Transfer Membrane: Introduction

A transfer membrane is used in molecular biology and biochemistry techniques to transfer proteins, DNA, RNA, or other biological elements from a gel matrix to a solid support so that further detection and analysis may be performed. It is also known as a blotting membrane. Transfer membranes are available in different pore sizes, which may differ based on molecule being transferred. It can be made of nitrocellulose or PDVF, as they compatible with protein and nucleic acid bindings. The gel electrophoresis process plays a critical role in transfer membrane process.Global Transfer Membrane Market Analysis

After the COVID-19 outbreak, the demand for diagnostic tests has significantly increased. The rising investments to expediate drug and vaccine development has seen an upswing, accredited to high occurrence of genetic diseases. As a result, the transfer membrane market value has grown owing to its crucial involvement in the study of diseases, drug development as well as diagnostic tests.The transfer membranes hold immense significance in pharmaceutical industry for protein purification and analysis. This has led to novel innovations, aimed at fostering quality outcomes. One such common example is the launch of Immobilon® NOW by Merck. This is a transfer membrane roll which allows features like single-cut convenience, minimal waste, compact packaging to save space in the research lab and compatibility with mini or midi gels.

As per research, it has been indicated that PVDF membrane type has more advantages over nitrocellulose. They are compatible with several detection chemistries including chemogenic, radioactive, fluorescent, and chemiluminescent techniques. Therefore, to meet the high demand, Merck has four different types of PVDF membranes under the Immobilon® membranes section. These membranes offer high protein binding and durability, which is set to cater to the high transfer membrane market demand in upcoming years.

Global Transfer Membrane Market Segmentations

The report titled “Global Transfer Membrane Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type:

- Nylon

- Nitrocellulose

- PVDF

Market Breakup by Transfer:

- Semi-dry Electrotransfer

- Dry Electrotransfer

- Tank Electrotransfer

Market Breakup by Application:

- Amino Acid and Protein Sequencing Analysis

- Southern Blotting

- Northern Blotting

- Western Blotting

Market Breakup by End User:

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Academic and Research Institutes

- Others

Market Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Transfer Membrane Market Overview

North America, specifically the United States, has been dominating the transfer membrane market share. This considerable share may be accredited to the existence of a well-established research infrastructure and growing government investments in the pharmaceutical domain. Moreover, the presence of pioneer biotechnology and pharmaceutical companies, along with academic and research institutions also aid the growth of the market. Having a robust public healthcare system, Europe is second in line to lead the market share in forecast period.Due to high population growth, government initiatives, and private investments, the Asia Pacific region is anticipated to achieve rapid transfer membrane market growth in the future. The governments are gradually prioritising the high importance of medical research and development and working towards developing a technically enhanced infrastructure for effective research work. Furthermore, the private sector is booming with the advent of foreign investment. Pharma and biotech giants have started establishing their headquarters in the Asia Pacific region to leverage the academic talent along with the easy availability of other resources.

Global Transfer Membrane Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Thermo Fisher Scientific, Inc.

- Danaher

- Bio-Rad Laboratories

- Merck KGaA

- PerkinElmer, Inc.

- Abcam Plc.

- ATTO Corporation

- Santa Cruz Biotechnology, Inc.

- Azure Bio systems Inc.

- Advansta Inc.

- GVS S.p.A.

- GE Healthcare

- Axiva Sichem Biotech

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific, Inc.

- Danaher

- Bio-Rad Laboratories

- Merck KGaA

- PerkinElmer, Inc.

- Abcam Plc.

- ATTO Corporation

- Santa Cruz Biotechnology, Inc.

- Azure Bio systems Inc.

- Advansta Inc.

- GVS Filter TS.p.A.

- GE Healthcare

- Axiva Sichem Biotech

Table Information

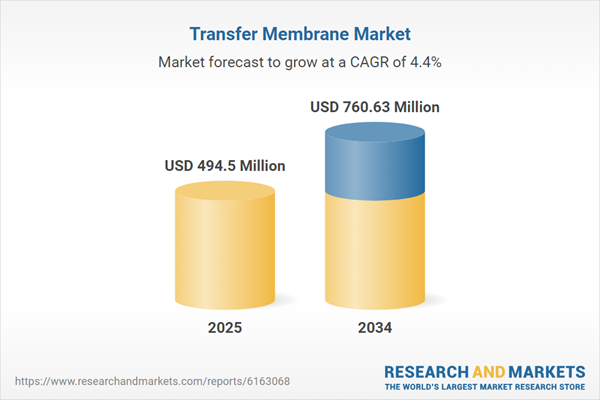

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 494.5 Million |

| Forecasted Market Value ( USD | $ 760.63 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |