Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, the requirement for intricate chemometric modeling and frequent calibration maintenance poses a substantial obstacle, potentially limiting widespread uptake among smaller businesses lacking technical resources. Despite these hurdles, key sectors remain dynamic. For example, Photonics21 reported that the photonics market for food and agriculture - a primary area for near-infrared application - experienced a compound annual growth rate of 11.8% in 2024. This strong expansion highlights the essential function of optical sensing innovations in updating global supply chain operations.

Market Drivers

The market is being transformed by the rising use of handheld and portable NIR analyzers, which shift analysis from centralized labs to the immediate point of need. This transition is especially vital for law enforcement, where the fast, non-destructive detection of illegal substances is essential. Modern miniature devices deliver results comparable to benchtop units, enabling officers to make instant decisions without damaging evidence. As cited by Spectroscopy Online in August 2024, a study on portable MicroNIR technology for illicit drug detection in Australia demonstrated high precision, with 99% of quantification values falling within a relative uncertainty of ±15%, a level of reliability that is speeding up global adoption by security agencies.Concurrently, strict pharmaceutical regulations requiring thorough quality control are boosting the need for sophisticated spectroscopic tools. Regulators are increasingly mandating Process Analytical Technology (PAT) standards, forcing manufacturers to adopt real-time monitoring solutions for compliance, which creates a strong market for high-precision equipment. In financial terms, Bruker Corporation's "Fourth Quarter and Full Year 2024 Financial Results" from February 2025 noted a 16.3% revenue rise in its Scientific Instruments segment due to high demand. Furthermore, Thermo Fisher Scientific reported that its Analytical Instruments segment achieved $7.46 billion in revenue in 2024, emphasizing the significant investment in optical sensing for industrial modernization.

Market Challenges

The expansion of the Global Near-Infrared (NIR) Spectroscopy Market is significantly impeded by the technical requirements associated with complex chemometric modeling and ongoing calibration maintenance. Unlike more straightforward analytical techniques, NIR spectroscopy depends heavily on sophisticated mathematical models to link spectral data with specific chemical or physical traits. This necessitates a workforce skilled in specialized data analysis and equipment upkeep - resources that are often rare or too costly for smaller businesses. As a result, prospective users frequently delay investing in these systems due to the operational difficulties and the continuous technical responsibility regarding model validation and recalibration.This shortage of specialized talent effectively limits the market's growth potential. Data from Technology Scotland in 2024 indicates that 78% of participants in the photonics and enabling technologies industry faced a skills gap over the previous year. This extensive lack of technical expertise directly hinders end-users from successfully implementing and maintaining advanced NIR systems, thereby retarding the technology's incorporation into essential industrial processes where real-time monitoring is critical.

Market Trends

The market is undergoing a fundamental shift due to the integration of Artificial Intelligence and Machine Learning in spectral analysis, which effectively lowers the barriers imposed by complex chemometric modeling. Modern algorithms, including convolutional neural networks and deep learning, now automate feature extraction from spectral data, allowing for precise classification without the need for extensive manual calibration by experts. This advancement is making spectroscopy more accessible in fields requiring fast qualitative analysis, such as agriculture. For instance, a January 2025 article in Spectroscopy Online detailed a study using a self-supervised learning framework that attained 99.12% classification accuracy on tea varieties, illustrating how software improvements are boosting instrument capabilities.At the same time, the adoption of Inline Process Analytical Technology (PAT) systems is spreading beyond standard pharmaceutical production into high-volume industrial materials processing. Sectors like recycling and waste management are increasingly utilizing automated, inline NIR systems to monitor material flows in real time, ensuring process efficiency and product purity without manual input. This need for continuous, automated quality assurance is fueling significant investment in sensor-based sorting technology. As reported in Tomra Systems' "4th Quarter and Full Year 2024 Financial Results" in February 2025, the company's Recycling segment saw a 37% revenue jump in Q4 2024, reflecting the growing industrial reliance on these optical sorting solutions.

Key Players Profiled in the Near-Infrared (NIR) Spectroscopy Market

- Thermo Fisher Scientific Inc.

- Bruker Corporation

- PerkinElmer Inc.

- Oxford Instruments PLC

- Shimadzu Corporation

- ABB Ltd.

- Agilent Technologies Inc.

- Metrohm AG

- Zeiss Group

- JASCO International Co., Ltd.

Report Scope

In this report, the Global Near-Infrared (NIR) Spectroscopy Market has been segmented into the following categories:Near-Infrared (NIR) Spectroscopy Market, by Type:

- Benchtop

- Portable

Near-Infrared (NIR) Spectroscopy Market, by Product:

- FT-NIR Spectrometers

- Dispersive

Near-Infrared (NIR) Spectroscopy Market, by Application:

- Medical Applications

- Remote Monitoring

- Agriculture

- Astronomical Spectroscopy

- Particle Measurement

- Industrial Use

- Material Science

Near-Infrared (NIR) Spectroscopy Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Near-Infrared (NIR) Spectroscopy Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Near-Infrared (NIR) Spectroscopy market report include:- Thermo Fisher Scientific Inc.

- Bruker Corporation

- PerkinElmer Inc.

- Oxford Instruments PLC

- Shimadzu Corporation

- ABB Ltd.

- Agilent Technologies Inc.

- Metrohm AG

- Zeiss Group

- JASCO International Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

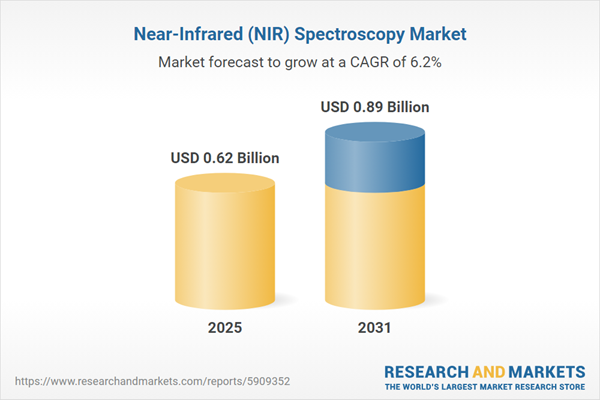

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 0.62 Billion |

| Forecasted Market Value ( USD | $ 0.89 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |