Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

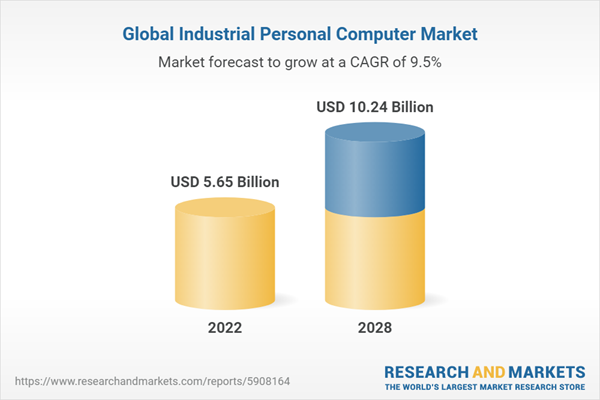

The Global Industrial Personal Computer market has seen tremendous growth in recent years, driven largely by digital transformation efforts across various industries worldwide. Sectors like manufacturing, emergency services, and retail have increasingly recognized the strategic importance of reliable, mission-critical communication capabilities to support their operations.

This growth has been fueled by heavy investments in innovation from vendors, resulting in Industrial Personal Computer platforms with enhanced features and more robust connectivity options. For industries like emergency response, the ability to transmit both data and voice in real-time through secure LTE networks is business critical. Integrated Industrial PC solutions provide a centralized way to manage networks and coordinate command across jurisdictions, enabling seamless inter-agency collaboration during emergencies. Vendors have also focused on developing ruggedized devices suitable for harsh and demanding work environments.

As industrial networks increasingly incorporate advanced technologies like IoT, cloud computing, and analytics, they are delivering more actionable insights to decision makers. This allows organizations to make more informed operational and logistical decisions to improve outcomes. Emerging 5G capabilities such as network slicing promise even lower latency and support for data-heavy applications.

With organizations globally prioritizing modernization of their mission-critical communications infrastructure, analysts remain bullish about the long-term market potential for Industrial Personal Computers. As network capabilities continue enhancing to support new applications, Industrial PCs are poised to remain central to connecting frontline workers and supporting business operations across industries.

Key Market Drivers

Digital Transformation Initiatives

One of the primary drivers fueling growth in the global industrial PC market is the widespread digital transformation occurring across industries. As organizations look to optimize operations, improve efficiency, and gain competitive advantages, they are increasingly leveraging technologies like IoT, cloud, analytics, and mobility solutions. Industrial PCs play a vital role in enabling these digital initiatives by serving as the edge devices that collect and transmit real-time data from equipment and machinery. They allow organizations to better monitor asset performance, predict maintenance needs, track inventory levels, and gain insights to make informed decisions. As digital transformation becomes more critical for business success, investments into industrial PCs and supporting infrastructure will continue rising substantially. Forward-thinking companies view digitalization not as a one-time project but an ongoing business strategy, ensuring long-term market opportunities.Demand from Process Industries

Process industries like manufacturing, oil & gas, chemicals, and food & beverage represent a major driver of industrial PC adoption. In these sectors, industrial automation through the use of PLCs, HMIs, and SCADA systems has become essential for optimizing production workflows. Industrial PCs serve as the centralized HMI and SCADA terminals, providing operators a unified view of plant operations on the factory floor. They enable remote monitoring and control of machinery from a single point. With growing complexity in production processes and the need for real-time process visibility, demand for ruggedized industrial PCs with enhanced computing power and graphics capabilities is surging from process industries. Furthermore, initiatives to modernize aging plant infrastructure through digital upgrades will sustain long-term market opportunities.Focus on Ruggedization and Long-Term Reliability

Industrial environments with extreme temperatures, vibrations, moisture, and dust pose unique challenges for computing devices. As a result, ruggedization features that enable durability and long lifecycles are a key purchase driver for industrial PCs. Vendors are focusing on developing devices with all-metal or reinforced casing, wide-temperature resistant components, spill-proof keyboards, and solid-state drives less susceptible to shocks. Frontline workers also demand reliable devices that can withstand accidental drops or other mishandling on the job. To address this, manufacturers are designing industrial PCs with features like fan-less cooling and passive thermal management for increased longevity. The need for reliable, rugged computing platforms that can withstand harsh conditions will remain a strong market driver in the coming years..Key Market Challenges

Cybersecurity Vulnerabilities

A major challenge that could hinder the growth of the industrial PC market is the rising threat of cyberattacks targeting operational technology environments. As industrial systems become increasingly connected to enterprise networks and the cloud, the existing cybersecurity perimeters are being eroded. Unlike traditional IT systems, industrial automation equipment may run for over a decade without updates and often lack the latest security protections. Furthermore, many organizations lack adequate security protocols specific to OT networks. This exposes vulnerabilities that can be exploited by bad actors to disrupt operations or even cause physical damage. Recent high-profile incidents involving ransomware have underscored this risk. If unaddressed, the lack of cybersecurity could reduce confidence among companies and negatively impact future industrial PC investments. Vendors will need to focus on developing more secure devices with embedded protections as well as offering comprehensive security solutions tailored for industrial environments. Manufacturers will also have to prioritize patch management and training users on secure protocols to mitigate risks.Budget Constraints

Budget limitations within process industries pose another challenge for the industrial PC market. While digital upgrades offer long-term benefits, the initial capital costs can be high, especially for asset-intensive sectors. The high pricing of industrial PCs compared to traditional office PCs also discourages some buyers. This is a particular concern during economic downturns when discretionary spending is reduced. Furthermore, the rapid pace of technology advancements means industrial machines may become obsolete quicker, reducing return on investment. To overcome this, vendors will need to emphasize the total cost of ownership advantages of their solutions through longer lifecycles and support. Offering flexible financing options, rentals, and leasing programs can also help address initial budget barriers. Additionally, lowering prices of entry-level industrial PCs through value engineering and partnerships could help attract new customers. Effectively communicating ROI through improved productivity and efficiencies will be key to justifying investments.Key Market Trends

Growing Adoption of IIoT Solutions

A major trend gaining momentum is the increasing integration of industrial IoT technologies with industrial PC systems. IIoT enables real-time data collection from machines and sensors to generate actionable insights. Industrial PC vendors have started offering IIoT-ready devices with built-in connectivity options like cellular, WiFi, and Bluetooth. They provide edge computing capabilities to analyze sensor data locally in addition to transmitting it to the cloud. This allows industries to leverage IIoT without relying on separate gateways or controllers. As IIoT solutions become more affordable, their adoption is expected to surge across sectors like manufacturing, energy, and transportation over the coming years. Leading industrial PC manufacturers are partnering with IIoT software companies to offer turnkey solutions. This trend will be a key growth driver as it enhances the value proposition of industrial PCs.Advancements in Edge Computing

Edge computing is emerging as an important trend, bringing computing capabilities closer to where data is generated, and actions need to be taken. Industrial PCs with powerful on-board processors and large storage capacities are evolving into ruggedized edge computing nodes. This distributed computing model provides benefits like lower latency, bandwidth savings, and offline data processing. It allows industries to derive insights locally without relying entirely on cloud infrastructure or bandwidth. Leading vendors are launching industrial PCs with advanced edge computing capabilities like AI/ML acceleration, virtualization support, and software-defined storage. As 5G networks roll out, more real-time edge applications will become possible. This will increase demand for edge-enabled industrial PCs capable of running analytics at the network's edge.Adoption of Larger Displays

Another notable trend is the increasing use of industrial PCs with larger, high-definition touchscreen displays in process plants and factories. Large displays offer benefits like consolidated views of multiple machines, virtualization of control rooms, and remote monitoring capabilities. They provide a better user experience for complex SCADA systems compared to traditional panel PCs. Leading manufacturers have started offering industrial PCs with display sizes ranging from 12-21 inches with projective capacitive touch. As digital transformation drives demand for more visualization, collaboration, and mobility in industrial settings, larger-screen industrial PCs will see rising popularity. Their ability to virtualize plant operations will be appealing to industries looking to modernize aging HMI infrastructure..Segmental Insights

Product Type Insights

In 2022, the panel PC segment dominated the global industrial personal computer market. Panel PCs accounted for nearly 30% of the total market share in 2022. Panel PCs, also known as industrial panel computers, are rugged all-in-one computing solutions optimized for frontline industrial applications. They comprise an integrated LCD or LED display with industrial grade CPU and I/O capabilities built into the same enclosure. Panel PCs are highly popular as they offer a compact footprint and require less installation efforts compared to other industrial PC form factors.Their all-in-one design with front accessible I/O ports makes panel PCs ideally suited as HMI terminals on the plant floor to visualize and control industrial machinery and processes. Given their mounting flexibility as well as resistance to vibration, shock, and wide temperature ranges, panel PCs have emerged as the preferred computing solution across industries like manufacturing, oil & gas, energy, and building automation. Leading applications include SCADA systems, industrial automation, machine monitoring, and process visualization. The panel PC segment is expected to retain its dominance during the forecast period as well owing to their intuitive form factor and rugged reliability demanded by industrial environments. Furthermore, advancements in display and processor technologies will continue enhancing the capabilities of panel PCs to support more visualization and edge computing applications.

Application Insights

In 2022, the human-machine interface (HMI) segment dominated the global industrial personal computer market by application. The HMI segment accounted for over 25% of the total market share in 2022.HMI systems allow operators to monitor and control industrial processes through easy-to-use graphical interfaces. Industrial PCs play a critical role in HMI applications as they serve as the centralized terminals to run HMI software. Through industrial PCs, operators can visualize real-time production data, modify setpoints, generate reports, and troubleshoot issues directly from the plant floor. The growth of digitization and Industry 4.0 initiatives across process industries has significantly driven HMI adoption in recent years.

Industrial PCs deployed for HMI purposes require rugged specifications to withstand harsh industrial environments. Panel PCs have emerged as the preferred form factor for HMI terminals owing to their compact sizes and front accessible I/O ports. The HMI segment is expected to maintain its dominance during the forecast period as well. This can be attributed to ongoing investments by manufacturers to modernize aging DCS and SCADA infrastructure through digital HMI upgrades. Furthermore, the implementation of advanced applications like augmented reality HMI interfaces will enhance the role of industrial PCs in supporting new visualization needs. The demand for specialized HMI industrial PCs with larger displays and powerful processors is also growing to enable more immersive operator experiences..

Regional Insights

In 2022, North America dominated the global industrial personal computer market, accounting for over 30% of the total market share. The United States plays a significant role in driving the regional market due to the presence of many large-scale process industries that are early adopters of industrial automation technologies.North America continues to be at the forefront of digitization initiatives across sectors such as oil & gas, automotive, food & beverage, and power generation. There is a strong focus on modernizing aging infrastructure and improving operational efficiencies through industrial IoT solutions. This has resulted in high demand for industrial PCs that can serve as edge computing nodes to support applications like predictive maintenance, remote monitoring, and analytics. Additionally, North America is home to leading industrial PC manufacturers such as Advantech, Beckhoff, and Siemens, which have a well-established market presence.

Furthermore, factors such as stable economic conditions, growing infrastructure investments, and emphasis on workplace safety through industrial automation continue to support the North American industrial PC market. The region is also an early adopter of emerging technologies such as 5G, which is expected to open up new opportunities for industrial applications in the coming years. As such, North America is anticipated to retain its dominance during the forecast period, continuing to account for over 30% of the global industrial PC market share.

Report Scope:

In this report, the Global Industrial Personal Computer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Industrial Personal Computer Market, By Product Type:

- Panel PCs

- Rackmount PCs

- Box PCs

- Embedded PCs

Industrial Personal Computer Market, By Application:

- Control Systems

- Data Acquisition and Analysis

- Human-Machine Interface (HMI)

- Industrial Automation

- Test and Measurement

- SCADA (Supervisory Control and Data Acquisition)

Industrial Personal Computer Market, By End-User Industry:

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Healthcare

- Aerospace and Defense

- Retail and Hospitality

Industrial Personal Computer Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Personal Computer Market.Available Customizations:

Global Industrial Personal Computer Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Advantech

- Beckhoff Automation

- Kontron

- Siemens

- General Electric

- Mitsubishi Electric

- Omron

- B&R Industrial Automation

- Rockwell Automation

- Schneider Electric

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 5.65 Billion |

| Forecasted Market Value ( USD | $ 10.24 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |