Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers

Rising Vehicle Production

The increasing production of vehicles in Vietnam is a major driver of tire demand. As the automotive industry expands, both passenger cars and commercial vehicles require a constant supply of tires. This growth is largely attributed to the rise in foreign direct investments (FDIs) by global automobile manufacturers, which has enhanced local production capacities. As the demand for vehicles continues to rise, tire manufacturers are positioned to benefit from the growing need for replacement tires, which boosts overall market growth. Moreover, the rise in domestic consumption and export opportunities further strengthens the automotive sector, fostering tire market development.This trend is expected to continue as production volumes grow in tandem with the increasing automotive fleet. The increasing penetration of vehicles in rural areas also adds to the demand for tires, creating new market opportunities. For instance, Vietnam’s domestic car production reached an estimated 388,500 units in 2024, a 27% increase from 2023, according to the General Statistics Office.

Approximately 134,500 vehicles were produced during the three-month registration fee reduction from September to November, accounting for one-third of the annual output. December saw a decline to 47,000 units, down from 52,400 units in November, as the fee reduction policy expired and manufacturers adjusted to avoid inventory surplus. By the end of November, domestically assembled vehicle sales hit 159,868 units, reflecting a 1.6% year-on-year increase and comprising 59.5% of total market sales. Looking ahead, domestic production is expected to grow with new factories from Chinese brands like Omoda, Jaecoo, Geely, and Lynk & Co in Thai Binh, Skoda's plant in Quang Ninh with 120,000-unit capacity launching in early 2025, and VinFast’s new electric car factory in Ha Tinh focused on VF 3 and VF 5 models.

Key Market Challenges

Fluctuating Raw Material Prices

The prices of key raw materials used in tire manufacturing, such as rubber, steel, and synthetic polymers, are highly volatile. These fluctuations often lead to unpredictable production costs, impacting the profitability of tire manufacturers. Price hikes in raw materials can result in higher tire prices for consumers, which may reduce demand, especially in price-sensitive market segments.Managing these cost fluctuations without compromising product quality remains a significant challenge for tire manufacturers. To mitigate this issue, manufacturers are increasingly seeking alternative sources of raw materials or exploring recycling methods. However, these alternatives often come with their own set of challenges, including limited availability or higher production costs. Balancing these fluctuations while maintaining competitive pricing remains a constant hurdle.

Key Market Trends

Shift Towards Smart Tires

The growing interest in smart vehicles has led to the emergence of smart tires equipped with sensors to monitor various parameters such as tire pressure, wear levels, and temperature. These innovations provide real-time data, enhancing vehicle safety and performance. As consumers become more technology-savvy, the demand for such smart solutions is expected to rise, encouraging tire manufacturers to develop new products with enhanced technological features. The integration of smart tires with vehicle diagnostics systems is expected to revolutionize vehicle maintenance, making it easier for car owners to monitor tire health. This trend not only caters to safety-conscious consumers but also appeals to those seeking better fuel efficiency and reduced maintenance costs. Smart tires are poised to become a mainstream offering in the automotive market.Key Market Players

- Bridgestone Corporation

- Betron Vietnam Co., Ltd

- Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries Ltd

- Danang Rubber JSC

- Pirelli & C. S.p.A.

- Yokohama Rubber Company Limited

- Kumho Tire Co. Inc

- BFGoodrich Tyres

- Hankook Tire & Technology Co., Ltd.

Report Scope:

In this report, the Vietnam Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Tire Market, By Vehicle Type:

- Passenger Car

- Two-Wheelers

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

Vietnam Tire Market, By Demand Category:

- OEM

- Aftermarket

Vietnam Tire Market, By Tire Construction Type:

- Radial

- Bias

Vietnam Tire Market, By Region:

- Northern

- Central

- Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Tire Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bridgestone Corporation

- Betron Vietnam Co., Ltd

- Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries Ltd

- Danang Rubber JSC

- Pirelli & C. S.p.A.

- Yokohama Rubber Company Limited

- Kumho Tire Co. Inc

- BFGoodrich Tyres

- Hankook Tire & Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

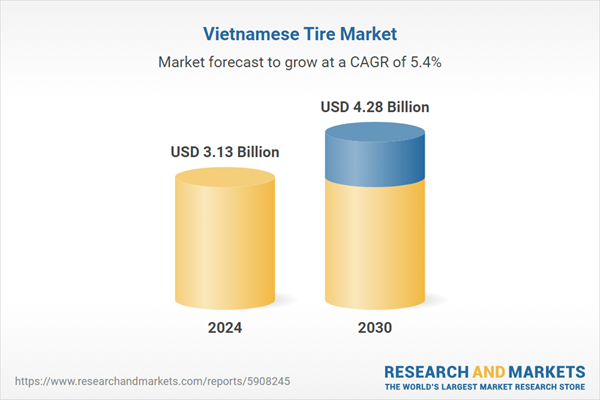

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.13 Billion |

| Forecasted Market Value ( USD | $ 4.28 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |