Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Mental health devices and platforms refer to a category of digital tools and technologies designed to support and improve mental well-being, provide mental health interventions, and assist individuals in managing their mental health. These devices and platforms leverage technology to offer various forms of mental health assistance, including self-help resources, therapy, counseling, monitoring, and education. Rising awareness of mental health issues and a growing global burden of mental health disorders have led to increased demand for mental health solutions. The recognition of the importance of mental well-being has driven market growth.

Key Market Drivers

Technological Advancements

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are increasingly employed to personalize mental health interventions by analyzing user data and providing tailored recommendations. These technologies can predict mental health trends and potential relapses by identifying patterns in user behavior and mood. For instance, a study by the Centers for Disease Control and Prevention (CDC) found that teenagers with four or more hours of daily screen time were more likely to experience anxiety (27.1%) or depression (25.9%) symptoms, highlighting the importance of monitoring digital interactions to assess mental well-being.Chatbots and virtual assistants powered by AI offer 24/7 support, engaging users in natural language conversations to provide immediate assistance. Wearable devices, such as smartwatches and fitness trackers, incorporate sensors to monitor physiological data like heart rate variability and sleep patterns, offering insights into mental health. The integration of these devices with telehealth platforms has been significant; data indicates that telehealth utilization among Medicare beneficiaries increased 63-fold in 2020, from approximately 840,000 visits in 2019 to nearly 52.7 million in 2020, underscoring the growing acceptance of remote mental health services.

Key Market Challenges

User Adoption and Engagement

Many individuals still hesitate to openly discuss their mental health issues due to stigma. Privacy concerns can also deter users from engaging with digital platforms, especially if they fear their data may not be kept confidential. Some mental health platforms may have complex features or require a learning curve, which can overwhelm users, especially those who are not tech-savvy. This can result in low adoption rates. Not everyone is aware of the availability and benefits of mental health devices and platforms. Limited awareness can hinder adoption, as potential users may not know these solutions exist. Not all individuals have access to the necessary technology or internet connectivity to use mental health platforms.This digital divide can limit adoption, particularly in underserved populations. Consistent engagement with mental health platforms often requires motivation and commitment. Some users may start using the platform but struggle to maintain regular engagement over time. Users may be skeptical about the efficacy of digital mental health interventions compared to traditional in-person therapy. Demonstrating the effectiveness of these platforms can be a challenge. There is a plethora of health and wellness apps available, including mental health apps. Users may feel overwhelmed by the number of options and may not stick with a single platform long enough to see benefits.

Key Market Trends

Data Security and Privacy

Mental health platforms often collect and store sensitive user data, including personal information and details about mental health conditions. Ensuring the confidentiality of this data is paramount to building trust with users. Various data protection regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union, impose strict requirements for the handling of healthcare and personal data. Compliance is essential to avoid legal repercussions. Data breaches can have severe consequences, including financial losses, reputational damage, and harm to users.Mental health platforms must implement robust security measures to protect against data breaches. Users are more likely to engage with mental health platforms if they trust that their data is secure. Building and maintaining user trust is essential for the success and adoption of these platforms. The ethical use of user data is a growing concern. It's essential for mental health platforms to have ethical data practices and to be transparent about how user data is used and shared. Implementing strong encryption techniques and access control measures can protect data both during transmission and when it's stored. This safeguards user privacy. Platforms should provide users with control over their data, including the ability to consent to data collection and to delete their data if they choose to discontinue using the platform. Secure communication channels, especially for telehealth and teletherapy services, are essential to protect the privacy of user-provider interactions.

Key Market Players

- Electromedical Products International, Inc

- Ginger Group Ltd.

- Happify Health

- Headspace Inc.

- Pear Therapeutics, Inc.

- Quartet Health

- Teladoc Health Inc.

- Woebot Health

- Clarigent Health

- Feel Therapeutics Inc.

Report Scope:

In this report, the Global Emerging Mental Health Devices and Platforms Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Emerging Mental Health Devices and Platforms Market, By Type:

- Platforms

- Devices

Emerging Mental Health Devices and Platforms Market, By Application:

- Stress

- Anxiety

- Depression

- Bipolar Disorder

- Others

Global Emerging Mental Health Devices and Platforms Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Emerging Mental Health Devices and Platforms Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Electromedical Products International, Inc

- Ginger Group Ltd.

- Happify Health

- Headspace Inc.

- Pear Therapeutics, Inc.

- Quartet Health

- Teladoc Health Inc.

- Woebot Health

- Clarigent Health

- Feel Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | March 2025 |

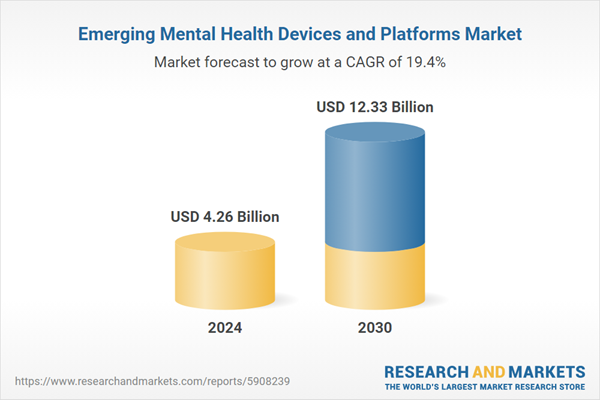

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.26 Billion |

| Forecasted Market Value ( USD | $ 12.33 Billion |

| Compound Annual Growth Rate | 19.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |