Egg Packaging Market Trends:

Increasing Consumption of Egg

The rising egg consumption worldwide is one of the key drivers for the growth of the egg packaging market. Eggs are a convenient and economical source of high-quality protein, making them a dietary staple. 261 million cases of eggs were produced in the United States in 2022. Of which, over half were sold as shell eggs through retail channels. More than one-fourth of the eggs produced were converted into products for food service, manufacturing, retail, and export markets. This growing demand is triggering the need for packaging solutions that will guarantee the safe transportation of eggs from one place to another. The egg packaging market forecast indicates continued growth, driven by the increasing consumption of eggs and the rising need for effective and sustainable packaging solutions to meet the demands of global transportation and distribution.Growing Demand for Convenience Foods

The growing demand for convenience foods has been contributing significantly to the demand for egg packaging. Busy lifestyles with busy schedules and reduced time to cook meals have motivated the majority of consumers to seek convenient, easy, ready-to-eat (RTE) or quick-to-cook food items. According to this trend, the market for convenience foods will reach US$ 782.7 billion by 2032 at a compound annual growth rate of 5.47%. Eggs are particularly suitable to this category due to their ease of preparation and versatility. Eggs have also been found to be a source of protein. They are also packed with heart-healthy unsaturated fats and are a rich source of essential nutrients, such as vitamin B6, B12, and vitamin D. This has spurred the development of a range of egg convenience foods, such as pre-cooked eggs, egg salads, and egg snacks, all requiring special packaging for maintaining quality and freshness.Expansion of Retail Chains and E-commerce Platforms

The mass upscaling of retail chains and online channels is having a positive impact on the size of the egg packaging market. The development of supermarkets, hypermarkets, and online food stores has expanded the availability and accessibility of eggs to more consumers. The Indian retail industry has a robust size of the market, ranking fourth globally and contributing over 10% to the GDP of India. The sector was valued at an astounding INR 91.89 trillion in 2022 and is expected to expand at a rate of more than 13% CAGR till 2027. In addition, the e-commerce segment is projected to be worth US$ 350 billion in 2030. It expanded 21.5% in 2022 at a value of US$ 74.8 billion. The trip has increased demand for effective retail and online-store packaging solutions so that eggs stay safe and fresh during long supply chains and at-home deliveries.Egg Packaging Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, material, and application.Breakup by Product Type:

- Cartons

- Trays

- Containers

- Others

Cartons accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cartons, trays, containers, and others. According to the report, cartons represented the largest segment.According to the egg packaging market report and trends, cartons had the largest market share since they are most favored due to their durability, ease of handling, and great protective qualities. Furthermore, these are made from a variety of materials such as molded pulp, plastic, and recycled paper, which offer a balance of durability and environment-friendliness. Moreover, the rising demand for cartons based on their configuration, with individual compartments that minimize breakage by protecting every egg while it is being transported and stored, is positively impacting the egg packaging market value.

Breakup by Material:

- Moulded Paper

- Polyethylene Terephthalate

- Polystyrene

Moulded paper holds the largest share of the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes moulded paper, polyethylene terephthalate, and polystyrene. According to the report, moulded paper accounted for the largest market share.As per the egg packaging market outlook and forecast, moulded paper accounted for the largest market share owing to its eco-friendly attributes, cost-effectiveness, and superior protective qualities. In addition, it is composed of recycled paper and different natural fibers, showcasing the growing consumer appetite for environmentally friendly packaging solutions. Moreover, these cartons offer excellent cushioning and shock absorption, reducing the chances of egg breakage during transport and handling. Moreover, moulded paper packaging is adaptable and can be effortlessly tailored with different shapes, sizes, and branding choices, thereby enhancing the egg packaging market share.

Breakup by Application:

- Retailing

- Transportation

- Others

Retailing represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes retailing, transportation, and others. According to the report, retailing represented the largest segment.Based on the egg packaging market overview, retailing was the largest segment. It includes eggs distribution via supermarkets, grocery stores, and the Internet. The increasing demand for egg packaging in retailing, due to the increasing need to preserve eggs' integrity and freshness and to provide convenient features like easy handling, understandable labeling, and tamper evidence, is driving the market growth. Additionally, the growth of online shopping for groceries, increasing the demand for strong and secure packaging that can handle the challenges of delivery, is enhancing the egg packaging market revenue.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest egg packaging market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for egg packaging.As per the egg packaging market analysis and research report, Asia Pacific dominated the market share, driven by several factors, including its large and rapidly growing population, increasing urbanization, and rising income levels. Additionally, the expansion of modern retail infrastructures, coupled with a growing awareness of food safety and quality, is bolstering the market growth. Along with this, the massive consumer base and robust agricultural sector in the region are contributing to the market growth. Furthermore, the ongoing push for sustainable packaging solutions in response to environmental concerns, spurring innovations in biodegradable and recyclable materials, is positively favoring the egg packaging industry.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the egg packaging industry include Brødrene Hartmann A/S, CKF Inc., Celluloses De La Loire, Dynamic Fibre Moulding (Pty) Ltd., Dispak Limited, Huhtamaki Oyj, Mauser Packaging Solutions, Ovotherm International Handels GmbH, Pactiv LLC (Reynolds Group Holdings Ltd.), Sanovo Technology Group, Sonoco Products Company, etc.

- The major egg packaging companies are focusing on innovation, sustainability, and strategic expansion to maintain and enhance their market positions. They are investing in developing eco-friendly packaging solutions and incorporating biodegradable and recyclable materials to meet the growing consumer demand for sustainable products. Moreover, leading players are leveraging advanced technologies to improve the durability and functionality of their packaging to ensure that eggs are better protected during transportation and storage. Additionally, they are expanding their geographical footprint through mergers, acquisitions, and partnerships to capitalize on the growth potential of emerging markets.

Key Questions Answered in This Report

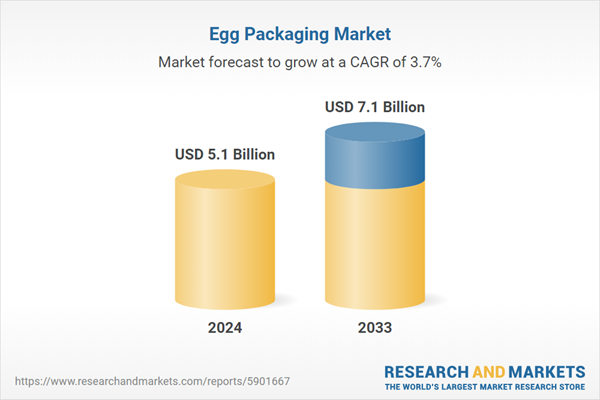

1. What was the size of the global egg packaging market in 2024?2. What is the expected growth rate of the global egg packaging market during 2025-2033?

3. What are the key factors driving the global egg packaging market?

4. What has been the impact of COVID-19 on the global egg packaging market?

5. What is the breakup of the global egg packaging market based on the product type?

6. What is the breakup of the global egg packaging market based on the material?

7. What is the breakup of the global egg packaging market based on the application?

8. What are the key regions in the global egg packaging market?

9. Who are the key players/companies in the global egg packaging market?

Table of Contents

Companies Mentioned

- Brødrene Hartmann A/S

- CKF Inc.

- Celluloses De La Loire

- Dynamic Fibre Moulding (Pty) Ltd.

- Dispak Limited

- Huhtamaki Oyj

- Mauser Packaging Solutions

- Ovotherm International Handels GmbH

- Pactiv LLC (Reynolds Group Holdings Ltd.)

- Sanovo Technology Group

- Sonoco Products Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |