Market Introduction

Increased demand from a variety of end users is driving investments in sub-orbital launch vehicle platforms in the European sub-orbital testing services market. One of the main obstacles in this sector is the high expenses and lengthy testing procedures linked to sub-orbital launches, which limit customer use. The reusability of sub-orbital platforms offers a chance to mitigate this by cutting prices, however as of right now, only a few number of major companies produce reusable solutions, providing service providers significant pricing power because of the lack of competition.In the future, more players are anticipated to enter the European sub-orbital market, which will lower the launch costs for sub-orbital testing services. There will be an increased need for sub-orbital testing services due to the expanding deployment of tiny satellites, especially in the 1-50 kg satellite mass segment. Sub-orbital testing service providers are expected to see a rise in demand between 2022 and 2032 since smaller spacecraft frequently use Commercial Off-The-Shelf (COTS) subsystems and components that are not normally space certified.

Market Segmentation:

Segmentation 1: by Payload Capacity

- 1-50 Kg

- 51-200 Kg

- 201-500 Kg

- 501 Kg and Above

Segmentation 2: by Application

- Human-Tended

- Automated

Segmentation 3: by Country

- France

- Germany

- Russia

- U.K.

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The service segment helps the reader understand the different end users that will generate the demand for sub-orbital testing services in Europe region. Moreover, the study provides the reader with a detailed understanding of the different sub-orbital testing services market based on payload capacity (1-50 kg, 51-200 kg, 201-500 kg, and 501 kg and above), and application (automated and human-tended).Growth/Marketing Strategy: The Europe sub-orbital testing services market has seen major development by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracted to strengthen their position in the Europe sub-orbital testing services market.

Competitive Strategy: Key players in the Europe sub-orbital testing services market analyzed and profiled in the study involve sub-orbital testing service providers. Moreover, a detailed competitive benchmarking of the players operating in the Europe sub-orbital testing services market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.Some of the prominent names established in this market are:

- PLD Space

- Skyrora Limited

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

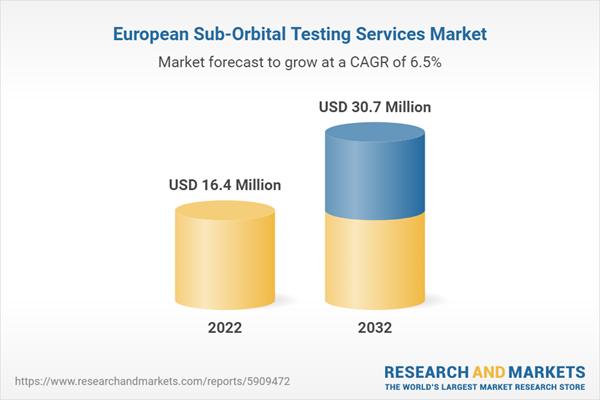

The Europe sub-orbital testing services market is estimated to reach $30.7 million by 2032, reveals the premium market intelligence study. The study also highlights that the market is set to witness a CAGR of 6.48% during the forecast period 2022-2032.The Europe Sub-Orbital Testing Services Market: Drivers and Challenges

Europe has the presence of a large number of manufacturing and research and development hubs. The region is also home to one of the leading national space agencies, the European Space Agency (ESA). This national space agency has been engaged with various space companies to demonstrate the capabilities of space transportation and testing services. Furthermore, the small satellite deployment in the region for satellite-based internet services by companies such as OneWeb and Airbus drives the demand for sub-orbital testing services.The region faces huge regulations from the ESA, which has restricted sub-orbital testing services growth. Hence, the waiting period for the payload to get tested in the sub-orbital region is significantly high. Additionally, there are still a smaller number of sub-orbital testing service providers in the region actively providing testing services, as most of the companies are in the development stage.

USPs of report

- A dedicated section on growth opportunities and recommendations

- Analysis of business drivers and challenges of the Europe Sub-Orbital Testing Services Market

- Detailed analysis of Sub-Orbital Testing Services Market for U.K., Germany, France and Russia

- A detailed company profile comprising established players

Analyst’s Perspective on Europe Sub-Orbital Testing Services Market

The Principal Analyst states, 'Multiple small-satellite operators are entering the space markets, and many of them are utilizing commercial-off-the-shelf components which are not necessarily built for space applications. This imposes a relatively higher risk of system failure on those missions. While microgravity testing can help them evaluate their systems before launch, the prohibitive cost of suborbital flights has kept them away from this market. However, multiple launch service providers are developing new platforms to provide affordable microgravity test opportunities to the space market participants. With the launch costs coming down, this market is expected to grow over the long term.'Key Questions Answered in the Report

- What are the trends in the Europe sub-orbital testing services market, and how is the market expected to change over the forecast period 2022-2032?

- How is the market expected to grow during the forecast period 2022-2032?

- What are the key developmental strategies implemented by the key players to sustain in this highly competitive market?

- What is the current and future revenue scenario of the Europe sub-orbital testing services market?

Companies Mentioned

- PLD Space

- Skyrora Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | November 2023 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 16.4 Million |

| Forecasted Market Value ( USD | $ 30.7 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 2 |