Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the key drivers of the North America IPM market is the increasing awareness of the adverse effects of chemical pesticides on ecosystems, non-target species, and human health. Consumers, farmers, and policymakers alike are seeking alternatives that are both effective in pest control and environmentally responsible. IPM strategies, which encompass biological control, cultural practices, and the careful application of pesticides as a last resort, align with these priorities.

The North America IPM market is characterized by its diversity, with various industries adopting IPM principles. In agriculture, IPM is being integrated into the production of a wide range of crops, from fruits and vegetables to grains and cotton. In urban and structural pest management, IPM is gaining prominence as a sustainable approach to control pests in homes, schools, and commercial buildings. Additionally, the adoption of IPM is growing in the forestry sector, where it is used to protect valuable timber resources.

Key Market Drivers

Environmental Awareness and Sustainability

Environmental awareness and sustainability are playing a pivotal role in boosting the North America Integrated Pest Management (IPM) market. As concerns about the ecological and health impacts of conventional pesticide use grow, consumers, farmers, and policymakers are increasingly turning to IPM as a more sustainable and environmentally friendly alternative. In February 2023, FMC has introduced Coragen® eVo insect control, powered by Rynaxypyr® active, for use on tobacco, brassica/cole crops, potatoes, tomatoes, lettuce, sweet corn, alfalfa, strawberries, and other vegetable crops.Coragen eVo is a highly concentrated formulation of Rynaxypyr active, the industry benchmark for fast-acting, long-lasting protection against Lepidopteran pests. Offering the same pest spectrum and effectiveness as Coragen insect control, Coragen eVo features three times the active ingredient concentration, allowing for a lower application rate. For ease of use, it has a standard application rate of 1.7 ounces per acre or approximately 1 quart per 20 acres. Additionally, it seamlessly tank mixes with other crop protection products, nutrients, and adjuvants.

Conventional pesticides can contaminate soil and water, harm beneficial insects, and disrupt natural predator-prey relationships. As a result, the shift towards IPM practices has gained momentum, as it encourages the use of natural predators, biological controls, and cultural practices to manage pests effectively. By reducing the reliance on chemical pesticides, IPM minimizes the environmental footprint of pest control efforts.

Regulatory Support and Compliance

Regulatory support and compliance have emerged as significant drivers boosting the North America Integrated Pest Management (IPM) market. Government agencies at the federal, state, and local levels have recognized the environmental and health benefits of IPM practices and have implemented regulations and programs to incentivize their adoption.regulatory support is the proactive role played by agencies like the United States Environmental Protection Agency (EPA). These agencies have developed comprehensive IPM programs, guidelines, and best practices to promote the responsible use of pesticides and encourage the adoption of IPM strategies. They provide valuable resources and technical assistance to farmers, pest control professionals, and other stakeholders, facilitating the transition to IPM.

Financial incentives and grants are also significant drivers. Government funding programs aimed at promoting sustainable agriculture often prioritize IPM practices. These financial incentives can help offset the initial costs associated with adopting IPM techniques, making it more accessible to farmers and businesses. In some cases, compliance with IPM guidelines may be a requirement for accessing certain grants or subsidies, further motivating stakeholders to embrace sustainable pest management. In February 2021, Anticimex U.S., a global pest control provider, has launched its new U.S. website. With locations in 21 states and 18 countries, the website provides easy access to each location through dedicated links. Anticimex currently operates across North America, Central America, Europe, and Asia.

Key Market Challenges

Initial Implementation Costs

Setting up monitoring systems to track pest populations and assess the effectiveness of IPM strategies can be costly. This includes the purchase of monitoring tools and equipment, as well as the installation of sensors and data collection systems. While these investments can provide valuable insights and help fine-tune pest management efforts, they can be a barrier for smaller-scale farmers or businesses with limited budgets.Incorporating biological control methods, such as introducing beneficial insects or predators, requires careful planning and initial investments. The purchase and release of these biological agents can add to the overall cost of IPM implementation. Additionally, ongoing monitoring and maintenance may be necessary to ensure the success of these natural pest control measures.

Properly implementing IPM strategies requires a deep understanding of pest biology, crop management, and ecosystem dynamics. Training and education are essential components of successful IPM adoption. While these programs can be invaluable, they can also entail costs related to workshops, seminars, and materials, as well as the time and effort required for participants to acquire new knowledge and skills.

Some IPM practices may necessitate infrastructure improvements or the purchase of specialized equipment. For example, the installation of insect traps or pheromone dispensers may be necessary to monitor and control pest populations effectively. These investments can be significant and may deter those facing budget constraints.

Key Market Trends

Consumer Demand for Organic Products

Consumer demand for organic products is a powerful driver behind the growth of the North America Integrated Pest Management (IPM) market. As more consumers prioritize healthier, sustainably produced food and products, there is a corresponding need for pest management practices that align with these values. IPM represents a sustainable and environmentally responsible approach to pest control, making it a natural fit for the organic and eco-conscious market.Organic products are typically produced without synthetic pesticides or genetically modified organisms (GMOs). Consumers who seek out organic goods do so with the expectation of products that are free from chemical residues and grown using environmentally friendly practices. IPM's focus on reducing chemical pesticide use and employing natural predator-prey relationships, cultural practices, and targeted pesticide applications as a last resort aligns seamlessly with these consumer expectations.

The demand for organic products extends beyond fruits and vegetables to include organic grains, dairy, meat, and processed foods. Producers of these organic goods recognize the importance of IPM in maintaining the organic integrity of their products. By implementing IPM practices, they can minimize the use of synthetic pesticides and adhere to organic certification standards, thus meeting the stringent requirements of the organic market. In November 2023, PURCOR Pest Solutions introduced its new e-commerce platform, providing customers with an enhanced online purchasing experience. Alongside this new digital option, customers will still have access to live sales and service agents for support.

Key Market Players

- BASF Corporation

- Advanced Integrated Pest Management

- SGS North America Inc.

- Bayer Corporation

- Ecolab Inc.

- Integrated Pest Management, Inc.

- Pest & Pollinator LLC

- PRIDE Industries

- Orkin LLC

- The Rainforest Alliance

Report Scope:

In this report, the North America Integrated Pest Management (IPM) Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Integrated Pest Management (IPM) Market, By Pest Type:

- Weeds

- Invertebrates

- Pathogens

- Vertebrates

North America Integrated Pest Management (IPM) Market, By Control Method:

- Biological Control

- Chemical Control

- Cultural Controls

- Mechanical & Physical Controls

- Other Control Method

North America Integrated Pest Management (IPM) Market, By Application:

- Agriculture

- Commercial buildings

- Industrial

- Residential

- Others

North America Integrated Pest Management (IPM) Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Integrated Pest Management (IPM) Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF Corporation

- Advanced Integrated Pest Management

- SGS North America Inc.

- Bayer Corporation

- Ecolab Inc.

- Integrated Pest Management, Inc.

- Pest & Pollinator LLC

- PRIDE Industries

- Orkin LLC

- The Rainforest Alliance

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | February 2025 |

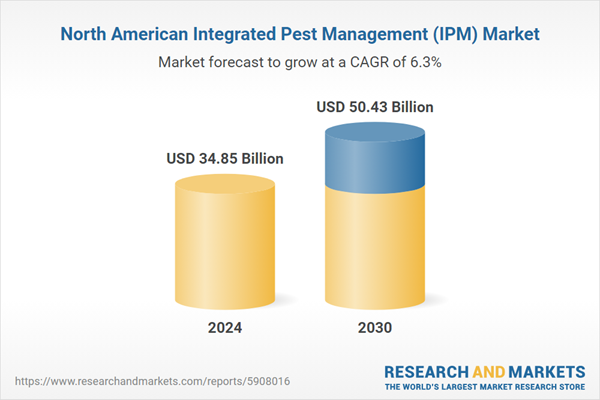

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.85 Billion |

| Forecasted Market Value ( USD | $ 50.43 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |