Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Data from the Japan Construction Equipment Manufacturers Association indicates that in 2024, the total shipment value of construction machinery for the fiscal year ending in March rose by 7.5%, achieving a record JPY 3.73 trillion, which underscores the sector's strong industrial demand. However, despite these positive trends, the market encounters substantial obstacles due to fluctuating raw material prices, especially for steel and rubber. These price instabilities can lead to unpredictable increases in manufacturing expenses, thereby squeezing profit margins for suppliers within the fluid transfer system industry.

Market Drivers

A major driver for the OTR fluid transfer system market is the global rise in infrastructure investment and construction projects, which require heavy-duty machinery utilizing intricate coolant and hydraulic networks. Cranes, loaders, and excavators depend on steel fittings and reinforced hoses to handle high-pressure fluid transmission needed for digging and lifting tasks. This link between construction activity and component demand is highlighted by recent industry data; the Indian Construction Equipment Manufacturers Association (ICEMA) noted in its May 2024 'Annual Report on Construction Equipment Industry' that construction equipment sales in India surged by 26% year-on-year to 135,650 units in FY24. This growth in fleet size directly increases the need for OEM fluid transfer assemblies and aftermarket replacements to ensure uninterrupted operations on demanding construction sites.Concurrently, the market is strengthened by the rising demand for mining equipment, fueled by increased mineral consumption for energy transition technologies. The harsh abrasive and thermal conditions of mining environments necessitate durable piping and tubing systems for lubrication and fuel lines. Evidence of this sector's robustness is found in Caterpillar Inc.'s '4Q and Full Year 2023 Results' from February 2024, which reported a 9% sales increase in the Resource Industries segment to $13.593 billion, indicating higher procurement of mining loaders and trucks that utilize fluid transfer technologies. Additionally, agricultural mechanization supports this growth; CNH Industrial N.V. reported in 2024 that its Agriculture segment achieved net sales of $18.14 billion for the full year 2023, highlighting the extensive industrial reliance on heavy off-highway equipment that drives the fluid transfer system market.

Market Challenges

Price volatility in raw materials, especially essential inputs like steel and rubber, significantly hinders the Global OTR Fluid Transfer System Market. This instability results in a manufacturing landscape where maintaining predictable costs is difficult. As the prices of inputs fluctuate erratically, producers of specialized fittings and hoses find it hard to offer stable pricing to their customers. Consequently, profit margins are squeezed because system suppliers frequently cannot pass on immediate cost increases to heavy machinery OEMs due to existing fixed contracts, limiting the funds available for business expansion and inventory buildup.In October 2024, the Association of Natural Rubber Producing Countries reported that global demand for natural rubber in the first three quarters hit 11.3 million tons, whereas production only reached 9.9 million tons, creating a significant supply shortage. This growing disparity between demand and supply leads to price surges for key rubber components essential for hydraulic hoses. These inflationary pressures compel manufacturers of OTR fluid transfer systems to bear increased procurement expenses, which suppresses overall market growth and diminishes financial flexibility within the industry.

Market Trends

The shift toward battery-electric powertrains is driving the development of specialized thermal management lines for electric OTR vehicles, fundamentally altering component engineering. In contrast to conventional hydraulic setups, electric machinery demands advanced liquid cooling circuits to manage high-voltage inverters and battery packs, requiring hoses that work with glycol-water mixtures instead of standard hydraulic oils. This technological transition is reinforced by growth in energy transition sectors; Caterpillar Inc. noted in its 'Second Quarter 2025 Financial Results' from August 2025 that its Energy & Transportation segment revenue rose by 7% to $7.8 billion, fueled by power generation and energy transition needs. This financial boost speeds up the adoption of specific thermal regulation tubing crucial for the reliability of next-generation electric loaders and excavators.Simultaneously, the adoption of quick-connect and leak-proof advanced fitting technologies is becoming a priority to reduce maintenance downtime and fluid loss in harsh conditions. Manufacturers are increasingly employing flat-face couplings capable of enduring extreme pressure surges while allowing for the quick, contamination-free exchange of hydraulic attachments. This emphasis on reliable connector performance is prompting strategic market consolidation; for instance, Danfoss Power Solutions announced in a November 2025 press release regarding its acquisition of Hydro Holding that the acquired hose fittings manufacturer had an annual turnover of EUR 60 million. Such acquisitions underscore the necessity for fluid transfer system providers to integrate advanced fitting technologies to guarantee leak-free operation under the high pressures of modern heavy-duty applications.

Key Players Profiled in the OTR Fluid Transfer System Market

- Cooper Standard

- TI Fluid Systems

- Gates Corporation

- Continental AG

- Kongsberg Automotive

- Hutchinson

- Akwel

- Tristone

- Lander Automotive

- Castello Italia

Report Scope

In this report, the Global OTR Fluid Transfer System Market has been segmented into the following categories:OTR Fluid Transfer System Market, by Equipment Type:

- Air Suspension Lines

- Air Brake line

- Transmission Oil Cooling Lines

- Engine Cooling lines

OTR Fluid Transfer System Market, by Material Type:

- Nylon

- Stainless Steel

- Aluminium

- Steel

- Rubber

OTR Fluid Transfer System Market, by Type:

- Hoses

- Tubing

OTR Fluid Transfer System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global OTR Fluid Transfer System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this OTR Fluid Transfer System market report include:- Cooper Standard

- TI Fluid Systems

- Gates Corporation

- Continental AG

- Kongsberg Automotive

- Hutchinson

- Akwel

- Tristone

- Lander Automotive

- Castello Italia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

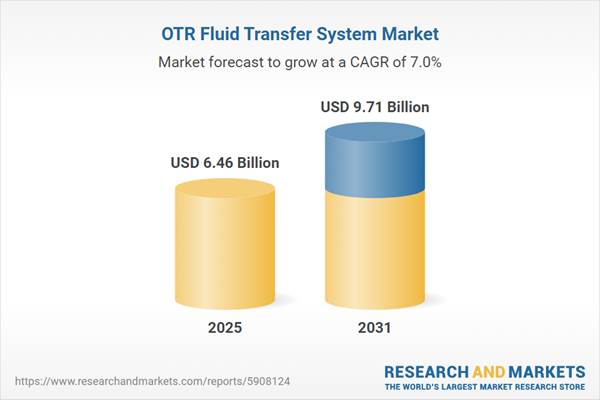

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.46 Billion |

| Forecasted Market Value ( USD | $ 9.71 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |