Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In conclusion, the Global Data Center Cooling Market is experiencing a profound transformation, driven by the imperative of efficiency and sustainability in data center operations. These solutions stand as the vanguard of data center management, ensuring the efficient and environmentally conscious operation of data centers, which are the backbone of our increasingly digital world. As data center technology continues to advance, the pivotal role of Data Center Cooling in shaping the future of data center sustainability and efficiency is indisputable, fostering innovation, resilience, and unwavering confidence in an ever-evolving digital landscape.

Key Market Drivers:

Escalating Demand for Data Center Infrastructure:

The first driving factor in the Global Data Center Cooling Market is the escalating demand for data center infrastructure. In our increasingly digital world, data centers have become the backbone of various industries, ranging from e-commerce and cloud computing to healthcare and finance. The rapid growth of data generation and consumption, driven by factors like IoT (Internet of Things), big data analytics, and the proliferation of digital services, has fueled the expansion of data center facilities. As organizations expand their data center footprints to meet the growing demand for computing power and storage capacity, the need for efficient cooling solutions becomes paramount.Data centers generate a significant amount of heat due to the operation of servers, storage devices, and networking equipment. This excess heat, if not effectively managed, can lead to equipment overheating, reduced performance, and even equipment failure. Therefore, the demand for advanced Data Center Cooling solutions that can maintain optimal operating temperatures, improve equipment reliability, and enhance overall data center efficiency is on the rise.

Environmental Sustainability and Energy Efficiency Goals:

The second key driving factor in the Global Data Center Cooling Market is the increasing focus on environmental sustainability and energy efficiency. Data centers are notorious energy consumers, and their energy consumption is closely scrutinized in the context of global efforts to reduce carbon emissions and combat climate change. Many organizations and governments worldwide have set ambitious sustainability goals, such as achieving carbon neutrality and reducing energy consumption. Data Center Cooling plays a crucial role in helping data centers become more energy-efficient and environmentally friendly. Traditional cooling methods, such as air conditioning, can be energy-intensive. In response to these challenges, innovative cooling technologies and practices have emerged, including free cooling, liquid cooling, and hot/cold aisle containment. These solutions aim to reduce the energy required for cooling, minimize carbon footprints, and align data center operations with sustainability objectives.Growth of Edge Computing and Hyperscale Data Centers:

The third driving factor is the growth of edge computing and hyperscale data centers. Edge computing refers to the decentralization of data processing and storage, bringing computing resources closer to the point of data generation and consumption. Edge data centers, located in various regions to support low-latency applications, have unique cooling requirements due to their distributed nature. They need efficient and scalable cooling solutions to maintain the optimal operating conditions of IT equipment in diverse environments.Hyperscale data centers, on the other hand, are massive facilities designed to handle substantial workloads, such as those of cloud providers and large enterprises. These data centers demand advanced cooling solutions that can deliver high levels of efficiency and cost-effectiveness to accommodate their scale and performance requirements. As the adoption of edge computing and hyperscale data centers continues to grow, the demand for innovative Data Center Cooling solutions tailored to these specific needs is driving market growth.

In summary, the Global Data Center Cooling Market is experiencing significant growth driven by the increasing demand for data center infrastructure, the imperative of environmental sustainability and energy efficiency, and the growth of edge computing and hyperscale data centers. These factors collectively contribute to the expansion and evolution of the Data Center Cooling industry, with a focus on delivering efficient, reliable, and sustainable cooling solutions for the data centers of today and tomorrow.

Key Market Challenges

Energy Efficiency and Sustainability Challenges:

One of the foremost challenges in the Global Data Center Cooling Market is achieving and maintaining energy efficiency and sustainability. Data centers are notorious for their high energy consumption, which has become a pressing concern in an era characterized by increasing environmental awareness and stringent regulations to combat climate change.Data center cooling systems often consume a substantial portion of the total energy used by a data center. Traditional cooling methods, such as computer room air conditioning (CRAC) units, can be inefficient, especially in older facilities. Achieving optimal energy efficiency while maintaining the required cooling capacity is a significant technical challenge.

The environmental impact of data centers, including their carbon footprint, is a growing concern. Many organizations are setting ambitious sustainability goals, aiming for carbon neutrality and reduced energy consumption. Cooling systems must align with these objectives, which can be challenging given the inherent cooling demands of data centers.

Effectively utilizing the waste heat generated by data center cooling systems remains a challenge. While some data centers use the waste heat for nearby facilities or district heating, widespread adoption of this practice is limited. Finding viable applications for waste heat and implementing heat reuse solutions is a complex task.

Scalability and Flexibility Challenges:

Another significant challenge in the Data Center Cooling Market is scalability and flexibility. Data centers are dynamic environments, and their cooling needs can change rapidly due to factors like server consolidation, technology upgrades, and shifting workloads.Data centers often need to scale up or down quickly to accommodate changing computing requirements. Cooling solutions should be modular and adaptable to allow for seamless expansion or contraction of cooling capacity without disrupting operations.

The rise of high-density computing, driven by technologies like AI and HPC (high-performance computing), places greater demands on cooling systems. Cooling solutions must effectively handle the concentrated heat generated by densely packed servers and equipment.

Many organizations operate in hybrid or multi-cloud environments, which involve a combination of on-premises and cloud-based resources. Achieving consistent and efficient cooling across these heterogeneous environments can be challenging.

Cost Management and ROI Challenges:

Cost management and return on investment (ROI) are persistent challenges in the Data Center Cooling Market. While energy-efficient cooling solutions can reduce operational costs, the initial investment and ongoing maintenance costs can be significant.Implementing advanced cooling solutions, such as liquid cooling or indirect free cooling, often requires a substantial upfront investment. Organizations may struggle to justify these capital expenditures, particularly in older data centers.

Managing the ongoing operational costs of cooling systems is crucial. This includes expenses related to electricity, maintenance, and monitoring. Balancing efficiency gains with operational costs while maintaining uptime can be a complex financial challenge.

Calculating the ROI of cooling system upgrades can be challenging, as it involves factors such as energy savings, equipment lifespan, and potential business disruptions during installation. Accurately estimating the payback period and long-term cost benefits is essential for informed decision-making.

In conclusion, the Global Data Center Cooling Market faces significant challenges related to energy efficiency and sustainability, scalability and flexibility, and cost management and ROI. Addressing these challenges requires innovative solutions, ongoing research and development, and collaboration between data center operators, equipment manufacturers, and environmental policymakers to create a more sustainable and efficient future for data center cooling.

Key Market Trends

Adoption of Liquid Cooling Technologies

The Data Center Cooling Market is witnessing a significant trend towards the adoption of liquid cooling technologies. As data centers continue to increase in power density due to the proliferation of high-performance computing (HPC) and artificial intelligence (AI) workloads, traditional air-based cooling methods are facing limitations in effectively dissipating the heat generated by densely packed servers and hardware.One of the most noteworthy developments is the growing adoption of immersion cooling, where servers and electronic components are submerged in a non-conductive liquid coolant. This approach provides direct and efficient heat removal, allowing data centers to achieve higher power densities while reducing energy consumption for cooling. Immersion cooling solutions are particularly appealing for hyperscale data centers and those focused on HPC applications.

Liquid cooling is also evolving to become more granular, with solutions that target individual server components, such as CPUs and GPUs. Direct-to-chip cooling solutions utilize microchannels and heat exchangers to deliver coolant directly to hot spots on server components, enhancing cooling efficiency and enabling higher computational performance.

Liquid cooling aligns with environmental sustainability goals, as it often requires less energy compared to traditional air conditioning systems. Additionally, the use of dielectric fluids that are non-toxic and non-flammable ensures safety and environmental compatibility.

Edge Data Center Cooling Solutions

The proliferation of edge computing, driven by the need for low-latency processing and real-time data analysis, is fueling a trend in specialized cooling solutions for edge data centers. Edge data centers are often located in diverse environments, including remote or harsh settings, where temperature control can be challenging.To address the unique requirements of edge data centers, manufacturers are developing compact and modular cooling systems that can be easily deployed in constrained spaces. These solutions are designed for scalability and can accommodate the fluctuating demands of edge computing workloads.

Some edge data centers are exploring eco-friendly cooling solutions, such as outdoor air cooling or free cooling, which leverage the local environment for temperature control. These approaches reduce energy consumption and environmental impact while optimizing performance.

Edge data center operators are increasingly adopting advanced monitoring and automation tools to remotely manage and optimize cooling systems. These tools provide real-time insights into temperature and humidity conditions, allowing for proactive maintenance and energy-efficient operation.

Artificial Intelligence-Driven Cooling Optimization

The integration of artificial intelligence (AI) and machine learning (ML) into data center infrastructure management (DCIM) is revolutionizing cooling optimization. AI-driven algorithms are capable of analyzing vast datasets related to temperature, humidity, server loads, and airflow patterns to make real-time adjustments to cooling systems.AI algorithms can predict potential hotspots and cooling inefficiencies, allowing data center operators to take proactive measures to prevent overheating and downtime. Predictive analytics also optimize the operation of cooling systems, reducing energy consumption.

AI-driven DCIM platforms enable adaptive cooling, where cooling resources are dynamically allocated based on workload demands. This ensures that cooling is provided precisely where and when it is needed, avoiding overcooling and reducing energy waste.

AI-based cooling optimization contributes to significant energy savings, reducing operational costs and environmental impact. Data center operators are increasingly prioritizing energy-efficient cooling solutions to align with sustainability goals and improve the overall cost-effectiveness of their operations.

In summary, the Global Data Center Cooling Market is witnessing trends that embrace liquid cooling technologies, cater to the specific needs of edge data centers, and leverage AI-driven optimization for improved energy efficiency and performance. These trends reflect the industry's commitment to addressing the challenges posed by rising power densities and the demand for environmentally responsible cooling solutions in the ever-evolving data center landscape.

Segmental Insights

Product Insights

Air conditioners is the dominating segment in the global data center cooling market. There are a few reasons for the dominance of the air conditioners segment. First, air conditioners are the most mature and widely used data center cooling technology. Second, air conditioners are relatively inexpensive and easy to install. Third, air conditioners are effective at cooling small to medium-sized data centers.Here are some of the key factors driving the growth of the air conditioners segment in the global data center cooling market:The increasing demand for data center space: The growing demand for data center space is driving the demand for air conditioners, as they are the most widely used data center cooling technology.

The increasing adoption of cloud computing: The increasing adoption of cloud computing is also driving the demand for air conditioners, as cloud computing providers need to cool their large data centers.The growing awareness of energy efficiency: Data center operators are becoming more aware of the importance of energy efficiency, and air conditioners are a relatively energy-efficient data center cooling technology.However, the liquid cooling segment is expected to grow at a faster rate than the air conditioners segment during the forecast period. This is due to the increasing demand for high-performance computing (HPC) and artificial intelligence (AI) applications, which generate a lot of heat and require more efficient cooling solutions.

Overall, air conditioners is the dominating segment in the global data center cooling market due to its maturity, wide use, and affordability. However, the liquid cooling segment is expected to grow at a faster rate in the coming years due to the increasing demand for high-performance computing and artificial intelligence applications.

Regional Insights

North America is the dominating region in the global data center cooling market.There are a few reasons for the dominance of North America in the global data center cooling market. First, North America is home to some of the largest and most advanced data centers in the world. Second, there is a high demand for data center cooling in North America due to the growing adoption of cloud computing and other data-intensive applications. Third, there are a number of leading data center cooling companies headquartered in North America.

Here are some of the key factors driving the growth of the data center cooling market in North America:

The increasing demand for data center space: The growing demand for data center space in North America is driving the demand for data center cooling solutions.The increasing adoption of cloud computing: The increasing adoption of cloud computing in North America is also driving the demand for data center cooling solutions, as cloud computing providers need to cool their large data centers.The growing awareness of energy efficiency: Data center operators in North America are becoming more aware of the importance of energy efficiency, and they are looking for data center cooling solutions that can help them to reduce their energy costs.Overall, North America is the dominating region in the global data center cooling market due to its large and advanced data center infrastructure, high demand for data center cooling, and the presence of a number of leading data center cooling companies. The growth of the market in the region is being driven by the increasing demand for data center space, the increasing adoption of cloud computing, and the growing awareness of energy efficiency.Report Scope:

In this report, the Global Data Center Cooling Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Data Center Cooling Market, By Product:

- Air Conditioners

- Precision Air Conditioners

- Liquid Cooling

- Air Handling Unit

- Others

Data Center Cooling Market, By Data Center Type:

- Large Scale

- Medium Scale

- Small Scale

Data Center Cooling Market, By Cooling Technique:

- Room-based Cooling

- Rack-based Cooling

- Row-based Cooling

Data Center Cooling Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Data Center Cooling Market.Available Customizations:

Global Data Center Cooling market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schneider Electric SE

- Vertiv Co.

- Rittal GmbH & Co. KG

- STULZ GmbH

- Airedale International Air Conditioning Ltd

- Mitsubishi Electric Corporation

- Johnson Controls International plc

- Asetek A/S

- Black Box Corporation

- Nortek Air Solutions, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

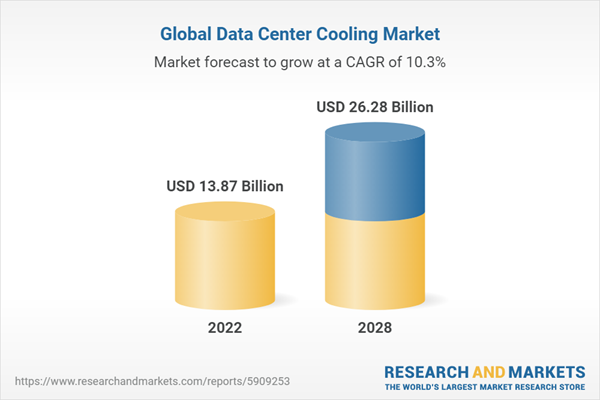

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 13.87 Billion |

| Forecasted Market Value ( USD | $ 26.28 Billion |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |