Hemoglobin Testing: Introduction

A hemoglobin test measures the amount of hemoglobin in your blood. Hemoglobin is a protein in your red blood cells that carries oxygen to your body's organs and tissues and transports carbon dioxide from your organs and tissues back to your lungs. If a hemoglobin test reveals that your hemoglobin level is lower than normal, it means you have a low red blood cell count (anaemia). Anemia can have many different causes, including vitamin deficiencies, bleeding, and chronic diseases.Global Hemoglobin Testing Market Analysis

The hemoglobin testing market is witnessing significant trends driven by innovations in the medical devices sector and a growing demand for improved patient outcomes and cost-effective healthcare solutions. One notable trend is the development of hemoglobin Point of Care (POC) Tests devices, with 12 such devices currently in various stages of development worldwide. These POC tests are expected to receive approval within the next decade, indicating a promising future for quick and convenient hemoglobin testing at the point of care.Research and development activities in the field of haemoglobin testing is playing a pivotal role in market growth. Notably, the introduction of smartphone technology by a professor at Purdue University's Weldon School of Biomedical Engineering is revolutionizing the industry. This technology allows for noninvasive and instant measurement of blood hemoglobin levels, providing a convenient and efficient diagnostic tool.

Furthermore, indigenous innovations are contributing to the market's evolution. The CSIR-Indian Institute of Toxicology Research (IITR) has introduced 'SenzHb,' a rapid hemoglobin detection test kit that operates on a paper-based platform and delivers results in just 30 seconds. Remarkably, this test kit is cost-effective, making it accessible to a broader population.

In summary, the hemoglobin testing market is shaped by trends such as the development of innovative POC testing devices, the integration of smartphone technology for hemoglobin measurement, and the introduction of cost-effective and rapid testing solutions. These trends collectively drive advancements in hemoglobin testing, offering healthcare providers and patients more efficient and accessible diagnostic options.

Global Hemoglobin Testing Market Segmentations

Hemoglobin Testing Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Automated Hematology Analyzers

- Point-of-Care

- Reagents and Consumables

Market Breakup by Test Type

- HbA1c Testing

- Blood Gas Testing

- Oximetry Testing

- CyanmetHemoglobin Testing

Market Breakup by Technology

- Chromatography

- Immunoassay

- Spectrophotometry

- Electrophoresis

- Others

Market Breakup by End User

- Hospitals

- Research Centres

- Laboratories

- Diagnostic Centres

- Homecare Settings

- Others

Hemoglobin Testing Market by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Hemoglobin Testing Market Overview

The hemoglobin testing market is experiencing notable growth driven by several key drivers. First and foremost is the rising incidence of anaemia, a condition characterized by low hemoglobin levels in the blood. As the prevalence of anaemia continues to increase, the demand for effective and accessible hemoglobin testing methods becomes crucial in diagnosing and managing this condition.Furthermore, the development of innovative digital health tools is significantly contributing to market growth. Specifically, the use of smartphone camera technology to measure blood hemoglobin levels represent a groundbreaking advancement. This technology has recently achieved recognition by winning the first phase of a National Institutes of Health (NIH)-funded challenge focused on enhancing maternal health outcomes. By allowing healthcare providers to assess a patient's hemoglobin levels using a simple photo of the patient's lower inner eyelid, this digital health tool offers a convenient and non-invasive method for Hemoglobin testing.

In summary, the haemoglobin testing market is driven by the increasing incidence of anaemia and the emergence of innovative digital health solutions that make hemoglobin testing more accessible and convenient. These drivers collectively contribute to improved healthcare outcomes, especially in the context of maternal health and other medical conditions where hemoglobin levels play a critical role in diagnosis and treatment.

Global Hemoglobin Testing Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Abbott

- Bio-Rad Laboratories,Inc.

- Danaher

- F. Hoffmann-La Roche Ltd.

- EKF Diagnostics

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc.

- ACON Laboratories, Inc.

- BIOMEDOMICS INC.

- Hemosure, Inc.

- Humasis Co., Ltd.

- Immunostics Inc.

- Germaine Laboratories, Inc.

- Portea Medical

- LifeSign LLC

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abbott

- Bio-Rad Laboratories,Inc.

- Danaher

- F. Hoffmann-La Roche Ltd.

- EKF Diagnostics

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc.

- ACON Laboratories, Inc.

- BIOMEDOMICS INC.

- Hemosure, Inc.

- Humasis Co., Ltd.

- Immunostics Inc.

- Germaine Laboratories, Inc.

- Portea Medical

- LifeSign LLC

Table Information

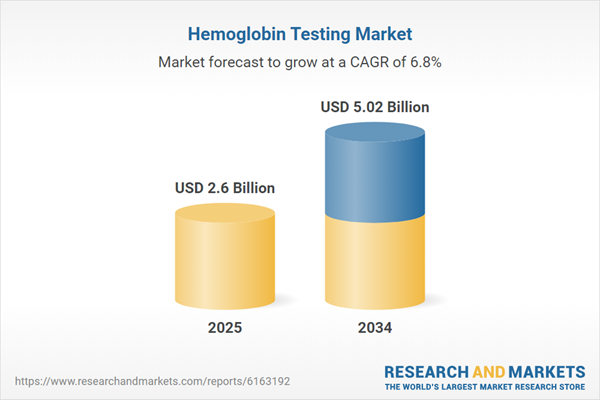

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 5.02 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |