Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary drivers of the global pea flour market is the increasing consumer awareness of the health benefits associated with pea-based products. Pea flour is rich in protein, fiber, and essential nutrients, making it a preferred choice for health-conscious consumers. Furthermore, its gluten-free nature caters to individuals with dietary restrictions, such as celiac disease sufferers. This has led to a surge in demand for pea flour in various food products, including baked goods, snacks, and meat alternatives.

In addition to its health benefits, the sustainability aspect of pea cultivation has contributed to the market's growth. Peas are nitrogen-fixing crops that improve soil quality, making them an environmentally friendly choice. As sustainability concerns continue to gain traction, more food manufacturers are incorporating pea flour into their products. The global pea flour market is poised for further expansion, with innovative applications and product diversification expected to drive its growth in the coming years.

Key Market Drivers

Rising Demand for Plant-Based Proteins

One of the most prominent drivers of the global pea flour market is the increasing demand for plant-based proteins. As more consumers adopt vegetarian, vegan, and flexitarian diets, there is a growing need for alternative protein sources. Pea flour, made from yellow and green peas, is an excellent source of plant-based protein, containing around 20-25% protein content. This has made it a popular choice for food manufacturers looking to enhance the protein content of their products, including plant-based meats, dairy alternatives, protein bars, and snacks. The rising awareness of the environmental and health benefits associated with plant-based diets further fuels the demand for pea flour.Rising Disposable Income Levels

Another significant driver is the increasing demand for gluten-free and allergen-friendly food products. Pea flour is naturally gluten-free, making it suitable for individuals with celiac disease or gluten sensitivity. Moreover, it is free from common allergens like soy and nuts, making it a safe choice for those with allergies. As consumers become more health-conscious and seek out products that cater to their dietary restrictions, food manufacturers are incorporating pea flour into a wide range of gluten-free and allergen-friendly products, such as pasta, bread, and snacks.Growing Health and Wellness Trends

The global focus on health and wellness has led to a surge in demand for nutritious and functional food ingredients. Pea flour is rich in essential nutrients, including fiber, vitamins, and minerals. It is also known for its low glycemic index, which can help in managing blood sugar levels. These health benefits have made pea flour a valuable ingredient in products aimed at promoting health and well-being, such as protein powders, smoothie mixes, and fortified foods. Consumers are increasingly seeking products that offer nutritional value, and pea flour aligns with this trend.Sustainability and Environmental Concerns

Sustainability has become a critical driver in the global food industry. Pea cultivation is known to have several environmentally friendly attributes. Peas are nitrogen-fixing crops, which means they improve soil quality by adding nitrogen to the soil, reducing the need for synthetic fertilizers. Additionally, pea crops require less water and have a lower carbon footprint compared to some other crops. As sustainability concerns continue to gain prominence, food manufacturers are turning to pea flour as a sustainable ingredient option, thereby boosting its demand. Consumers are also more likely to support products that have a positive environmental impact.Product Innovation and Diversification

The global pea flour market has benefited from ongoing product innovation and diversification. Food manufacturers are finding creative ways to incorporate pea flour into various products, expanding its applications beyond traditional uses. This includes the development of gluten-free pasta, pea protein isolates for plant-based meat alternatives, and baked goods made with pea flour. As the versatility of pea flour becomes more apparent, it opens up opportunities for new product launches and collaborations across the food industry, further propelling market growth.In conclusion, the global pea flour market is experiencing robust growth due to factors such as the increasing demand for plant-based proteins, the popularity of gluten-free and allergen-friendly products, a focus on health and wellness, sustainability concerns, and ongoing product innovation. As consumer preferences continue to evolve, and as the food industry adapts to meet these demands, the pea flour market is expected to expand further in the coming years, presenting opportunities for both manufacturers and consumers seeking nutritious and sustainable food options.

Download Free Sample Report

Key Market Challenges

Supply Chain Vulnerabilities

The global supply chain has faced disruptions in recent times, with the COVID-19 pandemic serving as a stark reminder of the vulnerabilities within the system. The pea flour market relies on a consistent supply of peas, and any disruptions in the agricultural supply chain can have a significant impact on production and availability. Factors such as adverse weather conditions, pest outbreaks, or transportation issues can lead to fluctuations in the supply of peas, affecting the pea flour market's stability. To mitigate this challenge, stakeholders in the industry must invest in supply chain resilience and diversify sourcing strategies.Price Volatility

Pea flour prices can be subject to volatility due to various factors, including fluctuations in the cost of pea production, changes in demand, and currency fluctuations. Peas are sensitive to environmental conditions, and their prices can be influenced by crop yields, which can vary from season to season. Additionally, as the demand for pea flour continues to rise, competition for peas as a raw material may intensify, potentially leading to price spikes. Food manufacturers and producers must closely monitor market dynamics and develop strategies to manage price volatility, such as entering into long-term supply agreements or hedging against price fluctuations.Consumer Acceptance and Taste Profile

While pea flour offers several nutritional benefits, including high protein content and gluten-free properties, it can sometimes face challenges related to consumer acceptance and taste profile. Pea flour can have a slightly earthy or beany flavor, which may not be universally appealing. Achieving a neutral or desirable taste profile is crucial, especially when pea flour is used in products where taste is a primary consideration, such as baked goods and snacks. Food manufacturers need to invest in research and development to improve the taste profile of pea-based products through flavor masking and enhancing techniques.Competition from Other Plant-Based Ingredients

The growing popularity of plant-based diets has led to increased competition among various plant-based ingredients. While pea flour has its unique advantages, such as high protein content and allergen-free properties, it competes with other plant-based ingredients like soy, almond, and chickpea flours. The choice of plant-based ingredient depends on factors such as taste, texture, and nutritional content, and food manufacturers often experiment with different options to create the ideal product. To address this challenge, stakeholders in the pea flour market must continuously innovate and differentiate their products to maintain a competitive edge.Regulatory Compliance and Labeling Requirements

The food industry is subject to strict regulatory oversight to ensure consumer safety and accurate product labeling. Regulatory requirements can vary from one region to another, and compliance can be complex, particularly for novel ingredients like pea flour. Food manufacturers must navigate these regulations, which may include labeling, allergen declarations, and nutritional claims. Failure to meet these requirements can result in product recalls or legal issues. Staying updated with evolving regulatory standards and ensuring full compliance is a significant challenge for businesses operating in the pea flour market. Collaboration with regulatory experts and industry associations can be instrumental in addressing this challenge.In conclusion, the global pea flour market offers significant growth opportunities, driven by consumer preferences for plant-based proteins and gluten-free products. However, it also faces challenges such as supply chain vulnerabilities, price volatility, taste profile concerns, competition from other plant-based ingredients, and regulatory compliance requirements. Successfully navigating these challenges requires proactive measures, including supply chain diversification, price risk management, taste enhancement strategies, innovation, and a deep understanding of regulatory standards. As the industry continues to evolve, addressing these challenges will be crucial for the sustained growth and success of the global pea flour market.

Key Market Trends

Rising Popularity of Plant-Based Diets

The global trend toward plant-based diets has had a profound impact on the pea flour market. As more consumers opt for vegetarian, vegan, or flexitarian lifestyles, the demand for plant-based protein sources has surged. Pea flour, with its high protein content (typically around 20-25%), has become a favored ingredient in plant-based food products. It is a key component in the formulation of plant-based meat alternatives, such as burgers, sausages, and nuggets. This trend aligns with growing concerns about health, environmental sustainability, and animal welfare, making pea flour a vital player in the plant-based food movement.Gluten-Free and Allergen-Friendly Product Development

Another prominent trend in the pea flour market is the increasing demand for gluten-free and allergen-friendly food products. Pea flour naturally lacks gluten, making it an ideal choice for individuals with celiac disease or gluten sensitivity. Additionally, it is free from common allergens like soy, nuts, and dairy, making it suitable for those with various food allergies. This has led to the incorporation of pea flour into a wide range of gluten-free products, including pasta, bread, pizza crusts, and baked goods. Food manufacturers are capitalizing on this trend to cater to the growing consumer base seeking allergen-friendly and gluten-free options.Diversification of Applications in Snacks and Baked Goods

Pea flour has witnessed a significant expansion of its applications beyond traditional uses. In recent years, it has gained traction in the snacks and baked goods segments. Pea flour is being used to create a variety of snack products like chips, crackers, and puffed snacks due to its versatility and ability to add protein and fiber content. In baked goods, it contributes to the development of gluten-free bread, muffins, and cookies, allowing consumers to enjoy their favorite baked treats without compromising on taste or nutrition. This diversification of applications is driving growth in the pea flour market, as it appeals to a broader range of consumers.Clean Label and Minimal Processing

The clean label movement is a significant trend in the food industry, emphasizing the use of minimally processed, natural, and recognizable ingredients. Pea flour aligns well with this trend as it is typically produced by simply milling dried peas, with no need for extensive processing or added chemicals. Consumers are increasingly seeking products with ingredient lists they can understand and trust. Pea flour's clean label appeal has made it an attractive choice for food manufacturers looking to meet consumer demand for more transparent and wholesome products. This trend is likely to continue as consumers prioritize health-conscious and transparent food choices.Innovation in Textured Pea Proteins

Textured pea proteins are gaining momentum in the global pea flour market. These proteins are created through processes like extrusion or thermoplastic extrusion, which transform pea flour into textured forms that mimic the texture of meat. They are used in plant-based meat analogs to replicate the mouthfeel and appearance of traditional meat products. The growth of this trend is driven by the desire to create more convincing and appealing plant-based meat alternatives. With ongoing research and development efforts, manufacturers are improving the texture and taste of textured pea proteins, making them a promising area of innovation in the pea flour market.In conclusion, the global pea flour market is experiencing dynamic changes driven by recent trends such as the rising popularity of plant-based diets, increased demand for gluten-free and allergen-friendly products, diversification of applications in snacks and baked goods, the clean label movement, and innovation in textured pea proteins. These trends reflect evolving consumer preferences, a growing awareness of health and sustainability issues, and the food industry's commitment to meeting these demands. As the market continues to evolve, stakeholders in the pea flour industry must remain agile and responsive to these trends to capitalize on the opportunities they present.

Segmental Insights

Category Insights

The global pea flour market is witnessing a significant surge in the demand for organic pea flour. This growing preference for organic products is driven by consumers' increasing awareness of the health and environmental benefits associated with organic foods. Organic pea flour is produced without the use of synthetic pesticides, herbicides, and genetically modified organisms (GMOs), making it a more sustainable and health-conscious choice. Consumers are becoming more discerning, seeking products that are free from chemical residues and environmentally friendly. As a result, food manufacturers are responding to this demand by incorporating organic pea flour into a wide range of organic food products, including snacks, baked goods, and plant-based protein alternatives. This trend is poised to continue as consumers prioritize clean, organic, and sustainably sourced ingredients in their diets.Furthermore, the rising demand for organic pea flour aligns with the broader global trend of embracing organic agriculture and sustainable farming practices. Organic farming methods promote soil health, reduce water pollution, and support biodiversity, making them more environmentally friendly than conventional farming practices. As consumers become more conscious of the ecological impact of their food choices, the demand for organic pea flour is expected to see continued growth. This trend underscores the importance of sustainability and health in shaping the future of the global pea flour market, with organic options becoming increasingly prominent in the marketplace.

Distribution Channel Insights

The global pea flour market is experiencing a notable rise in demand from direct sales channels. Direct sales refer to the method of selling products directly from the manufacturer or producer to the end consumer, bypassing traditional intermediaries like wholesalers and retailers. This trend is driven by several factors, including the desire for fresher and more diverse product options, increased consumer engagement, and the convenience of online shopping.Consumers today are seeking unique and high-quality food products, and direct sales allow them to connect directly with producers who often offer artisanal or specialty pea flour products. This direct interaction enables consumers to learn more about the sourcing, production methods, and sustainability practices of the brands they choose, fostering transparency and trust in the market. Additionally, the rise of e-commerce platforms has made it easier for consumers to access a wide variety of pea flour products directly from manufacturers, further fueling the demand for direct sales channels.

Furthermore, the COVID-19 pandemic accelerated the shift towards online shopping, and this change in consumer behavior has had a lasting impact. Many consumers have grown accustomed to the convenience and safety of online purchasing, and this preference extends to pea flour and other food products. As a result, manufacturers are investing in their online presence and e-commerce capabilities to meet the rising demand for direct sales, creating a more dynamic and competitive landscape in the global pea flour market.

Regional Insights

The Asia Pacific region is witnessing a significant surge in demand for pea flour, driving growth in the global pea flour market. This trend is primarily attributed to changing dietary preferences, increasing health consciousness, and a growing awareness of the nutritional benefits of pea-based products. As consumers in the Asia Pacific become more health-conscious and environmentally aware, they are seeking alternatives to traditional staples like wheat and rice. Pea flour, being gluten-free and rich in plant-based protein, aligns with these evolving dietary preferences and is increasingly finding its way into the diets of consumers in the region.Additionally, the Asia Pacific region is experiencing rapid urbanization and a rising middle-class population, which is driving the demand for convenient and nutritious food options. Pea flour, with its versatility, is being used in a variety of food products, including snacks, noodles, and baked goods, to cater to the growing demand for healthier and more convenient meal options. Furthermore, the shift towards plant-based diets and the increasing popularity of vegetarian and vegan lifestyles are contributing to the expansion of the pea flour market in the Asia Pacific region, as it serves as a valuable ingredient in plant-based protein products and meat alternatives. As these dietary trends continue to gain momentum, the demand for pea flour in the Asia Pacific is expected to continue its upward trajectory, making it a focal point for both regional and global pea flour producers.

Report Scope:

In this report, the Global Pea Flour Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Pea Flour Market, By Category:

- Organic

- Inorganic

Pea Flour Market, By Type:

- Green

- Yellow

- Maple

- Marrowfat

Pea Flour Market, By Distribution Channel:

- Direct Sales

- Indirect Sales

Pea Flour Market, By Region:

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- Egypt

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pea Flour Market.Available Customizations:

Global Pea Flour Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ingredion

- Grain Millers, Inc.

- AGT Food and Ingredients

- Golden Grain Mills

- A&B Ingredients, Inc.

- Midlands Holdings

- Barry Farm Foods

- Murlidhar Industries

- Bob’s Red Mill Natural Foods

- Informa Markets

Table Information

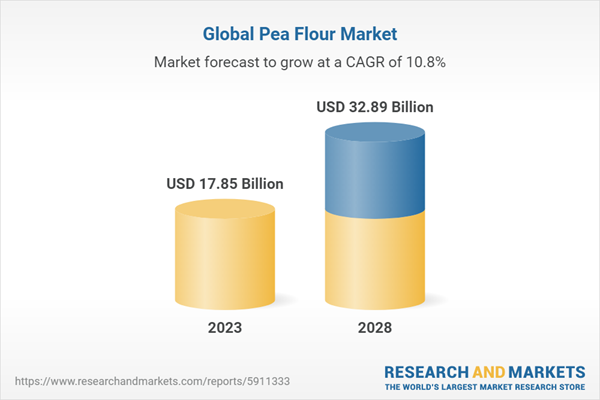

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 17.85 Billion |

| Forecasted Market Value ( USD | $ 32.89 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |