Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these robust growth factors, the market encounters substantial obstacles due to strict municipal regulations concerning light pollution and driver safety, which often limit the issuance of installation permits in densely populated urban centers. These regulatory constraints can cause delays in infrastructure projects and restrict the number of viable locations for deploying new screens. The scale of investment in this sector remains immense; according to AVIXA, the digital signage segment of the professional audiovisual market was forecast to reach $41.4 billion in 2024, underscoring the significant capital dedicated to these visual communication technologies.

Market Drivers

The rapid growth of the Digital Out-of-Home (DOOH) advertising sector serves as the primary catalyst for the Global Outdoor LED Display Market. As cities increasingly digitize, conventional billboards are being superseded by programmable, dynamic LED screens that facilitate real-time content updates and higher audience engagement. This transition is powered by programmatic advertising technologies that enable precise demographic targeting, thereby driving the demand for high-resolution digital displays. This vitality is reflected in market data; according to the Out of Home Advertising Association of America's 'Q2 2024 OOH Revenue Report' from August 2024, the digital out-of-home segment saw a 7.5% revenue increase year-over-year, outperforming other formats. Furthermore, the DPAA reported in 2024 that 96% of surveyed marketers and agencies intend to maintain or boost their digital out-of-home spending in the upcoming year.Concurrently, the surge in installations within sports stadiums and live entertainment arenas is generating significant demand for hardware. Venue operators are investing heavily in massive high-definition LED video walls and ribbon boards to elevate the fan experience and rival home viewing quality. These projects require displays with industrial-grade durability and high brightness to handle outdoor conditions while providing broadcast-quality images, leading to valuable contracts for manufacturers. Highlighting this trend, Daktronics reported in their 'Fiscal Year and Fourth Quarter 2024 Financial Results' in June 2024 that orders for the fourth quarter rose by 14.6% year-over-year, a growth largely attributed to strong demand in their Live Events business unit, emphasizing the importance of entertainment projects in driving market volume.

Market Challenges

Stringent municipal regulations targeting light pollution and driver safety represent a significant impediment to the physical expansion of the Global Outdoor LED Display Market. Although urbanization drives the demand for dynamic advertising infrastructure, local legal frameworks often lead to the denial or delay of installation permits in high-density metropolitan zones. This regulatory environment creates a supply-side bottleneck where media owners cannot deploy high-brightness screens in prime locations, effectively capping the inventory available to advertisers. Consequently, the market is unable to fully exploit the revenue potential and operational efficiency of digital networks, as zoning ordinances and safety compliance standards restrict the physical rollout of these assets.The financial repercussions of these regulatory barriers are considerable, as they directly constrain the growth of the digital segment that underpins the industry's value. When permits are limited, capital investments in the sector yield diminishing returns due to a scarcity of viable deployment sites. The economic stake reliant on these permissions is vast; according to the World Out of Home Organization, global digital out-of-home (DOOH) expenditure hit $17.9 billion in 2024. This figure highlights the massive amount of revenue that depends on successfully navigating complex regulatory landscapes, as strict enforcement directly hinders the deployment of the digital assets required to support such market volumes.

Market Trends

The integration of Naked-Eye 3D and Anamorphic Illusion Technology is redefining the functional and aesthetic impact of digital signage in urban settings. Moving beyond traditional flat displays, this trend employs L-shaped curved screens and forced-perspective content to generate hyper-realistic, three-dimensional visuals that appear to extend outward without the need for wearable devices. This technology is increasingly utilized in landmark projects to boost viewer engagement and social media sharing, effectively transforming static infrastructure into major tourist attractions. A notable instance of this adoption occurred in July 2024, when Hikvision announced the successful installation of a 316-square-meter naked-eye 3D LED display on the façade of the BLOQUE innovation hub in Mexico, demonstrating the international scale of this immersive technology's deployment.In parallel, the market is experiencing a shift toward ultra-fine pixel pitch solutions for outdoor environments, necessitated by the demand for superior visual clarity in pedestrian-heavy areas. As viewing distances shorten in corporate plazas and luxury retail zones, manufacturers are ramping up production of high-density modules that bring indoor-quality resolution to outdoor settings. This transition is supported by substantial commercial investment in advanced packaging technologies such as Chip-on-Board (COB) and Micro LED, which improve contrast and durability for exterior use. The financial significance of this shift is clear; in its '2023 Year in Review' published in January 2024, Leyard reported that annual orders for its Micro LED product lines surpassed 600 million RMB, indicating strong market demand for high-definition architectures that are increasingly shaping outdoor product specifications.

Key Players Profiled in the Outdoor LED Display Market

- Barco

- Daktronics Inc.

- Electronic Displays Inc.

- LG Electronics

- Panasonic Holdings Corporation

- Sony Corporation

- Toshiba Corporation

- Lighthouse Technologies Limited

- Shenzhen Dicolor

- Optoelectronics Co. Ltd.

Report Scope

In this report, the Global Outdoor LED Display Market has been segmented into the following categories:Outdoor LED Display Market, by Technology:

- Individually Mounted

- Surface Mounted

Outdoor LED Display Market, by Color Display:

- Monochrome Display

- Tri-Color Display

- Full Color Display

Outdoor LED Display Market, by Application:

- LED Billboards

- Perimeter LED Boards

- LED Mobile Panel

- LED Traffic Lights

- LED Video Walls

- Other LED Matrix Boards

Outdoor LED Display Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Outdoor LED Display Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Outdoor LED Display market report include:- Barco

- Daktronics Inc.

- Electronic Displays Inc.

- LG Electronics

- Panasonic Holdings Corporation

- Sony Corporation

- Toshiba Corporation

- Lighthouse Technologies Limited

- Shenzhen Dicolor

- Optoelectronics Co. Ltd

Table Information

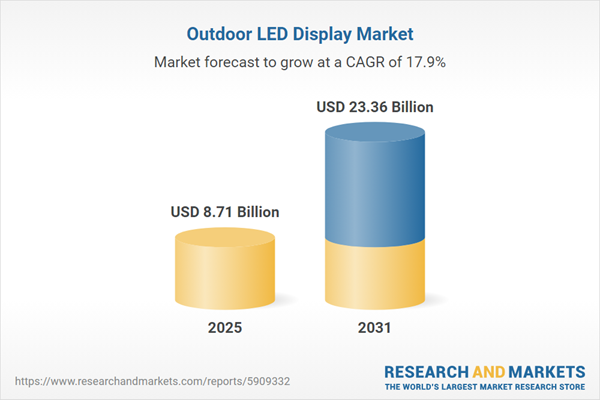

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.71 Billion |

| Forecasted Market Value ( USD | $ 23.36 Billion |

| Compound Annual Growth Rate | 17.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |