Aluminum foil packaging is a versatile and essential element in the packaging industry with a unique combination of properties. Aluminum foil is lightweight yet robust, impermeable to air, gases, and moisture, and can be easily molded to any shape. This type of packaging is particularly favored for its ability to maintain product integrity by protecting the contents from external factors such as light, oxygen, and microorganisms, thus extending shelf life. Being a highly conductive material, aluminum foil is also utilized for its thermal efficiency, making it an ideal choice for hot food packaging. Besides this, it is recyclable, contributing to sustainability initiatives. As a result, aluminum foil packaging finds extensive applications across the food and beverage, pharmaceuticals, and personal care industries to improve product safety, minimize waste, and optimize cost-efficiency.

The need for reliable, lightweight, and cost-effective packaging solutions due to the rise in online shopping and e-commerce activities will stimulate market growth during the forecast period. Aluminum foil's light weight makes it an economical choice for shipping, reducing the overall cost and carbon footprint of transportation. Additionally, the versatility of aluminum foil in accommodating various product shapes and sizes lends itself well to the diverse range of goods sold online. In line with this, technological advancements in packaging machinery and innovations such as thinner foil gauges that maintain high barrier properties are enhancing efficiency while reducing material costs. Moreover, the expanding middle-class population in emerging economies is creating new markets for consumer goods, where aluminum foil packaging is often the go-to choice for product protection and preservation, thus accelerating product adoption rates. Furthermore, the changing retail landscape, such as the establishment of large supermarket and hypermarket chains, are encouraging bulk purchases which necessitate durable and long-lasting packaging to maintain product integrity, thereby favoring market growth.

Aluminum Foil Packaging Market Trends/Drivers:

Escalating Demand for Convenience Foods

One of the most significant factors driving the aluminum foil packaging market is the escalating demand for convenience foods. As busy lifestyles become the norm, consumers are increasingly seeking quick and easy meal options that do not compromise on quality. Aluminum foil provides an effective packaging solution, serving as a barrier to external factors, including light, moisture, and oxygen that can degrade food quality. Thus, it ensures that convenience foods remain fresh, flavorful, and nutritious for extended periods. This characteristic aligns with the evolving consumer expectations and encourages manufacturers to adopt aluminum foil as their preferred packaging material, thereby fueling market growth.Rising Environmental Sustainability Concerns

Another crucial driver of the aluminum foil packaging market is the growing concerns for environmental sustainability. Aluminum foil is fully recyclable, which minimizes waste and lessens the environmental impact. In fact, recycling aluminum saves up to 95% of the energy required to make the same amount of aluminum from raw materials. This energy-efficient recycling process amplifies its eco-friendly credentials. This feature is increasingly important as both consumers and regulatory bodies are pushing for greener, more sustainable packaging solutions. The ability to recycle aluminum foil multiple times without any loss of quality places it at an advantage over other packaging materials like plastic, which may degrade during the recycling process.Robust Pharmaceutical Packaging Requirements

The pharmaceutical industry's stringent packaging requirements represent a major driving force behind the escalating demand for aluminum foil. Medications often require a high barrier to moisture, light, and oxygen to maintain their efficacy over time. Aluminum foil, especially when used in blister packaging, offers this level of protection. It ensures the integrity of sensitive active pharmaceutical ingredients (APIs) while controlling the release rates of medicines, making it integral for drugs with specific dosage requirements. The growth in telemedicine and mail-order pharmacies, which necessitate medications to be shipped over long distances, adds another layer of complexity to pharmaceutical packaging, making aluminum foil an even more crucial component, thus propelling market growth.Aluminum Foil Packaging Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global aluminum foil packaging market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, packaging type, foil type, thickness, and end use industry.Breakup by Product:

- Foil Wraps

- Pouches

- Blisters

- Containers

- Others

Foil wraps represent the most widely used product

The report has provided a detailed breakup and analysis of the market based on the product. This includes foil wraps, pouches, blisters, containers, and others. According to the report, foil wraps represented the largest segment.Foil wraps offer unparalleled versatility as they can be used for wrapping a wide variety of items, from food to industrial products. They also provide superior barrier properties, effectively blocking moisture, light, and oxygen, which are critical factors for preserving the quality of packaged goods. This makes foil wraps an ideal choice for both food preservation and the safeguarding of other sensitive products, such as pharmaceuticals. Moreover, they are extremely user-friendly owing to their easy to fold and seal nature, increasing their popularity among both manufacturers and consumers.

Foil wraps also offer cost-effectiveness as the lightweight nature of foil wraps significantly reduces shipping and transportation costs, making them an economically appealing option. Furthermore, the trend toward convenience and on-the-go lifestyles is augmenting the demand for single-serving packaging and ready-to-eat meals, which are often best served by foil wraps. Additionally, foil wraps are highly recyclable and align with the growing consumer and regulatory emphasis on sustainability. The capacity to recycle them without loss of quality contributes to their environmental advantage, enhancing their overall market appeal and propelling the segment growth.

Breakup by Packaging Type:

- Rigid Packaging

- Flexible Packaging

- Semi-Rigid Packaging

Rigid packaging represents the most popular packaging type

A detailed breakup and analysis of the market based on the packaging type has also been provided in the report. This includes rigid packaging, flexible packaging, and semi-rigid packaging. According to the report, rigid packaging accounted for the largest market share.Rigid packaging exhibits excellent structural strength and durability, which provides superior protection for the packaged products against physical damage, environmental factors, and tampering. This makes rigid packaging an ideal choice for fragile or heavy items and for products that require a long shelf-life. In industries such as pharmaceuticals, where the integrity of the product is of utmost importance, rigid packaging like aluminum foil blister packs is often preferred.

In addition, rigid packaging offers superior barrier properties against light, moisture, and oxygen, which are essential for preserving the quality and extending the shelf-life of different products, including food and pharmaceuticals. The aesthetic and functional design possibilities with rigid packaging also contribute to its popularity. It provides ample space for branding, labeling, and other regulatory information, which enhances its marketability. In terms of consumer experience, the rigidity of the packaging allows for easier stacking and storage, both in retail environments and in consumers' homes, thereby supporting segment growth.

Breakup by Foil Type:

- Printed

- Unprinted

Unprinted holds the largest share in the market

The report has provided a detailed breakup and analysis of the market based on the foil type. This includes printed and unprinted. According to the report, unprinted represented the largest segment.The main factors that are driving the growth of this segment are the versatility and wide-ranging applications of unprinted aluminum foil across various industries. Besides this, it eliminates the need for the additional printing process, thereby reducing manufacturing costs. This makes it an attractive and cost-effective choice for manufacturers looking for economical yet efficient packaging solutions.

Furthermore, unprinted aluminum foil is universally applicable, serving as a flexible packaging option that can be easily customized or labeled post-production to suit specific needs. It also acts as an excellent barrier to light, moisture, and oxygen, preserving the integrity and extending the shelf-life of the packaged products. Apart from this, the absence of ink and other printing materials makes unprinted aluminum foil more easily recyclable, aligning with the increasing consumer and regulatory demand for sustainable packaging solutions, amplifying its appeal in environmentally conscious market and fostering segment growth.

Breakup by Thickness:

- 0.007 mm - 0.09 mm

- 0.09 mm - 0.2 mm

- 0.2 mm - 0.4 mm

0.09 mm - 0.2 mm dominates the market

A detailed breakup and analysis of the market based on the thickness has also been provided in the report. This includes 0.007 mm - 0.09 mm, 0.09 mm - 0.2 mm, and 0.2 mm - 0.4 mm. According to the report, 0.09 mm - 0.2 mm accounted for the largest market share.The 0.09 mm to 0.2 mm thickness range strikes a balance between structural integrity and flexibility, making it suitable for numerous industries due to its versatility and adaptability to a wide range of applications. In the food sector, aluminum foil within this thickness range is ideal for wrapping individual items, covering containers, and even forming pouches for numerous food products. Its ability to provide a robust barrier against light, moisture, and oxygen ensures the preservation of food quality.

Furthermore, in pharmaceutical packaging, this thickness range is often used for blister packs, providing the necessary protection for medicines against external elements. Its versatility extends to industrial applications as well, where it can be employed for insulation and heat exchangers. The 0.09 mm to 0.2 mm range offers the right balance of strength and flexibility, making it the preferred choice across multiple sectors, thus augmenting the growth of this segment.

Breakup by End Use Industry:

- Food and Beverage

- Tobacco

- Pharmaceuticals

- Cosmetics

- Others

Food and beverage accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes food and beverage, tobacco, pharmaceuticals, cosmetics, and others. According to the report, food and beverage represented the largest segment.The food and beverage industry relies on aluminum foil packaging as it offers unparalleled protection against moisture, light, and oxygen, making it an ideal choice for preserving the freshness, flavor, and nutritional value of various food products. Whether it is wrapping perishable items, sealing ready-to-eat meals, or packaging dairy products, aluminum foil plays a vital role in ensuring food quality during transportation, storage, and retail display.

Furthermore, the versatility of aluminum foil packaging allows it to cater to diverse food and beverage categories, from confectionery and snacks to dairy, beverages, and even pet food. Its ability to conform to various shapes and sizes, coupled with its excellent heat retention properties, makes it ideal for both packaging and cooking applications. Also, the rising trend toward single-serving and on-the-go food options aligns perfectly with the convenience offered by aluminum foil packaging. Additionally, as sustainability becomes an increasingly critical concern, aluminum foil's recyclability adds to its appeal, meeting the demand for more eco-friendly packaging solutions in the food and beverage industry.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific held the biggest share in the market for aluminum foil packaging due to a confluence of several compelling factors. The region is home to some of the world's most populous countries, including China and India, where there is a growing middle-class population with high disposable incomes. This demographic shift has led to greater consumption of packaged foods and beverages, thus strengthening the demand for effective packaging solutions like aluminum foil.

Moreover, the burgeoning e-commerce sector in the region has led to a rise in online shopping and home delivery services. Aluminum foil's lightweight nature and its ability to preserve the quality of products during transit make it a favored choice for packaging in this context. Also, the food and beverage industry in the Asia Pacific region is experiencing rapid expansion and diversification, catering to diverse consumer preferences. Aluminum foil is indispensable in ensuring the freshness and safety of a wide range of food products.

Besides this, the pharmaceutical sector in Asia Pacific is expanding due to a growing aging population and increased healthcare needs, resulting in a higher demand for secure and reliable pharmaceutical packaging, often involving aluminum foil. Furthermore, the heightened emphasis on sustainability in packaging choices aligns with aluminum foil's recyclability and environmental friendliness, further contributing to its heightened popularity in the region, positioning Asia Pacific as the leading regional market.

Competitive Landscape:

The market is experiencing steady growth as key players are actively engaged in several strategic initiatives to maintain and expand their market presence. These initiatives include continuous research and development (R&D) efforts to improve foil performance and reduce costs, thereby enhancing competitiveness. The leading manufacturers are also investing in sustainable practices, such as increasing the recyclability of their products and reducing environmental impacts. Furthermore, these industry leaders are expanding their global reach through mergers, acquisitions, and collaborations, enabling them to tap into emerging markets and diversify their product offerings. They are also focusing on customer-centric approaches by offering customized solutions to meet the specific needs of various industries, such as food and beverages, pharmaceuticals, and industrial applications. We expect the market to witness a rise in strategic collaborations amongst key players, consolidation of portfolios, and new product launches to drive healthy competition within the aluminum foil packaging domain during the forecast period.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alcoa Corporation

- Aliberico SLu

- Alufoil Products Pvt. Ltd.

- Amcor Ltd.

- Carcano Antonio S.p.A

- Constantia Flexibles

- Coppice Alupack Ltd. (Euro Packaging UK Ltd)

- JW Aluminum

- Novelis Inc. (Hindalco Industries)

- Raviraj Foils Ltd.

- Zhangjiagang Goldshine Aluminium Foil Co., Ltd.

Key Questions Answered in This Report

1. How big is the aluminum foil packaging market?2. What is the future outlook of aluminum foil packaging market?

3. What are the key factors driving the aluminum foil packaging market?

4. Which region accounts for the largest aluminum foil packaging market share?

5. Which are the leading companies in the global aluminum foil packaging market?

Table of Contents

Companies Mentioned

- Alcoa Corporation

- Aliberico SLu

- Alufoil Products Pvt. Ltd.

- Amcor Ltd.

- Carcano Antonio S.p.A

- Constantia Flexibles

- Coppice Alupack Ltd. (Euro Packaging UK Ltd.)

- JW Aluminum

- Novelis Inc. (Hindalco Industries)

- Raviraj Foils Ltd.

- Zhangjiagang Goldshine Aluminium Foil Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | August 2025 |

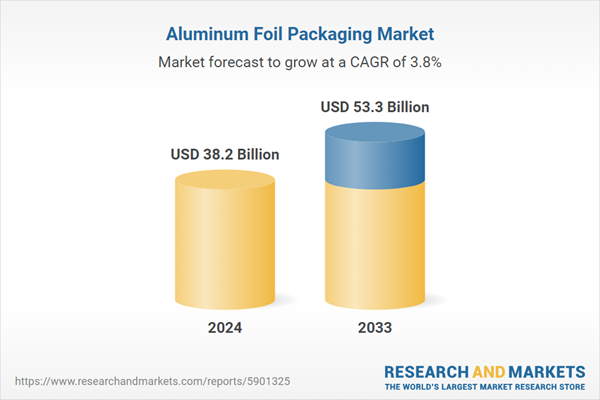

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 38.2 Billion |

| Forecasted Market Value ( USD | $ 53.3 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |