Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Electric vehicles rely on advanced adhesives for critical applications such as battery pack assembly, structural bonding, and thermal management. As manufacturers prioritize weight reduction to extend driving range and improve energy efficiency, adhesives are increasingly used to bond lightweight materials like aluminum and carbon fiber composites. These materials offer improved performance and fuel economy but require specialized adhesives to ensure strong, durable bonds.

EV manufacturing must adhere to stringent safety standards, particularly in relation to crashworthiness and fire resistance. High-performance adhesives are essential to meeting these requirements, especially in battery modules and structural components. However, the unique materials used in EVs, such as lithium-ion batteries and advanced composites present challenges in adhesion and long-term durability. EVs generate considerable heat during operation and charging, making thermal stability a critical performance parameter for adhesives.

Emerging trends in the EV adhesives market include growing demand for sustainable, low-VOC, and bio-based adhesives. As sustainability gains prominence across the value chain, manufacturers are seeking environmentally friendly solutions that align with global regulatory frameworks and corporate ESG goals. Innovations in thermally conductive adhesives are also gaining traction, enabling better heat dissipation in battery packs and power electronics, which is vital for performance and safety. Customization is another key market trend. With each automaker pursuing unique EV designs and architectures, there is rising demand for tailor-made adhesive formulations that meet specific functional requirements. This need for bespoke solutions is driving innovation and collaboration between EV manufacturers and adhesive suppliers.

Key Market Drivers

Growing Demand for Light Weight Vehicles is Major Factor for Electric Vehicle Adhesives Market Growth

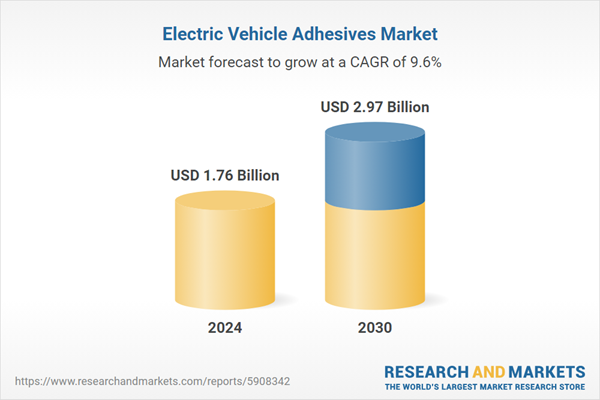

The global electric vehicle (EV) adhesives market is witnessing robust growth, largely driven by the automotive industry’s increasing focus on lightweight construction to improve vehicle efficiency and performance. As electric vehicles continue to gain traction due to stringent emission regulations, climate change concerns, and technological advancements, reducing vehicle weight has become a strategic priority for manufacturers. Lightweighting not only enhances energy efficiency but also extends the driving range, two critical factors influencing EV adoption.According to the International Energy Agency (IEA), global EV stock surpassed 16.5 million units in 2023, more than triple the level seen in 2018. This rapid market expansion has led to greater emphasis on advanced manufacturing materials and processes, where adhesives play a pivotal role. Unlike traditional mechanical fasteners, adhesives facilitate the bonding of dissimilar and lightweight materials such as aluminum, magnesium, carbon fiber composites, and engineered plastics.

This approach enables automakers to reduce vehicle mass while ensuring structural integrity, crashworthiness, and durability. Battery systems, which account for approximately 25-30% of an EV’s total weight, represent another key application area for adhesives. Adhesives are increasingly used in battery cell bonding, module integration, and thermal management. High-performance adhesive formulations contribute to lighter battery assemblies and support efficient heat dissipation, especially during fast charging and high-load operations.

Adhesives are essential in securing components in innovative chassis and body architectures designed to accommodate battery packs and optimize weight distribution. The shift toward modular EV platforms and increased customization has further accelerated the demand for application-specific adhesive solutions. Innovation in adhesive technology is keeping pace with evolving automotive needs. Manufacturers are investing heavily in R\&D to develop formulations with enhanced thermal stability, vibration resistance, and durability under extreme conditions. Bio-based and low-VOC adhesives are also gaining popularity as sustainability becomes a key industry priority.

As EV sales are expected to exceed 50% of new car registrations in key markets like China, Europe, and the U.S. by 2030, the demand for lightweight construction materials and by extension, automotive adhesives, is projected to rise significantly. The EV adhesives market will continue to grow as manufacturers seek high-performance bonding solutions to meet stringent performance, safety, and environmental standards in next-generation electric vehicles.

Key Market Challenges

Adhesive Compatibility with lithium-ion batteries and lightweight Composites

Environmental concerns are serving as a substantial roadblock to the growth of the global Electric Vehicle Adhesives market. Electric Vehicle Adhesives play a vital role in various industries, particularly in aerospace, automotive, and construction, where lightweight, high-strength materials are in demand. However, the formulations of many traditional Electric Vehicle Adhesives often contain volatile organic compounds (VOCs) and hazardous chemicals, which raise red flags in an era of heightened environmental consciousness.Strict regulations and sustainability goals have driven industries to seek greener alternatives, putting pressure on adhesive manufacturers to reformulate their products. Transitioning to eco-friendly Electric Vehicle Adhesives requires extensive research and development, which can be time-consuming and costly. Additionally, the approval processes for new environmentally responsible adhesive solutions can delay market entry.

To navigate this challenge and promote market growth, companies must prioritize the development of low-VOC or VOC-free Electric Vehicle Adhesives, embrace sustainable manufacturing practices, and actively engage with regulatory bodies to ensure compliance. This commitment to environmental responsibility will not only address current concerns but also position businesses favorably in a market increasingly driven by eco-friendly innovations.

Key Market Trends

Advanced Thermal Management

Advanced thermal management is a crucial trend propelling the growth of the global EV (Electric Vehicle) Adhesives market. With the rapid expansion of the electric vehicle industry, efficient thermal management has become imperative. EVs rely on complex battery systems and power electronics that generate significant heat during operation. To ensure optimal performance, safety, and longevity of these components, thermal management solutions are essential.Adhesives play a vital role in this context by securing and thermally conducting critical components such as battery cells, power electronics, and cooling systems. Advanced EV adhesives are formulated to offer strong adhesion, electrical insulation, and superior thermal conductivity, helping dissipate heat efficiently and maintain the ideal operating temperature.

As the electric vehicle market continues to grow, driven by environmental concerns and advancements in battery technology, the demand for specialized EV adhesives is on the rise. Companies that innovate and provide advanced thermal management adhesive solutions are well-positioned to capitalize on this trend, contributing to the development of more efficient and reliable electric vehicles.

Key Market Players

- 3M Company

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- Ashland, Inc.

- PPG Industries, Inc.

- Permabond Engineering Adhesives Ltd.

- Wacker Chemie AG

- Bostik SA - An Arkema company

- L&L Products, Inc.

Report Scope:

In this report, the Global Electric Vehicle Adhesives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Electric Vehicle Adhesives Market, By Resin:

- Epoxy

- Silicon

- Polyurethane

- Acrylic

- Other

Electric Vehicle Adhesives Market, By Vehicle Type:

- Electric Trucks

- Electric Buses

- Electric Bikes

- Electric Cars

Electric Vehicle Adhesives Market, By Application:

- Exterior

- Interior

- Powertrain

Electric Vehicle Adhesives Market, By Substrate:

- Plastic

- Composite

- Metals

- Others

Electric Vehicle Adhesives Market, By End Use:

- Pack & Module Bonding

- Thermal Interface Bonding

- Battery Cell Encapsulation

- Other

Electric Vehicle Adhesives Market, By Region:

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Qatar

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electric Vehicle Adhesives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Company

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- Ashland, Inc.

- PPG Industries, Inc.

- Permabond Engineering Adhesives Ltd.

- Wacker Chemie AG

- Bostik SA – An Arkema company

- L&L Products, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.76 Billion |

| Forecasted Market Value ( USD | $ 2.97 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |