Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Semiconductor Demand

The global flip chip market is on an upward trajectory due to the escalating demand for semiconductors across a multitude of industries. As technological advancements continue to reshape our world, the demand for smaller, more efficient, and higher-performance semiconductor devices has surged. Flip chip technology has emerged as a linchpin in meeting these demands by offering enhanced electrical and thermal properties compared to traditional packaging methods. The semiconductor industry, which forms the backbone of modern technology, relies heavily on flip chip packaging to deliver smaller form factors and better heat dissipation. This trend is driven by an array of applications spanning consumer electronics, automotive, telecommunications, data centers, and emerging sectors like 5G connectivity and artificial intelligence. As the world becomes increasingly reliant on semiconductors for innovation and progress, the global flip chip market is set to continue its growth trajectory.Technological Advancements

The flip chip market is characterized by rapid technological advancements aimed at further improving the performance, reliability, and versatility of flip chip technology. Manufacturers are consistently innovating to develop new materials, processes, and designs that push the boundaries of what is possible. These advancements encompass improvements in flip chip interconnects, substrate materials, and underfill materials, among others. Additionally, innovations in 3D packaging technologies, such as through-silicon vias (TSVs), have unlocked new possibilities for miniaturization and performance optimization. The ongoing quest for ever-smaller, more powerful electronic devices is propelling the flip chip market forward. These technological strides not only cater to current applications but also enable the integration of flip chip technology into emerging sectors like Internet of Things (IoT) devices, autonomous vehicles, and advanced medical equipment. As the pace of innovation quickens, the global flip chip market remains at the forefront of semiconductor packaging, ready to meet the evolving needs of industries and consumers.Enhanced Thermal Management

Effective thermal management is a critical factor in modern electronics, especially as devices become more powerful and compact. The flip chip market is driven by its ability to offer superior thermal management solutions compared to traditional packaging methods. By directly attaching semiconductor chips to substrates, flip chip technology enables efficient heat dissipation, preventing overheating and ensuring device reliability. This capability is particularly crucial in applications like data centers, where high-performance computing demands robust cooling solutions. As industries seek to maximize the capabilities of electronic devices, the flip chip's thermal advantages make it a preferred choice. Additionally, as the automotive industry embraces electric and autonomous vehicles, effective thermal management becomes paramount for the safety and longevity of onboard electronics. The flip chip market's capacity to address these thermal challenges positions it as a key driver in the semiconductor packaging landscape.Expansion in IoT and Automotive Sectors

The proliferation of the Internet of Things (IoT) and the rapid evolution of the automotive industry are driving significant growth in the global flip chip market. IoT devices, characterized by their compact size and diverse functionality, rely on semiconductor technology that can meet stringent space and performance requirements. Flip chip packaging excels in this regard, offering a compact footprint, low power consumption, and excellent signal integrity. As the IoT ecosystem continues to expand across smart homes, wearables, healthcare devices, and industrial applications, the flip chip market is poised to capitalize on this growth. In the automotive sector, the rise of electric vehicles (EVs) and autonomous driving technologies has heightened the demand for advanced semiconductors that can withstand the rigors of automotive environments. Flip chip technology's durability, reliability, and thermal management capabilities align perfectly with these demands, making it an indispensable part of modern automotive electronics. As both IoT and automotive sectors continue their expansion, the global flip chip market stands as a pivotal enabler of these transformative technologies, driving its sustained growth and relevance.Key Market Challenges

Technological Complexity and Fragmentation

The Global Flip Chip Market faces significant challenges stemming from the intricate nature of its technology and market fragmentation. Within this market, various flip chip packaging methods and materials coexist, leading to a complex landscape. The diversity of flip chip options, such as copper pillar, solder bump, and fan-out wafer-level packaging, can be overwhelming for both manufacturers and consumers. This technological complexity often results in compatibility issues, where different flip chip technologies may not align with the specific requirements of a particular application. Such complexities can lead to frustration and confusion, particularly for product developers striving to integrate flip chip solutions seamlessly. Furthermore, the fragmentation within the Flip Chip Market extends to variations in substrate materials, underfill compounds, and bonding techniques, further complicating the landscape. To address these challenges, industry stakeholders must work collaboratively to streamline and standardize flip chip technologies, simplifying the selection and integration process for manufacturers and ultimately promoting market growth.Environmental Impact

The widespread adoption of flip chip technology has introduced environmental concerns related to electronic waste (e-waste). As electronic devices utilizing flip chip packaging become more prevalent, the disposal of old or non-functional devices poses a growing environmental challenge. Many consumers and organizations dispose of outdated electronics without proper recycling or disposal, contributing to the mounting problem of e-waste. To address this issue, it is imperative to implement sustainable practices within the flip chip market. Establishing recycling programs for electronic devices containing flip chip components can encourage responsible disposal and minimize the environmental impact. Furthermore, standardizing flip chip designs and promoting the use of interchangeable components can reduce waste generation and simplify recycling efforts. Manufacturers also play a pivotal role in mitigating the environmental impact by adopting eco-friendly manufacturing practices and materials. Incorporating recyclable or biodegradable materials in flip chip production and adopting energy-efficient manufacturing processes contribute to a more sustainable flip chip market. By taking collective actions to address environmental concerns, the flip chip industry can align itself with global sustainability goals and reduce its impact on electronic waste.Standardization of Packaging Methods

One of the notable challenges faced by the flip chip market is the absence of universally accepted packaging standards. Unlike more established industries, flip chip technology lacks a cohesive, widely-adopted standardization framework. This issue is particularly prominent in industries such as consumer electronics and telecommunications, where various product developers and manufacturers may employ different flip chip packaging methods and materials. The absence of a unified standard complicates product compatibility, maintenance, and interchangeability, ultimately affecting user convenience and product development timelines. The development of standardized flip chip packaging methods is crucial to streamline the integration process, reduce costs, and enhance overall market coherence. Collaborative efforts among industry stakeholders are essential to establish common packaging standards that facilitate smoother product development and integration across different sectors.Quality Assurance and Compliance

Ensuring the quality and compliance of flip chip components with international standards remains an ongoing challenge in the flip chip market. Manufacturers must navigate a complex web of regulations and standards encompassing electrical safety, electromagnetic compatibility, and environmental impact. Non-compliance with these standards can result in product recalls, legal liabilities, and reputational damage. The dynamic nature of technology and evolving regulatory landscape necessitate continuous testing, certification, and adherence to emerging standards. Manufacturers must invest in stringent quality assurance processes and stay vigilant to evolving compliance requirements to navigate this complex challenge successfully. Additionally, fostering transparency and traceability in the supply chain can enhance confidence in the quality and compliance of flip chip components, further addressing this challenge in the market.Key Market Trends

Proliferation of Miniaturized Electronics

The global Flip Chip Market is witnessing a surge in growth driven by the proliferation of miniaturized electronic devices across various industries. These compact, high-performance devices have become ubiquitous in our daily lives, powering everything from smartphones and smartwatches to medical devices and automotive electronics. As the demand for smaller, more powerful electronic devices continues to rise, flip chip technology has emerged as a vital enabler. Flip chip packaging offers a space-efficient and high-performance solution, allowing manufacturers to pack more functionality into smaller form factors. This trend is set to persist and expand as industries such as healthcare, IoT, and automotive integrate increasingly miniaturized electronics into their products. The Flip Chip Market's trajectory aligns with the relentless pursuit of innovation in electronics, with flip chip technology positioned at the forefront of enabling this transformation.Advancements in Packaging Materials and Methods

The Flip Chip Market is characterized by rapid advancements in packaging materials and methods. Manufacturers are continually innovating to enhance the performance and reliability of flip chip components. Materials like copper pillars and solder bumps are being refined to improve electrical and thermal conductivity, enabling faster data transfer and better heat dissipation. Additionally, fan-out wafer-level packaging (FOWLP) is gaining traction for its ability to accommodate multiple dies and complex designs, offering a cost-effective and versatile solution. The market's focus on materials and methods extends to underfill compounds, encapsulation techniques, and bonding processes, all aimed at improving flip chip reliability and durability. As the demand for high-performance electronics grows, these advancements will remain pivotal in shaping the future of the Flip Chip Market.Rise of Heterogeneous Integration

Heterogeneous integration is emerging as a transformative trend within the Flip Chip Market. This approach involves combining different semiconductor technologies, such as logic, memory, and sensors, into a single package, enabling enhanced functionality and performance. Heterogeneous integration leverages flip chip technology to interconnect diverse components, creating synergies between traditionally separate systems. This trend is particularly significant in applications like artificial intelligence (AI), autonomous vehicles, and data centers, where diverse semiconductor technologies must work seamlessly together. The adoption of heterogeneous integration is set to grow as industries seek to unlock new capabilities and improve the efficiency of electronic systems.Sustainability and Environmental Responsibility

Environmental sustainability has become a central theme in the Flip Chip Market, mirroring global concerns about climate change and resource conservation. Manufacturers are increasingly focusing on sustainable practices, including the use of eco-friendly materials, energy-efficient manufacturing processes, and recycling initiatives. Flip chip components that adhere to strict environmental standards are gaining favor among environmentally conscious consumers and organizations. The market's commitment to sustainability extends beyond compliance; it represents a collective effort to minimize the environmental impact of electronic waste (e-waste) and reduce energy consumption. As sustainability takes center stage, the Flip Chip Market is poised to evolve into a more environmentally responsible and conscientious industry.Digital Transformation of Supply Chains

The Flip Chip Market is experiencing a digital transformation of its supply chains, similar to the trends seen in the Flip Chip market. The rapid expansion of e-commerce and online retail channels has revolutionized the way consumers and businesses access flip chip components. Online platforms provide consumers with unprecedented access to a wide range of flip chip products from various manufacturers and vendors. This digital convenience allows consumers to compare prices, read reviews, and make informed purchasing decisions. For manufacturers and suppliers, e-commerce has opened up global markets, enabling them to reach a broader customer base. As the digitalization of supply chains continues to reshape the market dynamics, the Flip Chip Market is poised to benefit from increased accessibility, competition, and consumer empowerment.Segmental Insights

Packaging Technology Insights

In 2022, within the Global Flip Chip Market, the Ball Grid Array (BGA) packaging technology segment asserted its dominance and is expected to maintain its prominent position throughout the forecast period. BGA packaging, particularly in its advanced iterations like 2.5D and 3D configurations, emerged as the preferred choice for semiconductor packaging due to its exceptional versatility and performance capabilities. BGA packaging offers a compact and highly efficient solution for interconnecting semiconductor dies, making it ideal for a wide range of applications across industries. The domination of BGA packaging can be attributed to several key factors. First and foremost, 2.5D and 3D BGA configurations enable the integration of multiple semiconductors dies into a single package, fostering enhanced functionality and performance within a smaller footprint. This aligns perfectly with the prevailing trend of miniaturization in electronic devices, where consumers and industries demand smaller yet more powerful gadgets. Additionally, BGA packaging excels in managing thermal dissipation, which is crucial for modern high-performance electronics. As electronic devices become more powerful and heat-sensitive, the superior thermal management offered by BGA packaging becomes a critical advantage.Furthermore, BGA packaging technology's compatibility with a wide range of semiconductor devices, including CPUs, GPUs, memory chips, and sensors, further solidifies its dominance. It can accommodate diverse components within a single package, facilitating heterogeneous integration, a trend gaining significant traction in applications like artificial intelligence, autonomous vehicles, and data centers. Moreover, BGA's robust electrical and mechanical connections ensure reliable performance, making it suitable for mission-critical applications. The enduring dominance of BGA packaging technology in the Global Flip Chip Market is a testament to its adaptability, efficiency, and ability to address the evolving demands of the semiconductor industry. As industries continue to advance technologically and seek more compact and powerful electronic solutions, BGA packaging, especially in its advanced 2.5D and 3D forms, is poised to remain the preferred choice for semiconductor packaging, driving the market's growth and innovation in the coming years.

Wafer Bumping Process Insights

In 2022, the copper pillar wafer bumping process dominated the global flip chip market and is expected to maintain its dominance during the forecast period. Copper pillar bumping is a widely adopted wafer bumping technique that offers several advantages over other processes. It involves the deposition of copper pillars on the wafer surface, which serve as the interconnects between the chip and the substrate. Copper pillar bumping provides superior electrical performance, high signal integrity, and improved thermal dissipation compared to other wafer bumping processes. It also offers better reliability and scalability, making it suitable for a wide range of applications, including consumer electronics, automotive, telecommunications, and industrial sectors. The increasing demand for high-performance and miniaturized electronic devices, coupled with the need for improved functionality and reliability, has driven the dominance of copper pillar wafer bumping in the flip chip market. Additionally, the transition towards lead-free and environmentally friendly manufacturing processes has further boosted the adoption of copper pillar bumping, as it eliminates the use of hazardous materials such as lead. Overall, the copper pillar wafer bumping process is expected to continue dominating the global flip chip market due to its superior performance, reliability, and compatibility with various semiconductor devices.Product Insights

In 2022, the System-on-Chip (SoC) segment dominated the global flip chip market and is expected to maintain its dominance during the forecast period. SoC refers to an integrated circuit that combines multiple functionalities and components onto a single chip, including processors, memory, and other system components. The increasing demand for compact and power-efficient electronic devices, such as smartphones, tablets, and wearable devices, has driven the dominance of SoCs in the flip chip market. SoCs offer several advantages, including reduced form factor, improved performance, and lower power consumption. They enable the integration of multiple functions onto a single chip, resulting in enhanced efficiency and cost-effectiveness. The growing adoption of advanced technologies, such as 5G, artificial intelligence, and Internet of Things (IoT), further fuels the demand for SoCs in various industries, including consumer electronics, automotive, and healthcare. Additionally, the continuous advancements in semiconductor manufacturing processes, such as miniaturization and improved transistor density, have facilitated the development of more powerful and efficient SoCs. These factors contribute to the dominance of the SoC segment in the global flip chip market and are expected to drive its growth in the forecast period.Regional Insights

In 2022, Asia Pacific dominated the global flip chip market and is expected to maintain its dominance during the forecast period. The region's dominance can be attributed to several factors. Firstly, Asia Pacific is home to some of the largest semiconductor manufacturing hubs, including China, Taiwan, South Korea, and Japan. These countries have a strong presence in the global electronics industry and are major contributors to the production of flip chip-based devices. The region's well-established supply chain, advanced manufacturing capabilities, and technological expertise give it a competitive edge in the global market. Furthermore, the increasing demand for consumer electronics, such as smartphones, tablets, and wearable devices, in Asia Pacific drives the growth of the flip chip market. The region has a large population with a rising middle class, leading to higher disposable incomes and increased consumer spending on electronic devices. This, in turn, fuels the demand for flip chip technology, which offers advantages such as miniaturization, improved performance, and higher reliability.Moreover, Asia Pacific is witnessing significant growth in industries such as automotive, healthcare, and telecommunications, which are major consumers of flip chip-based components. The region's focus on technological advancements, research and development, and government initiatives to promote innovation further contribute to its dominance in the global flip chip market. Additionally, the presence of key market players, collaborations between industry stakeholders, and favorable government policies supporting the semiconductor industry in Asia Pacific strengthen its position in the global market. These factors, combined with the region's growing manufacturing capabilities and expanding consumer base, are expected to maintain its dominance in the flip chip market during the forecast period.

Report Scope:

In this report, the Global Flip Chip Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Flip Chip Market, By Wafer Bumping Process:

- Copper Pillar

- Tin-Lead Eutectic Solder

- Lead-Free Solder

- Gold Stud Bumping

Flip Chip Market, By Packaging Technology:

- BGA (2.1D/2.5D/3D)

- CSP

Flip Chip Market, By Product:

- Memory

- Light Emitting Diode

- CMOS Image Sensor

- SoC

- GPU

- CPU

Flip Chip Market, By End User:

- Military and Defense

- Medical and Healthcare

- Industrial Sector

- Automotive

- Consumer Electronics

- Telecommunications

Flip Chip Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Flip Chip Market.Available Customizations:

Global Flip Chip market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- Samsung Electronics Co., Ltd.

- Advanced Micro Devices, Inc. (AMD)

- Amkor Technology, Inc.

- ASE Group

- Texas Instruments Incorporated

- GlobalFoundries Inc.

- Powertech Technology Inc.

- Siliconware Precision Industries Co., Ltd. (SPIL)

Table Information

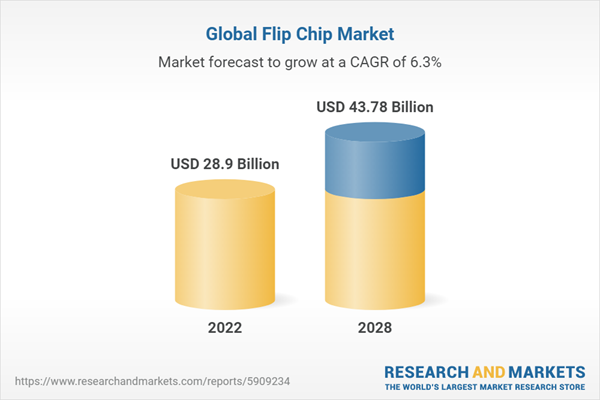

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 28.9 Billion |

| Forecasted Market Value ( USD | $ 43.78 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |