Oxidative Stress Assay Market Trends:

Technological Advancements

The oxidative stress assay market is experiencing rapid advancements in technologies for assay development, such as automation, high-throughput screening, and more advanced detection platforms. These advancements enhance the effectiveness of assays, thereby enabling clinicians and researchers to conduct numerous tests simultaneously, which improves speed and accuracy. Automation helps reduce human errors, which makes assays more dependable and accessible for clinical and research applications. These advancements are advantageous particularly in drug discovery and personalized medicine, where rapid analysis and high accuracy of oxidative stress biomarkers are critical for the development of targeted therapies and identification of disease structures.Increasing Demand for Personalized Medicine

Personalized medicine exhibits a noteworthy opportunity to augment the future of individualized healthcare for everyone, which is projected to revolutionize disease treatment and prevention. The Vision 2030 by International Consortium for Personalized Medicine (ICPerMed) focuses on five key aspects: individual and public engagement, inclusion of healthcare professionals, health-related data, implementation within healthcare systems, and the development of sustainable economic models. The sustainable economic models enable enhanced diagnostic, therapy, and preventive methods as new healthcare concepts for the advantage of the public. This trend is projected to transform the treatment of chronic ailments related to oxidative stress.Expansion of Research in Drug Discovery and Development

The rapid growth in R&D initiatives by key pharma and biotechnology companies for developing innovative treatment for critical diseases is projected to propel the demand for oxidative stress tests. According to the Pharma R&D Annual Review 2023 by Citeline, the total number of pharmaceutical companies involved in pharma-specific R&D activities with active pipelines were around 5,529, with over 21,292 pharmaceutical drugs under development. Numerous pharmaceutical and biotechnology companies are implementing oxidative stress assays in drug discovery and development for gauging the effects of new drug candidates on cellular oxidative stress. An upsurge in R&D expenditure for developing novel therapeutic drugs for targeted health conditions is anticipated to increase the market uptake for oxidative stress tests.Growing Adoption of Point-of-Care and At-Home Testing Kits

The growing popularity of point-of-care (POC) and at-home stress test kits is becoming ever more prevalent due to the proliferating demand for portable and easy-to-use health monitoring solutions. These test kits enable individuals to evaluate the levels of oxidative stress without the need for a hospital visit, which also encourages preventive health management. This trend aligns with the rising consumer interest in wellness and self-care. As the technology that drives portable testing devices witnesses advancements, the reliability and preciseness of these convenient kits continue to augment, driving the market growth further.Oxidative Stress Assay Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, technology, test type and end user.Breakup by Product:

- Reagents and Consumables

- Instruments

- Services

Reagents and consumables segment accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on product. This includes reagents and consumables, instruments, and services. According to the report, reagents and consumables represented the largest segment.Reagents and consumables form the mainstay of oxidative stress assay operations. These products are used for detecting a number of metabolites in pathways of oxidative stress and cellular damage, including reactive oxygen species and nitric oxide. The segment growth is driven by factors such as rapid surge in research initiatives for drug discovery and development, advancements in assay operations, and the increasing demand of reagents in detection of biomarkers.

Breakup by Technology:

- ELISA (Enzyme-Linked Immunosorbent Assay)

- Flow Cytometry

- Chromatography

- Microscopy

- High-Content Screening

- Label-Free Detection

- Others

ELISA holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes ELISA, flow cytometry, chromatography, microscopy, high-content screening, label-free detection, and others. According to the report, ELISA accounted for the largest oxidative stress assay market share.ELISA is highly sensitive assay for detecting a varied range of biomarkers. The increasing availability of ELISA for status markers in oxidative stress tests enables the assessment of several pathophysiologic conditions, such as diabetes. It helps identify and measure proteins and antigens in a given sample. ELISA finds applications across quality control, research, and diagnostics.

Breakup by Test Type:

- Indirect Assays

- Protein-Based Assays

- Lipid-Based Assays

- Nucleic Acid-Based Assays

- Antioxidant Capacity Assays

- Glutathione Assays

- Ascorbic Acid Assays

- Cell-Based Exogenous Antioxidant Assays

- Enzyme-Based Assays

- Reactive Oxygen Species-Based Assays

Indirect assays represented the leading market segment

The report has provided a detailed breakup and analysis of the market based on test type. This includes indirect assays (protein-based, lipid-based and nucleic acid-based assays), antioxidant capacity assays (glutathione assays, ascorbic acid, and cell-based exogenous antioxidant assays), enzyme-based assays, and reactive oxygen species-based assays. According to the report, indirect assays represented the largest segment.The indirect assays segment dominates the global market owing to the versatility of these assays in conducting the overall evaluation of oxidative stress. Indirect assays are suitable for analyzing low-expressed proteins based on the signal amplification by the secondary antibody. Secondary antibodies are comparatively inexpensive than primary antibodies used in direct assays and can be implemented to detect various primary antibodies.

Breakup by End User:

- Pharmaceutical Industry

- Research Institutes

- Others

Pharmaceutical industry exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes pharmaceutical industry, research institutes, and others. According to the report, the pharmaceutical industry accounted for the largest market share.The pharmaceutical companies in the market deploy oxidative stress assays for identifying and developing prospective targets for therapeutic treatment, evaluating the effectiveness of drug candidates in alleviating oxidative stress, and tracking the status of oxidative stress among patients undergoing treatment.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest oxidative stress assay market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for oxidative stress assay.The North America market holds a significant market share owing to increasing R&D funding and supportive government initiatives in healthcare sector. The presence of numerous pharmaceutical & biotechnology companies and research institutes developing novel therapies for diverse range of diseases and enhanced healthcare infrastructure is supporting the market expansion in the region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the oxidative stress assay industry include Abcam PLC, AMS Biotechnology (Europe) Ltd., Biovision Inc. (Boai NKY Medical Holdings Ltd.), Cell Biolabs Inc., Enzo Biochem Inc., ImmunoChemistry Technologies LLC, Merck KGaA, Oxford Biomedical Research, Promega Corporation, Qiagen N.V., and Thermo Fisher Scientific Inc.

- Key players in the oxidative stress assay market are increasingly emphasizing strategic business initiatives including product launch, partnerships, mergers, and acquisitions to strengthen their foothold in the market. Companies including Abcam, Thermo Fisher Scientific, and Merck are involved in the development of advanced, high-throughput oxidative stress assay kits for quicker and more precise outcomes. Business tie-ups with pharmaceutical companies and research institutions enable these players to expand their application areas in drug discovery and personalized medicine. Furthermore, some of the key companies are investing in digital platforms and automation for enhancing the effectiveness and scalability of oxidative stress assays, while also monitoring the potential of emerging markets to widen their customer base and expand the market reach across different regions.

Key Questions Answered in This Report:

- How has the global oxidative stress assay market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global oxidative stress assay market?

- What is the impact of each driver, restraint, and opportunity on the global oxidative stress assay market?

- What are the key regional markets?

- Which countries represent the most attractive oxidative stress assay market?

- What is the breakup of the market based on product?

- Which is the most attractive product in the oxidative stress assay market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the oxidative stress assay market?

- What is the breakup of the market based on test type?

- Which is the most attractive test type in the oxidative stress assay market?

- What is the breakup of the market based on end user?

- Which is the most attractive end user in the oxidative stress assay market?

- What is the breakup of the market based on region?

- Which is the most attractive region in the oxidative stress assay market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global oxidative stress assay market?

Table of Contents

Companies Mentioned

- Abcam PLC

- AMS Biotechnology (Europe) Ltd.

- Biovision Inc. (Boai NKY Medical Holdings Ltd.)

- Cell Biolabs Inc.

- Enzo Biochem Inc.

- ImmunoChemistry Technologies LLC

- Merck KGaA

- Oxford Biomedical Research

- Promega Corporation

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

Table Information

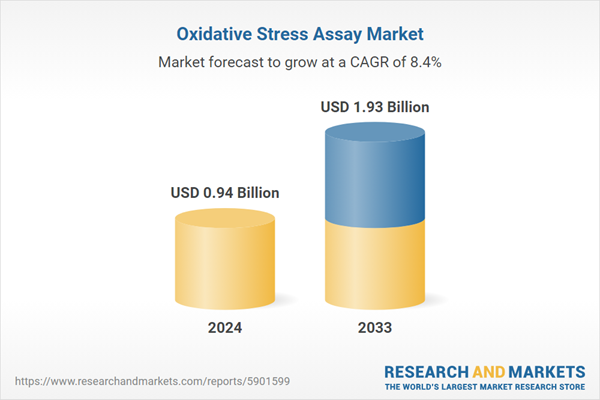

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.94 Billion |

| Forecasted Market Value ( USD | $ 1.93 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |