Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Wall Water Resistive Barrier market has experienced substantial growth in recent years, fueled by its widespread adoption across various industries on a global scale. Key sectors such as real estate, finance, and technology have come to recognize the paramount significance of effective Wall Water Resistive Barrier solutions in swiftly accessing both internal information and external data sources.

Stricter regulatory compliance requirements and heightened security concerns have compelled organizations to make substantial investments in advanced Wall Water Resistive Barrier solutions. These solutions now incorporate cutting-edge features like natural language processing, semantic search, and AI-powered recommendations, which enable users to retrieve the right information more efficiently while ensuring data access adheres to security protocols.

Leading vendors in the Wall Water Resistive Barrier market have launched innovative products boasting enhanced search interfaces, personalized search capabilities, and automated controls. These improvements significantly boost productivity and efficiency for knowledge workers. Furthermore, the integration of advanced technologies such as AI, machine learning, and predictive analytics is reshaping the landscape of information retrieval.

With the ever-increasing volumes of data and the growing need to extract insights from both structured and unstructured data sources, there is a heightened demand for Wall Water Resistive Barrier solutions. Companies are now collaborating closely with Wall Water Resistive Barrier providers to deploy customized solutions that cater to their specific needs. Additionally, the emergence of digital transformation initiatives in areas like customer experience, digital marketing, and e-commerce is opening up new avenues for the market.

The Wall Water Resistive Barrier market is poised for sustained growth as organizations continue to prioritize data-driven decision-making processes and aim to enhance the productivity of their knowledge workers. Investments in upgrades and the adoption of new search capabilities are expected to persist across various regions and industries. The market's ability to support high-growth, data-intensive workloads through AI-powered solutions paints a promising picture for its future.

Key Market Drivers

Growth in Construction Industry Driving Demand

The construction industry has been witnessing steady growth over the past few years globally. According to estimates, the global construction output is projected to grow by 85% to over $15.5 trillion by 2030. This growth is driven by factors such as rapid urbanization, rising income levels, population growth, and government investments in infrastructure development. As the construction of new residential and commercial buildings increases, it will positively impact the demand for wall water resistive barriers.Regionally, the Asia Pacific region is expected to lead the growth in construction industry given the massive infrastructure development programs underway in countries such as China, India, and Southeast Asian nations. China's ambitious 'Belt and Road Initiative' involving construction of roads, railways, and buildings across multiple countries is a major driver. In India, the government's 'Housing for All by 2022' program and Smart City projects are propelling construction of millions of new residential units. Similarly, ongoing urbanization and industrialization are fueling construction in Southeast Asian countries. The growth in APAC construction will drive the use of wall water resistive barriers in the region.

In North America as well, construction activities are rising given strong economic growth, population increase, and investments in infrastructure modernization. The United States remains one of the largest construction markets globally. Mega-projects such as the ongoing high-speed rail project in California and the planned infrastructure package will boost construction output in the country. The Trump administration's plans to modernize airports, roads, and bridges are also supportive of growth. The revitalization of aging infrastructure and construction of new transport networks, commercial buildings, and residential complexes will augment the demand for wall water resistive barriers in the North American market.

Coming to Europe, public infrastructure spending is increasing across major countries such as the UK, Germany, France, Italy, and Spain. Mega projects such as London's Crossrail project, Berlin's new airport, and high-speed rail lines in Spain are underway. The European Commission's 2021-2027 budget has also earmarked around $340 billion for projects supporting sustainable growth. Rising construction of green buildings to meet carbon emission targets will further support market growth. Overall, the wall water resistive barrier market will benefit from the growth in construction industry globally driven by urbanization, investments, and infrastructure modernization programs.

Stringent Building Regulations Driving Adoption of Advanced Barriers

Governments across the world are formulating stringent energy efficiency standards for buildings as part of efforts to reduce carbon emissions from the construction sector. These regulations mandate use of advanced building materials and technologies that enhance a building's insulation properties and lower energy consumption. As a result, the demand for high-performance wall water resistive barriers is on the rise globally.In the United States, ASHRAE (American Society of Heating, Refrigerating and Air-Conditioning Engineers) has updated its energy standards which now require commercial buildings to reduce energy usage by 30% compared to previous norms. Similarly, IECC (International Energy Conservation Code) mandates tighter insulation and air-sealing requirements for residential and commercial construction. State-level codes like Title 24 in California are also getting more stringent over time. Compliance with codes is driving increased adoption of breathable, vapor permeable, and highly insulating wall barriers.

The European Union too has implemented the Energy Performance of Buildings Directive (EPBD) which makes it mandatory for all new buildings to be nearly zero-energy by 2021. Countries have formulated their own energy efficiency laws within this framework. For example, the UK has regulations on U-values (heat loss) that necessitate superior insulation barriers. Germany's EnEV law focuses on reducing heating energy demand of buildings significantly. Compliance with EU and national norms is propelling the European wall barrier market towards advanced, high-R value products.

Even in Asia, countries like China, India, Japan, and South Korea have introduced updated building energy codes on the lines of ASHRAE and IECC standards. China's GB 50189 code mandates reductions in building energy consumption. India's ECBC (Energy Conservation Building Code) has made it compulsory for large commercial buildings to meet stricter insulation and efficiency benchmarks. Such regulations are driving the replacement of conventional building papers with breathable, water-resistant, and high-R value wall barriers that enhance insulation and reduce heating/cooling loads of buildings.

Overall, the tightening of global energy efficiency standards for reducing carbon footprint of the construction sector has become a key driver for the wall water resistive barrier market. Advanced, high-performance barriers that comply with latest codes are seeing rising preference over traditional products. This shift towards products enhancing building insulation properties is expected to continue driving future market revenues.

Innovation in Materials Enhancing Barrier Performance

Continuous innovation in materials is allowing manufacturers to develop new generations of wall water resistive barriers with superior functionality, ease of installation, and durability compared to traditional building papers or felt. The introduction of advanced material variants is expanding product offerings as well as driving replacement of existing barriers. This material innovation is a key factor positively impacting the future growth prospects of the global market.One of the innovations gaining traction is the development of polymer-modified cementitious coatings for use as water-resistant barriers. These cement-polymer hybrid coatings have enhanced properties such as high vapor permeability, water resistance, flexibility, and adhesion strength. They provide durable protection against water ingress while allowing walls to breathe naturally. Being cement-based, they are also more fire-resistant than plastic barriers.

Another notable innovation is the usage of advanced polymers and composites in manufacturing water-resistant building wraps. For example, polyolefin copolymer films offer high strength, flexibility in cold temperatures, and self-sealing abilities against punctures. Metallized polymer composites provide superior moisture resistance as well as reflectivity for reducing solar heat gain. Some manufacturers have also introduced breathable, air and water-resistant wraps made from recycled polyethylene materials.

Nanotechnology is another area facilitating new product introductions. For instance, nanosilica additives are making cementitious barriers more durable and flexible. Nanoclay additives in polymer films enhance their mechanical strength and permeability. Even bio-based polymers from renewable resources such as cellulose are finding applications as sustainable building wraps.

From an installation perspective, self-adhesive water-resistant sheathing membranes are gaining popularity over traditional horizontal or vertical application methods for barriers. These one-side adhesive variants can be quickly rolled out and stuck onto sheathing surfaces, saving labor and installation time on construction sites. Pre-fabricated drainage mats or fluid-applied coatings are other easy-to-apply innovations.

Overall, continuous R&D into novel materials, additives, production processes, and installation technologies is allowing manufacturers to expand their portfolio of advanced wall water resistive barriers. The superior performance and ease-of-use characteristics of innovative variants will drive their increasing substitution of conventional products over the coming years. This material innovation will remain a key factor supporting long-term market growth prospects.

Key Market Challenges

Intense Competition Driving Pricing Pressures

The wall water resistive barrier market is highly competitive on account of the presence of numerous global and regional manufacturers. Intense rivalry exists among key players like DuPont, Dow Building Solutions, Henry Company, Wr Grace, and Sika who collectively account for a major share of global revenues. Additionally, private label brands from large retailers also pose stiff competition.Such a competitive environment acts as a barrier to frequent or significant price increases by manufacturers. Players are constrained in their ability to regularly hike product costs due to the risk of losing customers to cheaper alternatives offered by rivals. This poses challenges in terms of maintaining healthy profit margins, especially during periods when raw material costs are volatile.

Moreover, the bargaining power of buyers in the form of large construction and building material companies is also strong. They negotiate on price while demanding better quality, service levels, and supply chain reliability from vendors. This transfer of risk to suppliers further limits the scope for frequent price hikes.

In order to stay competitive on costs, companies have to focus on achieving scale, operational efficiencies as well as sourcing raw materials economically on a global basis. They also invest heavily in R&D to continuously innovate and expand their portfolio of premium product variants targeting specific performance segments. However, such strategies require large capital investments, adding to business challenges.

The threat of new entrants also remains high given the lack of significant entry barriers in terms of technology, manufacturing expertise or customer loyalty. New players often enter by offering me-too products at aggressive prices, intensifying competition. This restricts the ability of incumbents to freely pass on higher input costs to customers.

Overall, the intensely competitive nature of the industry acts as a challenge for players in terms of maintaining optimal profitability without frequent price corrections, especially during periods of rising costs. Strategic responses are needed to overcome this challenge.

Environmental Regulations on Plastic Waste

A major challenge faced by the wall water resistive barrier industry relates to the stringent environmental regulations being introduced worldwide on plastic waste and pollution. Since most traditional building wraps used in exterior construction are made from plastic films like polyethylene or polypropylene, they are coming under increased regulatory scanner.For example, the European Union has banned numerous single-use plastic items and also implemented laws making producers responsible for collection and recycling of plastic packaging waste. Non-compliance can attract heavy penalties. Similarly, several states and cities in the US and Canada have prohibited or taxed specific disposable plastic products while setting recycling and reuse targets.

Even countries like China and India which receive plastic scrap for recycling from developed nations have now imposed restrictions on plastic waste imports due to environmental and health concerns. This is disrupting global recycling streams for plastic construction materials.

Rising public awareness about plastic pollution is also driving demand for eco-friendly alternatives to traditional plastic wraps. However, developing truly sustainable and commercially viable substitutes remains a technical challenge. Moreover, establishing separate collection, sorting and recycling infrastructure for construction waste adds to business costs.

Staying compliant with evolving regulations requires investments and process changes across the value chain from material sour costs.

Staying compliant with evolving regulations requires investments and process changes across the value chain from material sourcing to waste disposal. Manufacturers have to set up take-back programs and establish mechanisms for recycling plastic packaging and film scrap generated at construction sites. They also need to optimize plastic content in products and shift towards use of recycled resins.

Non-compliance or inability to quickly adapt products/processes can lead to financial penalties, loss of reputation as well as customer attrition. The evolving regulatory scenario thus poses compliance cost and operational burdens for plastic barrier manufacturers. Innovation in sustainable materials and technologies is critical to overcome this challenge.

Key Market Trends

Rising Demand for Breathable Water-Resistant Barriers

There is a growing trend of specifying breathable water-resistant barriers for construction, especially in commercial buildings. Traditional plastic sheeting is being replaced by advanced vapor permeable variants that allow inward diffusion of water in vapor form while blocking liquid water penetration.This is because conventional airtight plastic wraps can trap moisture within wall assemblies over time, leading to issues like mold growth. Vapor open barriers ensure walls dry naturally by breathing and prevent moisture buildup. They maintain a healthy indoor environment.

The emphasis on moisture management has increased with tightening building codes focusing on energy efficiency, indoor air quality, and durability. Proper moisture control enhances insulation performance, prevents structural damage, and creates a thermally comfortable interior.

Leading manufacturers have responded to this trend by developing breathable building wraps made of microporous films, breathable adhesives, and vapor permeable coatings. Their superior moisture control abilities are driving increased preference over plastic sheeting. This shift towards vapor permeable barriers is expected to continue in the coming years.

Growth in Demand for Self-Adhesive Water Barrier Products

The wall water resistive barrier industry is witnessing a trend where self-adhesive sheathing membranes are gaining traction over conventional building wraps requiring mechanical or adhesive fixing methods. Self-adhesive variants can be simply rolled out and stuck onto exterior sheathing surfaces.Their ease and speed of installation provides significant labor cost savings for builders. No additional adhesives or mechanical fasteners are required. This makes installation more convenient on sites with limited access or harsh weather conditions.

Leading manufacturers have launched self-adhesive barrier tapes, rolls and fluid-applied coatings tailored for different construction needs. Builders appreciate the installation flexibility they offer compared to traditional horizontal and vertical application methods.

The popularity of one-side adhesive barriers is expected to continue rising on account of their labor-saving and convenience advantages. This trend underscores the industry's shift towards easier-to-apply product formats preferred by builders.

Surging Demand in Renovation & Retrofit Segment

A notable trend in the wall water resistive barrier market is the rising demand from the renovation and retrofit construction segment. With aging commercial and residential building stocks worldwide, there is a growing focus on envelope upgrades for improved energy efficiency, moisture management and durability.Wall assemblies in older structures often used outdated building papers or lacked continuous air barriers. Their replacement with advanced water-resistant barriers delivers performance enhancements. This presents an opportunity to replace existing barriers.

Contractors are increasingly specifying high-performance, breathable wraps for re-siding, re-roofing and insulation upgrade projects. Manufacturers have introduced barrier solutions tailored for the retrofit segment.

Strict energy codes also mandate envelope upgrades during renovations. This is driving replacement of conventional sheathing with advanced, code-compliant variants. The trend underscores lucrative growth opportunities in the barrier retrofit and replacement market going forward.

Segmental Insights

Material Type Insights

The sheet or membrane barriers segment dominated the wall water resistive barrier market in 2022 and is expected to maintain its dominance during the forecast period. Sheet or membrane barriers accounted for the largest market share in 2022 and the trend is likely to continue from 2023-2032. This segment includes polyethylene (PE) films, modified bitumen membranes, self-adhered membranes, vapor permeable membranes and composite sheets that are used widely across residential, commercial and infrastructure construction. These sheet barriers are easy to install by simply rolling them out on exterior sheathing and provide effective protection against water ingress from wind-driven rains. Their proven performance, cost-effectiveness and widespread acceptance among builders have made them the material of choice for wall water resistive applications over other segments such as liquid-applied barriers and fluid-applied membranes. Moreover, sheet barriers offer versatility as they can be used on various substrates like plywood, oriented strand board, concrete, masonry and others. Leading manufacturers also offer self-adhesive sheet barriers that provide added convenience during installation. With tightening building codes and focus on moisture management, advanced breathable sheet barriers with high vapor permeability are gaining increased preference. This growing demand, coupled with strong distribution networks and brand recall of sheet barriers, will help this segment continue dominating the wall water resistive barrier market during the forecast period.Application Type Insights

The residential buildings segment dominated the wall water resistive barrier market in 2022 and is expected to maintain its dominance during the forecast period. Residential buildings accounted for the largest share of the global market in 2022 and the trend is likely to continue till 2032. This can be attributed to robust demand from the housing sector worldwide, especially in developing countries undergoing rapid urbanization. Wall water resistive barriers find widespread application in single-family homes, apartments, condominiums and other residential construction projects. Sheet barriers made of polyethylene films and modified bitumen membranes are commonly used residential applications due to their cost-effectiveness and easy installation process. Further, the residential segment benefits from strong demand for new construction activities as well as renovation projects involving barrier retrofits and replacements. Residential construction also demands breathable, vapor permeable sheet barriers for maintaining indoor air quality and preventing moisture issues in home envelopes. With growing global populations and rising incomes, residential construction output is expected to remain high, thereby driving continuous demand for wall water resistive barriers. Moreover, tightening building codes and energy efficiency norms also mandate use of advanced, code-compliant barriers in residential wall assemblies. Hence, the residential buildings segment is anticipated to continue dominating demand for wall water resistive barriers through the forecast period on account of robust housing industry growth worldwide and replacement requirements in aging homes..Regional Insights

The Asia Pacific region dominated the wall water resistive barrier market in 2022 and is expected to maintain its dominance during the forecast period. Asia Pacific accounted for the largest market share in 2022 and the trend is projected to continue till 2032. This can be attributed to massive infrastructure development and robust construction activities underway in the region, especially in China and India. Rapid urbanization, growing population, rising incomes, and government initiatives are fueling new residential, commercial and industrial construction in Asia Pacific. For example, China's ambitious high-speed rail and smart city projects are driving demand. India too is witnessing a construction boom on the back of housing and infrastructure development programs. Further, other South Asian countries are also witnessing an uptick in construction due to improving economies. The massive scale of projects in Asia Pacific involving roads, bridges, airports, rail networks and special economic zones creates sustained demand for wall water resistive barriers. Both polyethylene film barriers and advanced breathable sheet variants find widespread usage across Asia Pacific construction. Leading global manufacturers are also expanding their presence in the region through partnerships and investments to leverage opportunities. With continued infrastructure spending and housing growth projected over the coming years, the Asia Pacific region is expected to continue dominating the global wall water resistive barrier market during the forecast period.Report Scope:

In this report, the Global Wall Water Resistive Barrier Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Wall Water Resistive Barrier Market, By Material Type:

- Liquid-Applied Barriers,

- Sheet or Membrane Barriers,

- Fluid-Applied Membranes

Wall Water Resistive Barrier Market, By Application Type:

- Commercial Buildings

- Residential Buildings

- Institutional Buildings

Wall Water Resistive Barrier Market, By End-Use Industry:

- Construction

- Real Estate

- Infrastructure

Wall Water Resistive Barrier Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wall Water Resistive Barrier Market.Available Customizations:

Global Wall Water Resistive Barrier Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DuPont

- Dow Building Solutions

- WR Grace

- SIKA AG

- BASF SE

- Henry Company

- GCP Applied Technologies

- Kemper System America Inc

- Owens Corning

- Carlisle Construction Materials

Table Information

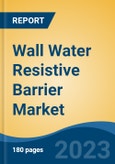

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 29.52 Billion |

| Forecasted Market Value ( USD | $ 43.28 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |