Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Two-Wheeler Ownership and Usage

One of the primary drivers of the global automotive two-wheeler engine oil market is the increasing ownership and usage of two-wheelers worldwide. This trend can be attributed to several factors, including urbanization, population growth, and improved economic conditions in emerging markets. As urban areas expand, there is a growing need for convenient and cost-effective modes of transportation. Two-wheelers, such as motorcycles and scooters, are often preferred in congested urban environments due to their maneuverability and ease of parking. This has led to a surge in two-wheeler ownership in cities worldwide. The global population continues to grow, particularly in countries like India, China, and Southeast Asian nations. These regions have witnessed a significant increase in two-wheeler ownership as more people seek affordable and efficient transportation options. Two-wheelers are often more affordable than four-wheelers, making them an attractive option in regions with lower average incomes. As disposable incomes rise, more individuals and families are purchasing two-wheelers, further fueling the demand for engine oils.Increasing Focus on Vehicle Maintenance

Another crucial driver for the global two-wheeler engine oil market is the growing emphasis on vehicle maintenance and engine health. This trend is influenced by several factors. The internet and digitalization have made it easier for vehicle owners to access information about the importance of regular maintenance and the role of engine oil in preserving engine health. Online forums, videos, and educational content have contributed to increased awareness. Modern two-wheelers are designed to last longer, and owners are keen to ensure their investments remain in good condition. Regular oil changes and maintenance are vital for extending the lifespan of two-wheeler engines. Consumers are becoming more environmentally conscious, and maintaining their vehicles optimally is seen as a way to reduce emissions and fuel consumption. Clean and efficient engines require quality engine oil. Many two-wheeler manufacturers recommend specific engine oil brands and types for their vehicles. This has led to brand loyalty and an increased demand for the recommended oils. These factors drive consumers to prioritize engine maintenance and regularly change engine oil, which, in turn, boosts the demand for automotive two-wheeler engine oil.Technological Advancements in Engine Oil

Advancements in engine oil technology have been a significant driver for the global market. Manufacturers and researchers continually work on improving the quality and performance of engine oils. Key technological drivers include: The development of synthetic and semi-synthetic engine oils has revolutionized the lubricants industry. These oils offer superior protection, viscosity stability, and longevity compared to conventional mineral-based oils. Engine oil formulations with lower viscosity provide better fuel efficiency and reduce friction, leading to improved engine performance. This is crucial as fuel efficiency standards become more stringent worldwide. Manufacturers are creating specialized engine oils designed for specific types of two-wheelers, such as high-performance motorcycles or scooters. These formulations cater to the unique needs of different vehicles, enhancing their efficiency and longevity. The inclusion of advanced additives in engine oils helps protect engines from wear, corrosion, and deposits. Additives like detergents, dispersants, and anti-wear agents contribute to better engine performance and longevity. Engine oil formulations are evolving to meet environmental regulations, with a focus on reducing emissions and environmental impact. Bio-based oils and oils with reduced environmental footprint are gaining traction. These technological advancements not only improve engine oil performance but also cater to the evolving needs of modern two-wheelers, further stimulating market growth.Growth in Aftermarket Sales

The aftermarket segment plays a significant role in driving the global two-wheeler engine oil market. Aftermarket sales encompass the distribution of engine oils through various channels, including independent retailers, auto parts stores, and e-commerce platforms. Several factors contribute to the growth of aftermarket sales. Many consumers prefer choosing their preferred engine oil brands and formulations for their two-wheelers. This leads to increased aftermarket sales as individuals seek specific products that align with their preferences and vehicle requirements.Aftermarket channels offer convenience and accessibility, making it easier for consumers to purchase engine oil when needed. With the proliferation of e-commerce platforms, consumers can order engine oil online and have it delivered to their doorstep. Intense competition in the aftermarket segment often results in competitive pricing, attracting cost-conscious consumers who seek value for their money. Independent workshops and mechanics play a crucial role in the aftermarket distribution of engine oils. They recommend and use specific brands, driving sales through word-of-mouth referrals. The aftermarket segment's growth is a testament to the demand for engine oils outside of manufacturer-specific service centers, contributing significantly to the overall market size.

Stringent Emission Regulations

Stringent emission regulations imposed by governments and environmental agencies worldwide are compelling two-wheeler manufacturers to develop more fuel-efficient and cleaner-burning engines. This regulatory push has direct implications for the automotive two-wheeler engine oil market: Emission standards often require manufacturers to improve the fuel efficiency of their vehicles. Low-viscosity engine oils with friction-reducing properties contribute to meeting these requirements by minimizing energy loss in the engine. Modern two-wheelers are equipped with catalytic converters to reduce harmful emissions. Engine oils must be compatible with these components and not interfere with their functioning. High-quality engine oils help keep engines clean and reduce the formation of deposits that can lead to increased emissions. This is crucial for complying with emissions standards. Regulatory authorities are increasingly concerned about the environmental impact of engine oils. This has led to the development of eco-friendly engine oil formulations that minimize harm to ecosystems. As emissions regulations become more stringent, two-wheeler manufacturers and consumers alike seek engine oils that meet these requirements. This drives the demand for technologically advanced, environmentally friendly engine oils that can help reduce emissions and meet regulatory standards.Key Market Challenges

Environmental Regulations and Sustainability Concerns

One of the most prominent challenges for the Global Automotive Two Wheeler Engine Oil market is the ever-increasing environmental regulations and sustainability concerns. Governments worldwide are implementing stricter emission norms, pushing automakers to develop cleaner and more fuel-efficient vehicles. This trend directly affects the demand for engine oils, as manufacturers seek lubricants that reduce friction, improve fuel economy, and minimize emissions. Adapting to these evolving regulations requires continuous innovation in oil formulations, putting pressure on manufacturers to invest in research and development.Technological Advancements in Engine Design

Rapid advancements in engine technology pose another significant challenge. Modern two-wheeler engines are becoming more sophisticated, with features like turbocharging, direct injection, and electric propulsion systems. These technological shifts demand specialized engine oils tailored to the unique requirements of these engines. The Global Automotive Two Wheeler Engine Oil market must keep pace with these changes, ensuring that their products meet the demands of cutting-edge engine designs while maintaining performance and reliability.Market Saturation and Competition

The automotive two-wheeler engine oil market is highly competitive and, in many regions, already saturated. Numerous manufacturers and brands are vying for market share, leading to intense price competition. This saturation, coupled with the emergence of private-label brands, poses challenges for established players, as they must continuously innovate, differentiate their products, and maintain quality to remain competitive. Price wars can impact profit margins and hinder investments in research and development.Consumer Shift Towards Electric Vehicles (EVs)

The global shift towards electric vehicles (EVs) represents a substantial challenge for the traditional automotive two-wheeler engine oil market. As electric two-wheelers gain popularity due to their eco-friendliness and lower operating costs, the demand for traditional engine oils may decline. Manufacturers must adapt by diversifying their product portfolios to include lubricants designed for electric powertrains. This shift requires not only new formulations but also changes in marketing strategies and distribution channels to cater to the evolving needs of consumers.

Supply Chain Disruptions and Raw Material Costs

The automotive two-wheeler engine oil market relies on a complex global supply chain for its raw materials, including base oils and additives. Disruptions in the supply chain, whether due to geopolitical factors, natural disasters, or economic instability, can impact production and lead to cost fluctuations. These uncertainties can strain manufacturers' ability to maintain stable prices and supply, potentially affecting customer trust and brand reputation. Moreover, fluctuating raw material costs can impact profit margins, requiring companies to manage their supply chain risks effectively.Key Market Trends

Synthetic and Semi-Synthetic Oils Dominate the Market

One of the most prominent trends in the Global Automotive Two Wheeler Engine Oil market is the increasing adoption of synthetic and semi-synthetic oils. These advanced lubricants offer superior performance, stability, and longevity compared to conventional mineral oils. As modern two-wheeler engines become more technologically advanced and demand higher levels of protection, synthetic and semi-synthetic oils have gained popularity. They provide better lubrication in extreme conditions, reduce friction, and enhance fuel efficiency. Moreover, these oils offer improved thermal stability, reducing the risk of oil breakdown and deposits. The trend towards synthetic and semi-synthetic oils is expected to continue as engine technology evolves, driving demand for higher-quality lubricants.Shift Towards Low-Viscosity Engine Oils

Another significant trend in the market is the shift towards low-viscosity engine oils. This trend is driven by the need to improve fuel efficiency and reduce emissions. Lower viscosity oils, such as 5W-30 and 0W-20, flow more easily and reduce friction within the engine, resulting in improved fuel economy. As global emission regulations become more stringent, manufacturers are increasingly recommending or requiring low-viscosity oils for their two-wheelers. This trend has pushed lubricant manufacturers to develop and market engine oils with lower viscosity grades, which are optimized to provide both engine protection and fuel efficiency.Eco-Friendly and Sustainable Lubricants

Environmental sustainability is a growing concern globally, and this has spurred the development and adoption of eco-friendly and sustainable lubricants in the Global Automotive Two Wheeler Engine Oil market. These lubricants are formulated with a focus on reducing their environmental impact, often by using biodegradable base oils and additives. Additionally, many manufacturers are emphasizing recyclability and reduced emissions during the production process. As consumers and governments increasingly prioritize environmental responsibility, the demand for eco-friendly lubricants is on the rise. This trend has led to a surge in research and development efforts within the industry, aiming to create lubricants that offer superior performance while adhering to sustainability principles.Customization and Specialty Lubricants

The market is witnessing a trend towards customization and specialty lubricants tailored to specific engine types, brands, and applications. Different two-wheeler manufacturers often have unique engine designs and requirements. As a result, some lubricant companies are working closely with manufacturers to develop lubricants that are precisely engineered for specific models or engine types. These specialty lubricants aim to optimize engine performance, extend component life, and enhance overall reliability. This trend underscores the industry's commitment to delivering tailor-made solutions to meet the evolving needs of two-wheeler manufacturers and their customers.Digitalization and Predictive Maintenance

Digitalization and the integration of technology in the automotive industry are transforming the way engine oils are managed and maintained. IoT (Internet of Things) sensors and predictive maintenance software are becoming more prevalent, allowing two-wheeler owners and service providers to monitor the condition of engine oil in real-time. These systems can detect changes in oil quality, temperature, and contamination levels, enabling proactive maintenance and oil change scheduling. This trend not only enhances the performance and longevity of engines but also reduces maintenance costs and downtime. As digitalization continues to advance, the market is likely to witness further integration of technology in engine oil management and maintenance practices.Segmental Insights

Grade Analysis

The mineral, synthetic, and semi-synthetic categories of automotive engine oil make up most of the global market for engine oil. Compared to the synthetic and semi-synthetic oil categories, the mineral engine oil category commands the biggest market share for motor oils globally. As a byproduct of the oil refining process, mineral oil is produced directly from refined crude petroleum oil. Because they are less expensive and more readily available, mineral oils are mostly utilized in automobiles. Additionally, the most fundamental kind of oil and the kind most frequently utilized in most ordinary cars are mineral-based automobile engine oils. Where the weather is not particularly hot or cold, they are better suited for two-wheelers. Because semi-synthetic engine oils are less expensive than synthetic lubricants, the market for them is anticipated to rise over time. Mineral oil is a component in semi-synthetic oils, although only in small amounts.Regional Insights

Due to the highest concentration of automobiles, particularly in countries like China, India, and Thailand, the Asia Pacific region is the largest and experiencing the quickest growth in the global motor oil industry. Additionally, India and China are predicted to have the biggest number of vehicles on the road, and India also has the largest market for two-wheelers, all of which will contribute to the expansion of the market for automotive engine oil. The market in North America is distinguished by significant government assistance for energy-efficient car engine oil. Additionally, it is anticipated that widespread awareness among the local populace would keep the market for synthetic engine oil active. The use of this environmentally friendly oil will regulate the market in Europe. Additionally, it is expected that China and India will have the most vehicles on the road. Since India is the world's largest two-wheeler market, the government is likely to be more motivated to encourage the use of energy-efficient engine oils. It is anticipated that widespread consumer knowledge about synthetic motor oil will keep demand for the product high in Europe. The market in Europe is predicted to be driven by the use of this environmentally friendly oil. The market share of automotive engine oil represented by South America, the Middle East, and Africa is expected to increase throughout the projected period because these markets are currently developing.Report Scope:

In this report, the Global Automotive Two Wheeler Engine Oil Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Two Wheeler Engine Oil Market, By Grade:

- Synthetic

- Semi Synthetic

- Minerals

Automotive Two Wheeler Engine Oil Market, By Demand Category:

- OEM

- Aftermarket

Automotive Two Wheeler Engine Oil Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- France

- Russia

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Two Wheeler Engine Oil Market.Available Customizations:

Global Automotive Two Wheeler Engine Oil market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Royal Dutch Shell plc

- Pentagon Lubricants Private Limited

- Castrol Limited

- HINDUJA GROUP

- Saudi Arabian Oil Co.

- Total S.A

- Gazprom

- LUKOIL oil Company

- Exxon Mobil Corporation

- Chevron Corporation

Table Information

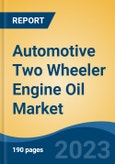

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 13 Billion |

| Forecasted Market Value ( USD | $ 20.02 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |