efficiency and product purity in various industrial applications.

Furthermore, according to the zeolite molecular sieve market forecast, the demand for desiccants is expected to grow as industries increasingly rely on effective moisture control solutions to safeguard their products. They are crucial in protecting products from moisture damage in industries such as pharmaceuticals, electronics, and packaging. Their high adsorption capacity ensures effective drying and moisture control, ensuring robust product quality and longevity.

Breakup by End Use Industry:

- Oil and Gas Industry

- Agricultural Industry

- Chemical Industry

- Pharmaceutical Industry

- Water Treatment Industry

- Construction Industry

- Others

Oil and gas industry exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, agricultural, chemical, pharmaceutical, water treatment, construction, and other industries. According to the report, oil and gas industry accounted for the largest market share.The increasing product employment across the oil and gas industry in refining and processing operations is bolstering the zeolite molecular sieve market size. These products play a critical role in catalytic cracking, hydrocracking, and isomerization processes, which are essential for converting crude oil into valuable fuels and chemicals. Their ability to selectively adsorb and remove impurities such as sulfur compounds and water enhances the efficiency and quality of end products. In addition to this, the industry's demand for high-performance materials to meet stringent environmental regulations and improve operational efficiency further contributes to the zeolite molecular sieve market value.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest zeolite molecular sieve market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for zeolite molecular sieve.Zeolite molecular sieve market analysis revealed that Europe enjoys the leading position due to stringent environmental regulations regarding pollution control, emissions reduction, and wastewater treatment. The well-established industrial sector, including petrochemicals, pharmaceuticals, and chemicals, heavily relies on zeolite molecular sieves for catalytic processes and purification applications. Moreover, the growing focus on sustainable and green technologies in Europe promotes the use of zeolites in renewable energy projects and eco-friendly products. The presence of key market players, advanced research and development (R&D) facilities, and substantial government support for clean technology further reinforce Europe's dominant position in the zeolite molecular sieve industry.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the zeolite molecular sieve industry include Arkema Group, BASF SE, CWK Chemiewerk Bad Köstritz GmbH, Honeywell UOP (Honeywell), Interra Global Corporation, KNT Group, Tosoh Corporation, Tricat Group, W. R. Grace & Company, Zeochem AG (Cph Chemie & Papier), etc.

- The competitive landscape is characterized by the presence of several zeolite molecular sieve companies striving for dominance through innovation, strategic partnerships, and geographic expansion. Manufacturers are leading the market, leveraging their robust R&D capabilities to develop advanced and customized zeolite products. These companies focus on expanding their product portfolios to cater to diverse applications across industries such as petrochemicals, water treatment, and healthcare. Furthermore, strategic collaborations and acquisitions are common strategies employed to enhance market presence and technological expertise. Emerging players and regional manufacturers are also entering the market, offering cost-competitive products targeting niche applications and further intensifying competition.

Key Questions Answered in This Report

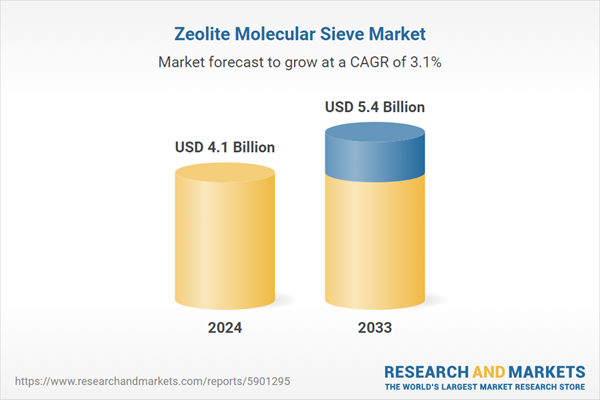

1. What was the size of the global zeolite molecular sieve market in 2024?2. What is the expected growth rate of the global zeolite molecular sieve market during 2025-2033?

3. What has been the impact of COVID-19 on the global zeolite molecular sieve market?

4. What are the key factors driving the global zeolite molecular sieve market?

5. What is the breakup of the global zeolite molecular sieve market based on the material?

6. What is the breakup of the global zeolite molecular sieve market based on the end use industry?

7. What are the key regions in the global zeolite molecular sieve market?

8. Who are the key players/companies in the global zeolite molecular sieve market?

Table of Contents

Companies Mentioned

- Arkema Group

- BASF SE

- CWK Chemiewerk Bad Köstritz GmbH

- Honeywell UOP (Honeywell)

- Interra Global Corporation

- KNT Group

- Tosoh Corporation

- Tricat Group

- W. R. Grace & Company

- Zeochem AG (Cph Chemie & Papier)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |