The rising demand for secure, user-controlled authentication solutions is a key factor fueling the growth of the OTP hardware authentication industry. Growing incidents of credential theft, regulatory pressure to strengthen identity verification, and increased adoption of digital services are pushing organizations toward robust authentication mechanisms. Hardware tokens, including OTP generators and FIDO2-compliant devices, offer strong protection as they operate offline and are less vulnerable to remote attacks. In this context, regulatory developments have further accelerated this trend. For instance, in February 2025, the Reserve Bank of India (RBI) introduced a revised authentication framework that mandates two-factor authentication for digital payments. The framework identifies hardware tokens, such as YubiKeys and FIDO2 devices, as reliable alternatives to SMS OTPs. This regulation has prompted banks, fintech platforms, and payment processors to deploy hardware tokens across customer touchpoints to ensure compliance and prevent fraud. Additionally, growing awareness of hybrid authentication devices that combine OTP and certificate-based authentication is also influencing product development and enterprise-level deployment strategies.

The United States stands out as a critical market disruptor due to increasing concerns over legacy authentication vulnerabilities and federal cybersecurity warnings. Following the Salt Typhoon cyberattack in January 2025, federal agencies, including the FBI and CISA, issued advisories against using SMS OTPs due to known flaws in the SS7 protocol. In this context, the industry is witnessing a rapid shift toward secure hardware-based authentication methods. The recommendation to adopt phishing-resistant tools has spurred demand for physical tokens, especially among critical infrastructure providers, government agencies, and financial institutions. Enterprises are now investing in hardware solutions that eliminate dependency on mobile networks and shared credentials. The heightened scrutiny on authentication standards in the U.S. is also prompting vendors to integrate advanced features, such as biometric validation and secure elements, within OTP hardware devices. This broader push toward zero-trust architectures and hardware-enforced security models is expected to influence purchasing decisions and shape market dynamics across the North American region in the coming years.

OTP Hardware Authentication Market Trends:

Focus on Seamless Token Management

Vendors are increasingly focusing on improving usability and resilience to promote OTP hardware token adoption. One major concern among enterprises using time-based OTP systems is token desynchronization, which often leads to failed authentications and higher helpdesk dependency. To address this, market players are embedding features that simplify token recovery and reduce support load. For instance, in February 2025, RSA introduced a key update in its Cloud Authentication Service by enabling a resynchronization feature for OTP hardware authenticators. This allows users to restore out-of-sync devices by entering the serial number and two valid consecutive OTPs, eliminating the need for backend intervention. This advancement strengthens the appeal of hardware tokens in sectors that prioritize security but struggle with operational disruptions. As user-friendly features become standard, hardware OTP tokens are expected to see broader enterprise uptake, particularly where auditability and offline security are vital. This trend aligns with the growing demand for robust, easy-to-manage solutions that reduce administrative overhead without compromising security, ultimately contributing to a streamlined and scalable authentication infrastructure for large organizations.Shift Toward Phishing-Resistant Solutions

Enterprises worldwide are steadily moving toward hardware authentication methods that can resist phishing and eliminate password-related risks. As cyberattacks grow targeted and sophisticated, especially those exploiting human error, there is a rising urgency for secure, user-centric login systems. FIDO2 hardware keys offer a high-assurance alternative by enabling passwordless authentication tied to a physical device, making them immune to phishing attempts. In January 2025, T-Mobile rolled out over 200,000 FIDO2 YubiKeys across its employee base, replacing legacy OTP methods. This large-scale shift not only reinforced internal cybersecurity but also demonstrated the scalability and practicality of hardware-backed passwordless authentication in real-world enterprise settings. By removing reliance on shared secrets and streamlining login experiences, the deployment sets a precedent for others operating in critical infrastructure and high-risk sectors. The trend reflects a clear move away from traditional OTP tokens toward advanced, phishing-resistant technologies. It also signals growing enterprise readiness to adopt modern identity verification tools that offer both enhanced protection and operational efficiency at scale.Rising Adoption of Secure Hardware Tokens

Due to the rising instances of phishing and cyberattacks, several organizations are using OTP hardware devices as they are isolated from the network and cannot be externally accessed. As per an industry report, phishing attacks have surged significantly, with global incidents rising by 58% from 2022 to 2023. In 2023, nine out of ten organizations reported experiencing at least one phishing attack. This represents one of the key factors impelling the market growth. Moreover, as these devices have long battery life and offer maximum security, they are widely utilized to support the operation, maintenance and management of various end use industries. As such, Visa announced its tokenization technology has generated over USD 40 Billion in e-commerce revenue and prevented USD 650 Million in fraud in one year. With 10 Billion tokens issued, 29% of Visa transactions now use tokens, enhancing security and data control. Furthermore, the growing traction of hybrid tokens, which are a combination of OTP and certificate-based authentication within a single device, is stimulating the market growth. Apart from this, the key players are incorporating innovative features, such as liquid crystal display (LCD) screen, keypads for passwords and biometric readers, to enhance the security of their products. JumpCloud’s 2024 IT Trends Report reveals that 83% of organizations still use password-based authentication and require multi factor authentication (MFA), while 66% mandate biometrics. They are also offering wireless product variants, which is expected to positively influence the market growth in the coming years.OTP Hardware Authentication Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global OTP hardware authentication market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, type, and end user.Analysis by Product Type:

- USB Tokens

- SIM Tokens

- Mini Tokens

- Others

Analysis by Type:

- Connected

- Disconnected

- Contactless

Analysis by End User:

- BFSI

- Healthcare

- Government

- Commercial Security

- Transportation

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States OTP Hardware Authentication Market Analysis

In 2024, United States accounted for 84.30% of the market share in North America. The United States OTP hardware authentication market is primarily driven by the increasing incidents of phishing and credential-based cyberattacks. In accordance with this, regulatory mandates such as HIPAA, PCI-DSS, and NIST guidelines driving compliance-driven adoption across healthcare, finance, and government sectors, are propelling market growth. Similarly, the rise in remote workforces, prompting enterprises to secure endpoint access with portable, tamper-resistant authentication devices, is fostering market expansion. According to an industry report, more than 22 Million remote workers were registered in 2023, marking a threefold increase over the past decade. In 2021, the share of remote workers rose significantly to 17.9%. Furthermore, growing enterprise investment in zero-trust security frameworks supporting the integration of hardware tokens, is influencing market demand. The escalating demand from the defense and critical infrastructure sectors for air-gapped and offline authentication is further bolstering market development. Additionally, continual advancements in USB-C and mobile-compatible tokens are broadening device compatibility and market reach. The rising popularity of password less login environments aligning with OTP hardware as a transitional security layer, is also impelling the market. Besides this, increased cybersecurity funding under federal and state-level initiatives continues to support expansion and technological innovation in the market.Europe OTP Hardware Authentication Market Analysis

The OTP hardware authentication market in Europe is progressing due to strict data protection regulations under the General Data Protection Regulation (GDPR), compelling organizations to adopt stronger authentication practices. In addition to this, increasing incidents of online fraud and identity theft driving demand for secure, offline verification methods, is impelling the market. An industry report indicates that digital fraud cases average over 249,000 annually. In the third quarter of 2022, Russia recorded the highest number of breached internet accounts, with 22.3 Million users affected. The expansion of digital banking and fintech services across the region requiring robust customer authentication protocols is augmenting product sales. Furthermore, favorable government-led eID and cybersecurity initiatives in countries like Germany and France promoting hardware-based security tools, are supporting market growth. The escalating adoption of electronic signatures for legal and administrative transactions is also encouraging higher use of certified OTP devices. Similarly, growth in cross-border business operations, necessitating standardized authentication mechanisms across diverse digital infrastructures, is expanding market scope. Moreover, rising awareness of supply chain vulnerabilities pushing enterprises to implement hardware-based identity verification is creating lucrative market opportunities.Asia Pacific OTP Hardware Authentication Market Analysis

The market in Asia-Pacific is being propelled by the rise in mobile and internet penetration, increasing the need for secure user authentication in financial and e-commerce platforms. In line with this, favorable government initiatives promoting digital identity systems in countries, such as India and Singapore, accelerating hardware token deployment, is fostering market expansion. Similarly, heightened awareness of cybersecurity threats in sectors, like banking, telecom, and healthcare, encouraging investment in strong authentication tools, is bolstering market reach. According to the Reserve Bank of India (RBI), Indian banks experienced 13.2 Million cyber-attacks between January and October 2023, highlighting growing cybersecurity challenges in the country’s financial sector. Furthermore, cross-border trade expansion in Southeast Asia leading to increased demand for standardized, secure access protocols, is propelling growth in the market. Apart from this, ongoing technological advancements in lightweight and cost-effective token devices are enhancing product adoption among small and medium-sized enterprises.Latin America OTP Hardware Authentication Market Analysis

In Latin America, the OTP hardware authentication market is propelled by the increasing cybersecurity breaches across financial institutions. Additionally, regulatory bodies in countries like Brazil and Mexico are reinforcing data protection compliance, driving heightened adoption of hardware tokens. Furthermore, growth in online government services, encouraging secure citizen access systems, is expanding market share. Moreover, rising investment in digital banking and fintech platforms creating demand for robust identity verification tools that offer offline functionality and tamper resistance, particularly in regions with limited internet infrastructure or high exposure to online fraud, is providing an impetus to the market. According to Distrito's Fintech Report 2024, Latin America attracted USD 15.6 Billion in fintech investments over the past decade, with Brazilian firms accounting for 66.7% of the total funding.Middle East and Africa OTP Hardware Authentication Market Analysis

The market in the Middle East and Africa is growing, as a result of the increasing cyber threats targeting financial and government institutions. Similarly, various national digital transformation strategies, particularly in Gulf countries, encouraging stronger identity verification systems, are accelerating market growth. Furthermore, the expansion of mobile banking and digital wallets, generating demand for reliable, offline-compatible security tools, is supporting market demand. The Saudi Arabian Monetary Authority has actively advanced digital payments, resulting in a 62% increase in 2022. That year, the country recorded 8 Billion digital transactions, amounting to more than USD 426 Billion. Moreover, the rapid integration of OTP tokens in public service portals and e-governance platforms is enhancing citizen data protection and fostering trust in digital infrastructure across both emerging and developed markets in the region.Competitive Landscape:

The market is shaped by rising innovation in authentication technologies, a focus on enhancing user convenience and increasing integration with enterprise security systems. Market players compete on product reliability, compact designs, and compliance with global security standards while expanding their presence through strategic partnerships, regional diversification, and tailored solutions for industry-specific security needs.The report provides a comprehensive analysis of the competitive landscape in the OTP hardware authentication market with detailed profiles of all major companies, including:

- Authenex Inc.

- Deepnet Security

- Dell EMC

- Entrust Datacard Corporation

- Feitian Technologies Co. Ltd.

- Fortinet Inc.

- HID Global Corporation (Assa Abloy AB)

- Microcosm Ltd.

- One Identity LLC (Quest Software)

- OneSpan Inc.

- RSA Security LLC (Symphony Technology Group)

- SafeNet, Inc.

- Securemetric Berhad

- Symantec Corporation (Broadcom Inc.)

- Thales Group

- Yubico Inc.

Key Questions Answered in This Report

1. How big is the OTP hardware authentication market?2. What is the future outlook of OTP hardware authentication market?

3. What are the key factors driving the OTP hardware authentication market?

4. Which region accounts for the largest OTP hardware authentication market share?

5. Which are the leading companies in the global OTP hardware authentication market?

Table of Contents

Companies Mentioned

- Authenex Inc.

- Deepnet Security

- Dell EMC

- Entrust Datacard Corporation

- Feitian Technologies Co. Ltd.

- Fortinet Inc.

- HID Global Corporation (Assa Abloy AB)

- Microcosm Ltd.

- One Identity LLC (Quest Software)

- OneSpan Inc.

- RSA Security LLC (Symphony Technology Group)

- SafeNet Inc.

- Securemetric Berhad

- Symantec Corporation (Broadcom Inc.)

- Thales Group

- Yubico Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | August 2025 |

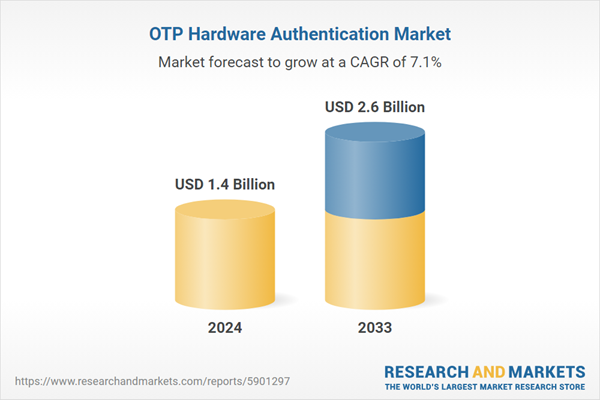

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |