Market Introduction

Aseptic connectors are tools designed to connect different elements in both upstream and downstream processes within bioprocessing and biomanufacturing. These connectors are sterile and ensure the preservation of a sterile fluid path when joining two tubing lines. In addition to bioprocessing applications, aseptic connectors are also utilized to link tubing, catheters, and syringes with various medical devices.Aseptic connectors are used to maintain sterility during the production of biopharmaceuticals, vaccines, and other biologically derived products. They facilitate the connection of sterile tubing and containers at various stages of the manufacturing process, ensuring the integrity of the final product. In medical settings, these connectors are used to establish sterile connections between tubing, catheters, syringes, and other medical devices. This is crucial in procedures such as intravenous (IV) administration and aseptic surgeries. Additionally, researchers may use aseptic connectors in laboratories to maintain sterile conditions when transferring fluids or samples, particularly in cell culture and microbiology experiments.

Industrial Impact

The global aseptic connectors market remains consolidated due to the presence of limited established players with a majority hold. Furthermore, the market has been characterized by intense competition among key players such as Danaher Corporation (Cytiva), Merck KGaA, Sartorius, and Thermo Fisher Scientific Inc.Key trends shaping the competition include rising demand for single-use aseptic connectors and increasing product innovation and collaboration with the labs. Companies that successfully navigate these trends are expected to gain a competitive edge within the market. Additionally, strategic partnerships and collaborations are becoming increasingly prevalent, allowing firms to leverage synergies for a comprehensive product portfolio. Most of the manufacturers in the market are collaborating and entering partnerships with not only other companies but also with research laboratories and academic institutes.

Market Segmentation:

Segmentation 1: by Type

- 1/2 inch Connectors

- 1/4 inch Connectors

- 3/8 inch Connectors

- 3/4 inch Connectors

- Others

1/2 inch Connectors Segment to Dominate the Aseptic Connectors Market (by Type)

Based on type, the global aseptic connectors market was led by the 1/2 inch connectors segment, which held a 28.36% share in 2022. 1/2 inch connectors refer to the internal diameter (ID) of the tubing or hose they are designed to connect with. They are common within the larger aseptic connector market, offering a good balance between flow rate and ease of flow manipulation.Segmentation 2: by Product

- Genderless

- Gendered

Genderless to Witness the Highest Growth between 2023 and 2033

In aseptic genderless connectors (connectors without gender specifications), the two components used for the connection are identical. This eliminates concerns related to orientation, inventory planning, and design that are associated with gendered connectors, streamlining the development of a single-use system. Genderless connectors present several notable benefits over their gendered counterparts, resulting in time efficiency, enhanced process security, simplified inventory management, and heightened operational and design flexibility.Segmentation 3: by End User

- Pharmaceutical and Biopharmaceutical Companies

- Other End Users

Pharmaceutical and Biopharmaceutical Companies Segment to Witness the Highest Growth between 2023 and 2033

Based on end users, the aseptic connectors market was led by the pharmaceutical and biopharmaceutical companies segment, which held an 80.07% share in 2022. Biopharmaceutical companies specialize in the development and production of advanced therapeutic drugs derived from biological sources. Aseptic connectors are vital components in their operations, ensuring the maintenance of strict sterile processes.Segmentation 4: by Region

- North America: U.S., and Canada

- Europe: France, Germany, Italy, U.K., Spain, and Rest-of-Europe

- Asia-Pacific: China, India, Japan, Australia, South Korea, and Rest-of-Asia-Pacific

- Latin America: Brazil, Mexico, and Rest-of-Latin America

- Rest-of-the-World

Recent Developments in the Aseptic Connectors Market

- In April 2023, Dover Corporation (Colder Products Company) introduced the AseptiQuik W Series, the largest genderless aseptic connectors in biopharma. These connectors enable efficient fluid handling in large-volume processes, significantly reducing fluid transfer times.

- In May 2023, Danaher (Cytiva) and the life sciences business of Pall Corporation completed their integration under the Danaher (Cytiva) brand. This union would combine their expertise and technologies to better serve the biotech industry, focusing on novel therapeutic development.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers:

Growing Demand for Sterile Connectors due to Increase in Biopharmaceutical Production: The biopharmaceutical sector has witnessed significant expansion in recent years, primarily propelled by factors such as scientific breakthroughs, the accelerated response to the pandemic, and a heightened focus on personalized medicine. While promising opportunities lie ahead, businesses operating within this industry must effectively manage evolving regulatory environments, overcome market access hurdles, and address sustainability considerations. The industry's capacity to adapt to these changing dynamics is ultimately expected to determine its growth trajectory and the influence it wields within the global healthcare landscape.Market Challenges:

High Cost of Manufacturing Sterile Connectors: This cost factor primarily stems from the stringent quality control measures and advanced technologies required to ensure compliance with safety and regulatory standards. Additionally, the use of specialized, medical-grade materials further escalates production expenses. The high cost of production not only impacts manufacturers but also influences the end-user adoption rates across various sectors. The need to balance cost-efficiency with regulatory compliance and quality is a critical challenge in this market, shaping its overall dynamics and future growth trajectory.Market Opportunities

Expansion into the Emerging Markets: This expansion is not only an opportunity for market penetration but also a means to contribute to the development of healthcare capabilities in these growing economies. The aseptic connectors market, through a judicious blend of innovation and market acumen, can establish a sustainable foothold in emerging markets, fostering long-term growth and resilience in an increasingly dynamic global landscape.How can this report add value to an organization?

Product/Innovation Strategy: The global aseptic connectors market has been segmented based on type, product, end user, and region.Growth/Marketing Strategy: Increasing potential of single-use technologies, their ease of use, and ongoing technological advancements in the field make this a really promising market for the coming years.

Competitive Strategy: The aseptic connectors market, vital for sterile connections in pharmaceutical manufacturing, biotechnology, and other life sciences applications, is highly sensitive to technological advancements, regulatory compliance, and product reliability.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2022. A historical year analysis has been done for the period FY2019-FY2021. The market size has been estimated for FY2022 and projected for the period FY2023-FY2033.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of upstream and downstream products of aseptic connectors.

- The market contribution of aseptic connectors is anticipated to be launched in the future and has been calculated based on the historical analysis of the solutions.

- Revenues of the companies have been referenced from their annual reports for FY2022 and FY2023. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available aseptic connector solutions. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in aseptic connectors, including the market players offering products and services. Resources such as CxOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from primary sources Include:

- Validation of the report’s segmentation and key qualitative findings

- Validation of the report’s segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio/li>

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.The genderless segment players led the market and captured around 73.20% of the market's presence as of 2022. The gendered segment, on the other hand, accounted for approximately 26.80% of the market presence in 2022.

Some of the prominent established names in this market are:

- Sartorius AG

- Merck KGaA

- Danaher Corporation (Cytiva)

- Norma Group SE (Connectors Verbindungstechnik AG)

- MEDInstill

- Dover Corporation (Colder Products Company)

- Saint-Gobain

- Corning Incorporated

- Thermo Fisher Scientific Inc.

- Advin Health Care

- Foxx Life Sciences

- SDP Inc.

- Refine Technology, LLC

- Spirax-Sarco Engineering plc (Watson-Marlow Fluid Technology Solutions)

- Added Pharma

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Sartorius AG

- Merck KGaA

- Danaher Corporation (Cytiva)

- Norma Group SE (Connectors Verbindungstechnik AG)

- MEDInstill

- Dover Corporation (Colder Products Company)

- Saint-Gobain

- Corning Incorporated

- Thermo Fisher Scientific Inc.

- Advin Health Care

- Foxx Life Sciences

- SDP Inc.

- Refine Technology, LLC

- Spirax-Sarco Engineering plc (Watson-Marlow Fluid Technology Solutions)

- Added Pharma

Table Information

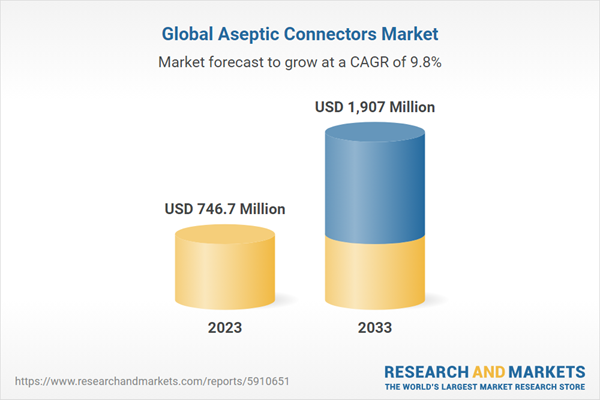

| Report Attribute | Details |

|---|---|

| No. of Pages | 126 |

| Published | March 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 746.7 Million |

| Forecasted Market Value ( USD | $ 1907 Million |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |