Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The dominance of palm vein scanners in the Healthcare sector is particularly notable, where these devices ensure accurate patient identification, enhance medical record management, and boost overall patient safety. Additionally, the Banking, Financial Services, and Insurance (BFSI) sector has adopted palm vein scanners for secure customer authentication, fraud prevention, and access control. The technology's versatility extends to commercial applications, access control in office buildings, data centers, and more. The Palm Vein Scanner market's growth is also driven by its integration with emerging technologies like IoT and Artificial Intelligence, further enhancing its functionality and utility. Moreover, stringent regulatory requirements and compliance standards contribute to the adoption of palm vein scanning technology across industries. This market's trajectory underscores its pivotal role in addressing security, access control, and identity verification challenges in a rapidly evolving digital and security-conscious world.

Key Market Drivers

Heightened Emphasis on Biometric Security:

The global Palm Vein Scanner market is experiencing significant growth due to the heightened emphasis on biometric security. As traditional authentication methods such as passwords and PINs prove increasingly vulnerable to security breaches, organizations across industries are turning to biometric solutions like palm vein scanning to enhance security. The uniqueness of palm vein patterns makes them extremely difficult to replicate, reducing the risk of unauthorized access, identity theft, and fraud. This driver is particularly relevant in sectors requiring robust security measures, such as finance, healthcare, and government, where the demand for secure authentication solutions continues to grow.Increased Focus on Hygiene and Contactless Technologies:

The COVID-19 pandemic accelerated the adoption of contactless technologies, including palm vein scanners. The need for touchless authentication methods to minimize physical contact and reduce the risk of virus transmission became paramount in various industries, from healthcare to hospitality. Palm vein scanning, being a contactless and hygienic biometric authentication method, gained traction as a preferred choice. This driver is expected to persist as businesses and institutions prioritize safety and hygiene in a post-pandemic world, driving the demand for palm vein scanners across multiple sectors.Rapid Growth in Healthcare Applications:

The global Palm Vein Scanner market is witnessing rapid growth in healthcare applications. Palm vein scanners are being adopted for patient identification, medical record management, and access control in healthcare facilities. The technology ensures accurate patient identification, reducing the risk of medical errors, incorrect treatments, and unauthorized access to patient records. With the increasing digitization of healthcare records and the emphasis on interoperability, palm vein scanners play a pivotal role in improving patient safety, enhancing the quality of care, and streamlining administrative processes in healthcare institutions.Integration with Emerging Technologies:

Palm vein scanners are being integrated with emerging technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI). This integration enhances their functionality and opens up new applications. For example, palm vein scanners can be linked to IoT devices for seamless access control or integrated with AI algorithms for advanced fraud detection and anomaly recognition. These integrations provide real-time insights, enable proactive responses, and make palm vein scanners more versatile and valuable in various industries, including smart cities, smart buildings, and Industry 4.0 applications.Strong Growth in Financial Services:

The financial services sector is experiencing strong growth in the adoption of palm vein scanners. Banks and financial institutions are deploying these scanners for customer identification, account access, and secure transactions. The technology's ability to prevent identity theft and fraud makes it an attractive choice for enhancing the security of financial transactions. Additionally, palm vein scanners are increasingly integrated into ATMs, enabling cardless cash withdrawals and enhancing the overall ATM experience. As financial services continue to evolve in the digital age, palm vein scanners are poised to play a pivotal role in ensuring secure and convenient transactions for customers.Key Market Challenges

High Initial Costs and Deployment Expenses:

One of the significant challenges facing the global Palm Vein Scanner market is the high initial costs and deployment expenses associated with implementing this technology. Palm vein scanning systems require specialized hardware, software, and infrastructure, which can be expensive to acquire and install. This cost barrier can deter smaller businesses and organizations from adopting palm vein scanners, limiting market penetration. Moreover, the total cost of ownership, including maintenance, training, and ongoing support, can add to the financial burden, making it challenging for some entities to justify the investment.Data Privacy and Security Concerns:

Data privacy and security concerns are paramount in the Palm Vein Scanner market. As palm vein patterns are used for authentication, ensuring the protection of biometric data is crucial. Any breach or unauthorized access to palm vein data can have severe consequences, including identity theft or fraudulent activities. Organizations deploying palm vein scanners must implement robust security measures, including encryption, access controls, and compliance with data protection regulations like GDPR or HIPAA. Addressing these concerns and gaining user trust is an ongoing challenge for the industry.Limited Standardization and Interoperability:

The lack of standardized palm vein scanning solutions poses a significant challenge in the market. Different manufacturers may use proprietary technologies, making it difficult for systems from different vendors to interoperate seamlessly. This lack of standardization hampers scalability and integration efforts, particularly in industries where multiple devices need to work together, such as healthcare or access control. Establishing industry-wide standards for palm vein scanning could facilitate broader adoption and enhance the technology's utility.User Acceptance and Convenience:

User acceptance and convenience are crucial factors influencing the adoption of palm vein scanners. Some users may find the process of palm scanning less intuitive or convenient compared to other authentication methods, such as fingerprint recognition or traditional ID cards. Educating users and ensuring a smooth and quick scanning process are ongoing challenges for manufacturers and organizations deploying palm vein scanning technology. User-friendly interfaces and seamless integration into existing workflows are essential to address this challenge effectively.Cultural and Ethical Considerations:

Global cultural and ethical considerations can also pose challenges in the adoption of palm vein scanners. In some regions, there may be cultural aversions to biometric data collection, raising concerns about privacy and consent. Ethical concerns regarding the storage and use of biometric data may vary across different countries and regions, leading to regulatory and compliance challenges. Navigating these cultural and ethical considerations and aligning with local laws and customs is essential for global market expansion.Key Market Trends

Growing Emphasis on Biometric Security:

One prominent trend in the global Palm Vein Scanner market is the increasing emphasis on biometric security. As organizations seek more robust and secure authentication methods, palm vein scanning has gained popularity. Unlike traditional authentication methods like passwords or PINs, palm vein patterns are unique to each individual and extremely difficult to replicate, enhancing security in applications such as access control, financial transactions, and healthcare record management. The rise of biometric security is driven by a growing awareness of data breaches and identity theft, pushing both public and private sectors to adopt more secure authentication methods.Healthcare Adoption for Patient Identification:

In the healthcare sector, palm vein scanners are increasingly being adopted for patient identification and medical record management. The trend is fueled by the need to reduce medical errors, enhance patient safety, and improve overall healthcare efficiency. Palm vein scanning ensures accurate patient identification, reducing the risk of medication errors, incorrect treatments, and unauthorized access to patient records. With the growing digitization of healthcare records and the emphasis on interoperability, palm vein scanners play a pivotal role in ensuring that the right patient receives the right care at the right time.Contactless Biometrics in Response to the Pandemic:

The COVID-19 pandemic accelerated the adoption of contactless technologies, including palm vein scanners. The need for touchless authentication methods to minimize physical contact and reduce the risk of virus transmission became paramount in various industries, including healthcare, finance, and access control. Palm vein scanning offers a hygienic and secure solution as it doesn't require physical contact, making it a preferred choice in a post-pandemic world. This trend is expected to persist as businesses and institutions continue to prioritize safety and hygiene.Integration with IoT and AI Technologies:

Palm vein scanners are increasingly integrated with Internet of Things (IoT) and Artificial Intelligence (AI) technologies. This integration enhances their functionality and opens up new applications. For instance, palm vein scanners can be connected to IoT devices for seamless access control or integrated with AI algorithms for advanced fraud detection and anomaly recognition. Such integrations provide real-time insights and enable proactive responses, making palm vein scanners more versatile and valuable in various industries.Expansion in Financial Services:

The financial services sector is witnessing significant growth in the adoption of palm vein scanners. Banks and financial institutions are using these scanners for customer identification, account access, and secure transactions. The technology's ability to prevent identity theft and fraud makes it an attractive choice for enhancing the security of financial transactions. Additionally, palm vein scanners are increasingly deployed in ATMs, enabling cardless cash withdrawals and enhancing the overall ATM experience. As financial services continue to evolve in a digital age, palm vein scanners will play a pivotal role in ensuring secure and convenient transactions.Segmental Insights

Offering Insights

Hardware segment dominates in the global palm vein scanner market in 2022. Palm vein scanner hardware includes the physical devices and components used for palm vein pattern recognition and authentication. Several factors contribute to the dominance of the Hardware segment in the market:

Hardware forms the core technology behind palm vein scanning. This includes the palm scanner devices equipped with near-infrared light sensors and cameras to capture the unique vein patterns beneath the user's skin. These devices are indispensable for any organization or application seeking to implement palm vein scanning technology.Palm vein scanning has found applications across various industries, including healthcare, finance, access control, and identity verification. In these sectors, the hardware components serve as the primary interface between users and the authentication system. For instance, in healthcare, hardware devices are used for patient identification and secure access to medical records. In finance, palm vein scanners are deployed for secure ATM transactions and customer authentication.

The hardware segment has seen continuous development and innovation, with manufacturers continually improving device accuracy, speed, and reliability. These advancements make palm vein scanners more attractive to a broader range of industries and applications. As a result, organizations can find devices that suit their specific needs, whether it's for high-speed access control or precision medical record verification.

Hardware manufacturers often have a global presence and distribution networks, allowing them to cater to a wide range of geographic markets. This global reach ensures that palm vein scanner hardware is accessible to organizations and businesses worldwide, further contributing to its dominance.

Functionality Insights

Physical access control & biometric authentication segment dominates in the global palm vein scanner market in 2022. Physical access control and biometric authentication are critical in ensuring the security of physical spaces, such as buildings, offices, data centers, and restricted areas. Palm vein scanning provides a highly secure means of verifying individuals' identities, reducing the risk of unauthorized access, theft, or breaches. As security concerns continue to rise globally, organizations increasingly turn to palm vein scanners for robust access control.Physical access control is a fundamental requirement across a wide range of industries, including government, healthcare, finance, corporate enterprises, and critical infrastructure. Palm vein scanners excel in these applications, offering a seamless and secure way to grant or deny physical access based on biometric authentication. This versatility across industries significantly contributes to the dominance of this segment.

Palm vein scanner systems designed for physical access control are often designed to integrate seamlessly with existing security infrastructure, including card readers, turnstiles, and electronic locks. This integration capability ensures that organizations can upgrade their access control systems without major disruptions to existing operations.

Many industries, such as healthcare and finance, must adhere to strict regulatory standards and compliance requirements. Palm vein scanning technology meets these standards by providing a reliable and secure method of ensuring that only authorized personnel gain physical access to sensitive areas. Compliance with regulations is a driving factor behind the adoption of physical access control solutions.

The global emphasis on contactless technologies, amplified by the COVID-19 pandemic, has fueled the demand for touchless and hygienic access control methods. Palm vein scanning aligns perfectly with this trend, as it offers a contactless means of authentication that reduces the risk of disease transmission and enhances user safety.

Organizations view physical access control and biometric authentication as long-term investments in security. Palm vein scanner systems are known for their durability and reliability, making them a cost-effective choice over time. Businesses and institutions are willing to invest in such systems to protect their assets and personnel effectively.

Regional Insights

North America dominates the Global Palm Vein Scanner Market in 2022. North America places a significant emphasis on biometric security solutions, driven by a growing need to combat identity theft, data breaches, and fraudulent activities. As a result, the region has become an early adopter of advanced biometric technologies like palm vein scanning. Organizations in the United States and Canada are increasingly turning to palm vein scanners to enhance security in various sectors, including finance, healthcare, government, and corporate enterprises.North America boasts a robust and highly digitized healthcare sector. Palm vein scanners are widely used for patient identification, ensuring accurate and secure access to medical records and treatment information. This application has gained prominence in the region due to the focus on patient safety, healthcare efficiency, and compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act).

The financial services sector in North America, including the United States, has witnessed significant adoption of palm vein scanners. Banks and financial institutions use these scanners for customer authentication, access control, and secure financial transactions. The technology's effectiveness in preventing identity theft and fraudulent activities aligns with the stringent security requirements of the financial industry.

North America is a hub for technological innovation, with many companies and research institutions actively developing and advancing biometric technologies. This environment fosters the growth of the palm vein scanner market, as local companies often pioneer new applications and integrations, driving adoption both domestically and globally.

The United States and Canada have well-established regulatory frameworks governing data privacy and biometric security. This regulatory clarity provides confidence to organizations and individuals alike in the responsible use of palm vein scanning technology. Compliance with standards and regulations enhances trust and encourages broader adoption.

North America was an early adopter of palm vein scanning technology, which allowed it to establish a strong foothold in the market. Early market entry provided manufacturers and service providers with the opportunity to develop and refine their solutions, making them more attractive to a broad range of industries and applications.

Report Scope:

In this report, the Global Palm Vein Scanner Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Palm Vein Scanner Market, By Offering:

- Hardware

- Software

- Services

Palm Vein Scanner Market, By Functionality:

- Logical Access Control & Biometric Authentication

- Physical Access Control & Biometric Authentication

Palm Vein Scanner Market, By End-User:

- Healthcare

- BFSI

- Commercial

- Others

Palm Vein Scanner Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Palm Vein Scanner Market.Available Customizations:

Global Palm Vein Scanner Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- NEC Corporation

- Fujitsu Limited

- Hitachi, Ltd.

- M2SYS Technology

- BioSec Group Ltd.

- IDLink Systems Pte Ltd.

- Bioenable Technologies Pvt. Ltd.

- Mofiria Corporation

- Eportation, Inc.

- Mantra Softech Pvt Ltd.

Table Information

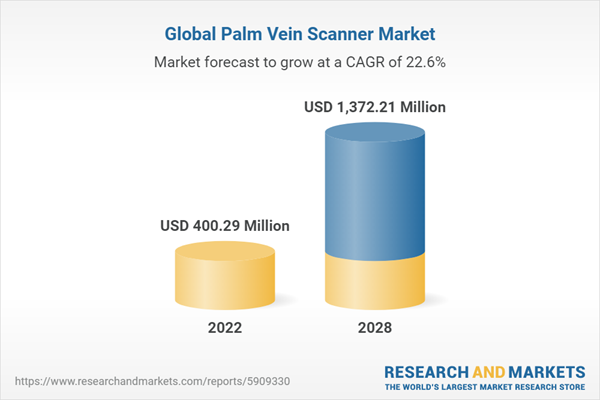

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 400.29 Million |

| Forecasted Market Value ( USD | $ 1372.21 Million |

| Compound Annual Growth Rate | 22.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |