Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Seed treatment fungicides play a critical role in protecting seeds from harmful fungal pathogens that can compromise germination and early plant growth. These treatments act as a first line of defense by preventing infections such as damping-off, seed rot, and seedling blight. According to recent agricultural research, fungal diseases are responsible for over 15% of global crop losses annually. By ensuring healthy seed emergence, fungicides contribute to stronger crop stands, better field uniformity, and ultimately, increased agricultural productivity across various climatic regions and soil types.

Technological advancements in formulation science have improved the effectiveness of seed treatment fungicides. Microencapsulation, polymer coatings, and controlled-release technologies are ensuring longer-lasting and more even protection. These innovations improve adhesion to the seed coat, limit phytotoxicity, and enhance environmental safety. Furthermore, the development of dual-mode action fungicides is increasing the efficacy against a broader spectrum of fungi. This is especially valuable in regions prone to unpredictable rainfall and soil moisture levels, where fungal disease pressure is high and early seed protection is crucial.

With global climate change leading to more favorable conditions for fungal outbreaks, the demand for preventative strategies like seed treatment fungicides is rising. Wet soils, fluctuating temperatures, and early-season humidity can significantly boost fungal proliferation, making pre-planting interventions more critical than ever. As farmers aim for better resilience and yield stability, seed treatment fungicides provide an efficient tool to reduce risk. Moreover, integrated pest management (IPM) strategies are encouraging the adoption of seed-based disease control, positioning fungicide-treated seeds as a foundation of sustainable, high-output farming systems.

Key Market Drivers

Emergence of Harmful Plant Pathogens

The rise of harmful plant pathogens, driven by the intensification of global agriculture, has elevated the role of seed treatment fungicides in crop protection. These pathogens threaten early plant development, with diseases such as Fusarium, Pythium, and Rhizoctonia causing significant seedling loss. According to recent data, nearly 40% of pre-emergence crop failures are linked to fungal infections, underscoring the importance of early disease prevention. Seed treatment fungicides, applied directly to seeds before sowing, act as a crucial line of defense by neutralizing fungal threats during the plant’s most vulnerable stages.The evolving nature of plant pathogens has added urgency to the use of seed treatment fungicides. Mutations in fungal strains have rendered some traditional protection methods less effective, pushing the need for more advanced and preventive approaches. In 2023, researchers identified over 70 new fungal strains impacting cereal and oilseed crops across temperate and tropical regions. Seed treatment fungicides provide broad-spectrum coverage, reducing the risk of outbreaks and ensuring higher crop uniformity. Their ability to shield the seed from infection before it enters the soil makes them indispensable for achieving reliable and consistent germination.

Climate change has amplified the problem by altering disease dynamics. Warmer temperatures and increased humidity are creating ideal conditions for the spread of plant pathogens, leading to more frequent and severe disease outbreaks. These shifting weather patterns have already increased the incidence of seedling diseases by 20% in certain high-risk regions. Farmers now require proactive protection to stabilize yields under these uncertain conditions. Seed treatment fungicides offer a solution by helping plants establish a strong, disease-free start, regardless of climate variability.

Beyond disease prevention, seed treatment fungicides also contribute to long-term crop health and food security. They minimize the need for repeated field applications of fungicides, reducing overall chemical usage and supporting environmentally responsible farming practices. As global food demand rises alongside increasing pathogen threats, the adoption of seed treatment fungicides is expected to grow rapidly. These treatments are becoming a core component of integrated disease management strategies, helping farmers mitigate crop loss, improve resilience, and safeguard global agricultural productivity.

Key Market Challenges

Regulatory Issues

Stringent regulations and restrictions on fungicide use by government bodies across the globe pose significant challenges. Regulatory issues are poised to become a significant deterrent to the global demand for seed treatment fungicides. Governments and environmental agencies worldwide are implementing stringent regulations due to growing concerns about the potential environmental and health impacts of fungicides. Many of these chemicals have been identified as potential contributors to issues such as water pollution, soil degradation, and biodiversity loss. Furthermore, evidence suggesting a link between exposure to certain fungicides and health problems in humans is leading to increased scrutiny.As a result, many countries are restricting the use of certain types of fungicides or imposing stricter application guidelines. This trend is expected to limit the growth of the seed treatment fungicides market. While the industry has been making efforts to develop more environmentally friendly and less harmful products, these initiatives have yet to fully counteract the negative perception of fungicides. Thus, the escalating regulatory landscape, coupled with growing public awareness and concern, is anticipated to decrease the demand for seed treatment fungicides globally.

Key Market Trends

Expanding Agribusiness in Developing Nations

The global demand for seed treatment fungicides is expected to rise significantly, primarily spurred by expanding agribusiness in developing nations. As these countries continue to focus on agricultural development as a crucial driver of their economies, the need for improved crop yields and disease management is becoming more paramount. Seed treatment fungicides offer a viable solution, protecting crops from various fungal diseases and enabling healthier growth. As the agribusiness sector expands, the necessity for such treatments increases proportionally.Furthermore, the heightened awareness about the harmful effects of fungal diseases on crop yield and quality is leading to a surge in demand for these fungicides. Also, the increasing global population and food demand put additional pressure on agricultural productivity, accentuating the need for effective seed treatments. Governments in these developing nations are also promoting the use of such fungicides by offering subsidies and incentivizing their use for farmers, contributing to the rise in demand. As such, the global market for seed treatment fungicides is set for robust growth, driven largely by the burgeoning agribusiness sector in developing countries.

Key Market Players

- BASF SE

- Syngenta Crop Protection AG

- Nufarm Limited

- Bayer AG

- Platform Specialty Products Corporation

- Sumitomo Corporation

- E.I. Du Pont De Nemours and Company

- FMC Corporation

- Certis Europe LLC

- Novozymes A/S

Report Scope:

In this report, the Global Seed Treatment Fungicides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Seed Treatment Fungicides Market, By Type:

- Synthetic Chemicals

- Biological

Seed Treatment Fungicides Market, By Crop Type:

- Cereals & Oilseeds

- Fruits & Vegetables

- Others

Seed Treatment Fungicides Market, By Form:

- Liquid

- Powder

Seed Treatment Fungicides Market, By Application:

- Seed Dressing

- Seed Coating

- Seed Pelleting

Seed Treatment Fungicides Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Seed Treatment Fungicides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Syngenta Crop Protection AG

- Nufarm Limited

- Bayer AG

- Platform Specialty Products Corporation

- Sumitomo Corporation

- E.I. Du Pont De Nemours and Company

- FMC Corporation

- Certis Europe LLC

- Novozymes A/S

Table Information

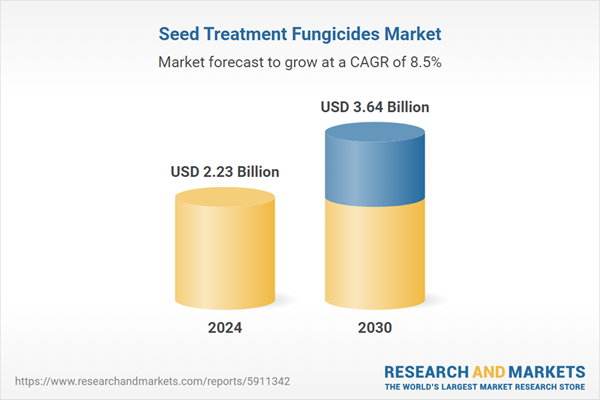

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.23 Billion |

| Forecasted Market Value ( USD | $ 3.64 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |