Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this strong growth trajectory, the market encounters significant hurdles due to strict data privacy regulations and security concerns. The collection and processing of real-time location data, which is essential for high-definition mapping, often conflicts with rigorous global privacy laws. This regulatory friction potentially limits data acquisition capabilities and raises compliance costs for solution providers, thereby slowing the pace of cross-border market expansion.

Market Drivers

The widespread adoption of smartphones and high-speed mobile internet acts as a primary catalyst for the digital map industry, effectively democratizing access to geospatial data. Advanced mobile networks facilitate the seamless streaming of essential content, such as real-time traffic updates and high-definition satellite imagery, which are crucial for modern navigation applications. This connectivity has driven immense user engagement; according to Alphabet Inc., Google Maps exceeded 2 billion monthly active users in 2024, demonstrating the sheer scale of consumer reliance on mobile mapping. Additionally, infrastructure is expanding to support these data needs; Ericsson’s 'Mobility Report' from June 2024 noted that global 5G subscriptions rose by 160 million in the first quarter of 2024, ensuring high-bandwidth capabilities are increasingly available for sophisticated location-based services.Concurrently, the surge in demand for autonomous and connected vehicle technology is reshaping the market, shifting focus from standard navigation to high-definition (HD) mapping. Autonomous systems require centimeter-level precision regarding lane geometry and environmental hazards to operate safely, necessitating deeper integration between map providers and automotive OEMs. This shift has prompted significant financial commitments from manufacturers; TomTom’s 'Annual Report 2023', released in February 2024, reported a record automotive backlog of €2.5 billion, underscoring the intensifying commercial necessity for embedded navigation and automated driving technologies. This trend ensures that the automotive sector remains a critical revenue stream for digital map developers.

Market Challenges

Stringent data privacy regulations and security concerns impose a significant restraint on the growth of the Global Digital Map Market. To maintain high-definition accuracy, map providers must process vast volumes of real-time location data, yet this requirement frequently conflicts with rigorous laws designed to protect user anonymity. Consequently, companies face restricted data acquisition capabilities and increased operational costs associated with legal compliance, which directly delays the cross-border expansion of mapping services.The complexity of adhering to fragmented legal standards creates a difficult environment for vendors attempting to scale their geospatial databases. This regulatory pressure forces organizations to divert substantial financial resources toward compliance measures rather than technical development. Underscoring the extent of this legislative landscape, the International Association of Privacy Professionals reported that in 2024, comprehensive consumer privacy bills were enacted or active in 19 distinct U.S. states. This patchwork of regulations requires digital map vendors to implement region-specific data handling protocols, thereby reducing the efficiency of global data integration and slowing the overall trajectory of the market.

Market Trends

The convergence of digital mapping with digital twin technology is transforming static geospatial datasets into dynamic virtual replicas of physical environments. This integration allows urban planners and infrastructure developers to simulate real-world scenarios, such as traffic flows or environmental changes, within a three-dimensional framework before physical implementation. This capability is essential for managing complex infrastructure lifecycles and optimizing asset performance through predictive analysis. According to Bentley Systems’ '2023 Annual Report' from February 2024, the company recognized total revenues of $1.23 billion, a financial result driven significantly by the continued adoption of infrastructure engineering software solutions that underpin these advanced digital twin capabilities.Simultaneously, the incorporation of sustainability and eco-friendly routing metrics is reshaping algorithm prioritization within navigation platforms. Service providers are increasingly leveraging artificial intelligence to analyze factors such as road incline, real-time traffic congestion, and specific engine types to suggest routes that minimize fuel consumption rather than solely optimizing for travel time. This shift addresses growing consumer awareness regarding environmental impact and supports broader corporate sustainability goals. According to Google’s 'Environmental Report 2024' released in July 2024, AI-enabled fuel-efficient routing features have helped prevent more than 2.9 million metric tons of greenhouse gas emissions cumulatively since the initiative was introduced.

Key Players Profiled in the Digital Map Market

- Google LLC (Alphabet)

- HERE Technologies

- TomTom International B.V.

- Esri Inc. (Environmental Systems Research Institute)

- Apple Inc.

- Mapbox Inc.

- Maxar Technologies

- NavInfo Co., Ltd.

- AutoNavi Holdings Ltd.

- Zenrin Co., Ltd.

Report Scope

In this report, the Global Digital Map Market has been segmented into the following categories:Digital Map Market, by Component:

- Solution (Tracking & Telematics

- Catchment Analysis

- Other)

- Service (Deployment & Integration Services

- Consulting & Advisory Services

- Other)

Digital Map Market, by Deployment Mode:

- On-Premise

- Cloud

Digital Map Market, by Technology:

- GIS

- LiDAR

- Digital Orthophotography

- Aerial Photography

- GPS

Digital Map Market, by Application:

- Asset Tracking

- Geo-Positioning & Geocoding

- Routing & Navigation

- Others

Digital Map Market, by End User:

- Travel

- Automotive

- Engineering & Construction

- Logistics & Transportation

- Energy & Utilities

- Telecommunication

- Others

Digital Map Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Map Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Digital Map market report include:- Google LLC (Alphabet)

- HERE Technologies

- TomTom International B.V.

- Esri Inc. (Environmental Systems Research Institute)

- Apple Inc.

- Mapbox Inc.

- Maxar Technologies

- NavInfo Co., Ltd.

- AutoNavi Holdings Ltd.

- Zenrin Co., Ltd.

Table Information

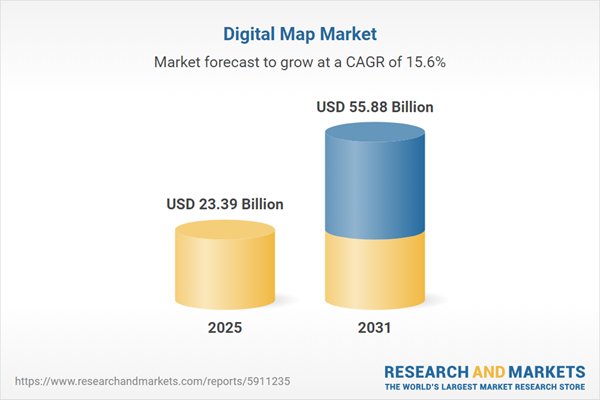

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 23.39 Billion |

| Forecasted Market Value ( USD | $ 55.88 Billion |

| Compound Annual Growth Rate | 15.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |