Consumer Electronics is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The growing global adoption of electric vehicles (EVs) serves as a paramount driver for the Intelligent Power Module (IPM) Market, directly fueling demand for high-performance power conversion solutions. IPMs are critical for efficient EV powertrains, battery management systems, and charging infrastructure, where their compact design and superior performance are essential for optimizing energy management and minimizing power losses. Ongoing technological advancements in EVs, including the push towards higher voltage platforms, inherently necessitate more robust and reliable power modules.Key Market Challenges

The inherent complexity and substantial initial costs associated with integrating advanced Intelligent Power Modules (IPMs) into diverse application systems represent a significant impediment to market growth. This challenge often results in longer development cycles and necessitates specialized engineering expertise, which increases the overall cost of product development for end-users. Consequently, smaller and medium-sized enterprises, which may lack extensive research and development budgets or dedicated technical staff, face a higher barrier to adopting these advanced power solutions. The capital expenditure required for sophisticated manufacturing and testing processes also contributes to the elevated cost structure of IPMs.Key Market Trends

The increasing integration of wide-bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), within intelligent power modules is a pivotal trend. This advancement significantly boosts IPM performance through higher switching frequencies, superior power efficiency, and enhanced thermal management. These attributes are critical for demanding applications including electric vehicle chargers and renewable energy systems. While the discrete semiconductor market faces headwinds, with the World Semiconductor Trade Statistics (WSTS) Spring 2025 forecast projecting single-digit declines for the segment in 2025, WBG innovation provides a path for revitalization.Key Market Players Profiled:

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- Semiconductor Components Industries, LLC

- Semikron Danfoss Elektronik GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- Future Electronics Group

- ST Microelectronics International N.V.

- Aptiv PLC

Report Scope:

In this report, the Global Intelligent Power Module Market has been segmented into the following categories:By Operational Voltage:

- 600V

- 1200V

By Power Device:

- IGBT

- MOSFET

By Application:

- Consumer Electronics

- Servo Drives

- Transportation

- Renewable Energy

- Others

By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia-Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Intelligent Power Module Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Intelligent Power Module market report include:- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- Semiconductor Components Industries, LLC

- Semikron Danfoss Elektronik GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- Future Electronics Group

- ST Microelectronics International N.V.

- Aptiv PLC

Table Information

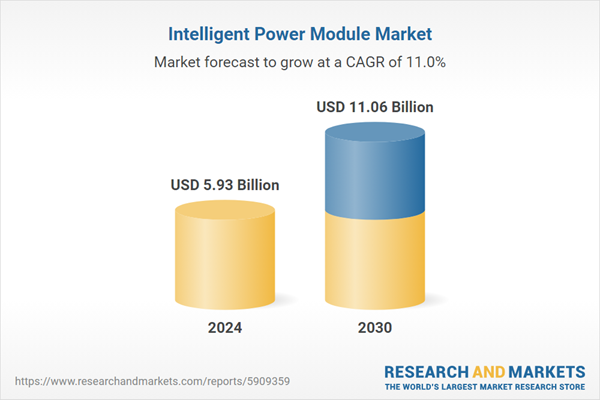

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.93 Billion |

| Forecasted Market Value ( USD | $ 11.06 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |