Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the industry faces notable hurdles regarding high installation complexities and significant initial capital outlays, which may restrict adoption among budget-conscious organizations. These financial obstacles are often exacerbated by the need for specialized technical maintenance and skilled labor to oversee integrated content systems. Highlighting the scale of this sector, specific data underscores the strong valuation of its key segments. As reported by the Audiovisual and Integrated Experience Association, the digital signage market within the professional audiovisual industry is anticipated to achieve a value of 41.4 billion U.S. dollars in 2024.

Market Drivers

The rapid growth of the Digital Out-of-Home (DOOH) advertising sector acts as a primary catalyst for market expansion. Advertisers are increasingly transitioning from static billboards to dynamic digital networks that facilitate real-time programmatic capabilities and audience analytics, driving the installation of large-format LED screens and high-brightness LCDs in urban centers and transit hubs. The economic impact of this shift is evident; according to the Out of Home Advertising Association of America, March 2025, in the 'OOH Ad Spend Hit Record $9.1B In 2024' report, United States out-of-home advertising revenue reached a historic high of $9.1 billion, emphasizing the essential role of commercial display hardware in visual communication.Additionally, the rising demand for interactive flat panel displays (IFPDs) within corporate and educational settings is reshaping the industry. As institutions adopt digital curriculums and hybrid work models, there is an accelerated replacement of traditional projection systems with touch-enabled collaboration boards crucial for video conferencing and interactive learning. This trend is reflected in major corporate performance; according to LG Electronics, January 2025, in the 'Fourth-Quarter and Full-Year 2024 Financial Results', the LG Business Solutions Company reported annual revenue of KRW 5.69 trillion, spurred by display sales for business and education. Furthermore, AVIXA projected in 2024 that professional audiovisual industry revenue would reach $325 billion, confirming the ecosystem's immense scale.

Market Challenges

Significant initial capital requirements combined with high installation complexities serve as primary restraints on the growth of the commercial display sector. Acquiring professional-grade screens entails substantial upfront costs, which are further burdened by expenses related to structural integration and infrastructure upgrades, making the market susceptible to economic fluctuations that impact corporate spending. This trend is highlighted by the Audiovisual and Integrated Experience Association, which projected in 2024 that the growth rate of the professional audiovisual industry would slow to 6.1 percent, a deceleration attributed in part to high interest rates limiting capital availability.Beyond financial hurdles, the market is impeded by the technical complexity involved in deploying these systems. Successful implementation demands specialized skilled labor to manage integrated content systems and guarantee continuous operation, a requirement that raises the total cost of ownership and creates logistical challenges for entities lacking internal audiovisual departments. Consequently, the shortage of qualified personnel and the resulting operational intricacies discourage potential buyers, thereby limiting market penetration in sectors with constrained resources.

Market Trends

The increasing adoption of Micro-LED and Mini-LED technologies is fundamentally elevating visual standards in the commercial sector, surpassing the limitations of traditional LCDs. These advanced architectures employ microscopic light-emitting diodes to provide superior contrast ratios, deeper blacks, and higher peak brightness, rendering them ideal for premium large-scale video walls in control rooms and retail environments. This shift toward direct-view LED solutions is supported by manufacturing advancements such as Chip-on-Board (COB) technology, which improves durability and enables seamless, bezel-free installations; according to Unilumin, May 2024, in the 'Ranking No.1, Unilumin Reshapes the Market Landscape of LED Video Wall Industry' press release, the company generated annual revenue of 7.41 billion Chinese yuan, highlighting the financial success of leaders adopting these advanced LED architectures.Concurrently, the integration of energy-efficient and sustainable display designs has emerged as a key operational priority for global enterprises seeking to lower operating costs and carbon footprints. Manufacturers are actively re-engineering product lines to reduce power usage through innovations like "zero-power" electronic paper (ePaper) for static signage and high-efficiency backlighting for dynamic screens, while also incorporating recycled materials and eco-friendly packaging to meet strict Environmental, Social, and Governance (ESG) mandates. The dedication to this green transition is reflected in industry metrics; according to Samsung Electronics, June 2024, in the '2024 Sustainability Report', the company’s Device eXperience division attained a 93.4 percent renewable energy conversion rate, demonstrating the sector's operational pivot toward environmental responsibility.

Key Players Profiled in the Commercial Display Market

- Elo Touch Solutions, Inc.

- HP Inc.

- Samsung Electronics Co., Ltd.

- NCR Corporation

- Diebold Nixdorf, Inc.

- Posiflex Technology, Inc.

- Sharp Electronics Corporation

- Toshiba Corporation

- Radiant Technology, Inc.

- Bematech

Report Scope

In this report, the Global Commercial Display Market has been segmented into the following categories:Commercial Display Market, by Product:

- Digital Signage

- Display Monitor

- Display TVs

Commercial Display Market, by Technology:

- LCD

- LED

Commercial Display Market, by Component:

- Hardware

- Software

Commercial Display Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial Display Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Commercial Display market report include:- Elo Touch Solutions, Inc.

- HP Inc

- Samsung Electronics Co., Ltd.

- NCR Corporation

- Diebold Nixdorf, Inc.

- Posiflex Technology, Inc.

- Sharp Electronics Corporation

- Toshiba Corporation

- Radiant Technology, Inc.

- Bematech

Table Information

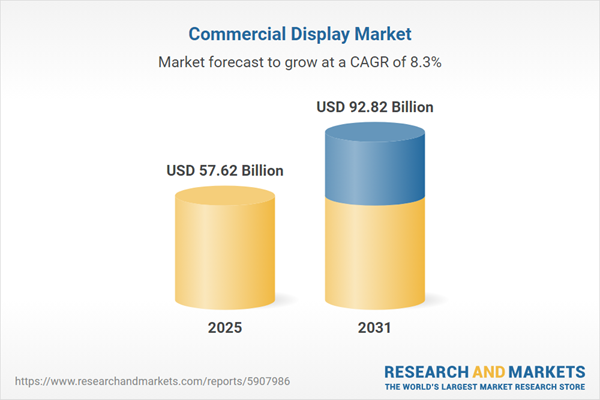

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 57.62 Billion |

| Forecasted Market Value ( USD | $ 92.82 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |