The market for agricultural films is experiencing robust growth as it is influenced by a variety of changing factors that are revolutionizing the agricultural industry. With farming practices constantly becoming more advanced, the need for advanced solutions like agricultural films is rising. The films are utilized extensively for a variety of reasons such as improving crop output, managing environmental conditions, and safeguarding plants against unfavorable climate conditions. The practice of embracing new agricultural methods is catalyzing the demand for such films, which are being used in greenhouses, tunnels, and open fields. With the world's population still growing, the demand for food is also increasing, with farmers embracing technologies that can optimize land use efficiency. Agricultural films like polyethylene (PE) films are utilized to prolong the growing season, control temperature, and defend crops against pests and diseases.

The United States agricultural films industry is growing at a strong rate, driven by a mix of factors that are revolutionizing farming practices in the country. With the ever-present pressure to boost agricultural productivity and keep up with the demands of an increasing population, the take-up of cutting-edge solutions, such as agricultural films, is growing. These alternatives, employed for purposes like plant protection, temperature control, and increasing crop yield, are gaining traction in both traditional and controlled environment agriculture (CEA) systems. The efficiency improvement and sustainability trend are constantly driving the market in the US. One of the key drivers for the market is the growing emphasis on enhancing crop yields to achieve food security requirements. As the requirement for food production goes up, farmers are embracing sophisticated technologies that maximize productivity while optimizing the use of land. In 2025, the USDA’s Farm Service Agency (FSA) encouraged agricultural producers to enroll in the Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) programs to review elections and sign contracts. Both the safety net initiatives, administered by USDA’s Farm Service Agency (FSA), offer essential income assistance to qualifying farmers facing significant drops in crop prices or revenues for the 2025 crop year.

Agricultural Films Market Trends:

Adoption of Biodegradable Variants

The growing emphasis on sustainability is prompting a shift towards biodegradable alternatives. This trend is gaining popularity as regulatory pressures increase and farmers seek eco-friendly solutions to reduce their environmental footprint. For instance, global greenhouse gas (GHG) emissions grew by 51% from 1990 to 2021. In July 2024, BASF developed Tinuvin NOR 211 AR to support film converters and producers globally in navigating the use of plastic materials in agricultural applications. This innovative high-efficiency heat and light stabilizer safeguards and extends the durability of agricultural plastics needing resistance to elevated levels of inorganic substances such as chlorine and sulfur. Tinuvin NOR 211 AR presents a valuable solution for agricultural plastics subjected to severe thermal stress, UV exposure, and inorganic chemicals frequently utilized in crop management and disinfection. This is raising the market value of agricultural films.Elevating Use of Smart Technologies

Farmers seek to optimize crop production via advanced technologies, thereby impelling the agricultural films market growth. For instance, AI systems in California vineyards led to a 25% increase in yield and 20% water savings. Smart films are specifically designed with embedded sensors or responsive materials that can regulate light, temperature, and humidity levels within greenhouses or open fields. In March 2024, the Central Tuber Crops Research Institute (CTCRI), part of the Indian Council of Agricultural Research (ICAR), launched an e-crop, an IoT device designed for smart agriculture. It promotes crop development instantly by considering soil moisture, nutrient levels, and weather conditions. This represents agricultural films market price trends. This latest technology is a prime example of the current trend of integrating Internet of things (IoT) devices with farm systems to further crop management and aid market price influences for farm films. The ongoing evolution and implementation of intelligent farm technologies are fueling the demand for specialty films both in developed and developing countries.Widespread Popularity of Waste Regulations

The widespread popularity of waste laws is intensely impacting the market for agricultural films, with more focus being placed on environment friendly and sustainable practices, thereby offering a favorable agricultural films market outlook. Agricultural films have several advantages, including saving on labor and enriching the soil by preventing the need to dispose of them after use and remove them. Films traditionally have the drawback of causing environmental waste, but with a growing need for minimizing such waste, alternative films are in demand. Consequently, manufacturers are retorting by creating novel formulations that balance durability and biodegradability. These developments ensure agricultural films not only satisfy the performance needs of the agricultural industry but also are aligned with sustainability objectives, working to decrease the carbon footprint of agriculture operations. Agricultural films provide benefits like reduced labor costs and improved soil health, as they eliminate the need for disposal after use and removal. Manufacturers are responding to this demand by launching new formulations that balance durability with biodegradability, thereby meeting both agricultural performance requirements and sustainability goals. In March 2024, Berry Global’s European flexible films division showcased its latest developments in agricultural films and pouches at three events hosted by Applied Market Information Ltd. (AMI) in Barcelona and Valencia, Spain.Agricultural Films Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global agricultural films market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.Analysis by Type:

- Low-Density Polyethylene

- Linear Low-Density Polyethylene

- High-Density Polyethylene

- Ethylene Vinyl Acetate

- Others

Analysis by Application:

- Greenhouse

- Silage

- Mulching

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Agricultural Films Market Analysis

The United States is experiencing increasing agricultural films adoption, holding a share of 83.20%, due to the growing focus on sustainable farming. According to the U.S. Department of Agriculture, in 2023, USDA invested over USD 46 Million in the Sustainable Agriculture Research and Education (SARE) program. Farmers are integrating mulching films, greenhouse covers, and silage films to enhance soil health, reduce water usage, and improve crop productivity. The emphasis on biodegradable and recyclable films is accelerating as environmental concerns shape agricultural practices. Technological advancements in film materials are supporting higher durability and better light diffusion, further optimizing plant growth. With sustainability initiatives gaining traction, agricultural film adoption continues to expand, supporting long-term resource efficiency. The demand for precision agriculture tools incorporating protective films is also rising, ensuring optimized land utilization and controlled farming environments. As sustainable farming remains a central priority, agricultural film adoption is expected to maintain its upward trajectory.Asia Pacific Agricultural Films Market Analysis

Asia-Pacific is witnessing significant agricultural films adoption due to the growing investment in agriculture startups. For instance, as of 2024, the number of agri startups jumped multifold to 7,000 in the last nine years in India. These startups are developing advanced mulching and greenhouse films to enhance crop yield and reduce dependency on chemical treatments. The rising demand for efficient irrigation solutions is driving the deployment of water-retaining plastic films to conserve moisture and improve soil conditions. Supportive government policies promoting modern farming techniques further fuel the adoption of innovative films for enhanced agricultural efficiency. With increased investment in smart farming, biodegradable and UV-resistant agricultural films are gaining prominence, ensuring better pest management and controlled crop environments. The integration of data-driven agriculture solutions is also expanding, leveraging high-performance films for improved farm productivity and sustainability, making agricultural films a key component in regional farming advancements.Europe Agricultural Films Market Analysis

Europe is witnessing extensive agricultural films adoption due to the growing focus on greenhouse gas reduction. For instance, the EU has a planned target for 2030 of a 55 % net reduction in greenhouse gas emissions. Farmers are increasingly utilizing low-carbon footprint films to minimize agricultural emissions while improving soil conservation. The shift toward biodegradable alternatives is gaining momentum, reducing reliance on conventional plastic-based films that contribute to environmental pollution. High-tech greenhouse films with enhanced thermal regulations are being deployed to optimize energy efficiency, further lowering greenhouse gas emissions. With regulatory frameworks encouraging eco-friendly practices, manufacturers are introducing recyclable and compostable films to align with carbon neutrality targets. Research initiatives focused on sustainable polymers are enhancing film durability and effectiveness. As industries strive to minimize environmental impact, agricultural films adoption is expected to grow in alignment with greenhouse gas reduction efforts.Latin America Agricultural Films Market Analysis

Latin America is seeing increased agricultural films adoption as agriculture production expands, necessitating efficient farming solutions. According to the Food and Agriculture Organization of the United Nations (FAO), crop production in Brazil reached an all-time high of 308 million metric tons in 2021. Farmers are utilizing mulch and silage films to improve water retention, pest management, and crop quality in diverse climates. Enhanced productivity is driving demand for high-durability and UV-resistant films, optimizing harvest cycles. Government initiatives promoting sustainable agricultural techniques are further accelerating film adoption.Middle East and Africa Agricultural Films Market Analysis

The adoption of agricultural films is increasing in the Middle East and Africa due to heightened investments in agricultural innovation. For example, in 2024, the Gates Foundation and the U.A.E. jointly invested USD 200 Million in agricultural innovation to utilize AI and technology in addressing urgent and future challenges to food systems resulting from climate change. Farmers are incorporating advanced films to safeguard soil, maintain moisture, and enhance climate resilience. The use of UV-resistant films is increasing, aiding in the production of high-yield crops in difficult conditions.Competitive Landscape:

Market players in the agricultural films sector are continuously innovating to meet the heightened demands of the agricultural industry. Key activities include the development of new film formulations that offer enhanced durability, biodegradability, and environmental sustainability. Companies are investing in research and development (R&D) to create smart agricultural films embedded with sensors that regulate temperature, humidity, and light for optimized crop growth. Additionally, major players are focusing on expanding their product portfolios to include films suitable for a variety of farming practices, including organic and controlled environment agriculture. As per the agricultural films market forecast, strategic partnerships, acquisitions, and collaborations are expected to become common as companies aim to strengthen their market position and cater to the growing demand for sustainable agricultural solutions across global markets.The report provides a comprehensive analysis of the competitive landscape in the agricultural films market with detailed profiles of all major companies, including:

- Ab Rani Plast Oy

- Armando Alvarez S.A.

- BASF SE

- Berry Global Inc.

- Exxon Mobil Corporation

- Kuraray Co. Ltd

- Novamont S.p.A.

- RKW Hyplast

- The Dow Chemical Company

- Trioplast Industrier AB

Key Questions Answered in This Report

1. How big is the agricultural films market?2. What is the future outlook of agricultural films market?

3. What are the key factors driving the agricultural films market?

4. Which region accounts for the largest agricultural films market share?

5. Which are the leading companies in the global agricultural films market?

Table of Contents

Companies Mentioned

- Ab Rani Plast Oy

- Armando Alvarez S.A.

- BASF SE

- Berry Global Inc.

- Exxon Mobil Corporation

- Kuraray Co. Ltd

- Novamont S.p.A.

- RKW Hyplast

- The Dow Chemical Company

- Trioplast Industrier AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | August 2025 |

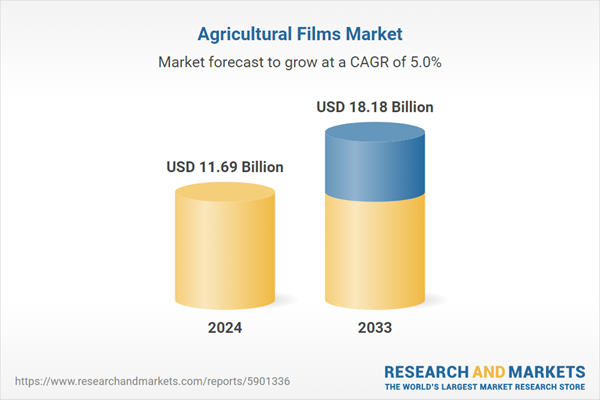

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 11.69 Billion |

| Forecasted Market Value ( USD | $ 18.18 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |