Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Surging Demand for Photopolymers in the Dental Sector

The dental industry is a key contributor to the rising demand for photopolymers, driven by the material's versatility, precision, and aesthetic compatibility. As of 2025, the global oral care market is projected to generate USD 54.79 billion, with the United States accounting for approximately USD 10 billion. Photopolymers have become essential in restorative dentistry for applications such as cavity fillings, cosmetic reshaping, and repairing chipped teeth. Their ability to closely match the natural color of teeth ensures visually appealing results. In both clinical and dental lab environments, light-cured resins are increasingly preferred due to their rapid curing times, durability, and biocompatibility. These attributes are contributing to the widespread adoption of photopolymer-based composites in modern dental care.Key Market Trends

Advancements in Material Science

Innovations in material science are continuously enhancing the properties and application range of photopolymers. Custom formulations are being developed to cater to the distinct needs of sectors like healthcare, aerospace, and automotive. In healthcare, the emphasis is on biocompatibility and performance, particularly in applications like 3D-printed medical devices and vascular scaffolds. For example, photocurable bioresins infused with graphene are being explored for vascular stents that support drug delivery and controlled biodegradation. Similarly, lightweight, high-strength photopolymer composites are gaining traction in aerospace prototyping and tooling. These scientific advancements are not only expanding the functional scope of photopolymers but also improving sustainability and therapeutic performance across industries.Key Market Players

- Henkel AG & Co. KGaA

- Arkema S.A.

- Evonik Industries AG

- BASF SE

- ANYCUBIC Technology Co., Ltd.

- Keystone Industries

- Stratasys Ltd.

- Liqcreate

- Photocentric Ltd., U.K.

- Carbon, Inc.

Report Scope:

In this report, the Global Photopolymers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Photopolymers Market, By Performance:

- Low

- Mid

- High

Photopolymers Market, By Technology:

- SLA

- DLP

- cDLP

Photopolymers Market, By Application:

- Dental

- Medical

- Audiology

- Jewellery

- Automotive

- Others

Photopolymers Market, By Region:

- Asia Pacific

- China

- India

- Australia

- Japan

- South Korea

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- North America

- United States

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Photopolymers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Henkel AG & Co. KGaA

- Arkema S.A.

- Evonik Industries AG

- BASF SE

- ANYCUBIC Technology Co., Ltd.

- Keystone Industries

- Stratasys Ltd.

- Liqcreate

- Photocentric Ltd., U.K.

- Carbon, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

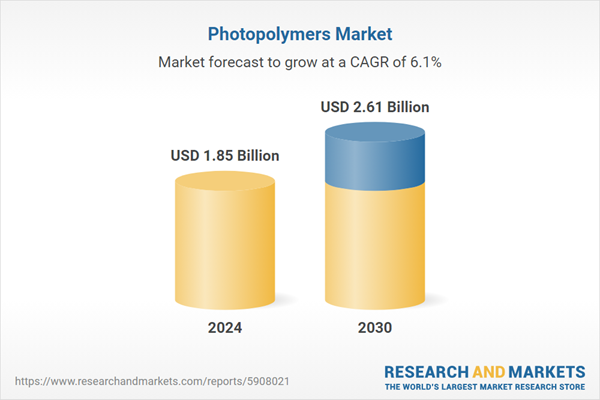

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.85 Billion |

| Forecasted Market Value ( USD | $ 2.61 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |