Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Promoters are often chosen based on their strength and specificity, depending on the desired level of gene expression and the type of host cell. Expression vectors have an origin of replication, which is a DNA sequence recognized by the host cell's replication machinery. This sequence allows the vector to replicate and propagate inside the host cell, ensuring that the introduced gene is passed on to daughter cells during cell division.

Key Market Drivers

Gene Therapy Expansion

Expression vectors serve as crucial gene delivery vehicles in gene therapy. They are used to transport therapeutic genes into target cells, facilitating the correction of genetic defects or the introduction of therapeutic genes to treat various diseases. Gene therapy has expanded beyond rare diseases to include a wide range of therapeutic applications, such as cancer treatment, genetic disorders, neurological diseases, and cardiovascular conditions. Each application may require tailored expression vectors to achieve optimal gene delivery and expression. The increasing number of gene therapy clinical trials and the approval of gene therapies by regulatory agencies drive demand for expression vectors.These vectors are essential for producing therapeutic genes used in clinical studies and commercialized treatments. Gene therapy research often demands customized expression vectors. Researchers and biotech companies may require vectors that are specific to their therapeutic targets, ensuring precise gene delivery and appropriate expression levels. Many gene therapies rely on viral vectors, such as adeno-associated virus (AAV) vectors and lentiviral vectors, for gene delivery. The development and commercialization of viral vector-based gene therapies have led to a surge in demand for these vectors. For instance, according to the World Health Organization (WHO) in 2021, non-communicable diseases (NCDs) account for 41 million deaths annually, representing 71% of all global deaths. Over 15 million people aged 30 to 69 die each year from NCDs, highlighting their significant impact on public health worldwide.

Key Market Challenges

Safety Concerns

Expression vectors, particularly those used in gene therapy and biopharmaceutical production, must adhere to strict biosafety regulations. Ensuring that vectors do not pose risks to human health, or the environment is essential. Biosafety levels and containment measures are established to prevent accidental release or exposure to genetically modified organisms (GMOs) and biohazardous materials. The use of expression vectors for gene editing, such as CRISPR-Cas9 technology, raises concerns about off-target effects and unintended genetic modifications. Ensuring the precision and safety of gene editing procedures is a critical challenge.The release of genetically modified organisms into the environment, even unintentionally, can have ecological consequences. Proper containment and disposal methods are necessary to prevent environmental contamination. In gene therapy, the integration of expression vectors into the host genome may pose long-term safety risks. Insertional mutagenesis, where vector integration disrupts normal gene function, is a concern.

In biopharmaceuticals, the presence of vector-related proteins or antigens in therapeutic products can trigger an immune response in patients, leading to safety issues and reduced efficacy. Achieving tissue-specific expression using expression vectors is challenging but critical for minimizing off-target effects and ensuring safety in gene therapy applications. Viral vectors used in gene therapy can trigger immune responses in patients. Strategies to mitigate vector immunogenicity are essential to improve safety and therapeutic efficacy.

Key Market Trends

Environmental Sustainability

Biotechnology companies are increasingly adopting green bioprocessing practices that reduce the environmental impact of expression vector production. This includes optimizing fermentation processes to minimize waste, energy consumption, and resource use. There is a growing demand for expression vector systems that are environmentally friendly. Companies are developing vector systems that use fewer resources and generate less waste during production. Research and development efforts are focused on creating biodegradable vectors that break down naturally after use, reducing the environmental burden of vector disposal.Companies are exploring sustainable sourcing of raw materials used in vector production, such as growth media components, to reduce the environmental footprint of vector manufacturing. Investments in energy-efficient biomanufacturing processes and facilities are becoming more common. This reduces energy consumption during vector production and contributes to sustainability goals. Sustainable practices aim to minimize waste generation throughout the vector production process. This includes recycling and reusing materials when possible. Companies are taking steps to measure and reduce the carbon footprint associated with vector production and distribution. This may involve using renewable energy sources and optimizing transportation logistics.

Key Market Players

- Thermo Fisher Scientific, Inc.,

- Promega Corporation

- Agilent Technologies, Inc.

- Bio-Rad Laboratories Inc.

- QIAGEN NV

- Merck KGaA

- TAKARA HOLDINGS Inc.

- GenScript Corp.

- Quest Diagnostics

- Addgene, Inc.

Report Scope:

In this report, the Global Expression Vector Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Expression Vector Market, By Host Type:

- Bacterial expression vectors

- Mammalian expression vectors

- Insect expression vectors

- Yeast expression vector

- Others

Expression Vector Market, By Application:

- Therapeutic

- Research

- Others

Expression Vector Market, By End-User:

- Pharmaceutical & biotech

- Academic research

- Others

Expression Vector Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Expression Vector Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific, Inc.,

- Promega Corporation

- Agilent Technologies, Inc.

- Bio-Rad Laboratories Inc.

- QIAGEN NV

- Merck KGaA

- TAKARA HOLDINGS Inc.

- GenScript Corp.

- Quest Diagnostics

- Addgene, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | March 2025 |

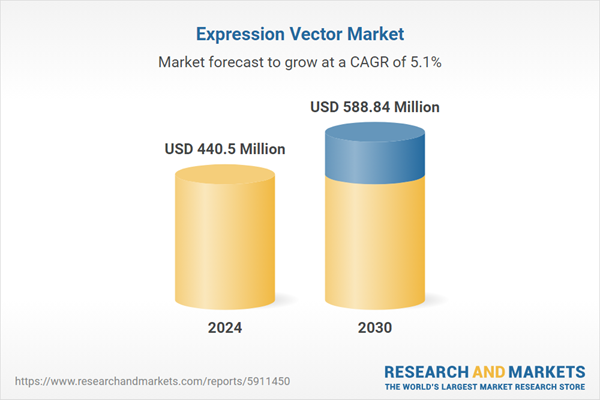

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 440.5 Million |

| Forecasted Market Value ( USD | $ 588.84 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |