Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

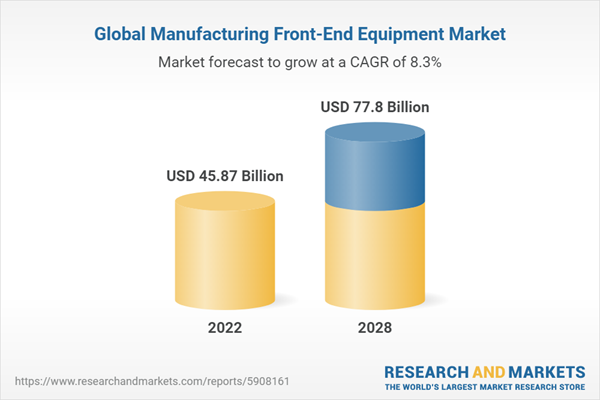

The global manufacturing front-end equipment market has witnessed significant growth in recent years and is projected to continue expanding rapidly. Driven by the increasing digital transformation of industries worldwide, sectors such as information technology and LED manufacturing have increasingly adopted fiber optic connectivity solutions to modernize infrastructure and gain competitive advantages.

A key focus on innovation has led to improved connectivity standards and more streamlined network management processes. Manufacturing front-end equipment has become a critical automation level supporting these advancements. Advanced network infrastructure now relies heavily on vast amounts of data transmitted over high-speed fiber optic cables to provide unprecedented operational insights on a global scale.

Connected systems that monitor networks in real-time via integrated fiber optic infrastructure allow for quick issue detection, predictive maintenance planning, and optimization of inspection schedules. As LED manufacturing networks and data center footprints expand globally, effectively overseeing connectivity performance across distributed systems is increasingly important.

Leading electronics manufacturing companies are leveraging powerful analytics tools hosted on scalable network platforms. This fosters seamless international collaboration while ensuring sensitive network data security and privacy. Front-end equipment vendors recognize these trends and are heavily investing in predictive maintenance modeling and intuitive connectivity management equipment tailored for global network users. Importantly, these solutions maintain strict data governance controls to guarantee regulatory compliance.

The convergence of connectivity, network protection, and management functionalities on integrated fiber optic platforms presents substantial growth opportunities. As these systems continue advancing capabilities in data analytics and automation, they promise more personalized real-time insights and increased optimization of critical operational processes. This positions industries like LED manufacturing to effectively manage evolving regulations and dynamic market demands into the future.

Analysts expect the positive global outlook for the manufacturing front-end equipment market to continue. Front-end equipment has become core infrastructure enabling network protection, streamlined operations, and regulatory compliance for telecom firms managing international networks at scale. As network technology progresses further, front-end equipment solutions will remain central to ensuring efficient, data-driven, and secure network management worldwide.

Key Market Drivers

Advancements in Semiconductor Technology

One of the primary drivers fueling the growth of the global manufacturing front-end equipment market is the continuous advancements in semiconductor technology. As consumer electronics, automotive, and industrial sectors increasingly rely on complex semiconductor devices with higher computing power and energy efficiency, semiconductor manufacturers are compelled to invest in cutting-edge front-end equipment. These advancements encompass innovations in lithography, etching, deposition, and cleaning equipment, allowing semiconductor manufacturers to produce smaller, more powerful, and energy-efficient chips. For instance, the transition to smaller nanometer technology nodes, such as 7nm and 5nm, necessitates state-of-the-art manufacturing front-end equipment to meet the stringent precision and performance requirements. Consequently, equipment providers are developing and offering advanced front-end solutions, fostering robust demand and innovation in the industry.Growing Demand for Consumer Electronics

The global appetite for consumer electronics, including smartphones, tablets, wearables, and smart appliances, has been a significant driver propelling the manufacturing front-end equipment market. The relentless demand for smaller, more powerful, and feature-rich electronic devices requires semiconductor manufacturers to invest in advanced front-end equipment to produce cutting-edge microchips. These chips, equipped with higher processing power and energy efficiency, enable the seamless operation of consumer electronics. Additionally, the rapid evolution of technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT) has further driven the need for advanced semiconductor devices. This surge in consumer electronics adoption has translated into consistent demand for front-end equipment, including lithography and etching machines, as manufacturers strive to meet consumers' ever-growing expectations for innovative and high-performance devices.Expansion of Data Centers and Cloud Computing

The expansion of data centers and the widespread adoption of cloud computing services have emerged as critical drivers for the global manufacturing front-end equipment market. Data centers, which underpin the digital infrastructure supporting cloud services, demand semiconductor devices capable of processing and storing vast amounts of data efficiently. To meet these requirements, semiconductor manufacturers must invest in advanced front-end equipment to produce high-performance processors, memory chips, and storage solutions. Cloud providers require semiconductor devices with enhanced computing power and energy efficiency to deliver seamless and scalable services to their customers. This has led to increased demand for state-of-the-art front-end equipment, such as deposition and CMP machines, as semiconductor manufacturers strive to meet the robust demand generated by the ever-expanding data center and cloud computing landscape. As cloud services continue to proliferate and data usage soars, the manufacturing front-end equipment market is poised for sustained growth, driven by the evolving needs of this technology ecosystem.Key Market Challenges

Cost and Capital Intensity

One of the foremost challenges facing the global manufacturing front-end equipment market is the high cost and capital intensity associated with acquiring and maintaining advanced equipment. Front-end equipment, including lithography machines, etching tools, and deposition systems, represents a significant capital investment for semiconductor manufacturers. The continuous need to upgrade and replace aging equipment to keep pace with evolving technology nodes further compounds the financial burden. The transition to smaller nanometer technology nodes, such as 7nm and 5nm, requires substantial investments in cutting-edge equipment, which can strain the budgets of semiconductor companies, particularly smaller players or startups.Moreover, the competitive landscape of the semiconductor industry necessitates a constant cycle of innovation and equipment upgrades to maintain market relevance. As a result, manufacturers face ongoing pressure to allocate substantial portions of their budgets to procure the latest front-end equipment, making it challenging to achieve profitability, especially during periods of economic uncertainty. To address this challenge, semiconductor equipment providers must explore strategies to lower the cost of ownership, enhance equipment efficiency, and provide flexible financing options to make these investments more accessible to a broader range of manufacturers.

Technological Complexity and Rapid Evolution

The fast-paced evolution of semiconductor technology, characterized by shrinking transistor sizes and increasing complexity, poses a significant challenge to the global manufacturing front-end equipment market. As semiconductor manufacturers push the boundaries of what is technologically possible, front-end equipment must keep pace with increasingly demanding requirements for precision, speed, and reliability. Developing and producing advanced equipment capable of meeting these demands is a complex and resource-intensive process.Furthermore, the need to adapt to new technology nodes and materials adds to the complexity. Manufacturers must invest in research and development to create equipment capable of handling new materials and processes. The introduction of extreme ultraviolet (EUV) lithography technology and 3D stacking techniques, for example, has required significant innovation in front-end equipment.

Semiconductor equipment providers face the challenge of ensuring that their products remain relevant and adaptable to emerging technologies. Rapid obsolescence can impact the long-term viability of equipment investments, making it imperative for manufacturers to offer upgrade paths and support for legacy equipment. Additionally, the need for highly skilled technicians and engineers to operate and maintain complex equipment further intensifies the challenge. To thrive in this environment, equipment manufacturers must commit to ongoing research and development efforts, collaborate with semiconductor manufacturers, and offer comprehensive training and support services to address the technological complexities of the industry.

Key Market Trends

Adoption of IIoT-Enabled Front-End Equipment

The adoption of Industrial Internet of Things (IIoT)-enabled front-end equipment is a significant trend that is reshaping the global manufacturing landscape. Manufacturers are increasingly recognizing the value of connecting their front-end equipment to the IIoT ecosystem. This connectivity allows for the real-time collection of crucial production data and operational insights. These insights are then analyzed through advanced analytics, enabling manufacturers to make data-driven decisions. IIoT-enabled front-end equipment offers numerous advantages, such as improved process efficiency, optimized changeover times, and reduced downtime through predictive maintenance. Moreover, remote monitoring capabilities and the ability to perform over-the-air updates enhance operational flexibility. Leading equipment vendors are placing a strong emphasis on developing secure IIoT-enabled front-end equipment equipped with edge computing capabilities to meet the demands of a rapidly evolving manufacturing landscape.Advancements in Machine Vision Technology

Advancements in machine vision technology integrated into front-end equipment are driving improvements in quality control and automation across various industries. These newer systems incorporate high-resolution cameras, advanced imaging sensors, and deep learning algorithms to perform intricate defect detection and complex pattern recognition tasks with exceptional accuracy. Machine vision technology is finding increasing applications in automating quality inspection processes, particularly in industries such as electronics manufacturing and food processing. The ability of these systems to precisely identify defects and anomalies enhances product quality, reduces waste, and boosts overall production efficiency. As machine vision technology continues to evolve, it is expected to play a pivotal role in enhancing the capabilities of front-end equipment, further driving efficiency and quality in manufacturing processes.Adoption of Collaborative Robots (Cobots)

The adoption of collaborative robots, or cobots, alongside front-end equipment is a growing trend that underscores the evolving nature of manufacturing. Cobots are designed to work alongside humans without the need for dedicated safety cages, making them an attractive solution for tasks such as material handling, assembly, and packaging. The integration of cobots with front-end equipment offers manufacturers increased flexibility in adapting to rapidly changing production needs. Cobots are known for their ease of use, versatility, and cost-effectiveness, making them valuable assets in modern manufacturing environments. As manufacturers seek ways to enhance efficiency and respond to shifting market demands, the adoption of cobots in conjunction with front-end equipment is expected to continue as a prominent trend in the manufacturing industry.

Segmental Insights

Automation Level Insights

In 2022, the Semi-Automated Front-End Equipment segment emerged as the dominant force in the Global Manufacturing Front-End Equipment Market and is expected to maintain its dominance throughout the forecast period. Semi-automated front-end equipment strikes a balance between manual and fully automated systems, offering manufacturers a pragmatic approach to enhancing efficiency and productivity. This segment found extensive adoption across various industries, including semiconductor manufacturing, electronics, and automotive, owing to its versatility and cost-effectiveness. Manufacturers increasingly favored semi-automated equipment as it allows for greater precision and repeatability in processes while still accommodating human intervention when necessary. The adaptability of semi-automated front-end equipment to different production scenarios, along with the ability to streamline workflows and reduce errors, made it a preferred choice for many manufacturing facilities. As industries continue to seek ways to optimize their operations without committing to the high costs of full automation, the Semi-Automated Front-End Equipment segment is poised to maintain its dominance, providing a practical and efficient solution to meet the evolving demands of modern manufacturing..Equipment Ownership Insights

In 2022, the "In-house Manufacturing" segment emerged as the dominant force in the Global Manufacturing Front-End Equipment Market and is anticipated to maintain its supremacy throughout the forecast period. The preference for in-house manufacturing of front-end equipment can be attributed to several key factors. Many leading semiconductor and electronics manufacturers opt for in-house production of front-end equipment to have greater control over the quality, customization, and integration of these critical components into their production processes. This approach allows them to tailor front-end equipment to specific manufacturing requirements, ensuring seamless compatibility and optimized performance. Furthermore, in-house manufacturing offers intellectual property protection and the ability to safeguard proprietary technologies and processes. It also enables companies to maintain stringent quality control and responsiveness to changing market demands.In-house manufacturing is particularly prevalent among large semiconductor companies with significant research and development capabilities, as they can leverage their expertise to design and produce front-end equipment tailored to their unique needs. While outsourcing manufacturing (foundries) offers advantages such as cost savings and flexibility, the strategic advantages and control offered by in-house manufacturing continue to drive its dominance in the Global Manufacturing Front-End Equipment Market. As technological advancements and innovation continue to shape the industry, in-house manufacturing provides companies with the agility and precision required to stay competitive and meet the evolving demands of the global market, thus solidifying its position as the dominant segment in this market..

Regional Insights

In 2022, the Asia-Pacific region emerged as the dominant force in the Global Manufacturing Front-End Equipment Market, and it is poised to maintain its dominance throughout the forecast period. Several factors contributed to Asia-Pacific's leadership in this market. The region hosts a substantial portion of the world's semiconductor manufacturing, with countries such as China, Taiwan, South Korea, and Japan playing pivotal roles in the global electronics and semiconductor industries. These countries are home to major semiconductor foundries and integrated device manufacturers (IDMs) that heavily invest in cutting-edge front-end equipment to meet the growing demand for advanced semiconductor devices. Additionally, the rapid expansion of electronics manufacturing and the presence of leading global technology companies in Asia-Pacific further boosted the demand for front-end equipment.Furthermore, government initiatives and policies aimed at fostering the growth of the semiconductor and electronics industries have propelled investments in front-end equipment across the region. The development of semiconductor clusters and technology parks in countries like Taiwan and South Korea has created favorable ecosystems for innovation and manufacturing.

The Asia-Pacific region's dominance is also underscored by its leadership in emerging technologies such as 5G, artificial intelligence (AI), and the Internet of Things (IoT), all of which rely on advanced semiconductor components. As these technologies continue to advance and become integral to various industries, the demand for front-end equipment in the Asia-Pacific region is expected to remain robust. Consequently, Asia-Pacific is well-positioned to maintain its dominance in the Global Manufacturing Front-End Equipment Market, serving as the epicenter of semiconductor manufacturing and technological innovation for the foreseeable future.

Report Scope:

In this report, the Global Manufacturing Front-End Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Manufacturing Front-End Equipment Market, By Automation Level:

- Manual Front-End Equipment

- Semi-Automated Front-End Equipment

- Fully Automated Front-End Equipment

Manufacturing Front-End Equipment Market, By Equipment Ownership:

- In-house Manufacturing

- Outsourced Manufacturing (Foundries)

- Semiconductor Manufacturing

- Electronics Manufacturing

- LED (Light Emitting Diode) Manufacturing

- MEMS (Micro-Electro-Mechanical Systems) Manufacturing

- Solar Cell Manufacturing

- Others

Manufacturing Front-End Equipment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Manufacturing Front-End Equipment Market.Available Customizations:

Global Manufacturing Front-End Equipment Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- KLA Corporation

- Applied Materials, Inc

- ASML Holding N.V

- Hitachi High-Tech Corporation

- Screen Semiconductor Solutions Co., Ltd.

- Nikon Corporation

- Lam Research Corporation

- Tokyo Electron Limited

- Rudolph Technologies, Inc.

- Planar Systems, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 45.87 Billion |

| Forecasted Market Value ( USD | $ 77.8 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |