Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In addition to enhancing crop resilience, insecticide seed treatment offers targeted pest control that minimizes the need for widespread foliar pesticide applications later in the crop cycle. This precision reduces the environmental footprint associated with conventional spraying methods, as only a small, localized amount of insecticide is used directly on the seed. Furthermore, this approach supports integrated pest management (IPM) strategies by reducing pest populations early, lowering the risk of infestations during critical growth stages. It also promotes more uniform crop emergence, leading to improved plant vigor, stand establishment, and resource efficiency across large farming tracts.

The growing prevalence of insecticide-resistant pests and the increasing demand for higher crop yields are driving innovations in seed treatment formulations. Manufacturers are developing advanced chemistries and combination products that provide extended protection and cater to specific crop-pest interactions. Insecticide seed treatments are also gaining traction in emerging markets where farmers seek affordable, scalable, and efficient pest control solutions. As global agriculture shifts toward sustainable and precision-driven practices, insecticide seed treatment is expected to play an even more prominent role in safeguarding food production, enhancing crop quality, and ensuring economic returns for growers across diverse agricultural systems.

Key Market Drivers

Increasing Demand for Crop Yield & Efficiency

The growing global population, projected to exceed 9.7 billion by 2050, is placing intense pressure on agricultural systems to boost food production without expanding arable land. In this context, insecticide seed treatments offer a strategic solution to maximize yield from every hectare. These treatments provide early-stage pest protection, reducing seedling loss and promoting vigorous plant establishment. Recent studies show that seed-applied insecticides can increase yield by up to 15 percent in crops like maize and soybeans, underscoring their value in enhancing farm productivity and supporting food security amid rising global demand.As farming intensifies, the frequency of crop rotations has increased, resulting in persistent pest pressures that traditional methods struggle to contain. Insecticide seed treatments act as a preemptive shield, defending seeds from soil-borne and early-season insect threats. In 2023, over 65 percent of large-scale farms in North America and South America reported seed treatments as essential for controlling wireworms, aphids, and root maggots. This early-stage protection improves plant health from the outset, ensuring higher emergence rates and more uniform field performance across diverse climatic conditions.

The shift toward sustainable agriculture is also accelerating the adoption of insecticide seed treatments. Unlike broadcast spraying, seed treatments apply targeted doses directly to the seed, minimizing runoff and off-target environmental effects. This precision aligns with the goals of eco-efficient farming. Research from 2022 found that seed-applied insecticides can reduce the need for subsequent foliar sprays by 30 to 50 percent, lowering overall chemical usage. As environmental regulations tighten, such eco-conscious pest control methods will gain greater acceptance among progressive farming communities.

Insecticide seed treatments also play a critical role in integrated pest management (IPM), a sustainable practice promoted globally. These treatments enhance pest resistance management by reducing reliance on post-emergence insecticides. With an increasing number of pests developing resistance to conventional sprays, seed treatment offers an effective, resistance-mitigating alternative. Additionally, the improved efficiency, ease of application, and compatibility with automated planting systems make insecticide seed treatments attractive for large and small farmers alike. This growing preference for precision-driven, resource-efficient solutions is expected to fuel market expansion in the coming years.

Key Market Challenges

Increasing Cases of Insecticides Resistance

The escalating prevalence of insecticide resistance is anticipated to dampen global demand for insecticide seed treatments. Insecticide resistance occurs when target pests evolve and develop immunity to the chemicals designed to eradicate them. This evolutionary adaptation diminishes the efficacy of insecticides, rendering them increasingly ineffective over time. Continuous and repeated use of the same insecticides not only encourages the development of resistant strains but may also inflict harm on non-target organisms and the greater ecological system.Consequently, this rising trend of resistance is casting doubt on the long-term viability of insecticide seed treatments as a sustainable pest management strategy. Furthermore, there are burgeoning concerns about the environmental and health implications of persistent insecticide use, which in turn, is fueling a shift towards alternative, eco-friendly pest management solutions. These include biological control methods, organic pesticides, and genetically modified (GM) crops with in-built resistance to pests. As more and more farmers and agricultural enterprises gravitate towards these innovative, sustainable alternatives, global demand for traditional insecticide seed treatments is likely to see a significant decline.

Key Market Trends

Increasing Prevalence of Crop Diseases

The global agricultural industry is facing a growing challenge in the form of increasing prevalence of crop diseases. This issue not only threatens the yield and quality of crops, but also poses a significant risk to food security worldwide. In order to mitigate these challenges, farmers and agricultural scientists alike are turning to innovative solutions such as insecticide seed treatments. These treatments are expected to see a significant rise in demand as they offer a proactive and effective approach to disease management in crops. By treating seed with insecticides prior to planting, farmers are able to protect their crops from the very onset, significantly reducing the chances of disease outbreaks.Furthermore, these treatments also offer protection against a wide range of pests, adding another layer of defense for crops. As the prevalence of crop diseases continues to rise, it is anticipated that these insecticide seed treatments will become an increasingly vital tool in global agricultural practices, driving significant demand and growth in the market. This approach not only ensures healthier crop yield but also contributes to sustainable farming practices by reducing the need for post-planting pesticide application.

Key Market Players

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- DuPont de Nemours, Inc.

- ADAMA Agricultural Solutions Ltd

- BioWorks Inc.

- Germains Seed Technology

- Incotec Group BV

- Nufarm Ltd

- Valent Biosciences Corporation

Report Scope:

In this report, the Global Insecticide Seed Treatment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Insecticide Seed Treatment Market, By Type:

- Synthetic Chemicals

- Biological

Insecticide Seed Treatment Market, By Crop Type:

- Cereals & Oilseeds

- Fruits & Vegetables

- Others

Insecticide Seed Treatment Market, By Form:

- Liquid

- Powder

Insecticide Seed Treatment Market, By Application Method:

- Seed Dressing

- Seed Coating

- Seed Pelleting

Insecticide Seed Treatment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Insecticide Seed Treatment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- DuPont de Nemours, Inc.

- ADAMA Agricultural Solutions Ltd

- BioWorks Inc.

- Germains Seed Technology

- Incotec Group BV

- Nufarm Ltd

- Valent Biosciences Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

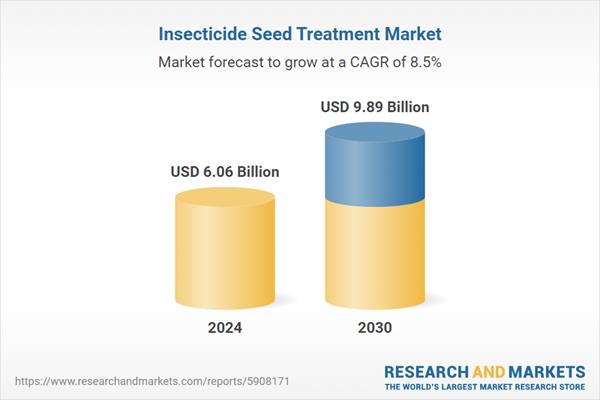

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.06 Billion |

| Forecasted Market Value ( USD | $ 9.89 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |