Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Compressed Natural Gas (CNG) market refers to the sector of the global energy industry dedicated to the production, distribution, and utilization of natural gas that has been compressed to reduce its volume and increase its portability as a vehicle fuel. CNG is a cleaner and more environmentally friendly alternative to traditional fossil fuels like gasoline and diesel due to its lower emissions of pollutants and greenhouse gases.

In this market, natural gas is compressed to high pressures and stored in specially designed tanks, making it suitable for use in a variety of transportation applications, including cars, buses, trucks, and even ships. CNG is considered a viable energy source for both private and public transportation, offering economic and environmental benefits.

Key components of the CNG market include the development of refueling infrastructure, the production and distribution of compressed natural gas, the manufacturing of CNG-powered vehicles and equipment, and regulatory policies that promote its adoption. As governments and industries worldwide seek cleaner and more sustainable energy solutions, the CNG market plays a pivotal role in reducing emissions, improving air quality, and advancing energy security.

Key Market Drivers

Environmental Concerns and Regulatory Policies

The global Compressed Natural Gas (CNG) market has been significantly influenced by growing environmental concerns and stringent regulatory policies aimed at reducing greenhouse gas emissions. As the world grapples with the detrimental effects of climate change, governments and international organizations have been pushing for cleaner energy alternatives to combat air pollution and reduce carbon footprints. CNG, as a low-emission fuel, has gained traction due to its potential to lower carbon dioxide (CO2) and other harmful emissions compared to conventional fossil fuels like gasoline and diesel.Numerous countries have implemented policies and incentives to promote CNG adoption. These measures include tax breaks, subsidies for CNG infrastructure development, and emissions reduction targets. Additionally, regulatory standards such as Euro VI in Europe and the Environmental Protection Agency's (EPA) emissions limits in the United States have set strict limits on vehicle emissions, further driving the CNG market's growth. In regions where pollution is a significant concern, like urban areas in Asia and Latin America, CNG has become an attractive option for public transportation and commercial fleets.

Energy Security and Diversification

Energy security and diversification represent another crucial driver of the global CNG market. Many nations are seeking ways to reduce their dependence on imported oil and natural gas, which can be susceptible to price fluctuations and geopolitical tensions. CNG is often sourced domestically or regionally, providing a stable and reliable energy source that can enhance energy security.Countries with abundant natural gas reserves, such as the United States and Russia, have embraced CNG as a means of utilizing their own resources and reducing reliance on foreign oil. This strategy can insulate nations from global energy market volatility, ensuring a stable energy supply even in times of geopolitical instability or supply disruptions.

Moreover, CNG can be used to diversify a nation's energy mix, promoting energy resilience and sustainability. By incorporating CNG into the transportation and industrial sectors, countries can reduce their vulnerability to oil price shocks and improve overall energy stability.

Economic Viability and Cost Savings

The economic viability of CNG has been a compelling driver for its adoption in the global market. CNG is often more cost-effective than traditional gasoline and diesel fuels, making it an attractive option for both consumers and businesses. The lower price of natural gas, combined with reduced maintenance costs for CNG vehicles, results in substantial savings over the life of the vehicle.Additionally, CNG can offer businesses a competitive advantage by reducing their operational costs. Fleet operators, in particular, have been keen to embrace CNG due to its cost-effectiveness. The payback period for investments in CNG infrastructure and vehicles can be relatively short, making it an appealing choice for organizations looking to improve their bottom line.

Technological Advancements

Advancements in CNG technology have played a pivotal role in driving market growth. Innovations in CNG storage and compression systems have improved vehicle range and efficiency. High-pressure CNG cylinders, lightweight materials, and advanced compression techniques have made CNG vehicles more practical and appealing to consumers. Additionally, advancements in engine technology have enhanced the performance of CNG-powered vehicles, making them a viable alternative to traditional gasoline and diesel engines.Furthermore, the development of biomethane as a renewable CNG source has opened up new possibilities for reducing carbon emissions even further. This innovation allows CNG to be produced from organic waste materials, providing a sustainable and environmentally friendly option for transportation fuel.

Increasing Urbanization and Congestion

Rapid urbanization and growing urban congestion have been driving forces behind the adoption of CNG in the global market. In densely populated urban areas, air quality deteriorates due to vehicular emissions, leading to health issues and environmental degradation. CNG offers a cleaner and more sustainable alternative for public transportation and commercial fleets operating in cities.Governments and city authorities in many parts of the world are actively promoting the use of CNG for public transit systems, taxis, and other high-mileage urban vehicles. CNG's lower emissions and reduced noise pollution contribute to improved air quality and a better quality of life for urban residents.

Public Awareness and Corporate Sustainability Initiatives

Public awareness of environmental issues and corporate sustainability initiatives have also contributed to the growth of the global CNG market. Consumers are increasingly conscious of the environmental impact of their choices, including their transportation decisions. As a result, there is a growing demand for eco-friendly transportation options.Many companies have recognized the importance of adopting sustainable practices and reducing their carbon footprint. Corporate fleets are transitioning to CNG as part of their sustainability efforts, not only to meet regulatory requirements but also to align with their corporate social responsibility goals. This shift in mindset has further accelerated the adoption of CNG as a clean and sustainable transportation fuel.

In conclusion, the global CNG market is being driven by a combination of environmental concerns, energy security, economic benefits, technological advancements, urbanization, and sustainability initiatives. These drivers are likely to continue shaping the market as governments, businesses, and consumers seek cleaner and more sustainable energy solutions in the coming years.

Government Policies are Likely to Propel the Market

Emission Reduction Targets and Incentives

One of the key government policies driving the global Compressed Natural Gas (CNG) market is the establishment of emission reduction targets and associated incentives. In the face of mounting concerns over air quality and climate change, governments worldwide have set ambitious goals to reduce greenhouse gas emissions from the transportation sector. CNG, known for its lower carbon dioxide (CO2) and pollutant emissions compared to conventional fuels, has emerged as a favored option to help meet these targets.To encourage the adoption of CNG, governments have implemented various policies. These include tax incentives, subsidies for CNG vehicle purchases, and grants for building CNG refueling infrastructure. In addition, some regions have established emission standards that favor CNG-powered vehicles, providing an economic advantage for cleaner transportation options. These policies not only stimulate demand for CNG but also contribute to the reduction of harmful emissions and improved air quality.

Renewable Natural Gas (RNG) Mandates

Renewable Natural Gas (RNG), often derived from organic waste materials, has gained significant attention as a sustainable and low-carbon alternative to conventional natural gas. Governments are increasingly introducing policies that mandate the inclusion of RNG in the natural gas supply, thus promoting the growth of the CNG market.These mandates typically require a certain percentage of the natural gas supply to come from renewable sources. By blending RNG with conventional natural gas, CNG becomes an even more environmentally friendly option, as RNG is considered carbon-neutral or even carbon-negative, depending on its production process. Government support for RNG not only benefits the environment but also encourages the expansion of CNG infrastructure and vehicle fleets powered by cleaner fuels.

Vehicle Emission Standards and Incentives

Government policies regarding vehicle emission standards have a direct impact on the adoption of CNG vehicles. Many countries and regions have set stringent emissions limits for automobiles to curb air pollution and mitigate climate change. CNG vehicles, known for their lower emissions of nitrogen oxides (NOx) and particulate matter, often comply with these standards more easily than traditional gasoline or diesel vehicles.To incentivize the adoption of cleaner transportation options, governments offer various benefits to CNG vehicle owners and operators. These may include reduced vehicle registration fees, exemptions from congestion charges, and access to high-occupancy vehicle lanes. In some cases, government fleets are required to include a certain percentage of alternative fuel vehicles, including CNG, further driving demand and innovation in the sector.

Investment in CNG Infrastructure

The development of a robust CNG infrastructure is critical for the growth of the CNG market. Governments play a pivotal role in facilitating this infrastructure expansion through strategic investments and policies. Policies may include grants, subsidies, or tax incentives for the construction and maintenance of CNG refueling stations.Furthermore, governments often collaborate with private sector partners to establish a network of CNG refueling stations along major highways and urban centers. By ensuring convenient access to CNG fueling, governments aim to eliminate one of the primary barriers to CNG adoption and encourage the widespread use of CNG for both public and private transportation.

Public Transportation Initiatives

Governments are increasingly prioritizing sustainable public transportation options to reduce traffic congestion, improve air quality, and decrease greenhouse gas emissions. CNG-powered buses and transit fleets have become a focal point of these initiatives due to their environmental benefits and cost-effectiveness.Government policies related to public transportation often involve financial support for the purchase of CNG buses, subsidies for transit agencies, and dedicated lanes or priority access for CNG-powered vehicles. These policies not only promote the use of CNG but also contribute to the development of a reliable and efficient public transportation system that benefits communities and reduces overall transportation emissions.

International Trade Agreements and Standards

The global nature of the CNG market necessitates international cooperation and the establishment of harmonized standards. Governments around the world are engaged in trade agreements and collaborations to facilitate the cross-border movement of CNG technology, vehicles, and infrastructure components.These agreements often involve the development of common technical standards, safety regulations, and certification processes for CNG equipment and vehicles. By streamlining international trade and ensuring product compatibility, governments aim to foster a competitive global CNG market that can flourish and address environmental and energy security challenges on a broader scale.

In conclusion, government policies in the global Compressed Natural Gas market encompass a wide range of initiatives, from emissions reduction targets and incentives to renewable natural gas mandates and infrastructure investments. These policies collectively drive the growth of the CNG market, support environmental goals, and contribute to a more sustainable and resilient transportation sector.

Key Market Challenges

Infrastructure Development and Accessibility

One of the primary challenges facing the global Compressed Natural Gas (CNG) market is the need for extensive infrastructure development and the associated issues of accessibility. Unlike conventional gasoline and diesel fuels, which have well-established distribution networks and refueling stations worldwide, CNG infrastructure is still in the process of expansion in many regions.Infrastructure Investment: Developing a comprehensive CNG infrastructure network involves significant capital investment, particularly for building refueling stations, pipelines, and compression facilities. Governments, private investors, and energy companies must collaborate to finance these projects, which can be a barrier in regions with limited resources or competing priorities.

Accessibility in Rural Areas: CNG infrastructure tends to be concentrated in urban and industrial areas, making it less accessible in rural or remote regions. This lack of accessibility can deter individuals and businesses in these areas from adopting CNG vehicles, limiting its market penetration.

Interoperability and Standards: The global CNG market could benefit from standardized infrastructure to ensure compatibility between different vehicle types and refueling stations. Without international standardization, vehicle owners may face challenges when traveling to regions with varying CNG infrastructure specifications.

Solutions: To address these infrastructure challenges, governments and industry stakeholders should work together to invest in and expand CNG infrastructure, particularly in underserved areas. Promoting public-private partnerships, incentivizing infrastructure development, and establishing clear technical standards can facilitate the growth of the CNG market and make it more accessible to a broader range of consumers and businesses.

Price Volatility and Supply Reliability

Price volatility and supply reliability pose significant challenges to the global CNG market, impacting its attractiveness as an alternative fuel source. While natural gas is often considered more stable in price compared to petroleum-based fuels, it is not immune to market fluctuations and supply disruptions.Natural Gas Price Fluctuations: The price of natural gas can be subject to fluctuations influenced by factors such as global energy demand, production levels, geopolitical events, and weather conditions. Sudden price spikes can affect the cost-effectiveness of CNG as a fuel option, potentially discouraging its adoption.

Supply Dependence: Many regions rely on a limited number of natural gas suppliers, which can create vulnerabilities in the supply chain. Dependence on a single supplier or a small group of suppliers can expose consumers to supply disruptions due to geopolitical tensions, production interruptions, or infrastructure failures.

Lack of Diversification: A lack of diversification in the sources of natural gas can further exacerbate supply reliability issues. Encouraging the development and utilization of alternative natural gas sources, such as renewable natural gas (RNG) derived from organic waste, can mitigate these concerns.

Solutions: To address price volatility and supply reliability challenges, stakeholders in the CNG market should consider diversifying their natural gas sources, investing in domestic production and RNG technologies, and exploring long-term supply agreements to secure stable pricing. Additionally, governments can support policies that promote energy diversification and resilience in the face of supply disruptions.

In conclusion, while the global Compressed Natural Gas (CNG) market presents numerous environmental and economic benefits, it is not without its challenges. Infrastructure development and accessibility issues, including the need for significant investments and addressing accessibility gaps, remain prominent hurdles. Additionally, price volatility and supply reliability concerns underscore the importance of diversifying natural gas sources and securing stable pricing mechanisms. Addressing these challenges requires collaborative efforts from governments, industry stakeholders, and the broader energy community to promote the growth and sustainability of the CNG market.

Segmental Insights

Associated Gas Insights

The Associated Gas segment had the largest market share in 2022 & expected to maintain it in the forecast period. Associated Gas is produced alongside crude oil in oil reservoirs. When oil wells are drilled, they often release natural gas as a byproduct. This co-production of oil and gas makes associated gas readily available at the same location, simplifying the process of capturing and utilizing it for various purposes, including CNG production. Since associated gas is produced alongside oil, capturing and processing it for CNG can be cost-effective. The cost of drilling, extracting, and transporting associated gas can be lower than for non-associated gas, which requires separate exploration and drilling efforts. This economic advantage has made associated gas a preferred source for CNG in many oil-producing regions. Flaring, the practice of burning off excess associated gas at oil wells, is both wasteful and environmentally harmful. Many governments and international organizations have imposed regulations and restrictions on gas flaring to reduce greenhouse gas emissions. Utilizing associated gas for CNG instead of flaring it aligns with environmental goals, making it a more attractive option for oil companies. Associated gas production tends to be stable and consistent over time as long as oil production continues. This reliability in supply makes it a dependable source for CNG production, particularly for meeting the demands of transportation and industrial sectors. Using associated gas for CNG, it ensures the efficient utilization of a valuable energy resource that might otherwise be wasted. This aligns with broader energy efficiency and resource conservation goals, which are of increasing importance in today's world. Some governments incentivize the utilization of associated gas to reduce flaring and promote cleaner energy sources like CNG. These policies encourage oil companies to capture and process associated gas for beneficial use, further boosting its dominance in the CNG market.Medium Or Heavy Duty Trucks Insights

The Medium Or Heavy Duty Trucks segment had the largest market share in 2022 and is projected to experience rapid growth during the forecast period. Medium and heavy-duty trucks typically have larger engines and higher fuel consumption compared to passenger vehicles. CNG is known for its cost-effective and eco-friendly nature. It can offer significant fuel savings, making it an attractive option for businesses that operate a fleet of such vehicles. Many countries and regions have stringent emissions regulations for heavy-duty vehicles. CNG is considered a cleaner alternative to diesel or gasoline, as it emits fewer greenhouse gases and pollutants. This makes it an appealing choice for trucking companies looking to comply with environmental regulations. While the initial cost of converting or purchasing CNG-powered trucks may be higher than traditional diesel vehicles, the lower cost of CNG fuel can result in substantial long-term savings. Over time, these savings can outweigh the initial investment. Governments in various countries often provide incentives, tax breaks, or subsidies to encourage the adoption of CNG vehicles. These incentives can make it more financially attractive for businesses to invest in CNG trucks, particularly in regions where natural gas is abundant. The availability of CNG refueling infrastructure is crucial for the adoption of CNG-powered vehicles. In some regions, governments or private companies have invested in building an extensive CNG refueling network, which further encourages the use of CNG in medium and heavy-duty trucks. Medium and heavy-duty trucks are commonly used for long-distance hauling and transportation of goods. CNG can offer a longer driving range compared to electric vehicles, making it a practical choice for these applications. Many companies have set sustainability and emissions reduction goals. Switching to CNG trucks can be a part of their strategy to reduce their carbon footprint and meet these targets. CNG technology for medium and heavy-duty trucks has been around for some time and is well-established. This reliability and experience with the technology make it a dependable choice for commercial applications. Reducing dependence on imported oil is a priority for many nations. Utilizing domestically sourced natural gas for transportation helps enhance energy security, which can be a significant driver for the adoption of CNG in commercial fleets. Advances in CNG engine technology, including improvements in fuel storage, engine efficiency, and emissions control, continue to make CNG a more attractive option for medium and heavy-duty trucks..Regional Insights

Asia Pacific

Asia Pacific held the largest market for CNG, accounting for over 50% of the global market share in 2022. The region is home to some of the largest CNG consumers in the world, including China, India, and Pakistan. The growth of the CNG market in Asia Pacific is attributed to a number of factors, including:

Rising air pollution levels in major cities, which are driving demand for cleaner fuels.Government initiatives to promote the use of CNG, such as subsidies and tax breaks.

Growing demand for CNG-powered vehicles in the commercial and public transportation sectors

North America

North America held the second-largest market for CNG, accounting for over 25% of the global market share in 2022. The region is home to a number of large CNG consumers, including the United States and Canada. The growth of the CNG market in North America is attributed to a number of factors, including:

Rising prices of fossil fuels such as gasoline and diesel

Government initiatives to promote the use of CNG, such as subsidies and tax breaks.Growing demand for CNG-powered vehicles in the commercial and public transportation sectors

Europe

Europe held the third-largest market for CNG, accounting for over 15% of the global market share in 2022. The region is home to a number of large CNG consumers, such as Italy, Germany, and France. The growth of the CNG market in Europe is attributed to a number of factors, including:

Stringent government regulations to reduce carbon emissions.Growing demand for CNG-powered vehicles in the commercial and public transportation sectors

Report Scope:

In this report, the Global Compressed Natural Gas Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Compressed Natural Gas Market, By Source:

- Associated Gas

- Non-Associated Gas

- Unconventional Sources

Compressed Natural Gas Market, By End User:

- Light Duty Vehicles

- Medium Or Heavy Duty Buses

- Medium Or Heavy Duty Trucks

Compressed Natural Gas Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Compressed Natural Gas Market.Available Customizations:

Global Compressed Natural Gas market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PJSC Gazprom

- Shell plc

- ExxonMobil Corporation

- TotalEnergies SE

- Chevron Corporation

- Eni S.p.A

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- PetroChina Company Limited

- National Petroleum Limited,

Table Information

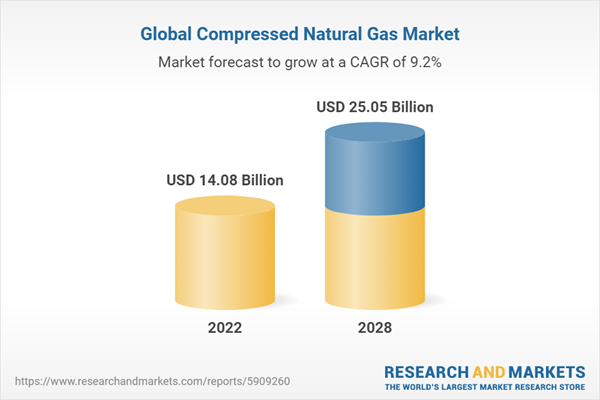

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 14.08 Billion |

| Forecasted Market Value ( USD | $ 25.05 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |