Personalized medicine, which customizes therapies according to a person’s genetic profile, is a critical factor propelling the companion diagnostics market demand. Matching particular treatments to a patient's distinct genetic profile necessitates accurate diagnostic tools, resulting in a greater need for companion diagnostics that assist in directing therapeutic choices for improved results and reduced side effects. Apart from this, improvements in diagnostic technologies, particularly in molecular diagnostics and next-generation sequencing (NGS), are notably enhancing the precision and dependability of companion diagnostics. These advancements enable the detection of genetic mutations and biomarkers with improved accuracy, thus increasing the effectiveness of therapies and driving the need for companion diagnostics in medical environments. Furthermore, healthcare investments are increasingly focused on precision medicine, which involves using diagnostic tests to tailor treatments. As more healthcare systems adopt targeted therapies and personalized treatment regimens, there is a higher demand for companion diagnostics, particularly in oncology, where tailored therapies are crucial.

Global Companion Diagnostics Market Trends:

Advancements in Gene Therapy and Rare Disease Diagnostics

With the growing use of gene therapies for genetic disorders, there is an increase in the demand for diagnostic tools that guarantee the safe and efficient use of these therapies. Companion diagnostics play a crucial role in determining which patients qualify for gene therapy, especially in rare genetic disorders where treatment effectiveness significantly relies on specific biomarkers. These diagnostics assist in identifying existing antibodies or genetic elements that may influence therapy effectiveness, guaranteeing that patients get the most suitable treatment. This critical role is actively being addressed by key players in the diagnostic and pharmaceutical industries, who are developing and gaining regulatory approvals for advanced companion diagnostic assays to facilitate the safe and effective administration of gene therapies. In 2024, Labcorp received FDA approval for its nAbCyte™ Anti-AAVRh74var HB-FE Assay, a companion diagnostic for Pfizer's gene therapy BEQVEZ™ (fidanacogene elaparvovec-dzkt) to treat hemophilia B. The test identified preexisting anti-AAVRh74var antibodies in patients, ensuring safe and effective gene therapy treatment. This approval marked a breakthrough in gene therapy diagnostics for rare genetic disorders.Integration of AI in Diagnostics

Tools powered by AI improve the speed, accuracy, and efficiency of diagnostic tests by examining extensive datasets, such as genetic and clinical data, to pinpoint biomarkers with unmatched precision. AI algorithms can aid in forecasting patient reactions to particular therapies, allowing for more tailored treatment strategies. In oncology and various complex conditions, AI enhances the process of selecting patients for clinical trials, guaranteeing that only those with the highest potential to benefit from the treatment are included. This technological progress is further solidified by strategic collaborations between companies, integrating AI-powered solutions to refine diagnostic processes and accelerate clinical trial advancements. In 2024, ABION and Deep Bio signed an MOU in Seoul, South Korea to collaborate on AI-driven companion diagnostics and cancer clinical trials. The partnership integrated Deep Bio’s AI-powered pathology tools into ABION’s drug pipeline to enhance precision in patient selection and accelerate trial efficiency. This supported ABION’s ongoing combination trials in lung cancer therapy.Increased Healthcare Investments

Investments in healthcare is a key factor influencing the market as worldwide healthcare systems aim to enhance treatment results and lower expenses. Governments, private investors, and healthcare organizations are focusing on personalized and precision medicine, which directly entails the utilization of companion diagnostics. By pinpointing the most effective therapies, companion diagnostics can minimize the trial-and-error method frequently encountered in traditional treatments, resulting in a more efficient allocation of healthcare resources. Moreover, the growing focus on value-based healthcare, linking reimbursement to patient results instead of care volume, corresponds effectively with the function of companion diagnostics in enhancing treatment precision. The cost-efficiency of targeted treatments facilitated by companion diagnostics further reinforces their incorporation into global healthcare systems. With rising economic pressures on healthcare systems, investments in tools that enhance efficient and effective care, like companion diagnostics, are strengthening the market growth.Global Companion Diagnostics Market Growth Drivers:

Rising Aging Population

With the growing geriatric population, there is a rise in the prevalence of chronic and age-related illnesses, such as cancer, heart diseases, and neurological conditions. Older adults frequently need more tailored therapies, which can yield the best outcomes when customized to their genetic profile. The World Health Organization (WHO) states that by 2030, one out of every six individuals worldwide will be 60 years or older, and this figure is expected to climb to 2.1 billion by 2050. This demographic change necessitates increased and enhanced diagnostic services, driving the demand for superior diagnostic instruments and testing solutions. Companion diagnostics allow healthcare professionals to customize treatments according to specific genetic profiles, enhancing treatment results and lowering the likelihood of negative reactions. This movement towards individualized healthcare is crucial for addressing the intricate requirements of aging populations.Strategic Partnerships and Collaborations

Partnerships and collaborations between diagnostic companies and pharmaceutical firms facilitate the combination of diagnostic tools with innovative therapies, guaranteeing that suitable patients obtain the most efficient treatments. Through the integration of knowledge in drug development and diagnostic technologies, these collaborations expedite the creation of companion diagnostics, simplify the regulatory approval process, and improve the accessibility of personalized healthcare options. With the increase in demand for precision medicine, these collaborations are vital for broadening the market offerings by developing all-encompassing, end-to-end solutions that facilitate the creation of targeted treatments. For example, in 2024, BD (Becton, Dickinson and Company) and Quest Diagnostics announced a global partnership to created flow cytometry-based companion diagnostics for cancer and other diseases. The partnership aimed to offer an end-to-end solution for the pharmaceutical industry, ranging from exploratory panel development to FDA-approved diagnostic kits. The goal was to advance personalized healthcare and improve clinical outcomes.Enhancing Regulatory Pathways for Diagnostic Approval

The advancement and improvement of regulatory processes for diagnostic approval are a crucial factor impelling the market growth. Regulatory agencies are simplifying the approval pathways for companion diagnostics, acknowledging their vital contribution to facilitating precision medicine. With quicker review periods and explicit frameworks for the creation and authorization of companion diagnostics tests, the regulatory landscape is becoming increasingly supportive of innovation in this area. These enhancements not only promote the advancement of novel diagnostic technologies but also offer more defined routes to market access for firms investing in companion diagnostics. In addition, as regulators recognize the significance of these assessments in guaranteeing the efficacy of novel treatments, they are generating more chances for companion diagnostics companies to prosper.Companion Diagnostics Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product & service, technology, indication, and end user.Breakup by Product & Service:

- Assays, Kits and Reagents

- Software and Services

Assays, kits and reagents hold the largest market share

The report has provided a detailed breakup and analysis of the companion diagnostics market based on the product & service. This includes assays, kits and reagents, and software and services. According to the report, assays, kits, and reagents represented the largest segment.Assays, kits, and reagents play important roles in identifying patients who are most likely to benefit from a particular therapeutic product. These diagnostic tools aid in determining the absence or presence of specific biomarkers, protein expressions, genetic mutations, etc., linked to the potential side effects and effectiveness of targeted therapies. This, in turn, is propelling the market growth in this segment.

Breakup by Technology:

- Immunohistochemistry (IHC)

- Polymerase Chain Reaction (PCR)

- In-situ Hybridization (ISH)

- Real-time PCR (RT-PCR)

- Gene Sequencing

- Others

Polymerase chain reaction (PCR) exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the technology. This includes immunohistochemistry (IHC), polymerase chain reaction (PCR), in-situ hybridization (ISH), real-time PCR (RT-PCR), gene sequencing, and others. According to the report, polymerase chain reaction (PCR) accounted for the largest market share.The growth in this segmentation is bolstered by the easy availability of polymerase chain reaction (PCR) kits and reagents used for companion diagnostics. Moreover, their widespread applications in detecting gene mutations with low or limited allele frequencies are contributing to their dominance in the global market.

Breakup by Indication:

- Cancer

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Gastric Cancer

- Melanoma

- Others

- Neurological Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Others

Cancer currently accounts for the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the indication. This includes cancer (lung cancer, breast cancer, colorectal cancer, gastric cancer, melanoma, and others), neurological diseases, infectious diseases, cardiovascular diseases, and others. According to the report, cancer represented the largest segment.The widespread incidence of cancer is propelling the usage of companion diagnostics, thereby fueling the market growth in this segmentation. According to the American Cancer Society, in January 2022, 1.9 million cancer cases were recorded in the U.S. Consequently, continuous product launches and approvals by government bodies are positively influencing the companion diagnostics market growth in this segmentation. For example, in October 2021, the United States Food and Drug Administration approved Agilent's Ki-67 IHC MIB-1 pharmDx (Dako Omnis), which assisted in identifying patients with early breast cancer (EBC). Besides this, according to the Lung Cancer Research Foundation, in the United States estimated 236,740 individuals were diagnosed with lung cancer in 2022, thereby propelling the need for lung cancer companion diagnostics.

Breakup by End User:

- Pharmaceutical & Biopharmaceutical Companies

- Reference Laboratories

- Contract Research Organizations

- Others

Pharmaceutical & biopharmaceutical companies hold the largest market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes pharmaceutical & biopharmaceutical companies, reference laboratories, contract research organizations, and others. According to the report, pharmaceutical & biopharmaceutical companies accounted for the largest market share.The rising adoption of companion diagnostics by pharmaceutical & biopharmaceutical companies in drug development is one of the primary factors propelling the market growth in this segmentation. Moreover, the inflating popularity of companion diagnostics biomarkers is also acting as another significant growth-inducing factor.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest companion diagnostics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America currently dominates the global market, with the United States emerging as a major contributor. Strategic collaborations among biopharmaceutical companies and companion diagnostic manufacturers are primarily augmenting the regional market. For example, QIAGEN and Denovo Biopharma partnered to develop a companion diagnostic test for the treatment of diffuse large B-Cell Lymphoma (DLBCL). Furthermore, the increasing drug approvals by governing authorities, such as the United States Food and Drug Administration (US FDA), are projected to bolster the companion diagnostics market in North America over the forecasted period.

Leading Key Players in the Companion Diagnostics Industry:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abbott Laboratories

- Agilent Technologies

- BioMerieux

- Danaher Corporation

- Roche Holding AG

- Myriad Genetics Inc.

- Siemens Healthcare

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

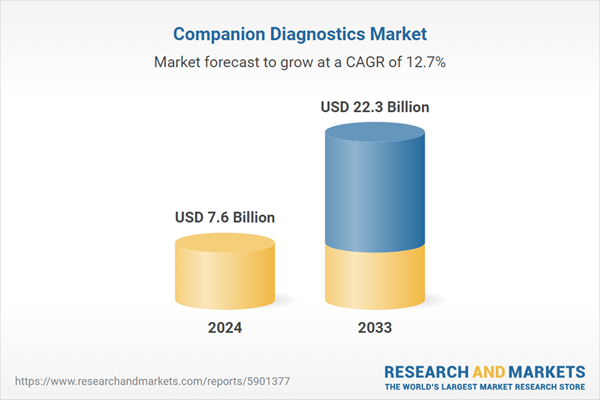

1. What was the size of the global companion diagnostics market in 2024?2. What is the expected growth rate of the global companion diagnostics market during 2025-2033?

3. What has been the impact of COVID-19 on the global companion diagnostics market?

4. What are the key factors driving the global companion diagnostics market?

5. What is the breakup of the global companion diagnostics market based on the product & service?

6. What is the breakup of the global companion diagnostics market based on the technology?

7. What is the breakup of the global companion diagnostics market based on the indication?

8. What is the breakup of the global companion diagnostics market based on the end user?

9. What are the key regions in the global companion diagnostics market?

10. Who are the key players/companies in the global companion diagnostics market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Agilent Technologies

- BioMerieux

- Danaher Corporation

- Roche Holding AG

- Myriad Genetics Inc.

- Siemens Healthcare

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.6 Billion |

| Forecasted Market Value ( USD | $ 22.3 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |