Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

They are especially beneficial in scenarios where fast-acting nutrients are required, such as during the growth phase of a plant. These fertilizers offer convenience and efficiency in application, allowing for precise nutrient delivery based on specific plant requirements. With their ability to dissolve in water, these fertilizers offer flexibility in terms of application methods. They can be easily incorporated into irrigation systems or applied as foliar sprays, ensuring that plants receive nutrients directly where it is needed most.

Key Market Drivers

Rapid Industrialization and Urbanization

The reduction in arable land is notably driving the growth of the water-soluble fertilizers market. Factors such as rapid industrialization and urbanization have led to a significant decrease in available arable land. In addition, inappropriate agricultural practices and deforestation have further contributed to the decline in fertility of arable land on a global scale. Agrosema Comercial Agricola Ltda, a Brazilian agricultural retailer, was scheduled to be acquired by Nutrien Ltd. in January 2020. The objective of this acquisition is to expand market share in the conventional and specialized fertilizers business in South America.The need to increase food production has become imperative, and it can only be achieved by improving the yield from existing farms. This is where water-soluble fertilizers come into play. By utilizing these fertilizers, farmers can enhance the yield of their food crops, thus addressing the growing demand for food grains. Research indicates that the demand for food grains is expected to significantly increase by 2030 due to the expanding global population. Developing nations, such as Brazil and India, will particularly face the challenge of fulfilling this demand, requiring an additional 120 million hectares of land. Consequently, the shrinking availability of global arable land is anticipated to drive the demand for fertilizers as a means to meet the rising food requirements. Considering these factors, the water-soluble fertilizers market is poised for growth during the forecast period, as it plays a crucial role in supporting food production and addressing the challenges posed by the diminishing arable land.

Key Market Challenges

Volatility in Raw Material Prices

Volatility in raw material prices is a significant challenge that poses obstacles to market growth. The production of water-soluble fertilizers primarily relies on substances derived from nitrogen, potassium, and phosphorus. Additionally, the manufacturing process involves the use of natural gas, potassium chloride, sulfur, and coal. Consequently, any increase in the prices of these raw materials elevates production costs, leading to reduced profit margins for manufacturers.Among the raw materials, natural gas holds particular significance as it is a major component in the production of nitrogen-based water-soluble fertilizers. The extraction of hydrogen, an essential element in this process, relies on natural gas. Thus, any surge in natural gas prices directly impacts the demand for these fertilizers. Consequently, the fluctuations in raw material prices can exert a negative influence on the global market throughout the forecast period. Given these dynamics, it becomes paramount for market players to closely monitor and anticipate any changes in raw material prices. By doing so, they can proactively adjust their strategies to mitigate the potential adverse effects and maintain a competitive edge in the market.

Key Market Trends

Rise In Demand for Micronutrient-Based Water-Soluble Fertilizers

The rise in demand for micronutrient-based water-soluble fertilizers is an emerging trend in the market. Micronutrients, which are trace minerals required by plants in small quantities, play a crucial role in various plant functions. Despite their low quantity requirement, micronutrient deficiency can significantly impact plant yield, growth, and overall health.The deficiency of essential micronutrients like zinc, iron, and magnesium can lead to stunted growth and other abnormalities in plants at different stages of their development. In November 2020, Gujarat State Fertilizers & Chemicals Ltd. (GSFC), a state-run enterprise, is set to introduce three new fertilizer variants under the Sardar brand for farmers in Himachal Pradesh, India. The official launch ceremony is scheduled for November 19, 2020, in the esteemed presence of Himachal Pradesh Chief Minister Jai Ram Thakur. Announcing the launch, Arvind Agarwal, Chairman & Managing Director of GSFC Ltd., tweeted that the initiative marks a significant step towards an #AtmaNirbharBharat, reaffirming the company's commitment to providing the best solutions for the farmers of Himachal Pradesh.

Key Market Players

- Captain Polyplast Ltd.

- CF Industries Holdings Inc.

- Roullier Group

- E.I.D. - Parry (India) Limited

- BMS Micro-Nutrients NV

- Yara International ASA

- Green Has Italia S.p.A.

- Grupa Azoty S.A.

- Gujarat State Fertilizers and Chemicals Ltd.

- Indian Farmers Fertiliser Cooperative Ltd.

Report Scope:

In this report, the Global Water Soluble Fertilizers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Water Soluble Fertilizers Market, By Type:

- Calcium Nitrate

- NPK

- Potassium Nitrate

- Potassium Sulphate

- Urea Phosphate

- Others

Water Soluble Fertilizers Market, By Composition:

- Straight

- Complex

Water Soluble Fertilizers Market, By Crop:

- Horticultural

- Turf & Ornamentals

- Field Crop

Water Soluble Fertilizers Market, By Application:

- Fertigation

- Foliar Application

Water Soluble Fertilizers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Water Soluble Fertilizers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Captain Polyplast Ltd.

- CF Industries Holdings Inc.

- Roullier Group

- E.I.D. - Parry (India) Limited

- BMS Micro-Nutrients NV

- Yara International ASA

- Green Has Italia S.p.A.

- Grupa Azoty S.A.

- Gujarat State Fertilizers and Chemicals Ltd.

- Indian Farmers Fertiliser Cooperative Ltd.

Table Information

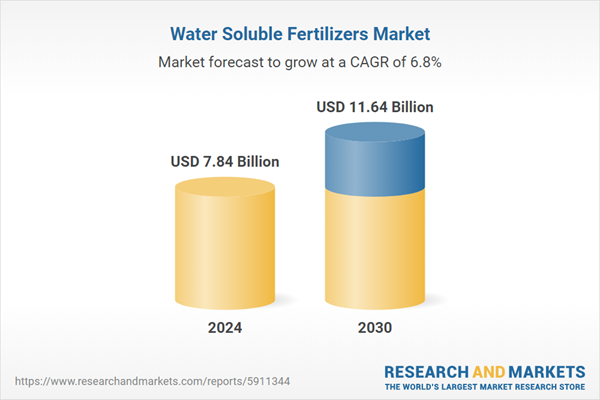

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.84 Billion |

| Forecasted Market Value ( USD | $ 11.64 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |