Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

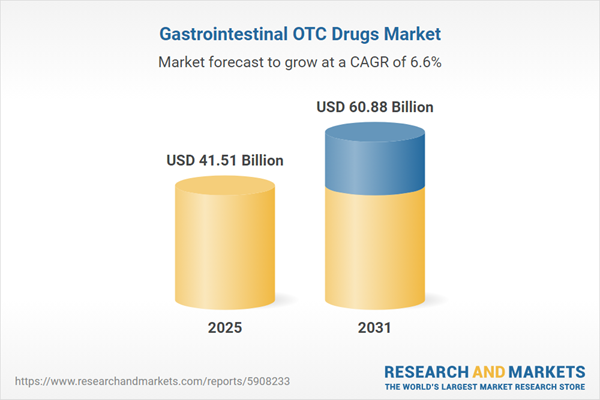

Key drivers of this growth include an aging global population requiring consistent management of chronic gastrointestinal conditions and the increasing prevalence of lifestyle-related digestive disorders. Additionally, healthcare systems around the world are promoting self-medication strategies to lower operational expenses and decrease the strain on primary care services. The magnitude of this demand is significant; the Association of the European Self-Care Industry reported that 4.7 billion packs of non-prescription medicines were sold in Europe in 2024 to address minor health concerns, including gastrointestinal ailments.

Despite these positive growth factors, the market encounters substantial obstacles due to strict regulatory frameworks concerning product safety and labeling. Regulatory authorities implement rigorous standards to ensure consumer protection and prevent adverse effects, a process that can prolong the approval of new formulations and escalate compliance costs for producers. This intense scrutiny serves as a major challenge, establishing high barriers to entry and potentially retarding the rate of innovation within the global gastrointestinal OTC industry.

Market Drivers

The increasing prevalence of common gastrointestinal disorders acts as a major catalyst for the Global Gastrointestinal OTC Drugs Market. Lifestyle changes following the pandemic have intensified the burden of digestive ailments, creating a need for accessible treatments for conditions like irritable bowel syndrome (IBS) and indigestion. This rising incidence drives consumers to seek immediate relief through non-prescription avenues, avoiding the logistical challenges of clinical appointments. For example, a study published in Clinical Gastroenterology and Hepatology in July 2025 indicated that the prevalence of functional dyspepsia in adults rose from 8.3% before the pandemic to 11.9% afterward, highlighting the growing demand for effective digestive remedies.Market expansion is further fueled by a growing consumer preference for preventive care and self-medication. As individuals take a more proactive approach to their health, the use of over-the-counter treatments for minor gastric issues has increased, supported by the greater availability of trusted brands and the reclassification of prescription drugs to OTC status. According to Haleon's 'Annual Report 2024', released in February 2025, the company's Digestive Health and Other segment achieved £2.0 billion in revenue with 5.5% organic growth, driven by product innovation. This trend is consistent with broader health behaviors; the 'STADA Health Report 2025', published in June 2025, noted that 66% of Europeans now attend most of their preventive checkups, reflecting a 5 percentage point rise in proactive health engagement that benefits the self-care sector.

Market Challenges

Rigorous regulatory frameworks regarding product labeling and safety present a significant barrier to the growth of the Global Gastrointestinal OTC Drugs Market. These strict standards, while necessary for consumer protection, place heavy operational demands on manufacturers by requiring extensive clinical testing and complex approval processes for new formulations. The substantial costs and lengthy timelines involved in meeting compliance requirements discourage investment in novel gastrointestinal therapies, effectively delaying the introduction of innovative relief options for conditions such as indigestion and heartburn. Consequently, manufacturers often must redirect resources from research and development to regulatory compliance, creating high entry barriers for smaller firms and stifling market dynamism.The magnitude of this operational challenge is underscored by the vast volume of products subject to such oversight. In 2024, the Association of the European Self-Care Industry reported that the sector managed over 4,000 non-prescription medicines derived from more than 200 different active pharmaceutical ingredients. This extensive portfolio necessitates continuous regulatory maintenance, where even minor updates to labeling or safety evaluations can impact thousands of product lines. Such regulatory density directly hinders the market's agility, making it difficult for companies to respond quickly to evolving consumer needs within the gastrointestinal sector.

Market Trends

The market is being reshaped by the proliferation of prebiotic and probiotic gut health supplements, as consumers increasingly prioritize microbiome optimization for long-term wellness. This trend extends beyond basic digestive relief toward advanced formulations designed to address specific conditions, such as immune system support and functional bowel disorders, through gut modulation. Manufacturers are reacting by introducing strain-specific, high-potency products with clinical validation, thereby elevating the segment above general wellness. This shift is reflected in the financial results of specialized firms; according to BioGaia's 'Year-end report January - December 2024', published in February 2025, net sales in the company’s Adult Health segment rose by 17% for the year, demonstrating strong global demand for targeted probiotic solutions.Simultaneously, there is a rising consumer preference for natural and herbal digestive remedies, driven by a demand for "clean label" alternatives to synthetic drugs. Shoppers are actively seeking plant-based ingredients like peppermint, ginger, and turmeric, known for their minimal side effects and gentle efficacy. This demand is prompting OTC manufacturers to launch herbal adjacencies or reformulate existing lines to attract holistic-minded consumers. Validating this trend, WholeFoods Magazine reported in February 2025, citing 'Highlights from CRN's 2024 Consumer Survey', that usage of ginger as a digestive aid increased to 13% among supplement users, indicating the growing integration of traditional botanical solutions into modern self-care regimens.

Key Players Profiled in the Gastrointestinal OTC Drugs Market

- Viatris Inc.

- Sandoz Group AG

- Johnson & Johnson Services, Inc.

- Sun Pharmaceuticals Industries Limited

- Teva Pharmaceuticals Industries Ltd.

- Zydus Life science Ltd.

- Sanofi SA

- Bayer AG

- Pfizer Inc.

- GlaxoSmithKline plc

Report Scope

In this report, the Global Gastrointestinal OTC Drugs Market has been segmented into the following categories:Gastrointestinal OTC Drugs Market, by Drug Class:

- Laxatives

- Gastrointestinal Cancer Treatments

- Gastric Acid Reducers

- Anti-Diarrheal

- Proton Pump Inhibitors

- H2 Inhibitors

- Gastric Acid Neutralizers

- Bowel Anti-Inflammatory

- Anti-Emetics

Gastrointestinal OTC Drugs Market, by Indication:

- Gastroesophageal Reflux Disease or Heartburn

- Constipation

- Diarrhea

- Motion Sickness

- Others

Gastrointestinal OTC Drugs Market, by End User:

- Hospitals Pharmacies

- Retail Pharmacies

- Online pharmacies

- Others

Gastrointestinal OTC Drugs Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Gastrointestinal OTC Drugs Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Gastrointestinal OTC Drugs market report include:- Viatris Inc.

- Sandoz Group AG

- Johnson & Johnson Services, Inc.

- Sun Pharmaceuticals Industries Limited

- Teva Pharmaceuticals Industries Ltd.

- Zydus Life science Ltd.

- Sanofi SA

- Bayer AG

- Pfizer Inc.

- GlaxoSmithKline PLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 41.51 Billion |

| Forecasted Market Value ( USD | $ 60.88 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |